Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Floor And Decor (NYSE: FND) and the best and worst performers in the home furnishing and improvement retail industry.

Home furnishing and improvement retailers understand that ‘home is where the heart is’ but that a home is only right when it’s in livable condition and furnished just right. These stores therefore focus on providing what is needed for both the upkeep of a house as well as what is desired for the aesthetics of a home. Decades ago, it was thought that furniture and home improvement would resist e-commerce because of the logistical challenges of shipping a sofa or lawn mower, but now you can buy both online; so just like other retailers, these stores need to adapt to new realities and consumer behaviors.

The 7 home furnishing and improvement retail stocks we track reported a slower Q1. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Thankfully, share prices of the companies have been resilient as they are up 6.1% on average since the latest earnings results.

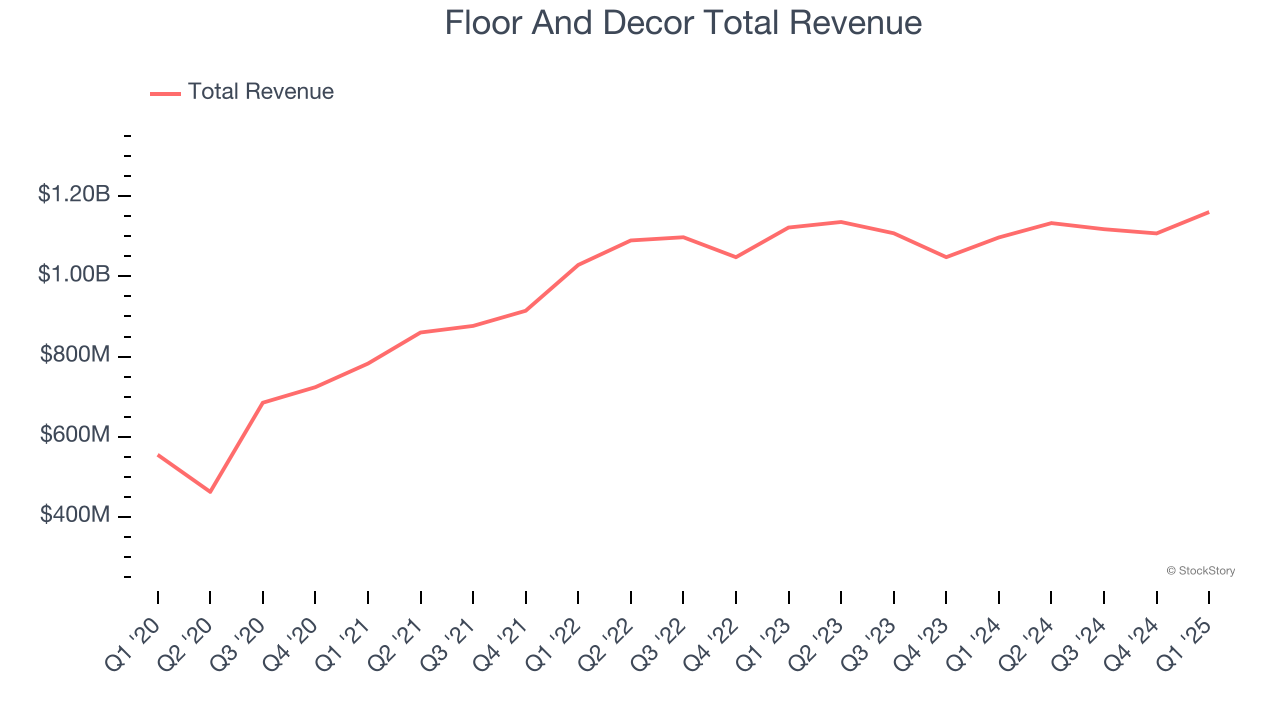

Floor And Decor (NYSE: FND)

Operating large, warehouse-style stores, Floor & Decor (NYSE: FND) is a specialty retailer that specializes in hard flooring surfaces for the home such as tiles, hardwood, stone, and laminates.

Floor And Decor reported revenues of $1.16 billion, up 5.8% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with full-year revenue guidance missing analysts’ expectations.

Tom Taylor, Chief Executive Officer, stated, “We are pleased to deliver fiscal 2025 first quarter diluted earnings per share of $0.45, compared to $0.46 in the same period last year. This result exceeded the low end of our first quarter earnings expectations, even though comparable store sales were at the lower end of our forecast. These first quarter results are a testament to our focus on what we can control. Despite the macroeconomic and geopolitical uncertainty, we believe we have a proactive, flexible plan that we are implementing and executing. We successfully managed an increase in tariffs in 2018 and 2019 by pursuing strategies to grow our market share and protect our profitability. Today, we intend to employ similar strategies to achieve these goals in 2025 and beyond.”

Interestingly, the stock is up 15.5% since reporting and currently trades at $83.49.

Read our full report on Floor And Decor here, it’s free.

