Wrapping up Q4 earnings, we look at the numbers and key takeaways for the analog semiconductors stocks, including Himax (NASDAQ: HIMX) and its peers.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 14 analog semiconductors stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.3% since the latest earnings results.

Best Q4: Himax (NASDAQ: HIMX)

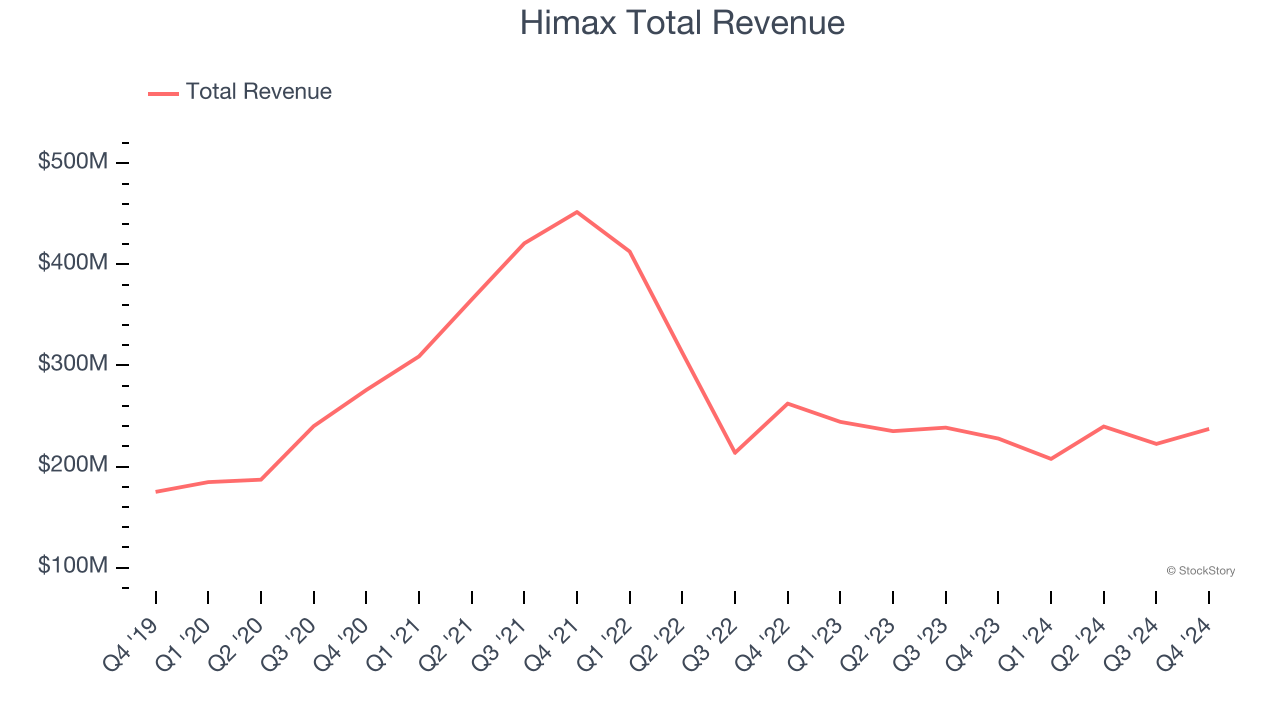

Taiwan-based Himax Technologies (NASDAQ: HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $237.2 million, up 4.2% year on year. This print exceeded analysts’ expectations by 7.3%. Overall, it was an incredible quarter for the company with a significant improvement in its inventory levels and an impressive beat of analysts’ EPS estimates.

“In 2024, our sales revenues in each quarter consistently outperformed guidance. We have consistently demonstrated our ability to handle most of rush orders, underscoring our agility, adaptability, strong capabilities in inventory management, and swift market responsiveness,” said Mr. Jordan Wu, President and Chief Executive Officer of Himax.

The stock is down 5.5% since reporting and currently trades at $8.62.

Is now the time to buy Himax? Access our full analysis of the earnings results here, it’s free.

