Educational publishing and media company Scholastic (NASDAQ: SCHL) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 7% year on year to $508.3 million. Its non-GAAP profit of $0.87 per share was 2.4% above analysts’ consensus estimates.

Is now the time to buy Scholastic? Find out by accessing our full research report, it’s free.

Scholastic (SCHL) Q2 CY2025 Highlights:

- Revenue: $508.3 million vs analyst estimates of $494.6 million (7% year-on-year growth, 2.8% beat)

- Adjusted EPS: $0.87 vs analyst estimates of $0.85 (2.4% beat)

- Adjusted EBITDA: $91.2 million vs analyst estimates of $87.72 million (17.9% margin, 4% beat)

- EBITDA guidance for the upcoming financial year 2026 is $165 million at the midpoint, below analyst estimates of $185 million

- Operating Margin: 10.5%, down from 12.7% in the same quarter last year

- Free Cash Flow Margin: 17%, up from 10.5% in the same quarter last year

- Market Capitalization: $602.6 million

Peter Warwick, President and Chief Executive Officer, said, "Scholastic delivered solid financial results in fiscal 2025, with strong Adjusted EBITDA in line with our original guidance. In the fourth quarter, continued strength in Children's Book Publishing and Distribution, combined with successful execution and disciplined cost management, helped offset macroeconomic pressures on school spending, which continued to impact the Education division".

Company Overview

Creator of the legendary Scholastic Book Fair, Scholastic (NASDAQ: SCHL) is an international company specializing in children's publishing, education, and media services.

