As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the renewable energy industry, including ChargePoint (NYSE: CHPT) and its peers.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 17 renewable energy stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 6.6% while next quarter’s revenue guidance was in line.

Luckily, renewable energy stocks have performed well with share prices up 17.7% on average since the latest earnings results.

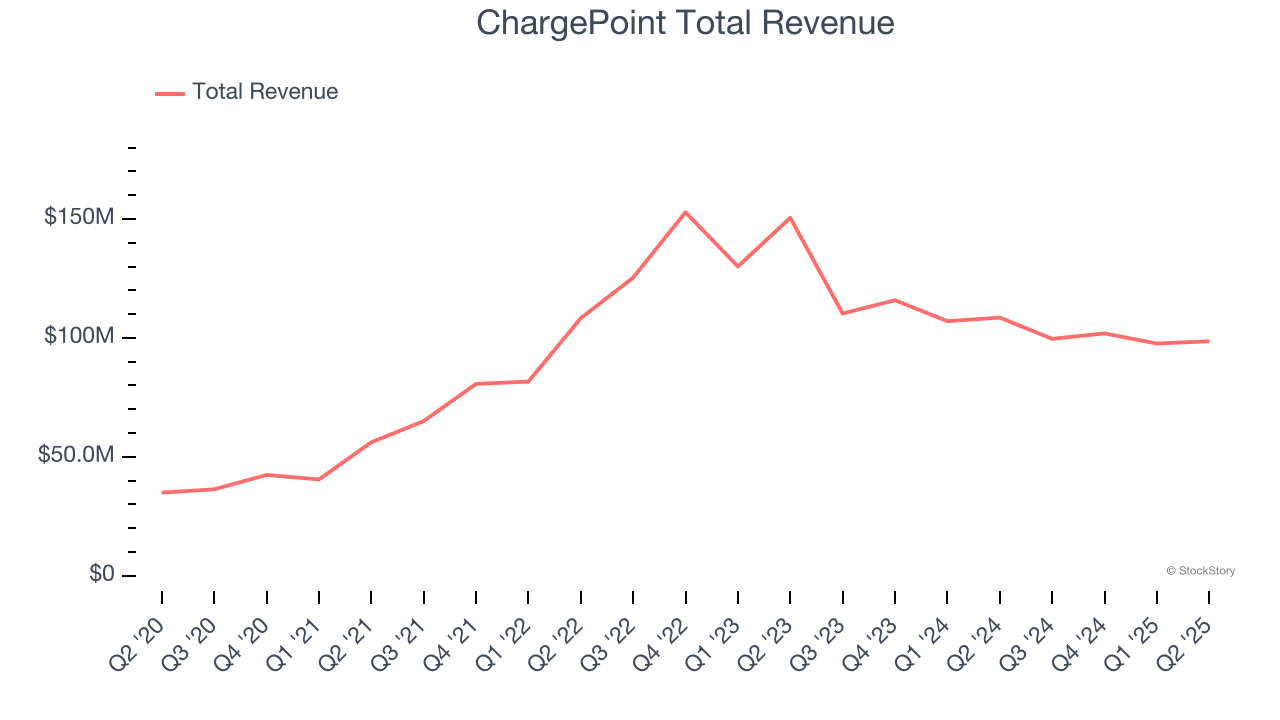

ChargePoint (NYSE: CHPT)

The most prominent EV charging company during the COVID bull market, ChargePoint (NYSE: CHPT) is a provider of electric vehicle charging technology solutions in North America and Europe.

ChargePoint reported revenues of $98.59 million, down 9.2% year on year. This print exceeded analysts’ expectations by 3.3%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EBITDA estimates.

Unsurprisingly, the stock is down 6.1% since reporting and currently trades at $10.21.

Is now the time to buy ChargePoint? Access our full analysis of the earnings results here, it’s free.

