Motion control and electronic systems manufacturer Helios Technologies (NYSE: HLIO) beat Wall Street’s revenue expectations in Q2 CY2025, but sales fell by 3.4% year on year to $212.5 million. On top of that, next quarter’s revenue guidance ($211.5 million at the midpoint) was surprisingly good and 7.2% above what analysts were expecting. Its non-GAAP profit of $0.59 per share was 17.4% above analysts’ consensus estimates.

Is now the time to buy Helios? Find out by accessing our full research report, it’s free.

Helios (HLIO) Q2 CY2025 Highlights:

- Revenue: $212.5 million vs analyst estimates of $201.5 million (3.4% year-on-year decline, 5.5% beat)

- Adjusted EPS: $0.59 vs analyst estimates of $0.50 (17.4% beat)

- Adjusted EBITDA: $39.5 million vs analyst estimates of $36.8 million (18.6% margin, 7.3% beat)

- Revenue Guidance for the full year is $820 million at the midpoint, above analyst estimates of $783.9 million

- Adjusted EPS guidance for the full year is $2.40 at the midpoint, beating analyst estimates by 24.2%

- Operating Margin: 10.3%, down from 11.8% in the same quarter last year

- Free Cash Flow Margin: 14.9%, up from 11.7% in the same quarter last year

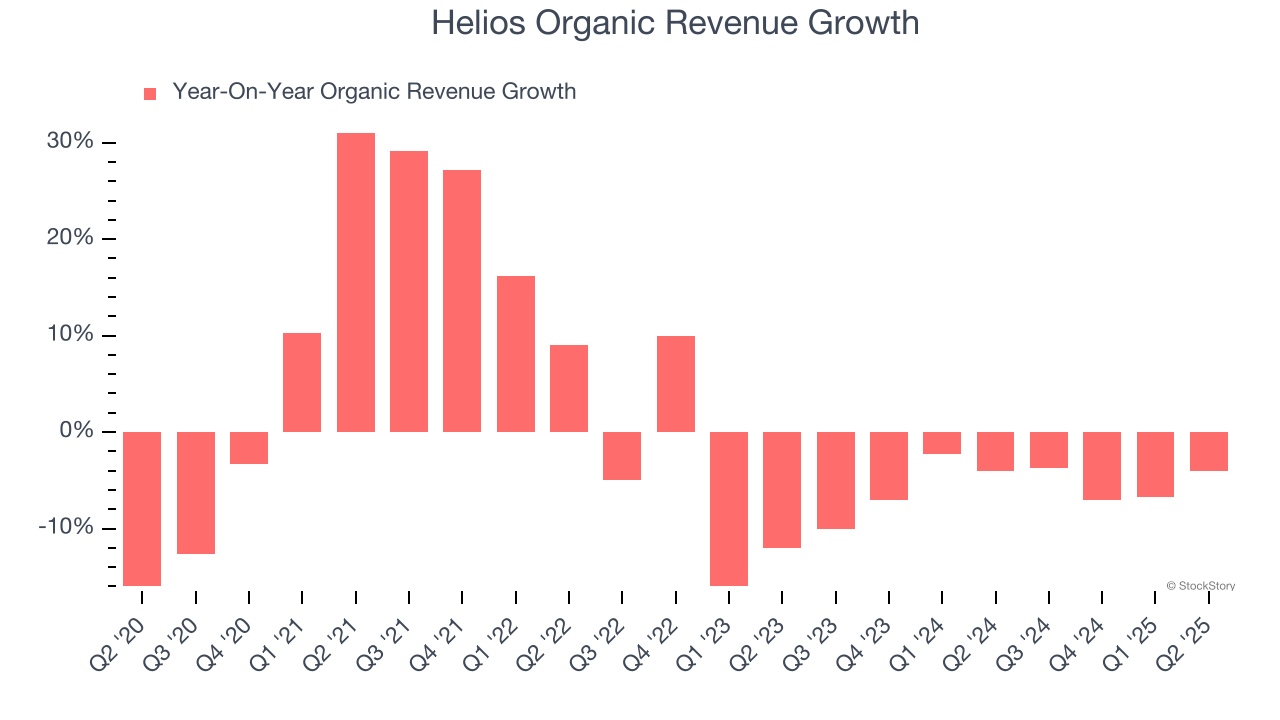

- Organic Revenue fell 4% year on year, in line with the same quarter last year

- Market Capitalization: $1.22 billion

“The Helios team continued to execute on our financial priorities to drive sequential operating leverage, improve our cash conversion cycle, reduce debt, and strengthen our earnings power to be better positioned to capitalize on improving demand trends. We generated a near record level of cash which further improved our already strong free cash flow conversion. We used that cash to strengthen our balance sheet as we continued to reduce debt and also return capital to shareholders through our consistent dividend and opportunistic share repurchase of our common stock,” said Sean Bagan, President, Chief Executive Officer and Chief Financial Officer of Helios.