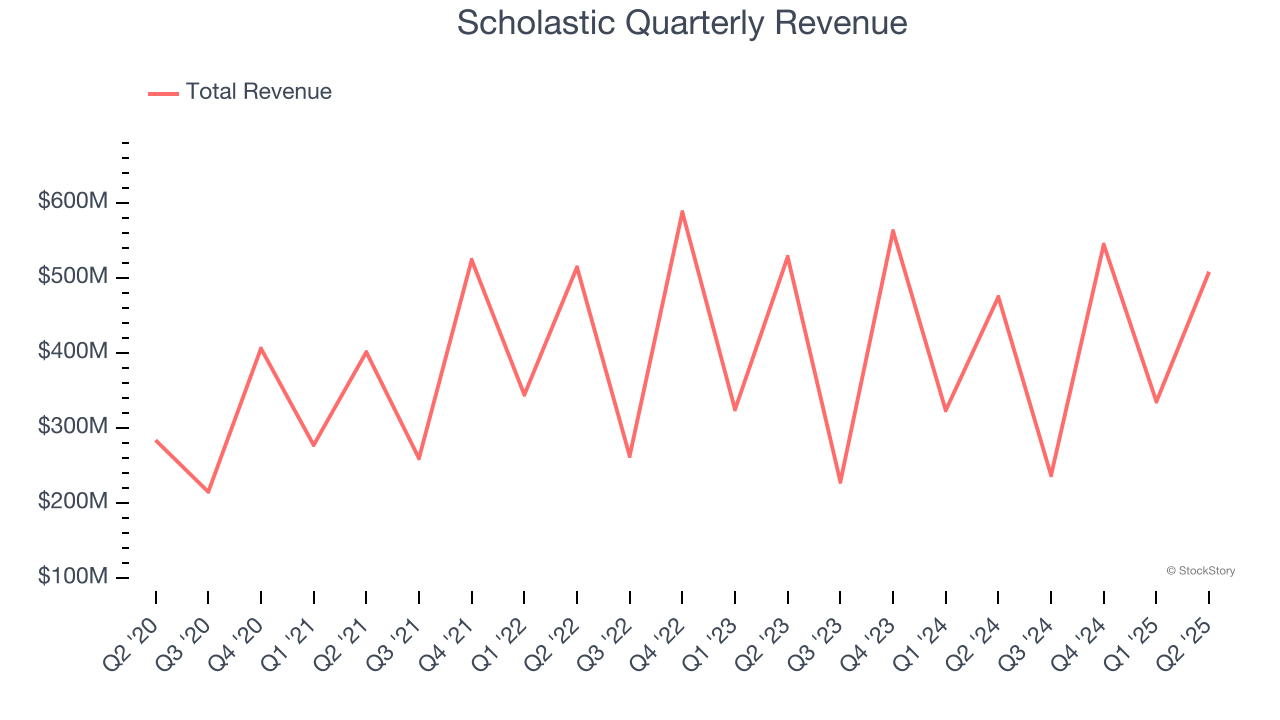

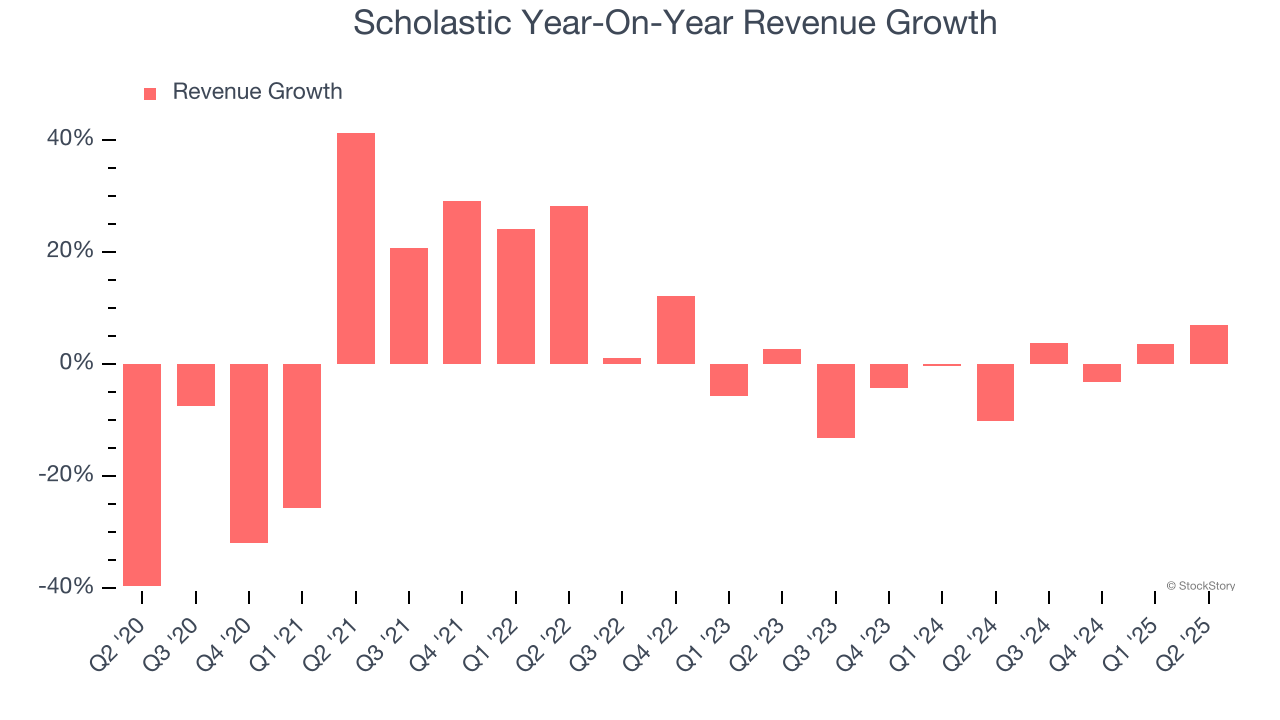

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Scholastic grew its sales at a weak 1.8% compounded annual growth rate. This was below our standards and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Scholastic’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.3% annually.

This quarter, Scholastic reported year-on-year revenue growth of 7%, and its $508.3 million of revenue exceeded Wall Street’s estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

