Boat and marine products retailer MarineMax (NYSE: HZO) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 8.3% year on year to $631.5 million. Its non-GAAP profit of $0.23 per share was 19.3% above analysts’ consensus estimates.

Is now the time to buy MarineMax? Find out by accessing our full research report, it’s free.

MarineMax (HZO) Q1 CY2025 Highlights:

- Revenue: $631.5 million vs analyst estimates of $580.5 million (8.3% year-on-year growth, 8.8% beat)

- Adjusted EPS: $0.23 vs analyst estimates of $0.19 (19.3% beat)

- Adjusted EBITDA: $30.92 million vs analyst estimates of $28.73 million (4.9% margin, 7.6% beat)

- Management lowered its full-year Adjusted EPS guidance to $1.90 at the midpoint, a 17.4% decrease

- EBITDA guidance for the full year is $155 million at the midpoint, below analyst estimates of $166.1 million

- Operating Margin: 3.6%, in line with the same quarter last year

- Locations: 70 at quarter end, down from 83 in the same quarter last year

- Same-Store Sales rose 11% year on year (2% in the same quarter last year)

- Market Capitalization: $438.7 million

Brett McGill, Chief Executive Officer and President of MarineMax, stated, “Despite facing a weak retail market and an uncertain macroeconomic climate, we delivered a strong second-quarter performance. Our 11% same-store sales growth highlights the exceptional execution by our team. This growth was supported by the ongoing joint promotional initiatives with our industry-leading manufacturing partners. While challenging conditions are exerting significant retail margin pressure across the recreational marine industry, our year-to-date gross margin of 32.7% is a testament to the strength of our strategic diversification. By expanding into high-value segments such as marinas, superyacht services, and finance and insurance, together with our premium brand focus, we have built a more resilient business model that continues to deliver strong performance."

Company Overview

Appropriately headquartered in Clearwater, Florida, MarineMax (NYSE: HZO) sells boats, yachts, and other marine products.

Boat & Marine Retailer

Retailers that sell boats and marine products sell products, sure, but they also sell an image and lifestyle to an often wealthier customer. Unlike a car–which many use daily to get to/from work and to run personal and family errands–a boat or yacht is certainly a discretionary, luxury, nice-to-have purchase. While there is online competition, especially for research and discovery, the boat and yacht market is still very brick-and-mortar based given the magnitude of the purchase and the logistical costs associated with moving these products over long distances.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $2.42 billion in revenue over the past 12 months, MarineMax is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers. On the bright side, it can grow faster because it has more white space to build new stores.

