Leading edge card issuer Marqeta (NASDAQ: MQ) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 20.1% year on year to $150.4 million. Guidance for next quarter’s revenue was better than expected at $148.4 million at the midpoint, 1.8% above analysts’ estimates. Its GAAP loss of $0 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Marqeta? Find out by accessing our full research report, it’s free.

Marqeta (MQ) Q2 CY2025 Highlights:

- Revenue: $150.4 million vs analyst estimates of $140.5 million (20.1% year-on-year growth, 7.1% beat)

- EPS (GAAP): $0 vs analyst estimates of -$0.03 (significant beat)

- Adjusted EBITDA: $28.51 million vs analyst estimates of $14.59 million (19% margin, 95.5% beat)

- Revenue Guidance for Q3 CY2025 is $148.4 million at the midpoint, above analyst estimates of $145.8 million

- Operating Margin: -6.1%, down from 83.9% in the same quarter last year

- Free Cash Flow was -$1.39 million, down from $8.72 million in the previous quarter

- Market Capitalization: $2.62 billion

Company Overview

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

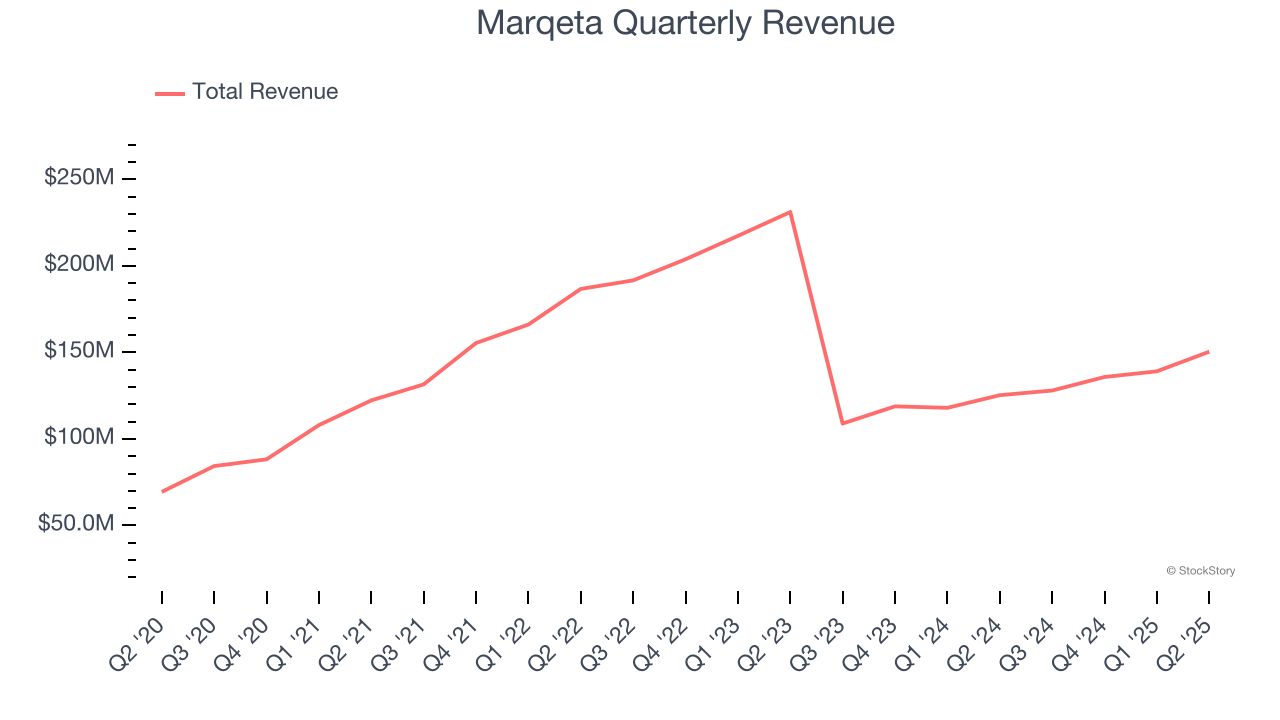

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Marqeta struggled to consistently generate demand over the last three years as its sales dropped at a 4.7% annual rate. This wasn’t a great result and is a tough starting point for our analysis.

