Manufacturing equipment and systems provider Advanced Energy (NASDAQ: AEIS) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 2.5% year on year to $415.4 million. Guidance for next quarter’s revenue was optimistic at $392 million at the midpoint, 2.3% above analysts’ estimates. Its non-GAAP profit of $1.30 per share was 18% above analysts’ consensus estimates.

Is now the time to buy Advanced Energy? Find out by accessing our full research report, it’s free.

Advanced Energy (AEIS) Q4 CY2024 Highlights:

- Revenue: $415.4 million vs analyst estimates of $393.7 million (2.5% year-on-year growth, 5.5% beat)

- Adjusted EPS: $1.30 vs analyst estimates of $1.10 (18% beat)

- Adjusted EBITDA: $96.58 million vs analyst estimates of $58.28 million (23.2% margin, 65.7% beat)

- Revenue Guidance for Q1 CY2025 is $392 million at the midpoint, above analyst estimates of $383.1 million

- Adjusted EPS guidance for Q1 CY2025 is $1.03 at the midpoint, above analyst estimates of $0.97

- Operating Margin: 8.2%, up from 3.4% in the same quarter last year

- Free Cash Flow Margin: 16.8%, similar to the same quarter last year

- Market Capitalization: $4.20 billion

“Fourth quarter results exceeded our guidance, with total revenue resuming year-over-year growth on better-than-expected demand in our semiconductor and data center computing markets,” said Steve Kelley, president and CEO of Advanced Energy.

Company Overview

Pioneering technologies for radio frequency power delivery, Advanced Energy (NASDAQ: AEIS) provides power supplies, thermal management systems, and measurement and control instruments for various manufacturing processes.

