Vacation ownership company Marriott Vacations (NYSE: VAC) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 9.3% year on year to $1.25 billion. Its non-GAAP profit of $1.96 per share was 13.2% above analysts’ consensus estimates.

Is now the time to buy Marriott Vacations? Find out by accessing our full research report, it’s free.

Marriott Vacations (VAC) Q2 CY2025 Highlights:

- Revenue: $1.25 billion vs analyst estimates of $1.22 billion (9.3% year-on-year growth, 2.4% beat)

- Adjusted EPS: $1.96 vs analyst estimates of $1.73 (13.2% beat)

- Adjusted EBITDA: $203 million vs analyst estimates of $191.3 million (16.3% margin, 6.1% beat)

- Management reiterated its full-year Adjusted EPS guidance of $6.75 at the midpoint

- EBITDA guidance for the full year is $765 million at the midpoint, above analyst estimates of $758 million

- Operating Margin: 10.9%, up from 8.9% in the same quarter last year

- Guests: 1.51 million, down 23,000 year on year

- Market Capitalization: $2.54 billion

“We delivered strong results in the quarter driving higher year-over-year first time buyer sales and reiterating our full year guidance, reflecting the resilience of our business model and the hard work of our associates,” said John Geller, president and chief executive officer.

Company Overview

Spun off from Marriott International in 1984, Marriott Vacations (NYSE: VAC) is a vacation company providing leisure experiences for travelers around the world.

