Regional banking company 1st Source (NASDAQ: SRCE) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 11.3% year on year to $108.2 million. Its GAAP profit of $1.51 per share was 2.5% above analysts’ consensus estimates.

Is now the time to buy 1st Source? Find out by accessing our full research report, it’s free.

1st Source (SRCE) Q2 CY2025 Highlights:

- Net Interest Income: $85.19 million vs analyst estimates of $81.79 million (15% year-on-year growth, 4.2% beat)

- Net Interest Margin: 4% vs analyst estimates of 3.9% (41 basis point year-on-year increase, 13.3 bps beat)

- Revenue: $108.2 million vs analyst estimates of $104.7 million (11.3% year-on-year growth, 3.4% beat)

- Efficiency Ratio: 48.4% vs analyst estimates of 50.8% (2.4 percentage point beat)

- EPS (GAAP): $1.51 vs analyst estimates of $1.47 (2.5% beat)

- Market Capitalization: $1.55 billion

Christopher J. Murphy III, Chairman and Chief Executive Officer, commented, "We are pleased that the strong start in 2025 continued through the second quarter. In spite of the noise in the economy and the uncertainty in the market, we are proud to have achieved a sixth consecutive quarter of margin expansion resulting from higher rates on investment securities, increased average loan and lease balances, and lower deposit costs."

Company Overview

Tracing its roots back to 1863 during the Civil War era, 1st Source Corporation (NASDAQ: SRCE) is a regional bank holding company that provides commercial, consumer, specialty finance, and wealth management services across Indiana, Michigan, and Florida.

Sales Growth

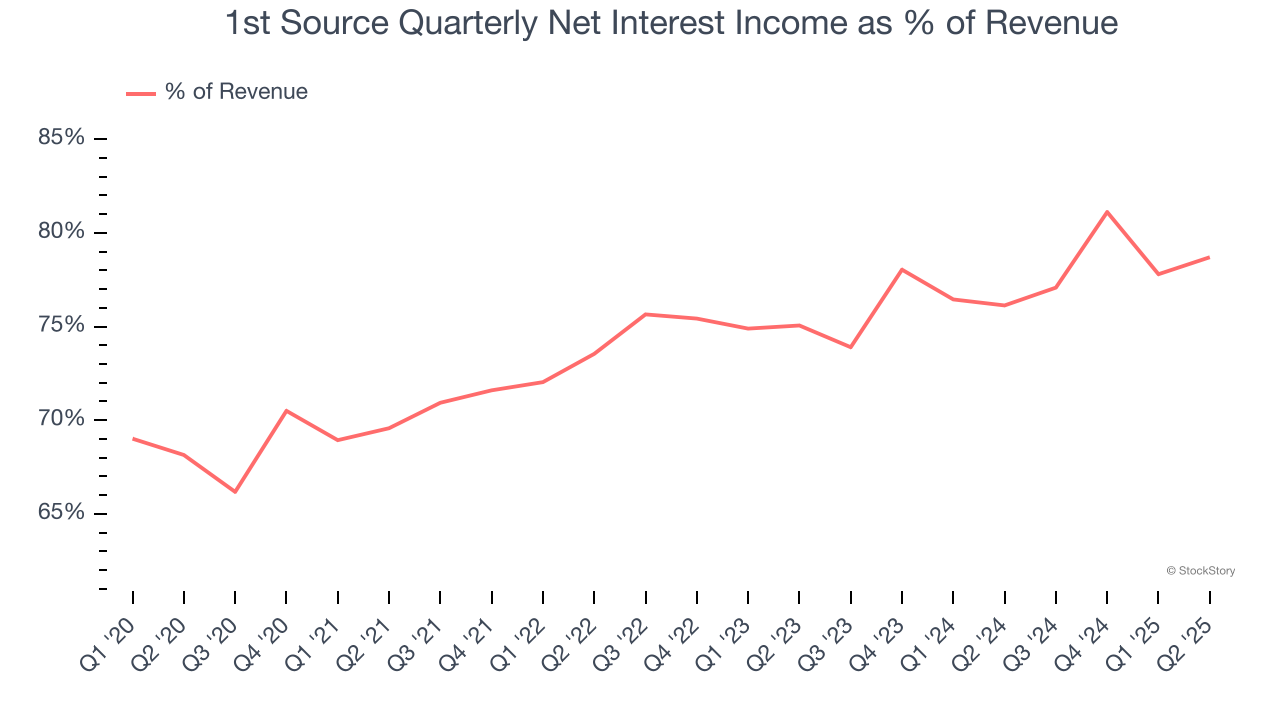

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income.