This quarter, Marqeta reported robust year-on-year revenue growth of 20.1%, and its $150.4 million of revenue topped Wall Street estimates by 7.1%. Company management is currently guiding for a 16% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.8% over the next 12 months, an acceleration versus the last three years. This projection is admirable and indicates its newer products and services will catalyze better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

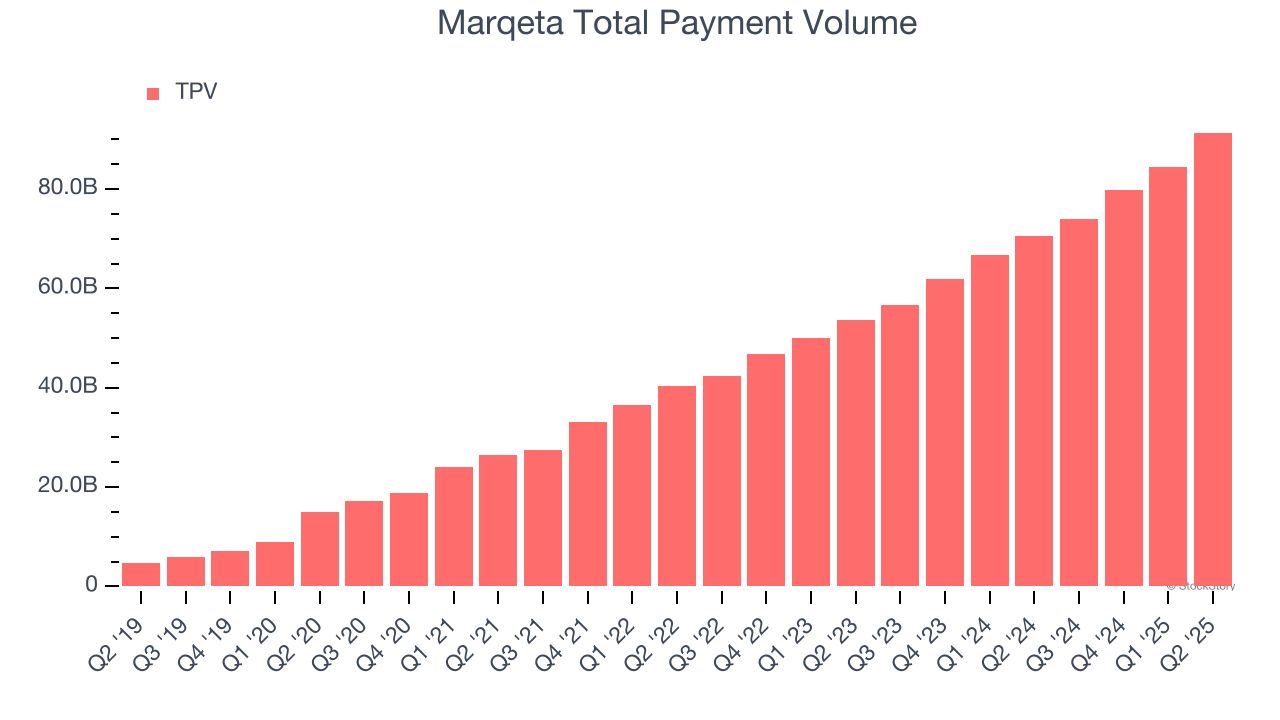

Total Payment Volume

TPV, or total processing volume, is the aggregate dollar value of transactions flowing through Marqeta’s platform. This is the number from which the company will ultimately collect fees, and the higher it is, the more chances Marqeta has to upsell additional services (like banking).

Marqeta’s TPV punched in at $91.39 billion in Q2, and over the last four quarters, its growth was fantastic as it averaged 28.9% year-on-year increases. This alternate topline metric grew faster than total sales, which could mean that take rates have declined. However, we can’t automatically assume the company is reducing its fees because take rates can also vary depending on the type of products sold on its platform.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Marqeta is extremely efficient at acquiring new customers, and its CAC payback period checked in at 0.8 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Marqeta more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Marqeta’s Q2 Results

We were impressed by how significantly Marqeta blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 16.9% to $6.66 immediately following the results.

Marqeta may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.