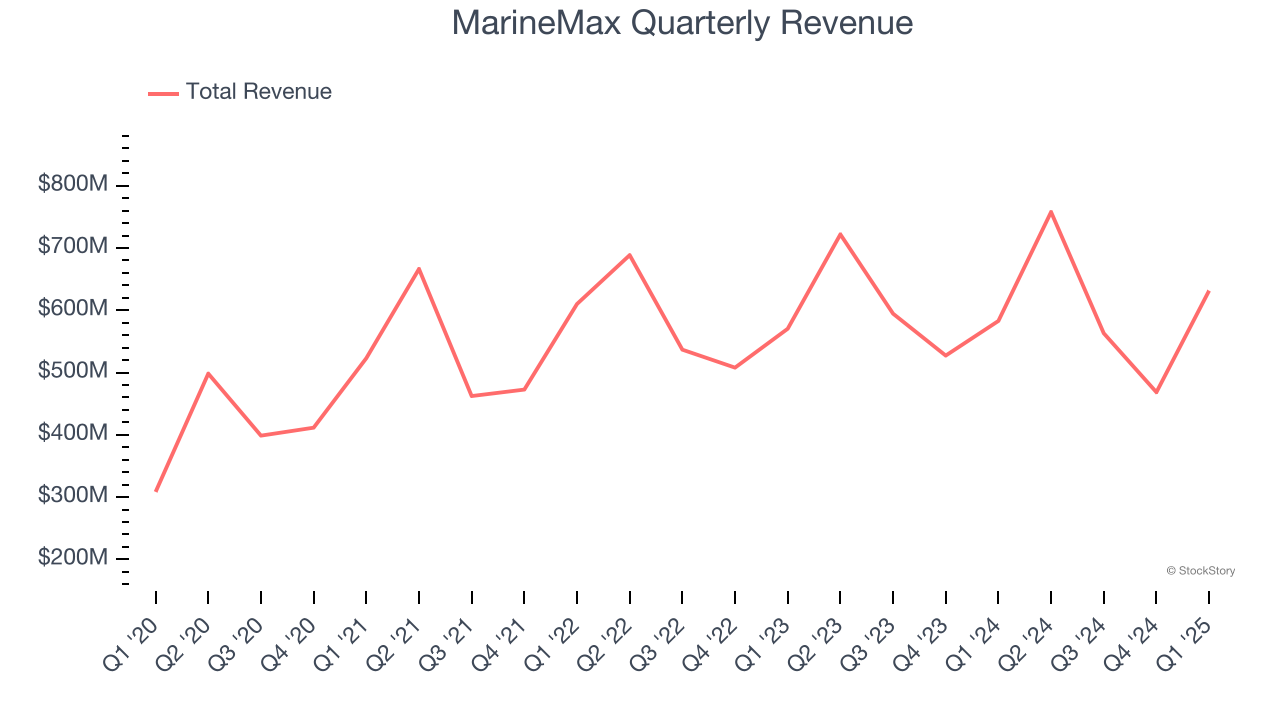

As you can see below, MarineMax’s sales grew at a decent 12.2% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) despite closing stores, implying that growth was driven by higher sales at existing, established locations.

This quarter, MarineMax reported year-on-year revenue growth of 8.3%, and its $631.5 million of revenue exceeded Wall Street’s estimates by 8.8%.

Looking ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and suggests its products will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Store Performance

Number of Stores

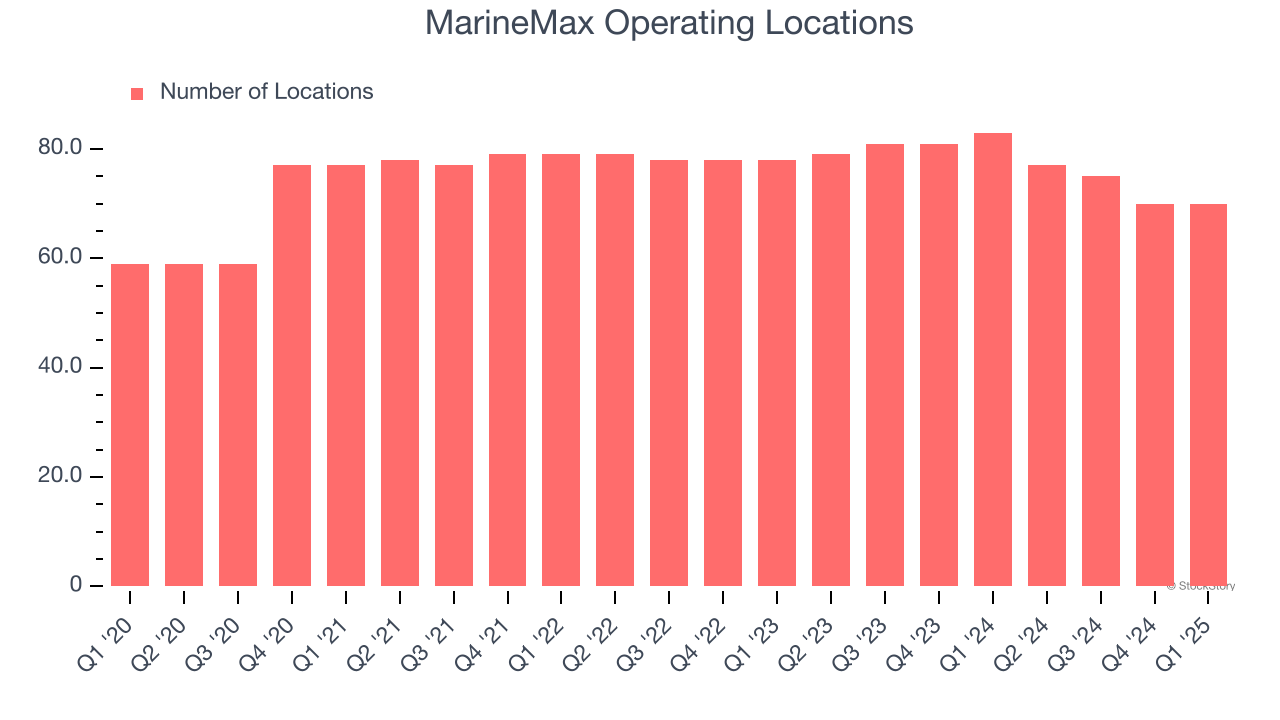

MarineMax listed 70 locations in the latest quarter and has generally closed its stores over the last two years, averaging 3.1% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