Company Overview

Founded on the principle of treating others as one wants to be treated, Helios (NYSE: HLIO) designs, manufactures, and sells motion and electronic control components for various sectors.

Revenue Growth

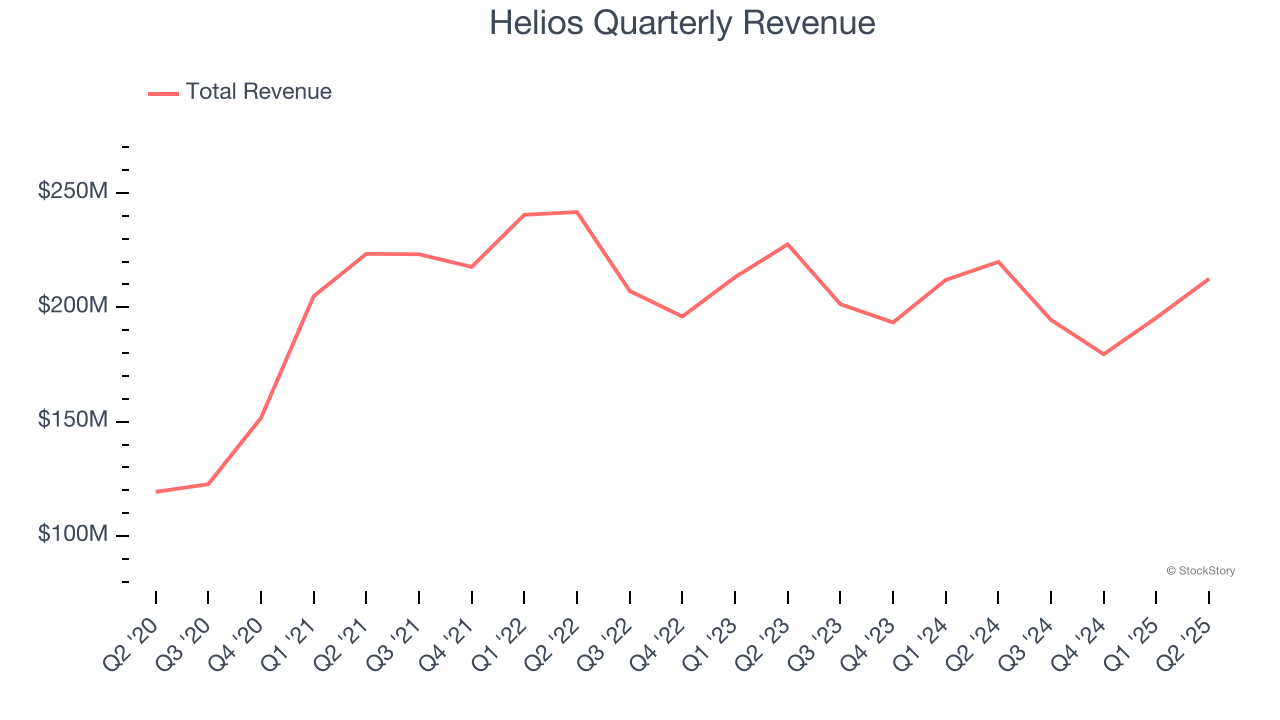

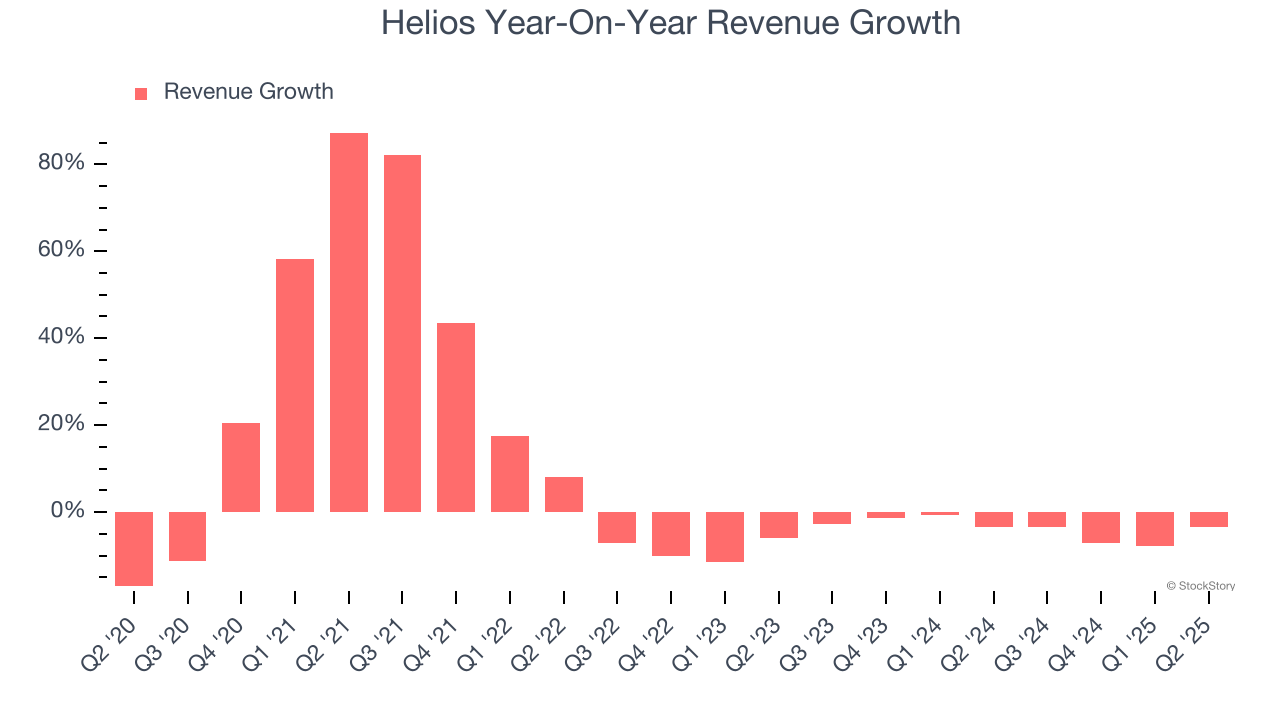

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Helios’s 8.8% annualized revenue growth over the last five years was decent. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Helios’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.7% over the last two years.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Helios’s organic revenue averaged 5.6% year-on-year declines. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Helios’s revenue fell by 3.4% year on year to $212.5 million but beat Wall Street’s estimates by 5.5%. Company management is currently guiding for a 8.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.7% over the next 12 months. Although this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

