Health and wellness products company Herbalife (NYSE: HLF) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 1.7% year on year to $1.26 billion. On the other hand, next quarter’s outlook exceeded expectations with revenue guided to $1.27 billion at the midpoint, or 1.6% above analysts’ estimates. Its non-GAAP profit of $0.59 per share was 18.6% above analysts’ consensus estimates.

Is now the time to buy Herbalife? Find out by accessing our full research report, it’s free.

Herbalife (HLF) Q2 CY2025 Highlights:

- Revenue: $1.26 billion vs analyst estimates of $1.27 billion (1.7% year-on-year decline, 1% miss)

- Adjusted EPS: $0.59 vs analyst estimates of $0.50 (18.6% beat)

- Adjusted EBITDA: $192.4 million vs analyst estimates of $167.4 million (15.3% margin, 14.9% beat)

- Revenue Guidance for Q3 CY2025 is $1.27 billion at the midpoint, above analyst estimates of $1.25 billion

- EBITDA guidance for the full year is $650 million at the midpoint, above analyst estimates of $642.9 million

- Operating Margin: 10.5%, up from 6.3% in the same quarter last year

- Free Cash Flow Margin: 5.8%, similar to the same quarter last year

- Organic Revenue was flat year on year, in line with the same quarter last year

- Market Capitalization: $963.5 million

Company Overview

With the first products sold out of the trunk of the founder’s car, Herbalife (NYSE: HLF) today offers a portfolio of shakes, supplements, personal care products, and weight management programs to help customers reach their nutritional and fitness goals.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $4.93 billion in revenue over the past 12 months, Herbalife carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

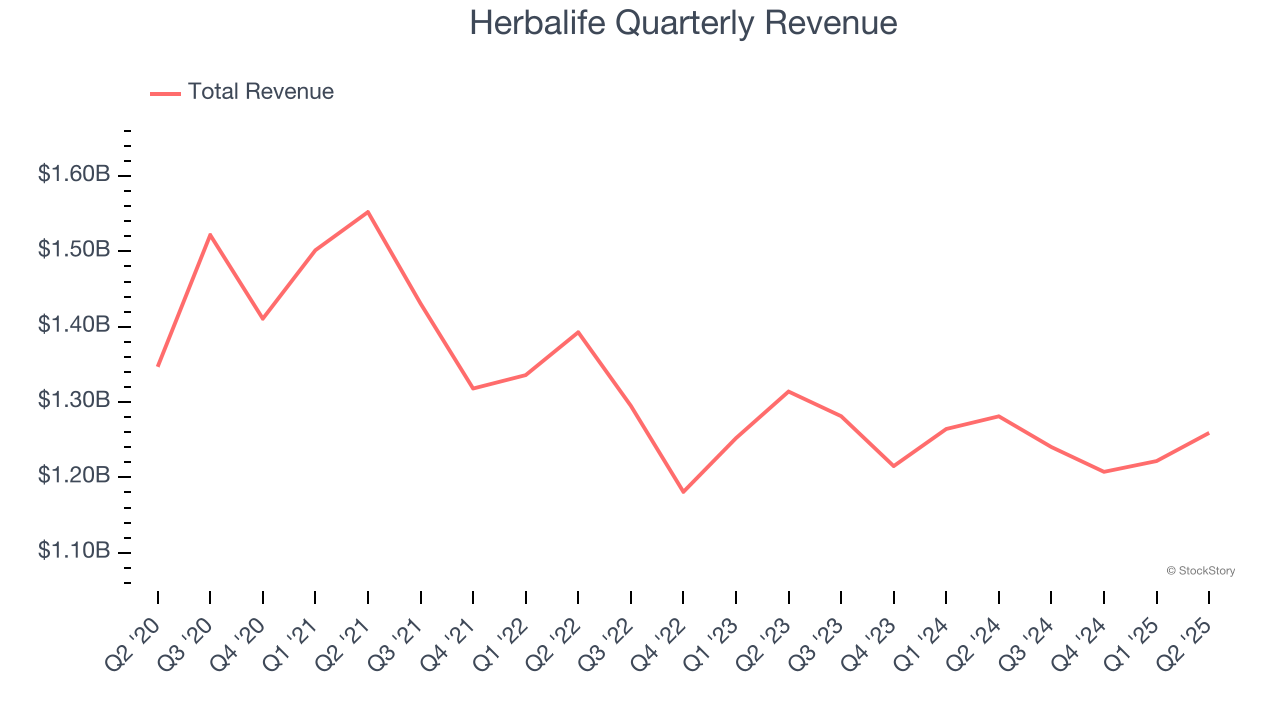

As you can see below, Herbalife’s demand was weak over the last three years. Its sales fell by 3.5% annually as consumers bought less of its products.

