As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the drug development inputs & services industry, including Repligen (NASDAQ: RGEN) and its peers.

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

The 8 drug development inputs & services stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 0.8%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.5% since the latest earnings results.

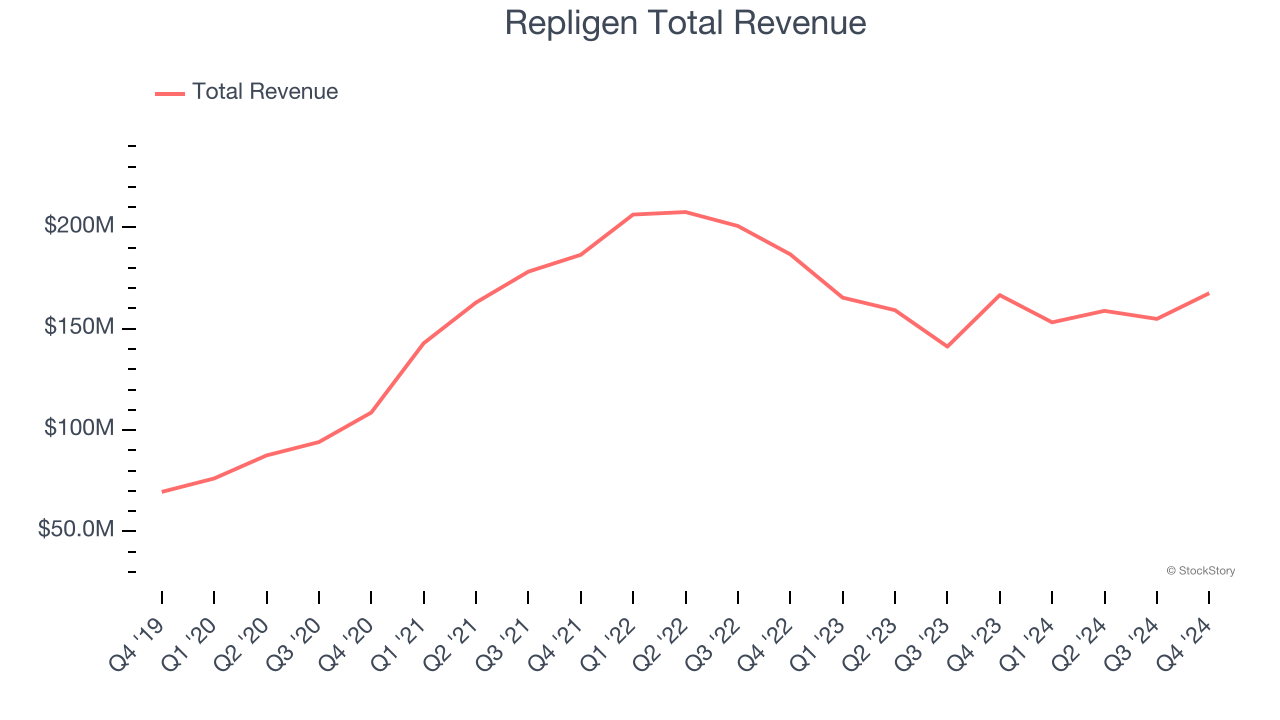

Repligen (NASDAQ: RGEN)

Founded in 1981, Repligen Corporation (NASDAQ: RGEN) develops and manufactures advanced products used in the production of drugs, with a focus on filtration, chromatography, and process analytics.

Repligen reported revenues of $167.5 million, flat year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a solid beat of analysts’ organic revenue estimates.

Olivier Loeillot, President and Chief Executive Officer of Repligen said, “During the fourth quarter, we were very encouraged by the continued momentum across our portfolio. Total revenue in the fourth quarter grew 13% excluding COVID, overcoming two points of currency headwind. Total orders outpaced sales by 6%, driven by our Filtration and Analytics franchises. The strength we saw in the third quarter for CDMOs and capital equipment continued during the fourth quarter, with sequential revenues increasing approximately 20% and 30% respectively. While we continue to monitor China and emerging biotech, the overall bioprocessing market is returning to growth. Our order momentum during the second half gives us confidence that we can achieve our 2025 guidance.”

Repligen scored the highest full-year guidance raise of the whole group. Even though it had a relatively good quarter, the market seems discontent with the results. The stock is down 14.6% since reporting and currently trades at $138.40.

Is now the time to buy Repligen? Access our full analysis of the earnings results here, it’s free.

