Carbonate fuel cell technology developer FuelCell Energy (NASDAQ: FCEL) fell short of the market’s revenue expectations in Q4 CY2024, but sales rose 13.8% year on year to $19 million. Its GAAP loss of $1.42 per share was 7.1% above analysts’ consensus estimates.

Is now the time to buy FuelCell Energy? Find out by accessing our full research report, it’s free.

FuelCell Energy (FCEL) Q4 CY2024 Highlights:

- Revenue: $19 million vs analyst estimates of $36.27 million (13.8% year-on-year growth, 47.6% miss)

- EPS (GAAP): -$1.42 vs analyst estimates of -$1.53 (7.1% beat)

- Adjusted EBITDA: -$21.07 million vs analyst estimates of -$15.64 million (-111% margin, 34.7% miss)

- Operating Margin: -173%, up from -254% in the same quarter last year

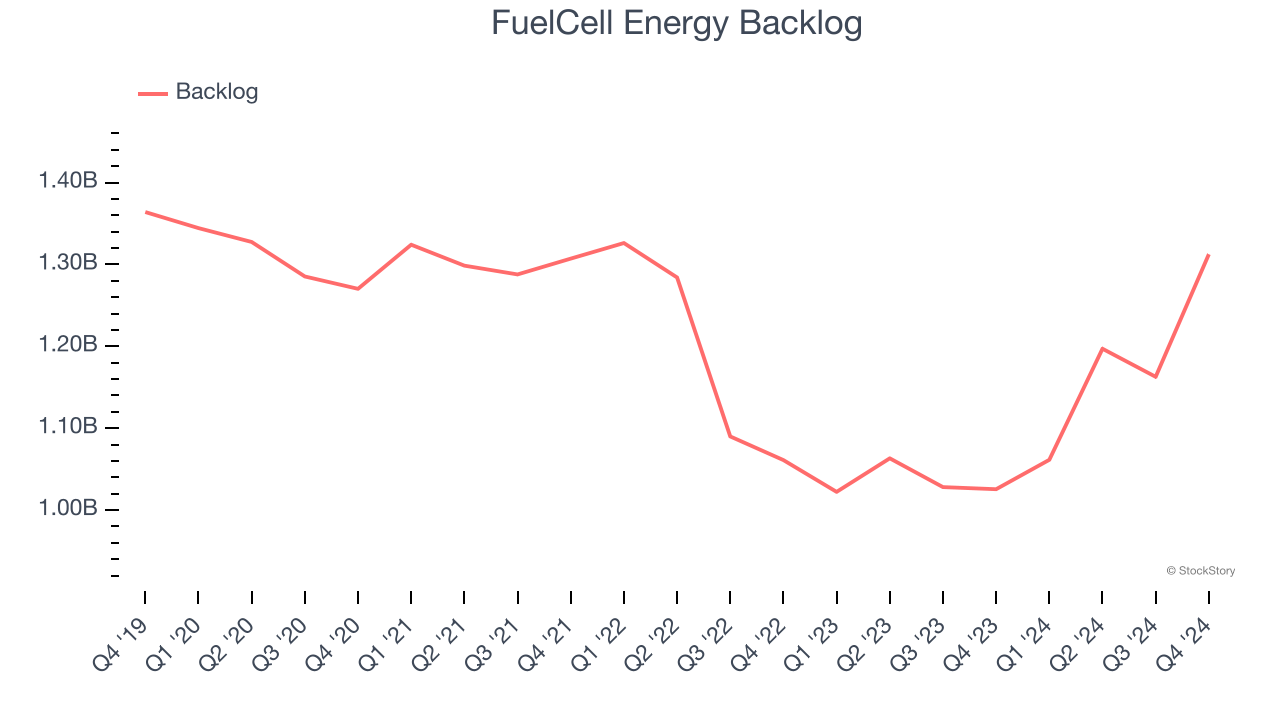

- Backlog: $1.31 billion at quarter end, up 28% year on year (beat vs expectations)

- Market Capitalization: $129.4 million

“We’ve made measurable strides since our global restructuring was announced early in the first fiscal quarter. Our cost-saving initiatives are already yielding positive outcomes, and our commitment to uncovering and capitalizing on growth opportunities is paying off,” said Jason Few, President and Chief Executive Officer.