Electronic Components

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

Sales Growth

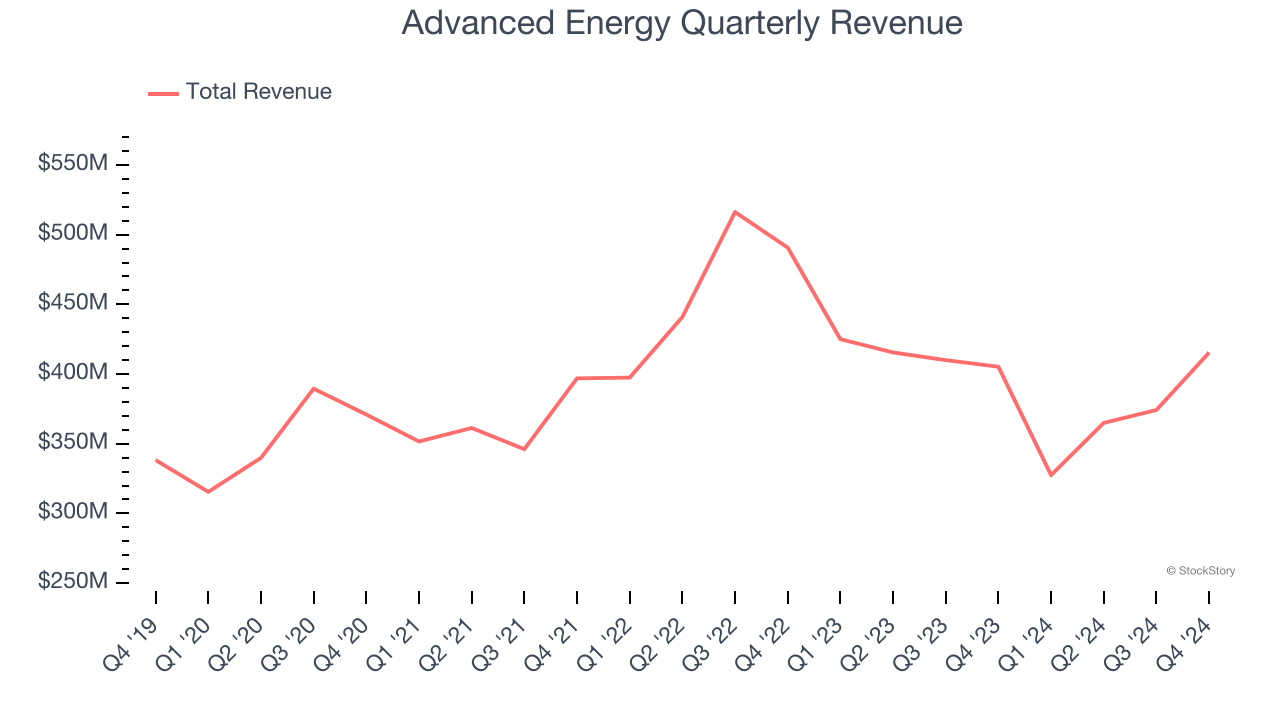

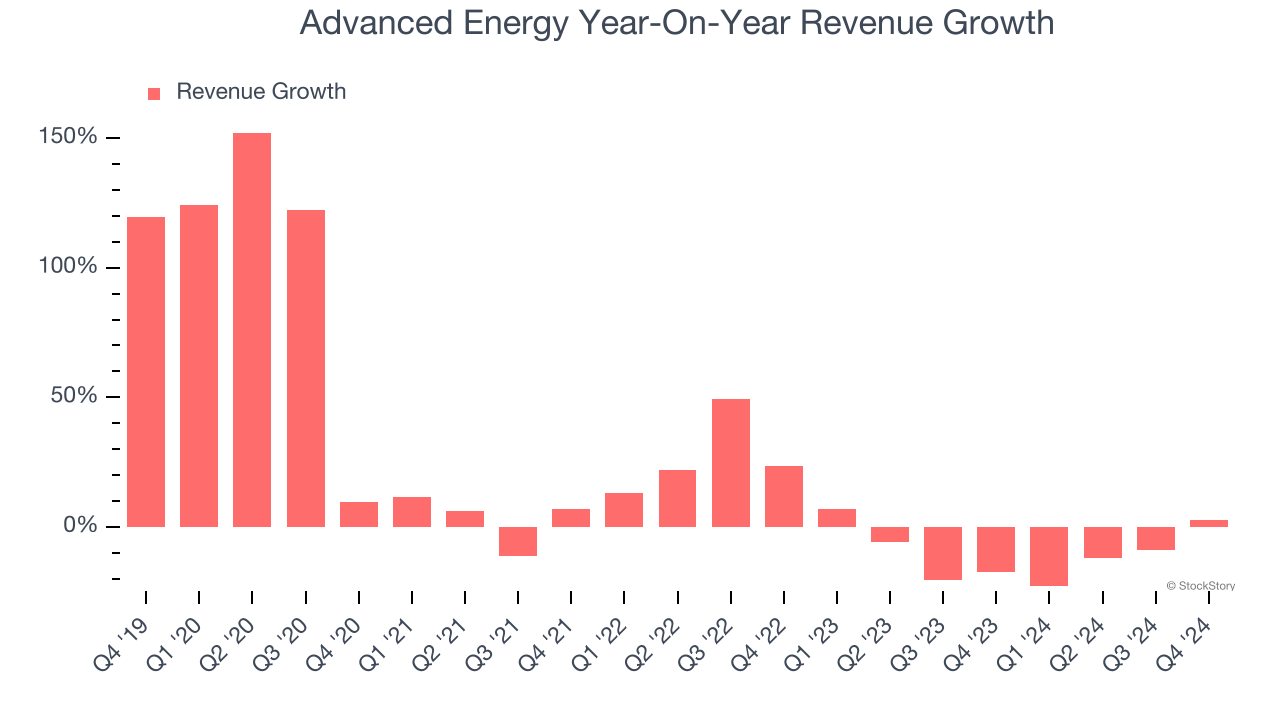

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Advanced Energy’s 13.4% annualized revenue growth over the last five years was excellent. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Advanced Energy’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 10.4% over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Semiconductor Equipment and Industrial and Medical Equipment, which are 54.6% and 18.5% of revenue. Over the last two years, Advanced Energy’s Semiconductor Equipment revenue (i.e., plasma power) averaged 6.3% year-on-year declines while its Industrial and Medical Equipment revenue (i.e., robotics) averaged 9.4% declines.

