Clinical research company Fortrea Holdings (NASDAQ: FTRE) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 1.8% year on year to $697 million. The company’s full-year revenue guidance of $2.5 billion at the midpoint came in 8.7% below analysts’ estimates. Its non-GAAP profit of $0.18 per share was 50.7% below analysts’ consensus estimates.

Is now the time to buy Fortrea? Find out by accessing our full research report, it’s free.

Fortrea (FTRE) Q4 CY2024 Highlights:

- Revenue: $697 million vs analyst estimates of $703.2 million (1.8% year-on-year decline, 0.9% miss)

- Adjusted EPS: $0.18 vs analyst expectations of $0.37 (50.7% miss)

- Adjusted EBITDA: $56 million vs analyst estimates of $75.16 million (8% margin, 25.5% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $2.5 billion at the midpoint, missing analyst estimates by 8.7% and implying -7.3% growth (vs -5.1% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $185 million at the midpoint, below analyst estimates of $277.6 million

- Operating Margin: -8%, down from -3.4% in the same quarter last year

- Free Cash Flow Margin: 2.9%, up from 1.3% in the same quarter last year

- Market Capitalization: $1.24 billion

“Our intense focus on our customers’ success and creating a better customer experience has resulted in the stronger demand that is reflected in this quarter’s book-to-bill,” said Tom Pike, chairman and CEO of Fortrea.

Company Overview

Spun off from Labcorp in 2023, Fortrea Holdings (NASDAQ: FTRE) provides contract research and development services for pharmaceutical and biotechnology companies, specializing in clinical trials, laboratory services, and data management.