Revenue Growth

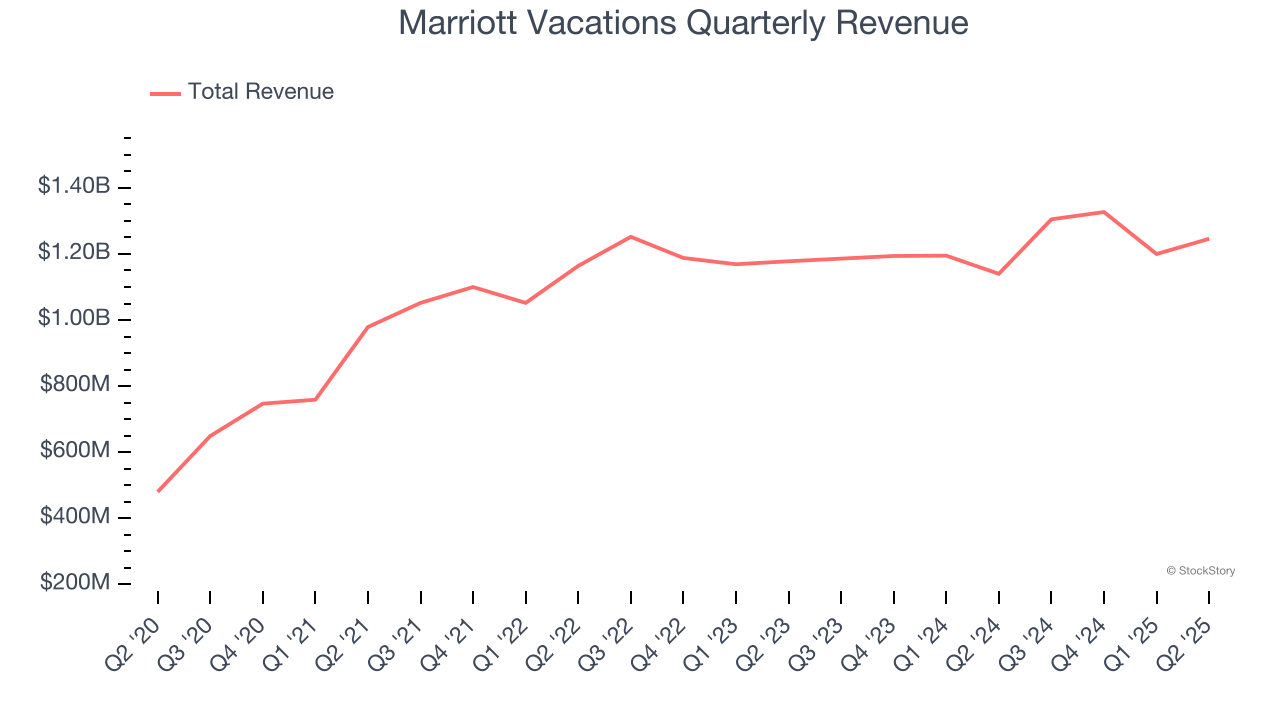

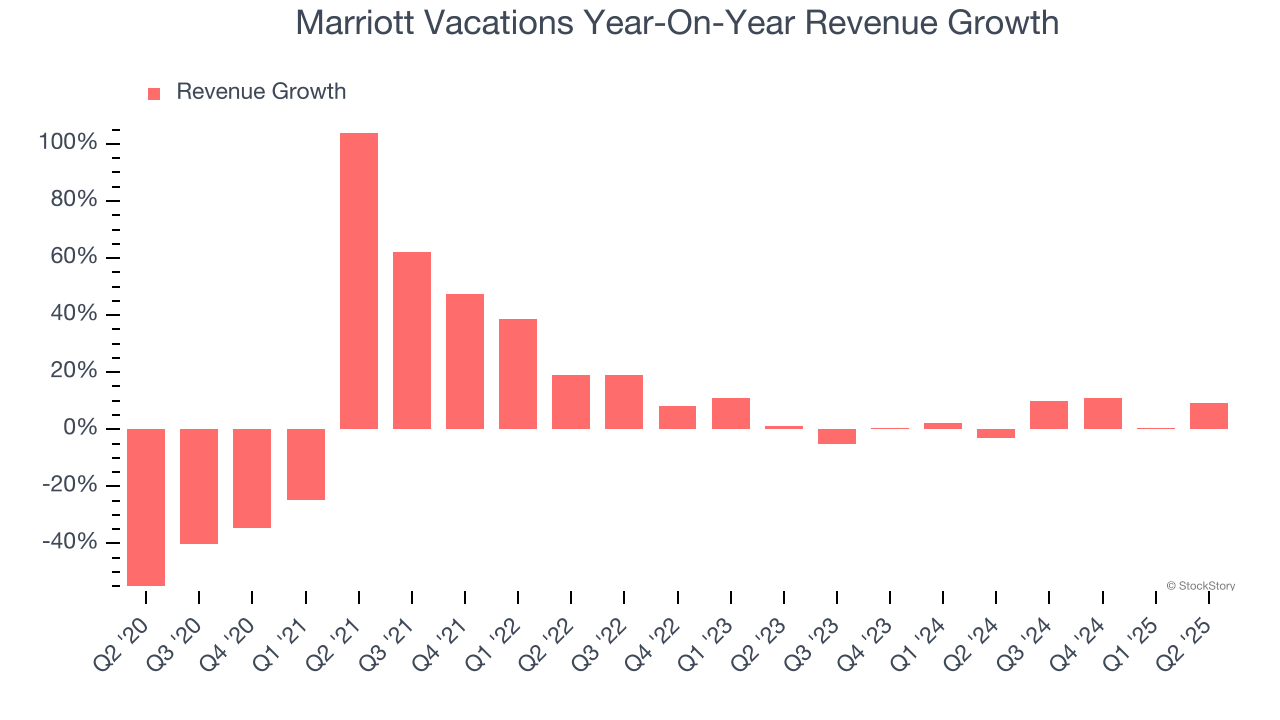

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Marriott Vacations’s 6.4% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Marriott Vacations’s recent performance shows its demand has slowed as its annualized revenue growth of 3% over the last two years was below its five-year trend.