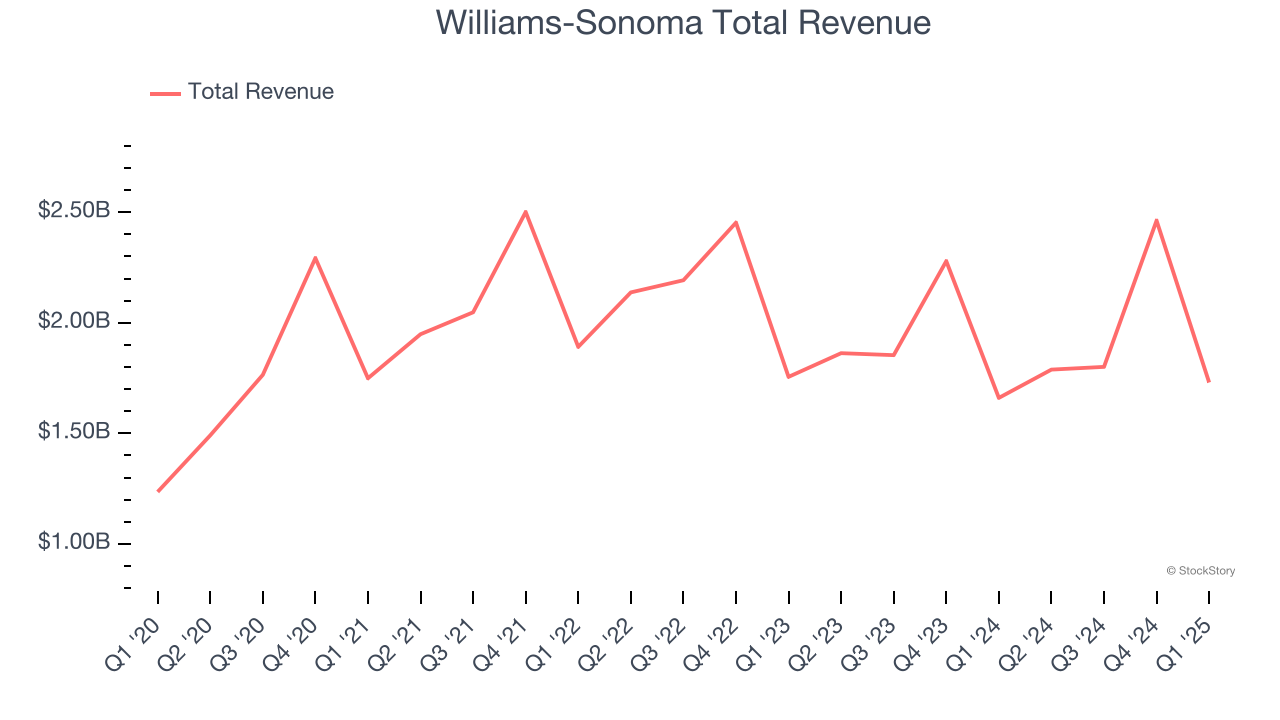

Best Q1: Williams-Sonoma (NYSE: WSM)

Started in 1956 as a store specializing in French cookware, Williams-Sonoma (NYSE: WSM) is a specialty retailer of higher-end kitchenware, home goods, and furniture.

Williams-Sonoma reported revenues of $1.73 billion, up 4.2% year on year, outperforming analysts’ expectations by 4%. The business had a strong quarter with a decent beat of analysts’ EBITDA estimates.

Williams-Sonoma delivered the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 3.2% since reporting. It currently trades at $173.

Is now the time to buy Williams-Sonoma? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: Sleep Number (NASDAQ: SNBR)

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ: SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

Sleep Number reported revenues of $393.3 million, down 16.4% year on year, falling short of analysts’ expectations by 1.2%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Sleep Number delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 3.7% since the results and currently trades at $8.08.

Read our full analysis of Sleep Number’s results here.

Home Depot (NYSE: HD)

Founded and headquartered in Atlanta, Georgia, Home Depot (NYSE: HD) is a home improvement retailer that sells everything from tools to building materials to appliances.

Home Depot reported revenues of $39.86 billion, up 9.4% year on year. This number surpassed analysts’ expectations by 1.6%. However, it was a slower quarter as it logged a miss of analysts’ EBITDA estimates and gross margin in line with analysts’ estimates.

The stock is down 2.1% since reporting and currently trades at $371.04.

Read our full, actionable report on Home Depot here, it’s free.

RH (NYSE: RH)

Formerly known as Restoration Hardware, RH (NYSE: RH) is a specialty retailer that exclusively sells its own brand of high-end furniture and home decor.

RH reported revenues of $814 million, up 12% year on year. This result missed analysts’ expectations by 0.6%. Aside from that, it was a mixed quarter as it also produced a solid beat of analysts’ EPS estimates but a significant miss of analysts’ EBITDA estimates.

RH pulled off the fastest revenue growth among its peers. The stock is up 14.9% since reporting and currently trades at $203.50.

Read our full, actionable report on RH here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.