Company Overview

Founded in 1969, FuelCell Energy (NASDAQ: FCEL) is a leading manufacturer and developer of carbonate fuel cell technology for stationary power generation.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Sales Growth

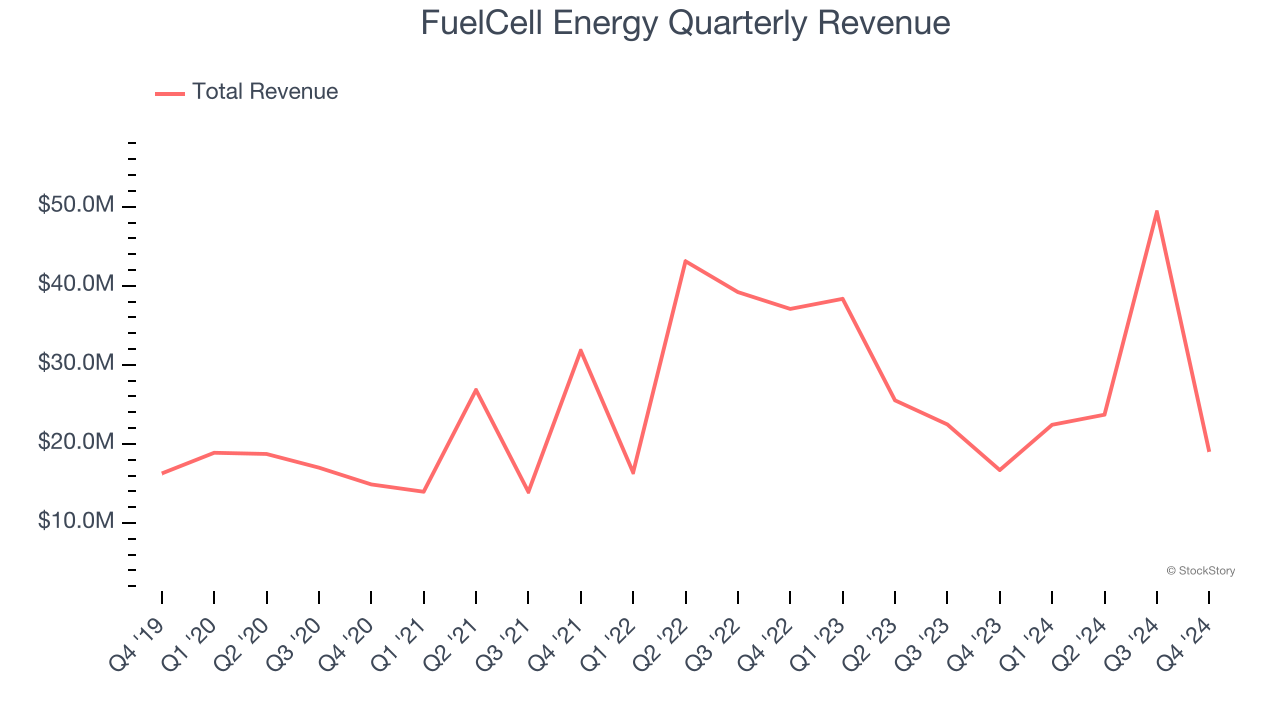

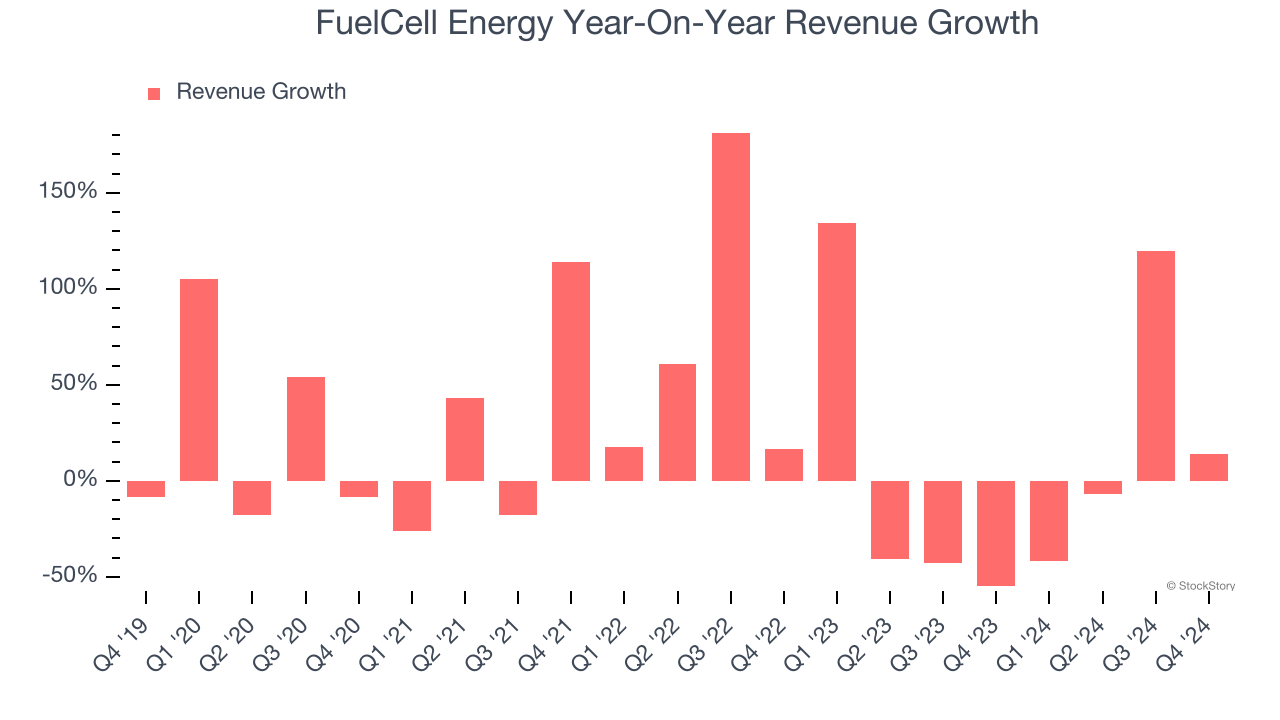

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, FuelCell Energy grew its sales at an exceptional 14.1% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. FuelCell Energy’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 8.2% over the last two years. FuelCell Energy isn’t alone in its struggles as the Renewable Energy industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. FuelCell Energy’s backlog reached $1.31 billion in the latest quarter and averaged 1% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for FuelCell Energy’s products and services but raises concerns about capacity constraints.

This quarter, FuelCell Energy’s revenue grew by 13.8% year on year to $19 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 62.2% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