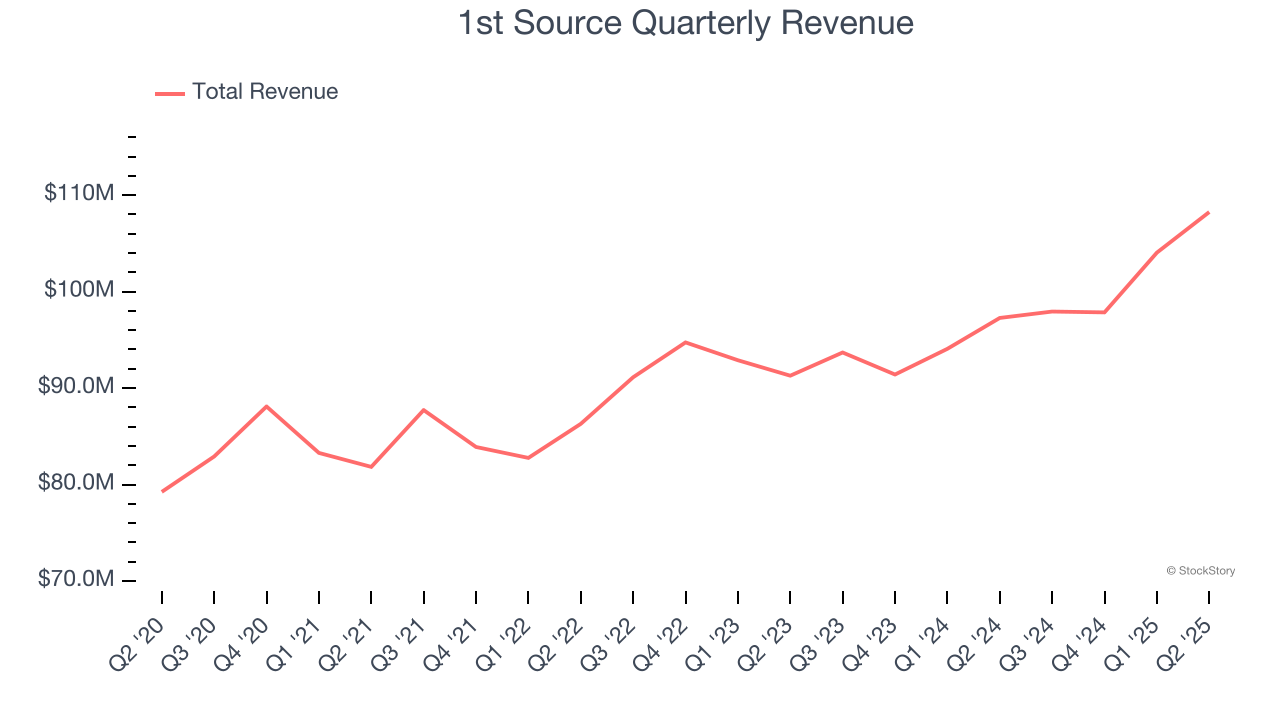

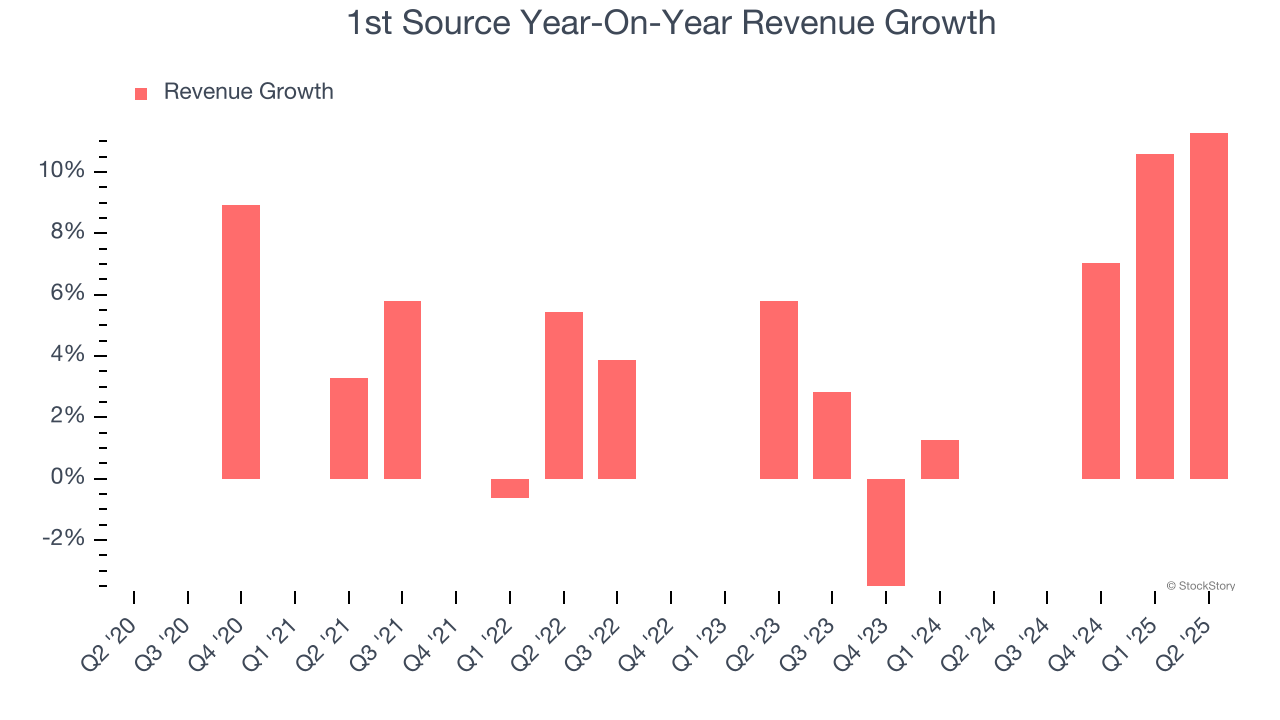

Unfortunately, 1st Source’s 4.8% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the bank sector, but there are still things to like about 1st Source.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. 1st Source’s annualized revenue growth of 5% over the last two years aligns with its five-year trend, suggesting its demand was stable.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, 1st Source reported year-on-year revenue growth of 11.3%, and its $108.2 million of revenue exceeded Wall Street’s estimates by 3.4%.

Net interest income made up 74.2% of the company’s total revenue during the last five years, meaning lending operations are 1st Source’s largest source of revenue.

Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Tangible Book Value Per Share (TBVPS)

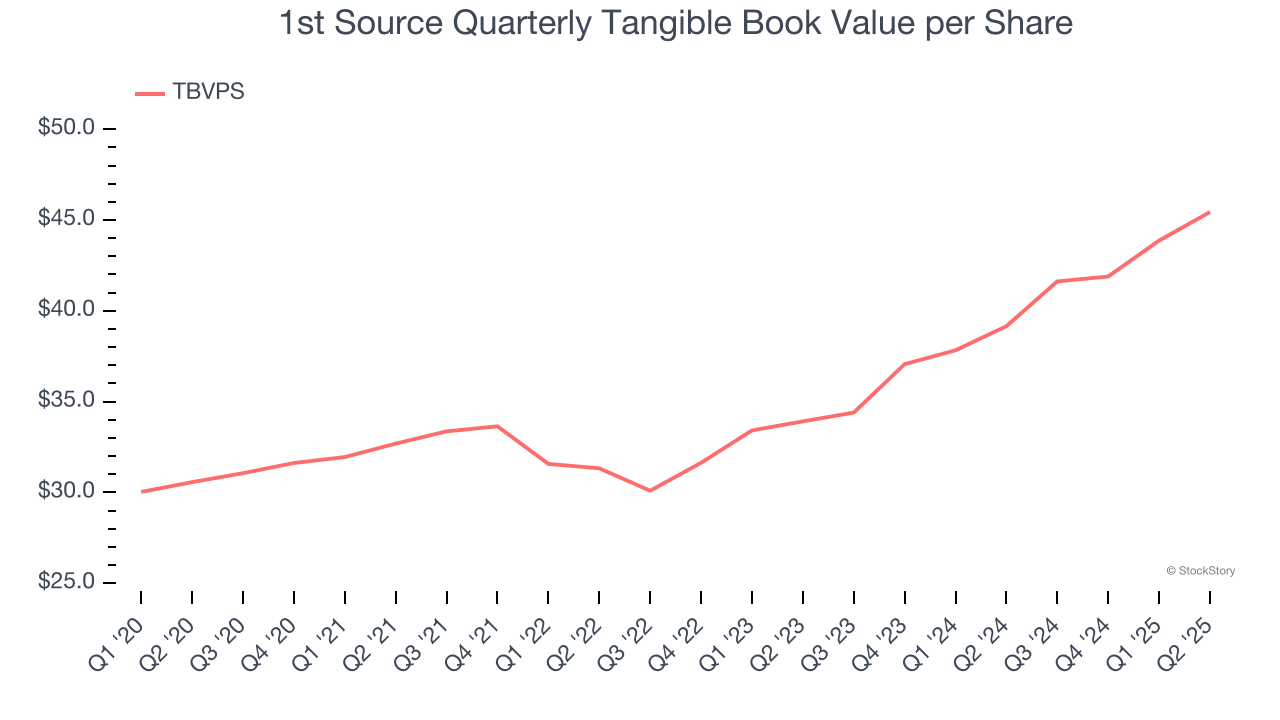

The balance sheet drives banking profitability since earnings flow from the spread between borrowing and lending rates. As such, valuations for these companies concentrate on capital strength and sustainable equity accumulation potential.

This explains why tangible book value per share (TBVPS) stands as the premier banking metric. TBVPS strips away questionable intangible assets, revealing concrete per-share net worth that investors can trust. Traditional metrics like EPS are helpful but face distortion from M&A activity and loan loss accounting rules.

1st Source’s TBVPS grew at an excellent 8.3% annual clip over the last five years. TBVPS growth has also accelerated recently, growing by 15.7% annually over the last two years from $33.92 to $45.44 per share.

Over the next 12 months, Consensus estimates call for 1st Source’s TBVPS to grow by 10.2% to $50.07, solid growth rate.

Key Takeaways from 1st Source’s Q2 Results

We enjoyed seeing 1st Source beat analysts’ net interest income expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EPS was in line and its tangible book value per share fell slightly short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock remained flat at $61.99 immediately after reporting.

So do we think 1st Source is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.