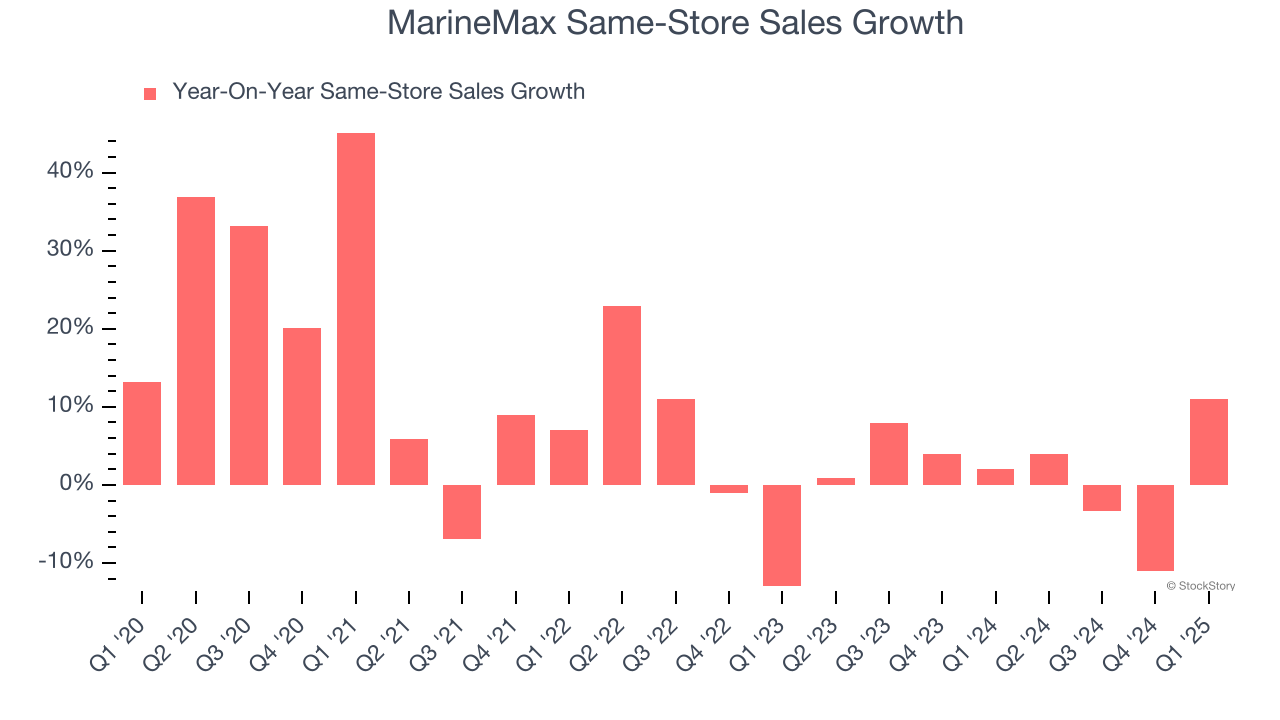

MarineMax’s demand within its existing locations has been relatively stable over the last two years but was below most retailers. On average, the company’s same-store sales have grown by 1.9% per year. Given its declining store base over the same period, this performance stems from a mixture of higher e-commerce sales and increased foot traffic at existing locations (closing stores can sometimes boost same-store sales).

In the latest quarter, MarineMax’s same-store sales rose 11% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from MarineMax’s Q1 Results

We were impressed by how significantly MarineMax blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. On the other hand, it lowered its full-year EPS guidance. Still, we think this was a decent quarter with some key areas of upside. The stock traded up 7.7% to $20.72 immediately following the results.

Indeed, MarineMax had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.