This quarter, Advanced Energy reported modest year-on-year revenue growth of 2.5% but beat Wall Street’s estimates by 5.5%. Company management is currently guiding for a 19.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.7% over the next 12 months, an improvement versus the last two years. This projection is commendable and suggests its newer products and services will spur better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

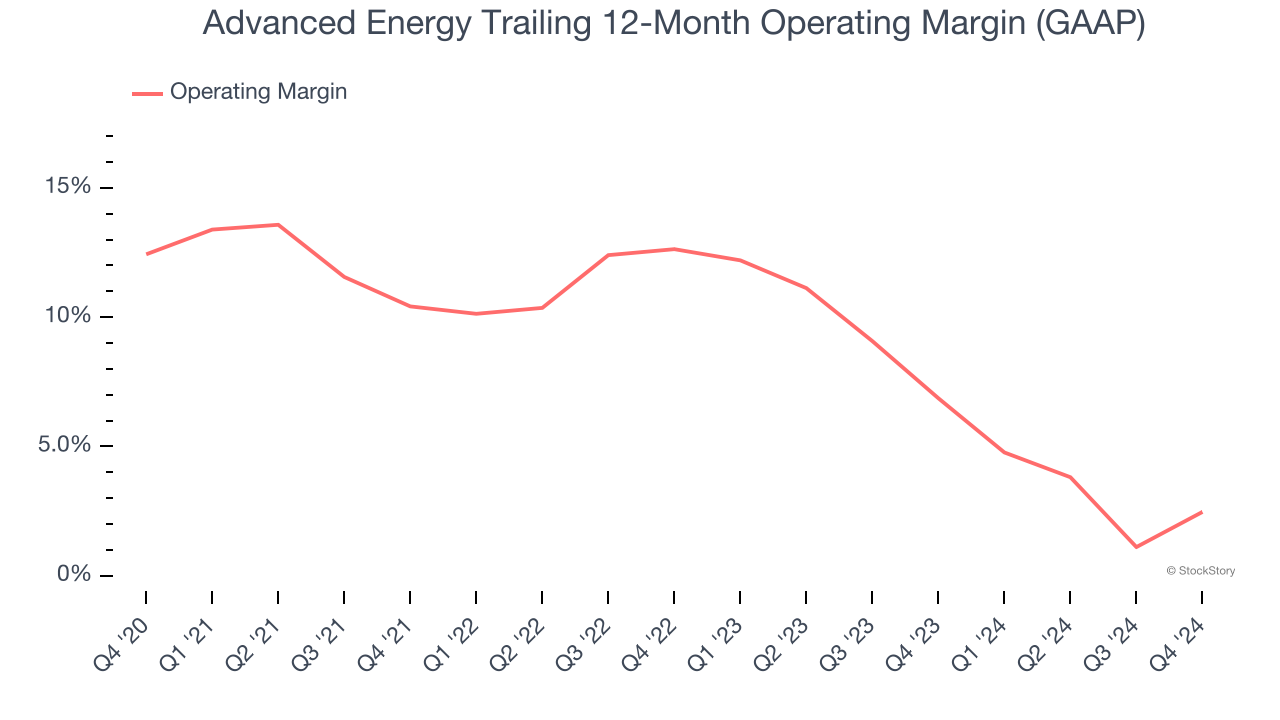

Advanced Energy has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.1%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Advanced Energy’s operating margin decreased by 10 percentage points over the last five years. Even though its historical margin is high, shareholders will want to see Advanced Energy become more profitable in the future.