This quarter, Herbalife missed Wall Street’s estimates and reported a rather uninspiring 1.7% year-on-year revenue decline, generating $1.26 billion of revenue. Company management is currently guiding for a 2.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months. While this projection implies its newer products will fuel better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Organic Revenue Growth

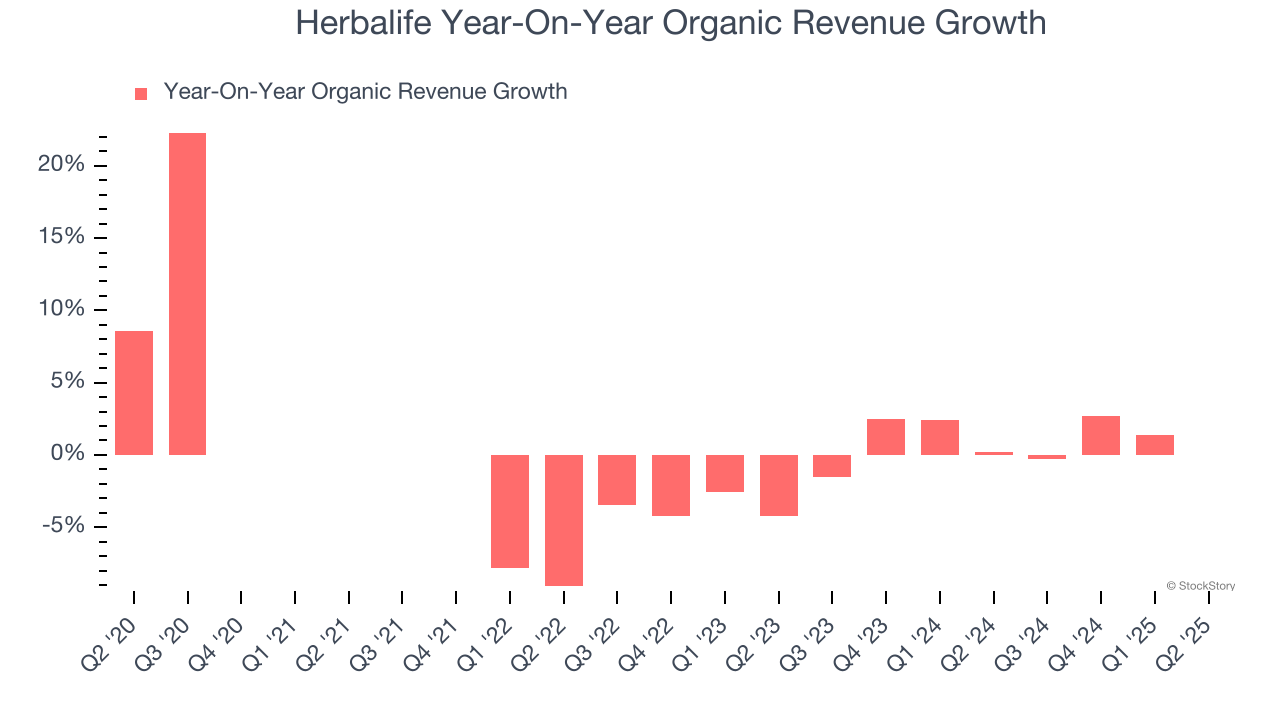

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Herbalife’s products has barely risen over the last eight quarters. On average, the company’s organic sales have been flat.

In the latest quarter, Herbalife’s year on year organic sales were flat. This performance was more or less in line with its historical levels.

Key Takeaways from Herbalife’s Q2 Results

We were impressed by how significantly Herbalife blew past analysts’ EBITDA expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its organic revenue missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock traded up 1.5% to $9.40 immediately after reporting.

Is Herbalife an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.