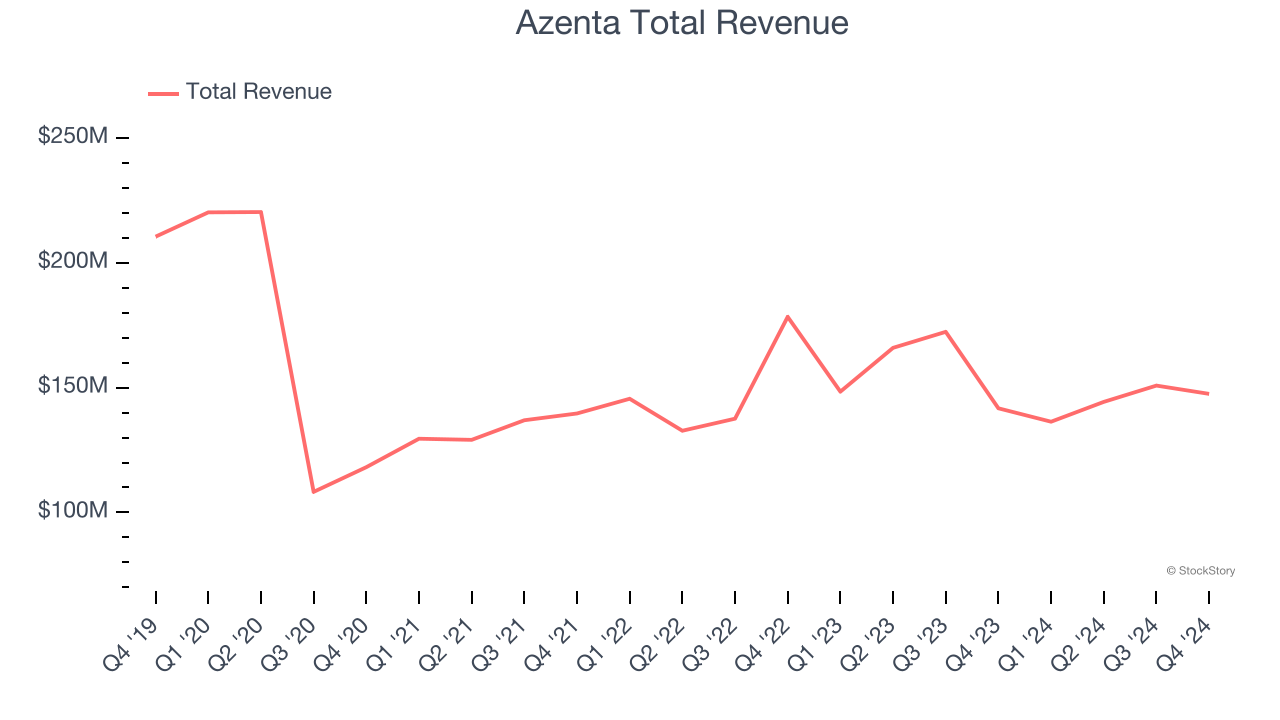

Best Q4: Azenta (NASDAQ: AZTA)

Founded as a small biotech firm, Azenta (NASDAQ: AZTA) provides services for life sciences research and biopharmaceutical applications such as sample management, cold chain logistics, and storage services.

Azenta reported revenues of $147.5 million, up 4.1% year on year, outperforming analysts’ expectations by 1.1%. The business had a very strong quarter with an impressive beat of analysts’ EPS estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 14.6% since reporting. It currently trades at $44.39.

Is now the time to buy Azenta? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Fortrea (NASDAQ: FTRE)

Spun off from Labcorp in 2023, Fortrea Holdings (NASDAQ: FTRE) provides contract research and development services for pharmaceutical and biotechnology companies, specializing in clinical trials, laboratory services, and data management.

Fortrea reported revenues of $697 million, down 1.8% year on year, falling short of analysts’ expectations by 0.9%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Fortrea delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. As expected, the stock is down 24.3% since the results and currently trades at $10.49.

Read our full analysis of Fortrea’s results here.

Medpace (NASDAQ: MEDP)

Founded in 1992, Medpace Holdings (NASDAQ: MEDP) provides full-service clinical development services to pharmaceutical, biotechnology, and medical device companies, specializing in the design and management of complex clinical trials.

Medpace reported revenues of $536.6 million, up 7.7% year on year. This number was in line with analysts’ expectations. Taking a step back, it was a slower quarter as it produced full-year revenue guidance missing analysts’ expectations.

The stock is down 4.5% since reporting and currently trades at $337.67.

Read our full, actionable report on Medpace here, it’s free.

IQVIA (NYSE: IQV)

Formed in 2016 through the merger of IMS Health and Quintiles, offers advanced analytics, technology solutions, and clinical research services to life sciences companies, helping them accelerate drug development and optimize healthcare operations.

IQVIA reported revenues of $3.96 billion, up 2.3% year on year. This result topped analysts’ expectations by 0.6%. Zooming out, it was a mixed quarter as it also produced a narrow beat of analysts’ constant currency revenue estimates but full-year revenue guidance slightly missing analysts’ expectations.

The stock is down 7.1% since reporting and currently trades at $190.63.

Read our full, actionable report on IQVIA here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.