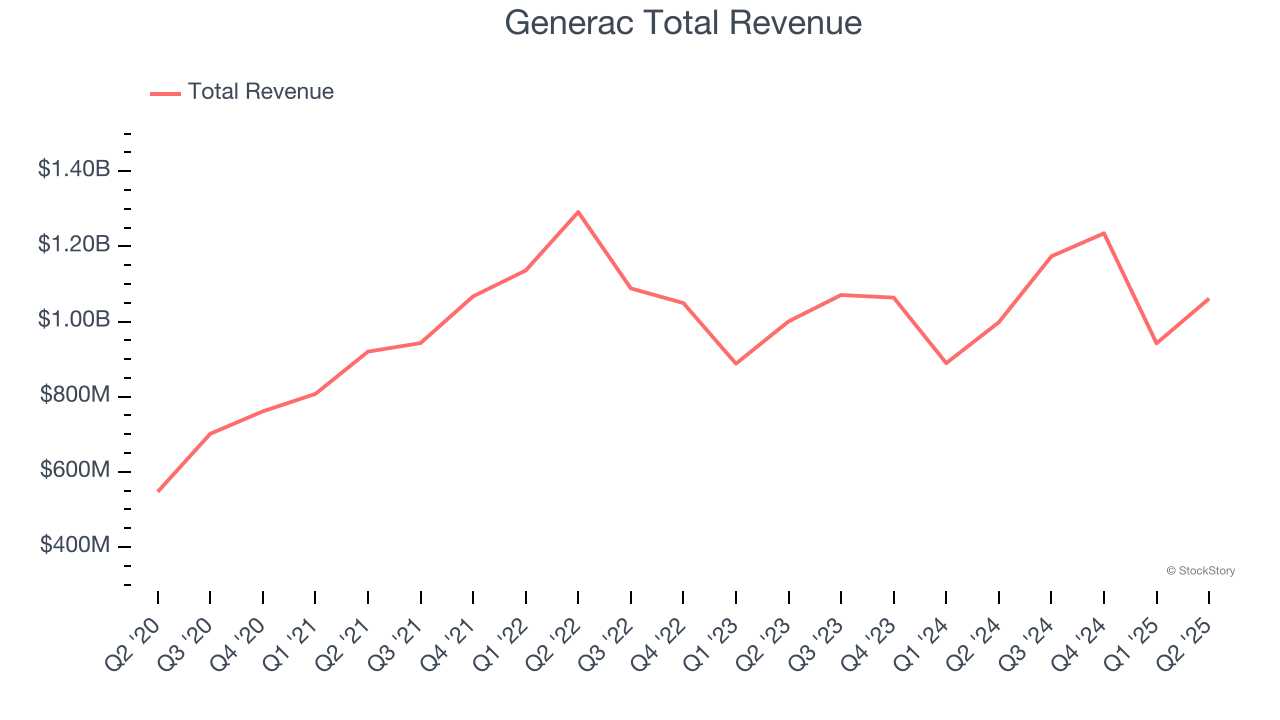

Best Q2: Generac (NYSE: GNRC)

With its name deriving from a combination of “generating” and “AC”, Generac (NYSE: GNRC) offers generators and other power products for residential, industrial, and commercial use.

Generac reported revenues of $1.06 billion, up 6.3% year on year, outperforming analysts’ expectations by 3.4%. The business had an incredible quarter with an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 21.8% since reporting. It currently trades at $184.30.

Is now the time to buy Generac? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Plug Power (NASDAQ: PLUG)

Powering forklifts for Walmart’s distribution centers, Plug Power (NASDAQ: PLUG) provides hydrogen fuel cells used to power electric motors.

Plug Power reported revenues of $174 million, up 21.4% year on year, exceeding analysts’ expectations by 10.4%. Still, it was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 9.1% since the results and currently trades at $1.45.

Read our full analysis of Plug Power’s results here.

EVgo (NASDAQ: EVGO)

Created through a settlement between NRG Energy and the California Public Utilities Commission, EVgo (NASDAQ: EVGO) is a provider of electric vehicle charging solutions, operating fast charging stations across the United States.

EVgo reported revenues of $98.03 million, up 47.2% year on year. This print topped analysts’ expectations by 15.7%. It was an exceptional quarter as it also produced a beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is up 8.1% since reporting and currently trades at $3.82.

Read our full, actionable report on EVgo here, it’s free.

Sunrun (NASDAQ: RUN)

Helping homeowners use solar energy to power their homes, Sunrun (NASDAQ: RUN) provides residential solar electricity, specializing in panel installation and leasing services.

Sunrun reported revenues of $569.3 million, up 8.7% year on year. This number beat analysts’ expectations by 4%. Overall, it was a stunning quarter as it also logged a solid beat of analysts’ customer base estimates and a beat of analysts’ EPS estimates.

The company added 30,810 customers to reach a total of 1.11 million. The stock is up 79.9% since reporting and currently trades at $16.21.

Read our full, actionable report on Sunrun here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.