In Q4, Advanced Energy generated an operating profit margin of 8.2%, up 4.8 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

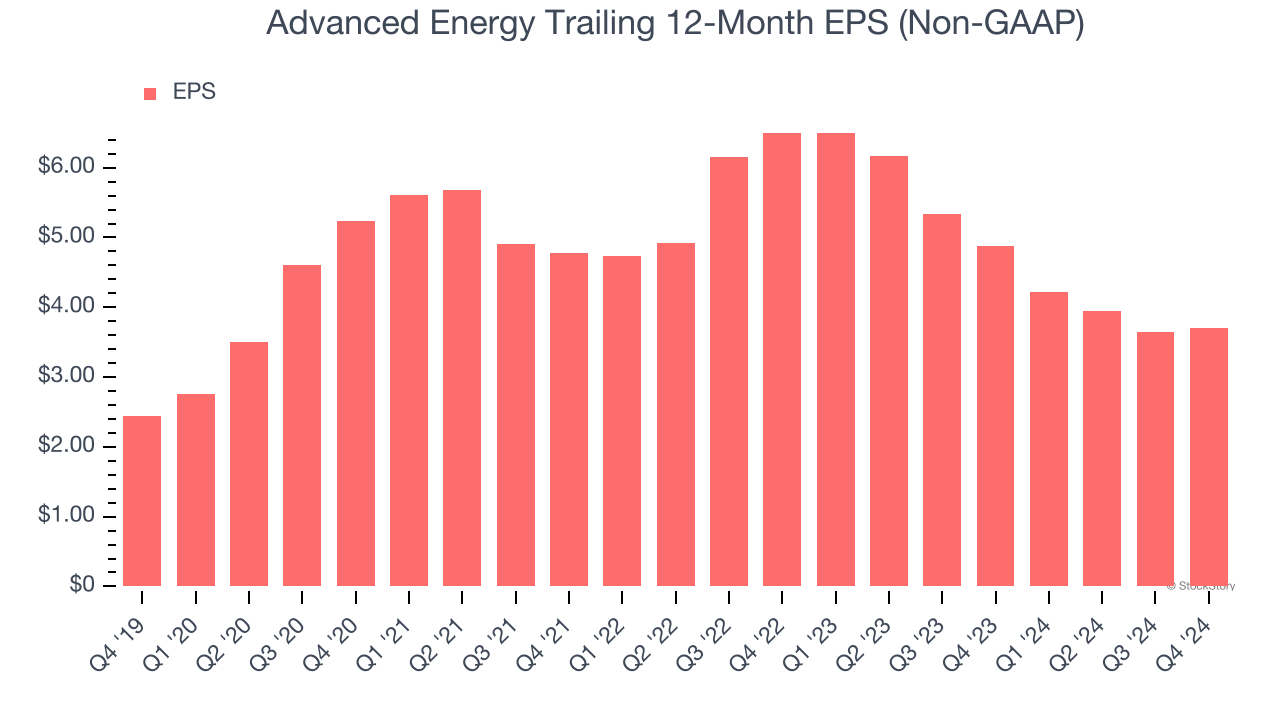

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Advanced Energy’s EPS grew at a decent 8.7% compounded annual growth rate over the last five years. However, this performance was lower than its 13.4% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into Advanced Energy’s earnings to better understand the drivers of its performance. As we mentioned earlier, Advanced Energy’s operating margin improved this quarter but declined by 10 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Advanced Energy’s two-year annual EPS declines of 24.5% were bad and lower than its two-year revenue performance.

In Q4, Advanced Energy reported EPS at $1.30, up from $1.24 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Advanced Energy’s full-year EPS of $3.71 to grow 34%.

Key Takeaways from Advanced Energy’s Q4 Results

We were impressed by how significantly Advanced Energy blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid quarter. The stock traded up 4.6% to $116.27 immediately following the results.

Advanced Energy had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.