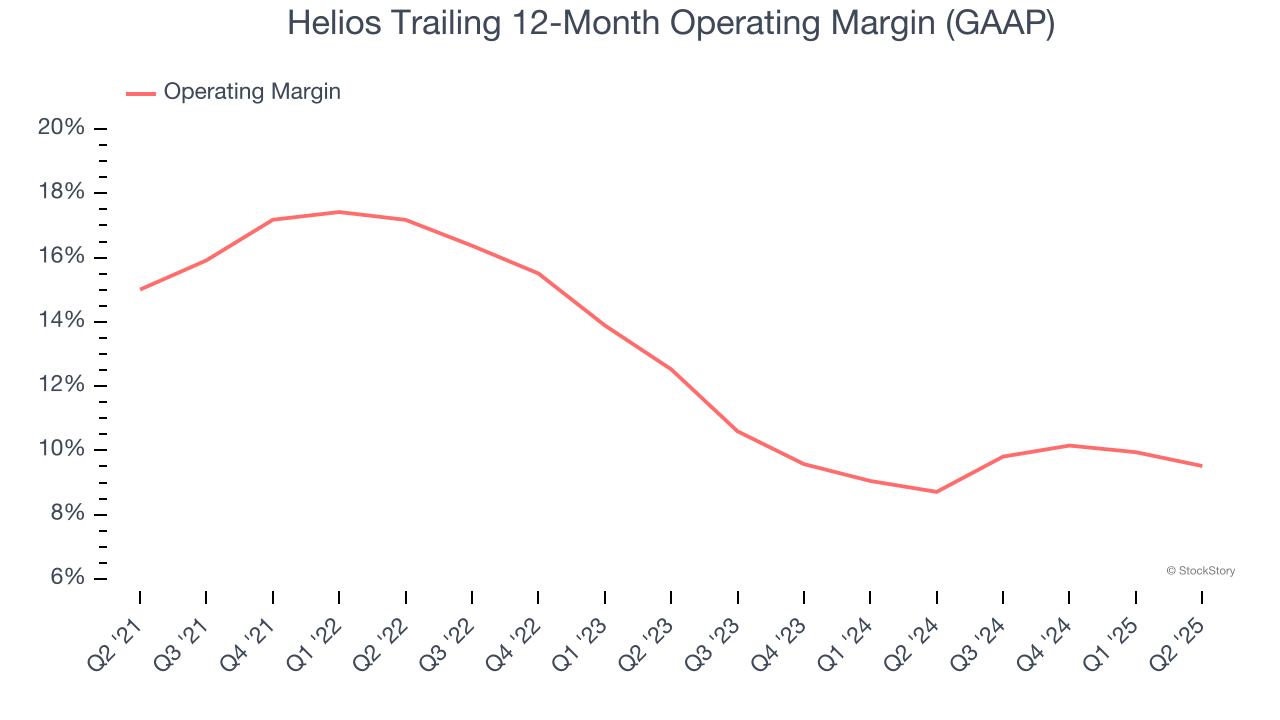

Helios has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.7%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Helios’s operating margin decreased by 5.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q2, Helios generated an operating margin profit margin of 10.3%, down 1.5 percentage points year on year. Since Helios’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