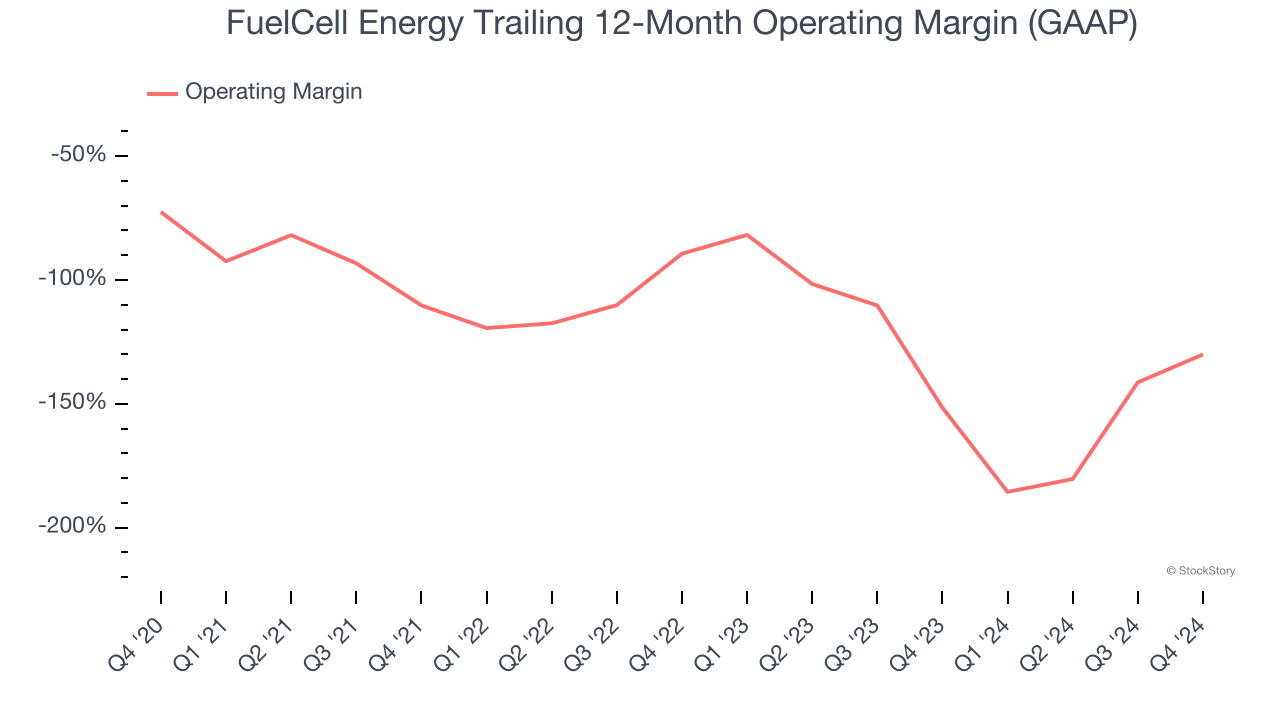

FuelCell Energy’s high expenses have contributed to an average operating margin of negative 112% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, FuelCell Energy’s operating margin decreased by 57.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. . FuelCell Energy’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, FuelCell Energy generated a negative 173% operating margin. The company's consistent lack of profits raise a flag.

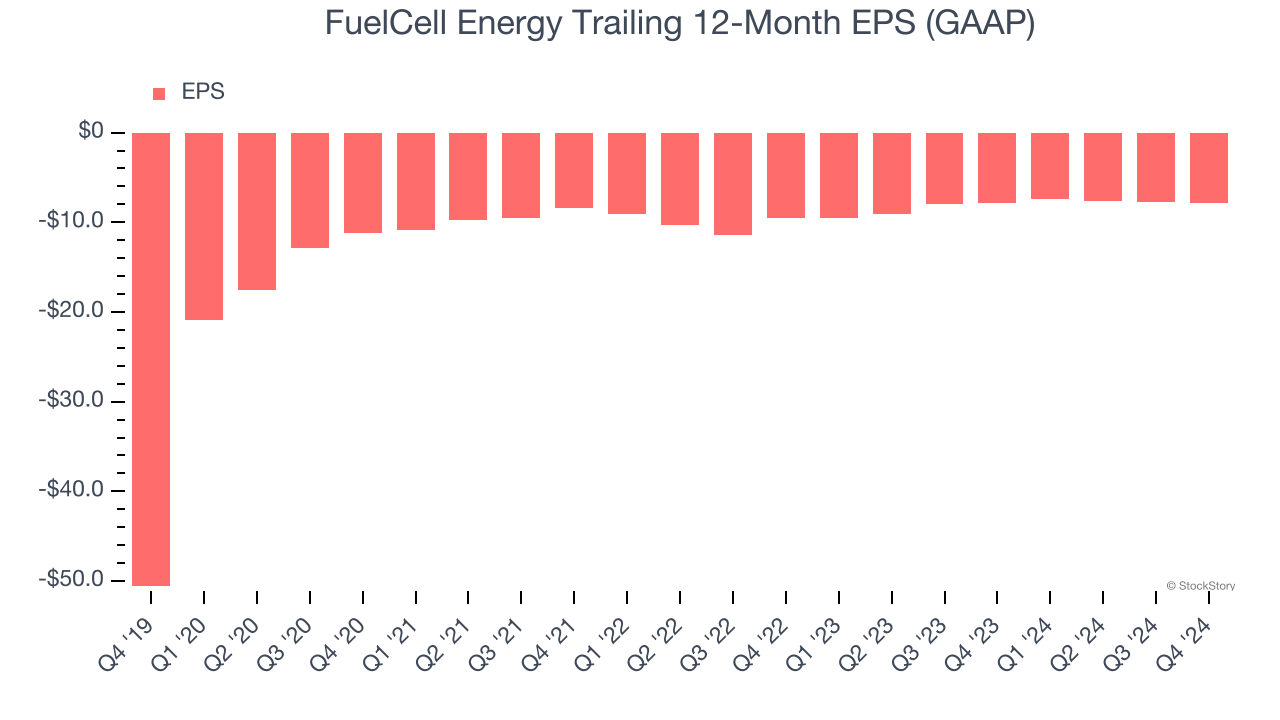

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although FuelCell Energy’s full-year earnings are still negative, it reduced its losses and improved its EPS by 31.2% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For FuelCell Energy, its two-year annual EPS growth of 9.2% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, FuelCell Energy reported EPS at negative $1.42, down from negative $1.37 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 7.1%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from FuelCell Energy’s Q4 Results

We liked that FuelCell Energy beat analysts’ backlog expectations this quarter. On the other hand, this did not translate into revenue, and in fact, its revenue missed. Additionally, its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 7.4% to $5.89 immediately after reporting.

So do we think FuelCell Energy is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.