Texas Instruments (NASDAQ: TXN)

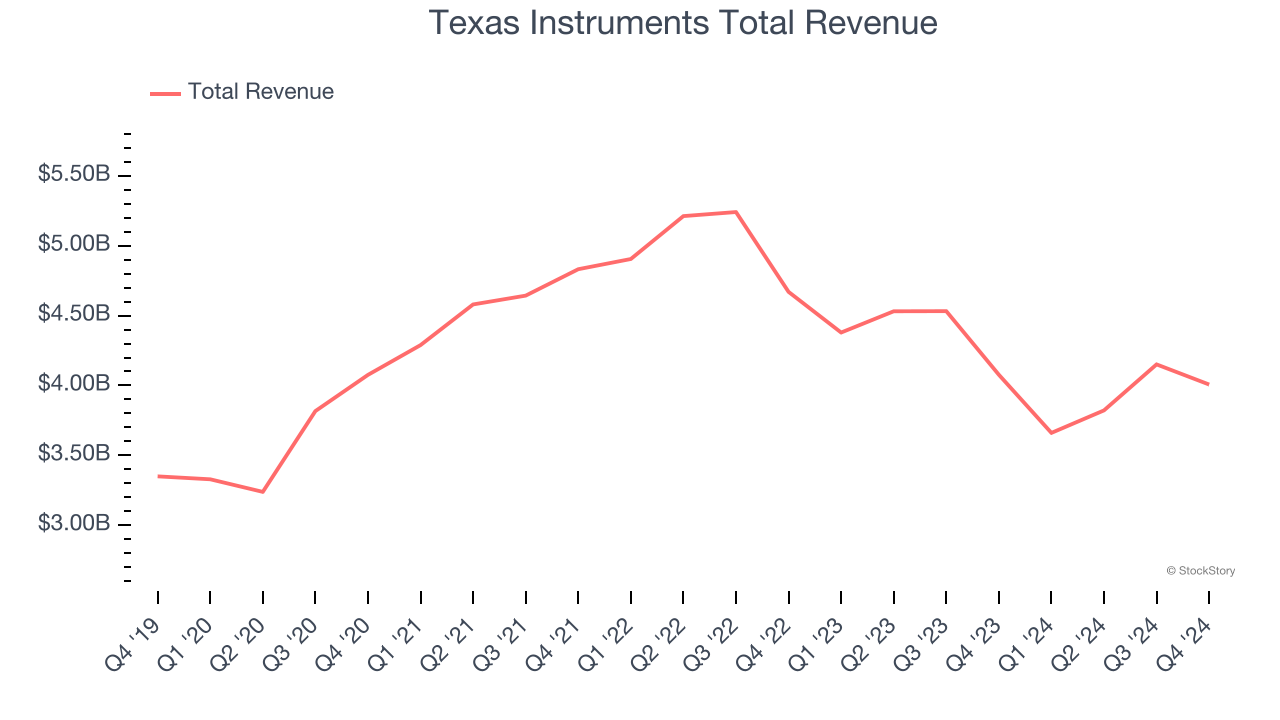

Headquartered in Dallas, Texas since the 1950s, Texas Instruments (NASDAQ: TXN) is the world’s largest producer of analog semiconductors.

Texas Instruments reported revenues of $4.01 billion, down 1.7% year on year, outperforming analysts’ expectations by 3.3%. The business had a very strong quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 6.7% since reporting. It currently trades at $187.21.

Is now the time to buy Texas Instruments? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Vishay Intertechnology (NYSE: VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE: VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $714.7 million, down 9% year on year, falling short of analysts’ expectations by 1.1%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Interestingly, the stock is up 9% since the results and currently trades at $18.11.

Read our full analysis of Vishay Intertechnology’s results here.

Sensata Technologies (NYSE: ST)

Originally a temperature sensor control maker and a subsidiary of Texas Instruments for 60 years, Sensata Technology Holdings (NYSE: ST) is a leading supplier of analog sensors used in industrial and transportation applications, best known for its dominant position in the tire pressure monitoring systems in cars.

Sensata Technologies reported revenues of $907.7 million, down 8.5% year on year. This result beat analysts’ expectations by 2.6%. Taking a step back, it was a satisfactory quarter as it also recorded a decent beat of analysts’ adjusted operating income estimates but an increase in its inventory levels.

The stock is up 4.7% since reporting and currently trades at $27.01.

Read our full, actionable report on Sensata Technologies here, it’s free.

Power Integrations (NASDAQ: POWI)

A leading supplier of parts for electronics such as home appliances, Power Integrations (NASDAQ: POWI) is a semiconductor designer and developer specializing in products used for high-voltage power conversion.

Power Integrations reported revenues of $105.3 million, up 17.6% year on year. This print was in line with analysts’ expectations. Aside from that, it was a slower quarter as it produced revenue guidance for next quarter missing analysts’ expectations significantly and an increase in its inventory levels.

The stock is down 2.8% since reporting and currently trades at $59.02.

Read our full, actionable report on Power Integrations here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.