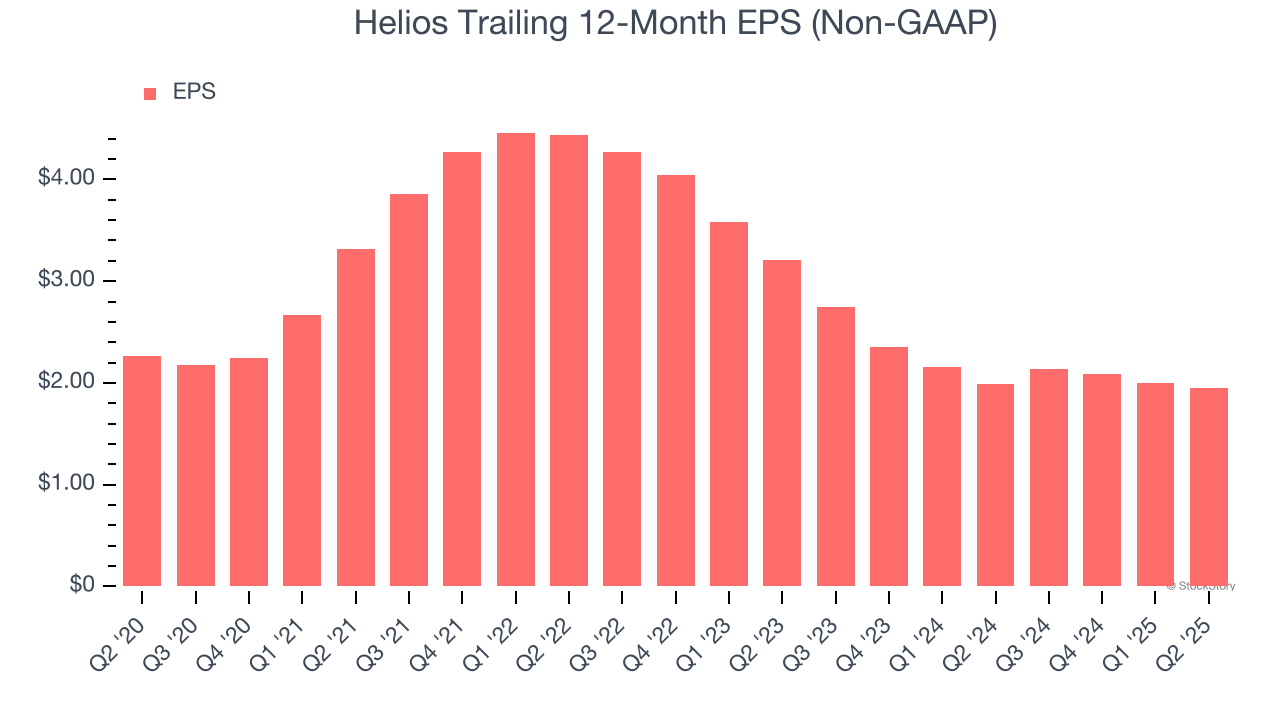

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Helios, its EPS declined by 2.9% annually over the last five years while its revenue grew by 8.8%. This tells us the company became less profitable on a per-share basis as it expanded.

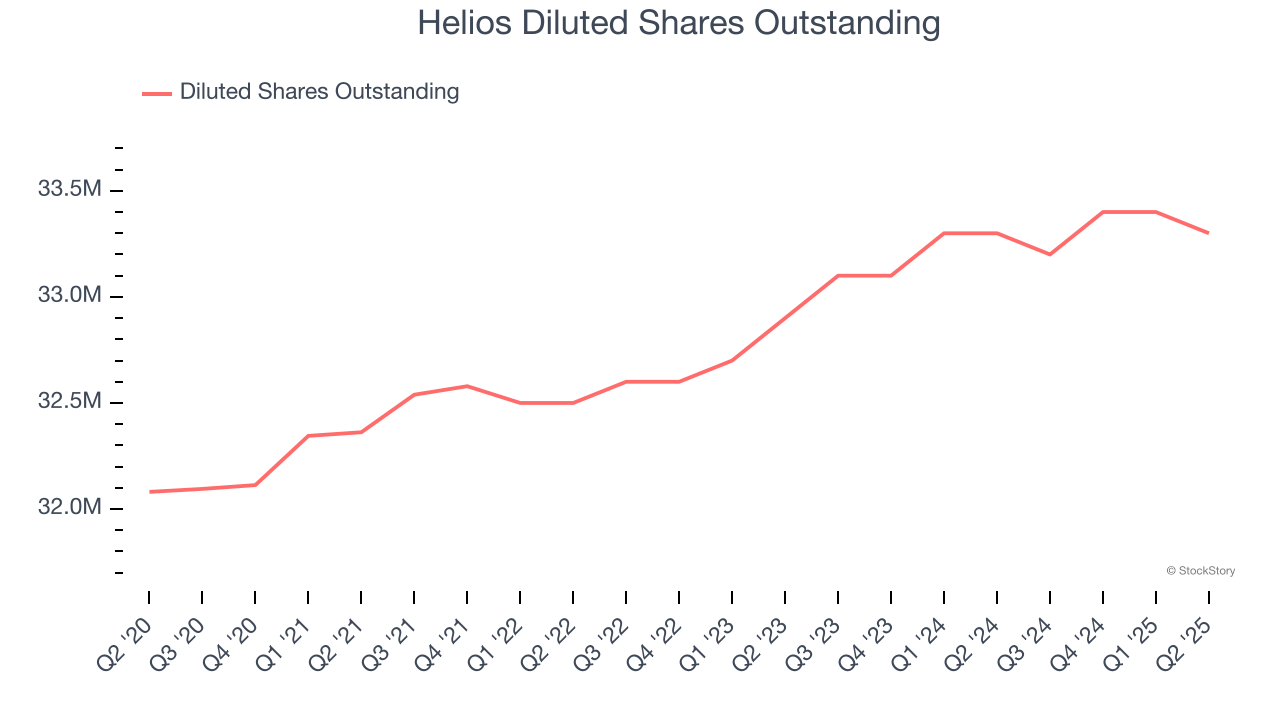

We can take a deeper look into Helios’s earnings to better understand the drivers of its performance. As we mentioned earlier, Helios’s operating margin declined by 5.5 percentage points over the last five years. Its share count also grew by 3.8%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Helios, its two-year annual EPS declines of 22.1% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q2, Helios reported adjusted EPS at $0.59, down from $0.64 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Helios’s Q2 Results

We were impressed by how significantly Helios blew past analysts’ organic revenue expectations this quarter. We were also glad its EPS guidance for next quarter trumped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 13.5% to $41.80 immediately following the results.

Helios put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.