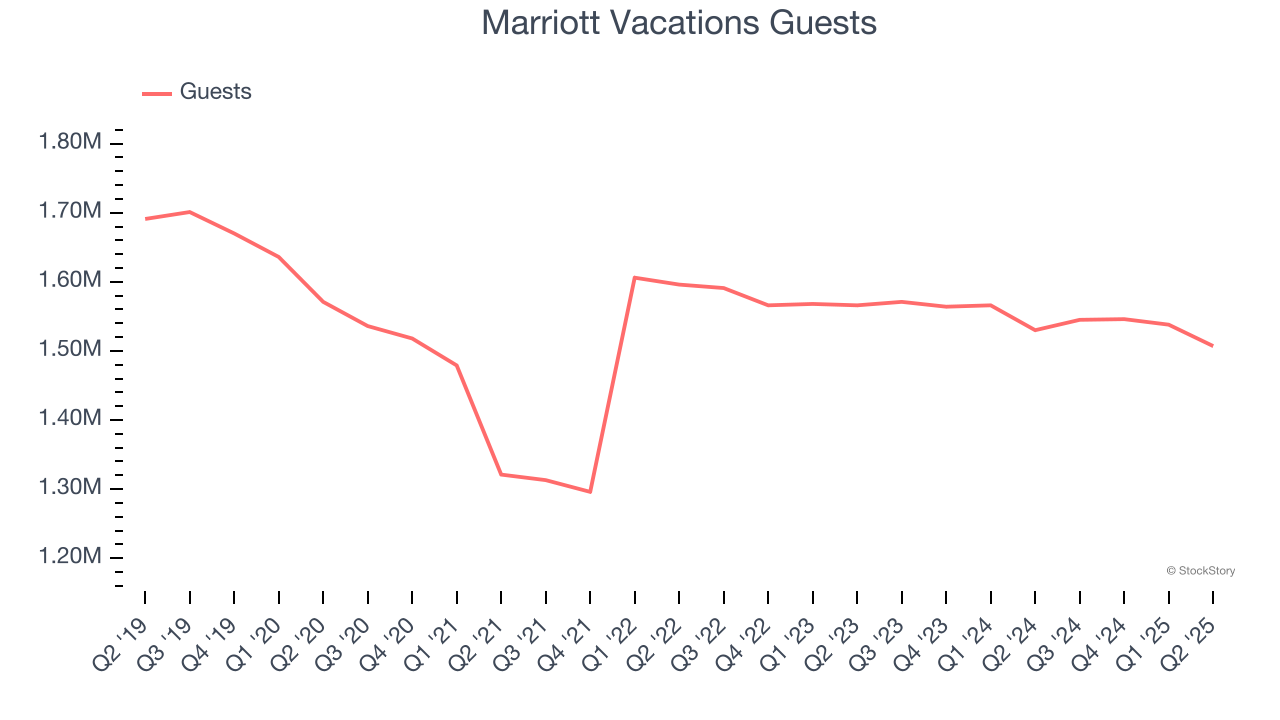

Marriott Vacations also discloses its number of guests and conducted tours, which clocked in at 1.51 million and 114,402 in the latest quarter. Over the last two years, Marriott Vacations’s guests averaged 1.2% year-on-year declines. On the other hand, its conducted tours averaged 3.4% year-on-year growth.

This quarter, Marriott Vacations reported year-on-year revenue growth of 9.3%, and its $1.25 billion of revenue exceeded Wall Street’s estimates by 2.4%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