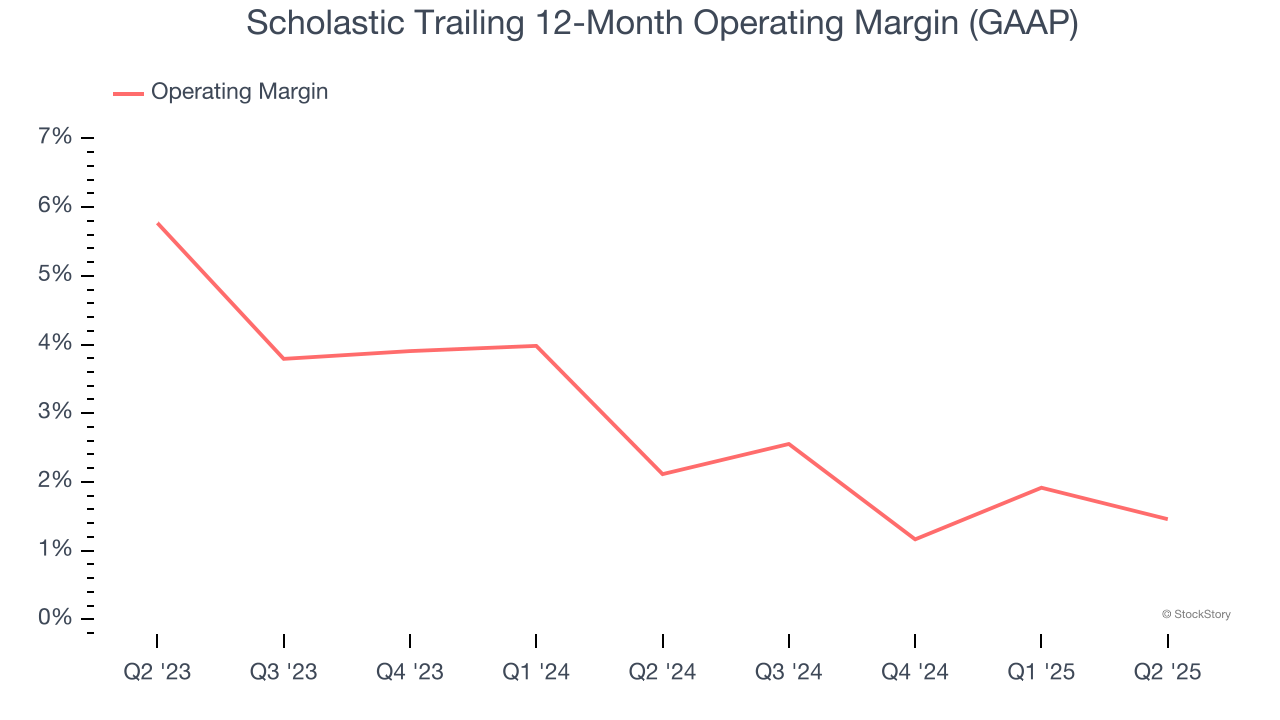

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Scholastic’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 1.8% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, Scholastic generated an operating margin profit margin of 10.5%, down 2.2 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

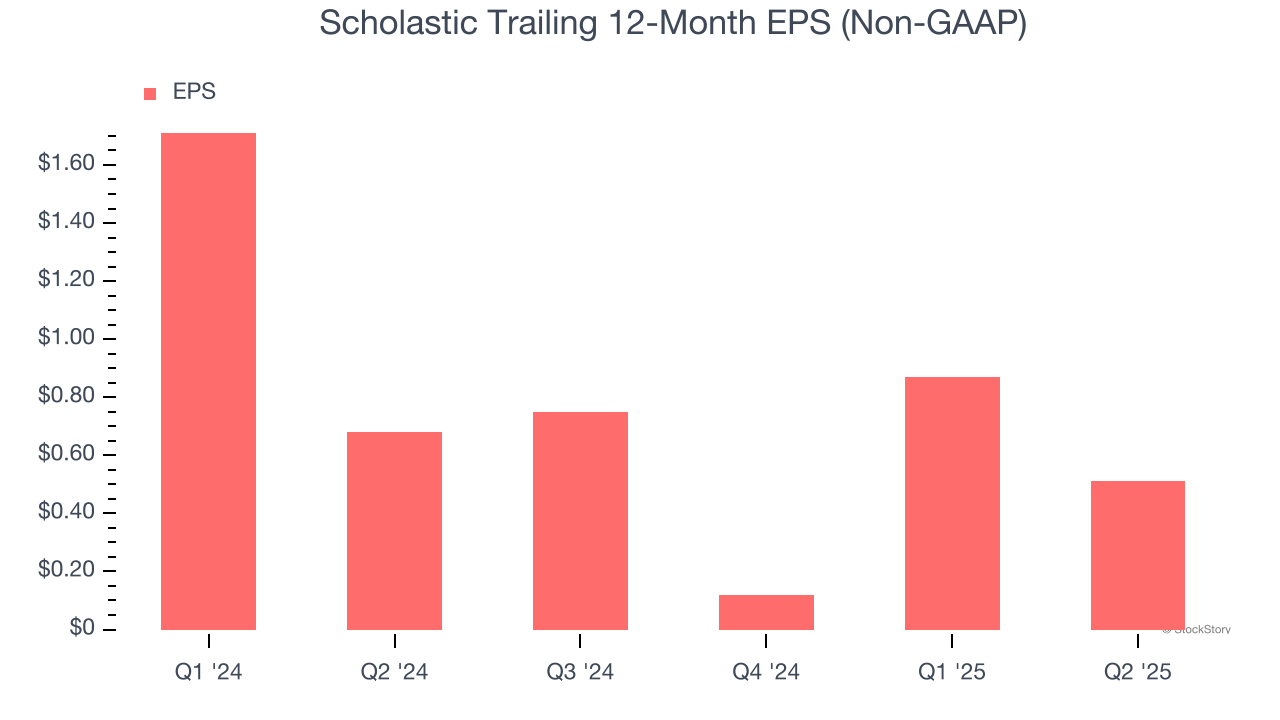

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Scholastic’s EPS grew at an unimpressive 8% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.8% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q2, Scholastic reported EPS at $0.87, down from $1.23 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 2.4%. Over the next 12 months, Wall Street expects Scholastic’s full-year EPS of $0.51 to grow 339%.

Key Takeaways from Scholastic’s Q2 Results

It was encouraging to see Scholastic beat analysts’ revenue, EPS, and EBITDA expectations this quarter. On the other hand, its full-year EBITDA guidance missed. Overall, this was a decent quarter. The stock traded up 9% to $23.49 immediately after reporting.

Is Scholastic an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.