Drug Development Inputs & Services

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

Sales Growth

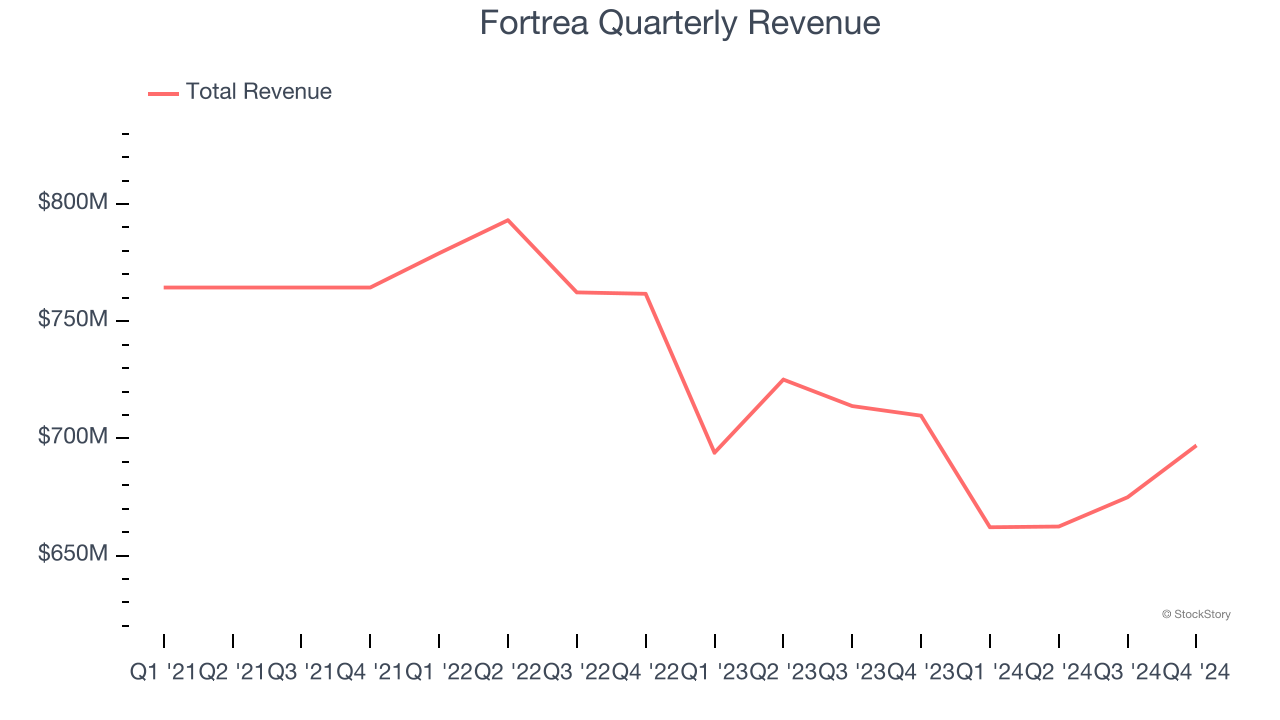

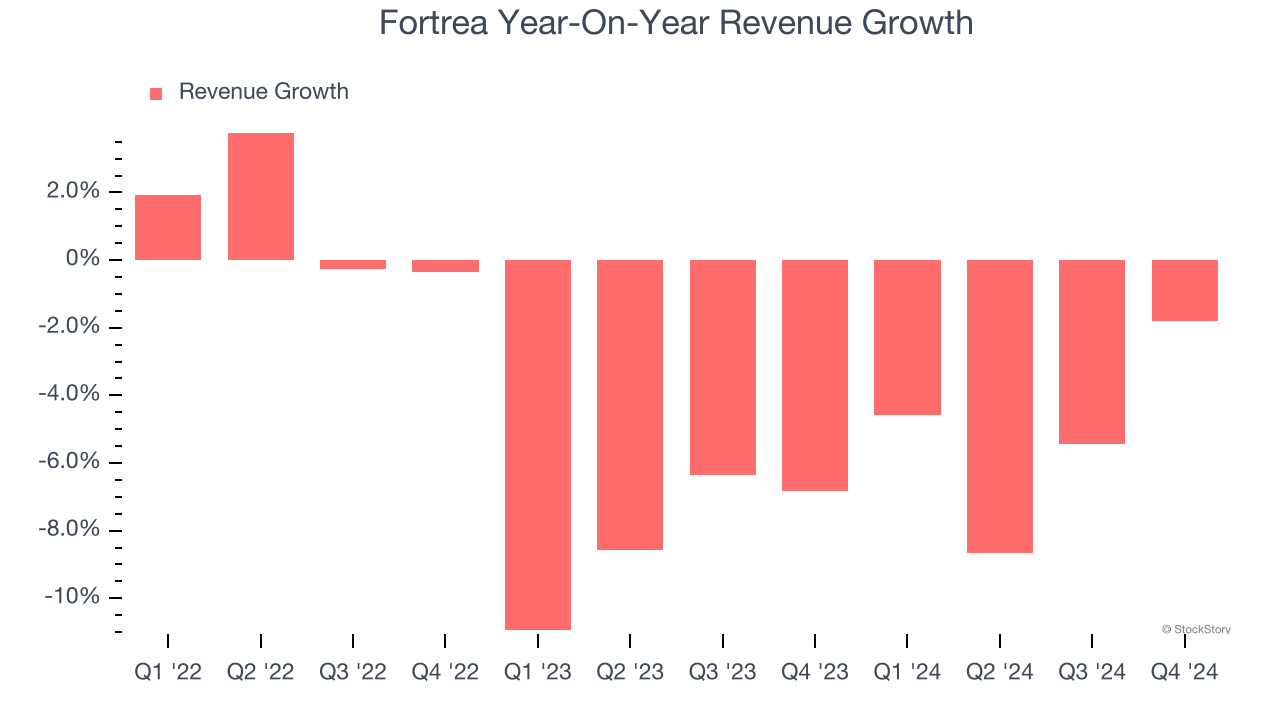

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Fortrea struggled to consistently generate demand over the last three years as its sales dropped at a 4.1% annual rate. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within healthcare, a stretched historical view may miss new innovations or demand cycles. Fortrea’s recent history shows its demand has stayed suppressed as its revenue has declined by 6.7% annually over the last two years.

This quarter, Fortrea missed Wall Street’s estimates and reported a rather uninspiring 1.8% year-on-year revenue decline, generating $697 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