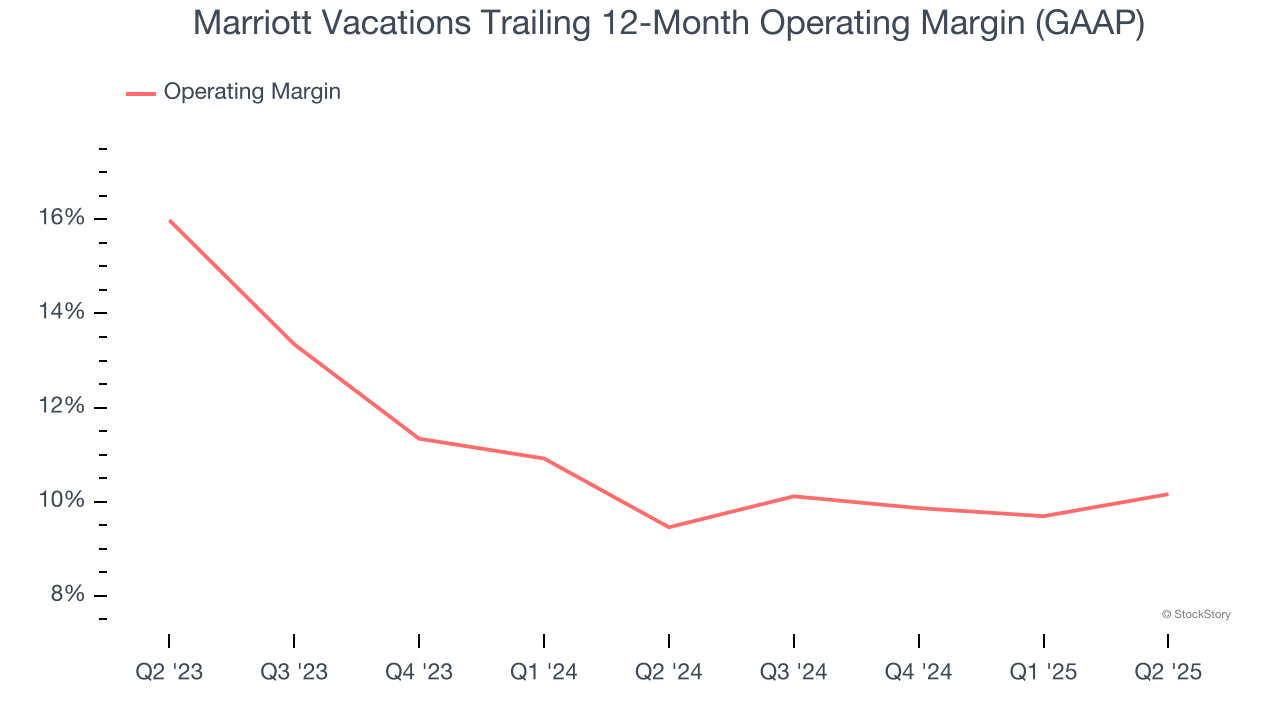

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Marriott Vacations’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 9.8% over the last two years. This profitability was mediocre for a consumer discretionary business and caused by its suboptimal cost structure.

In Q2, Marriott Vacations generated an operating margin profit margin of 10.9%, up 2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

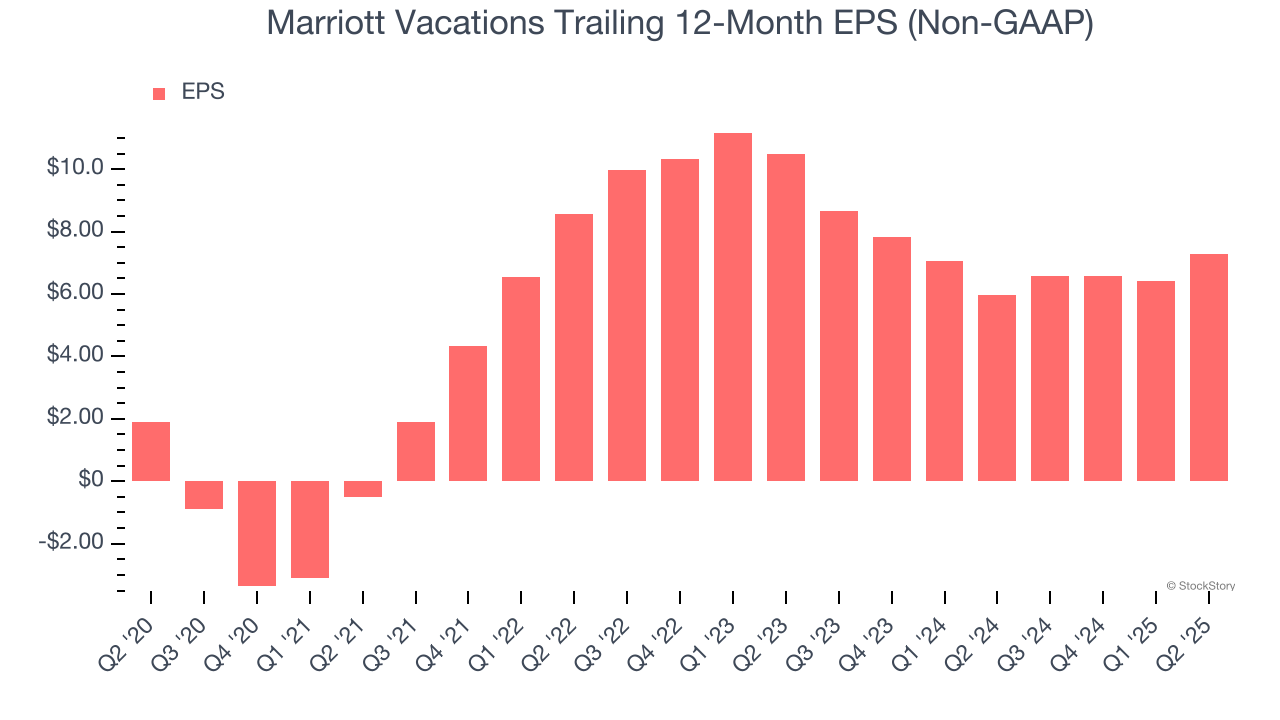

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Marriott Vacations’s EPS grew at an astounding 31% compounded annual growth rate over the last five years, higher than its 6.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q2, Marriott Vacations reported adjusted EPS at $1.96, up from $1.10 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Marriott Vacations’s full-year EPS of $7.28 to stay about the same.

Key Takeaways from Marriott Vacations’s Q2 Results

It was encouraging to see Marriott Vacations beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its number of guests missed. Overall, this print had some key positives. The stock traded up 1.7% to $75.80 immediately following the results.

Indeed, Marriott Vacations had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.