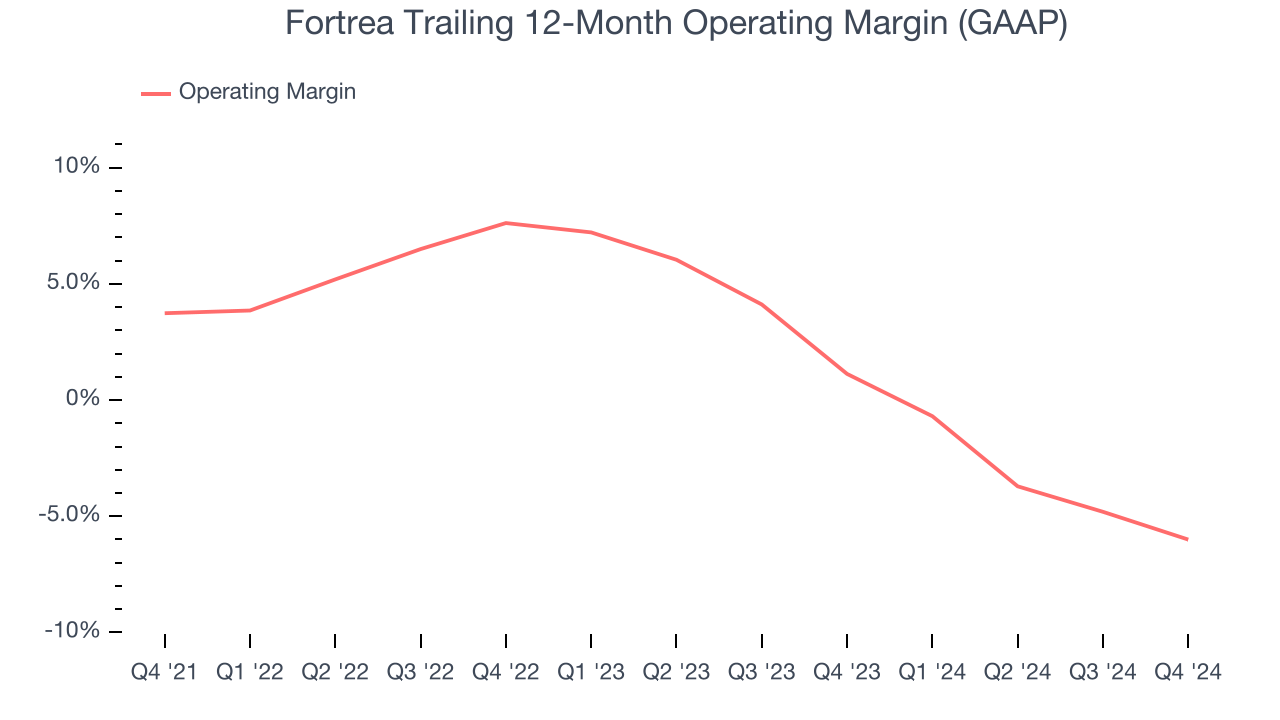

Fortrea was profitable over the last four years but held back by its large cost base. Its average operating margin of 1.9% was weak for a healthcare business.

Analyzing the trend in its profitability, Fortrea’s operating margin decreased by 9.7 percentage points over the last four years. This performance was caused by more recent speed bumps as the company’s margin fell by 13.6 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Fortrea generated an operating profit margin of negative 8%, down 4.6 percentage points year on year. This contraction shows it was recently less efficient because its expenses increased relative to its revenue.

Earnings Per Share

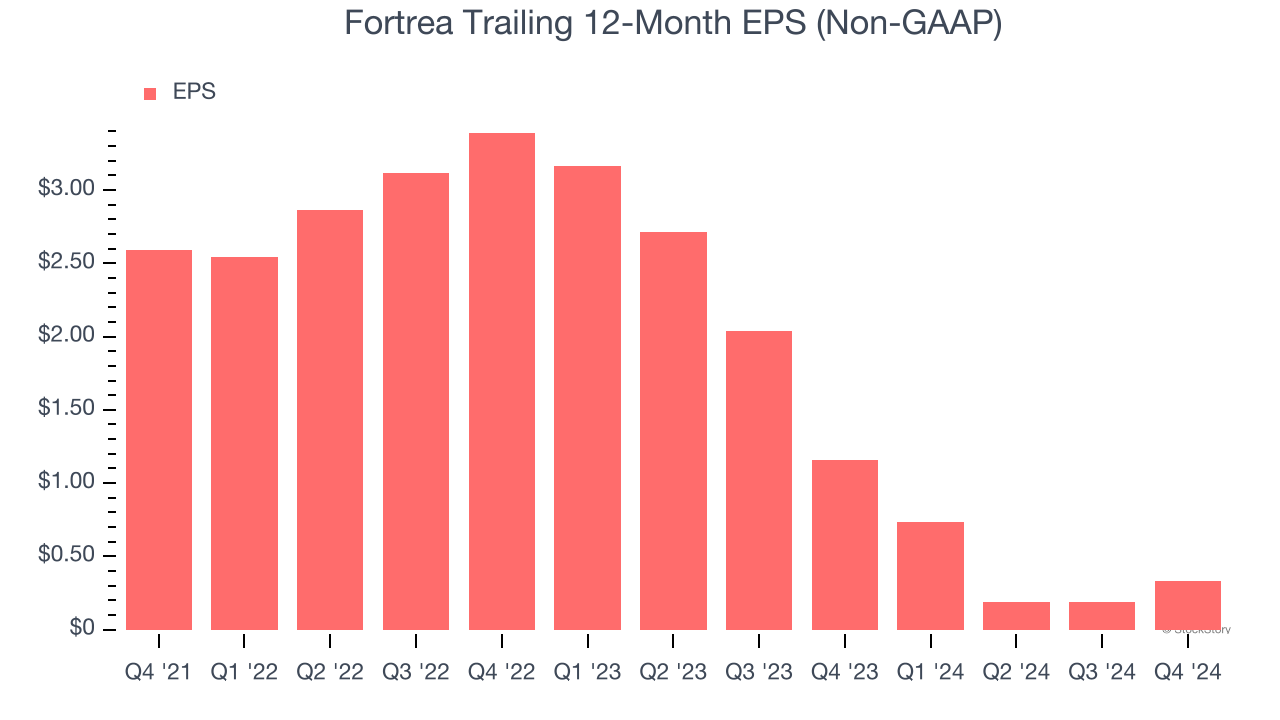

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Fortrea, its EPS declined by more than its revenue over the last three years, dropping 49.8% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, Fortrea reported EPS at $0.18, up from $0.04 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Fortrea’s full-year EPS of $0.33 to grow 297%.

Key Takeaways from Fortrea’s Q4 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed significantly and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 6.2% to $13 immediately following the results.

The latest quarter from Fortrea’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.