Since September 2020, the S&P 500 has delivered a total return of 85.4%. But one standout stock has doubled the market - over the past five years, ITT has surged 172% to $169.15 per share. Its momentum hasn’t stopped as it’s also gained 23.1% in the last six months thanks to its solid quarterly results, beating the S&P by 13.4%.

Is now still a good time to buy ITT? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does ITT Stock Spark Debate?

Playing a crucial role in the development of the first transatlantic television transmission in 1956, ITT (NYSE: ITT) provides motion and fluid handling equipment for various industries

Two Positive Attributes:

1. Operating Margin Reveals a Well-Run Organization

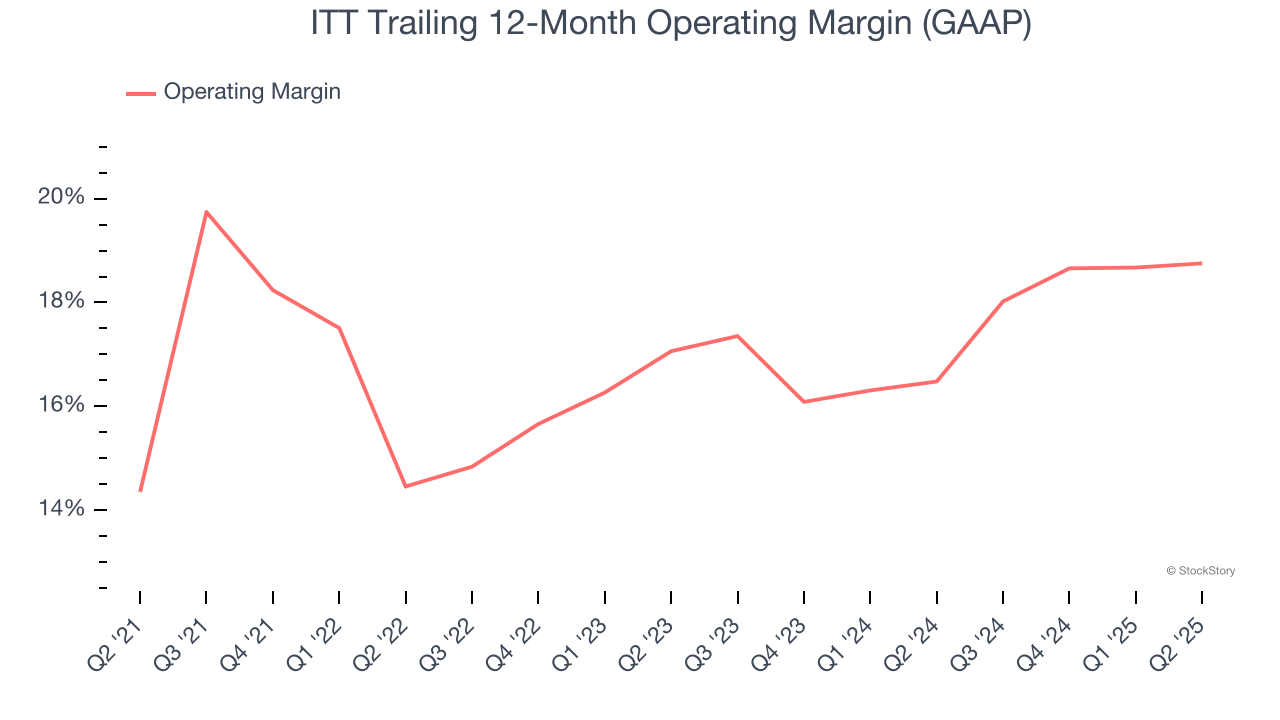

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

ITT has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.4%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

2. Increasing Free Cash Flow Margin Juices Financials

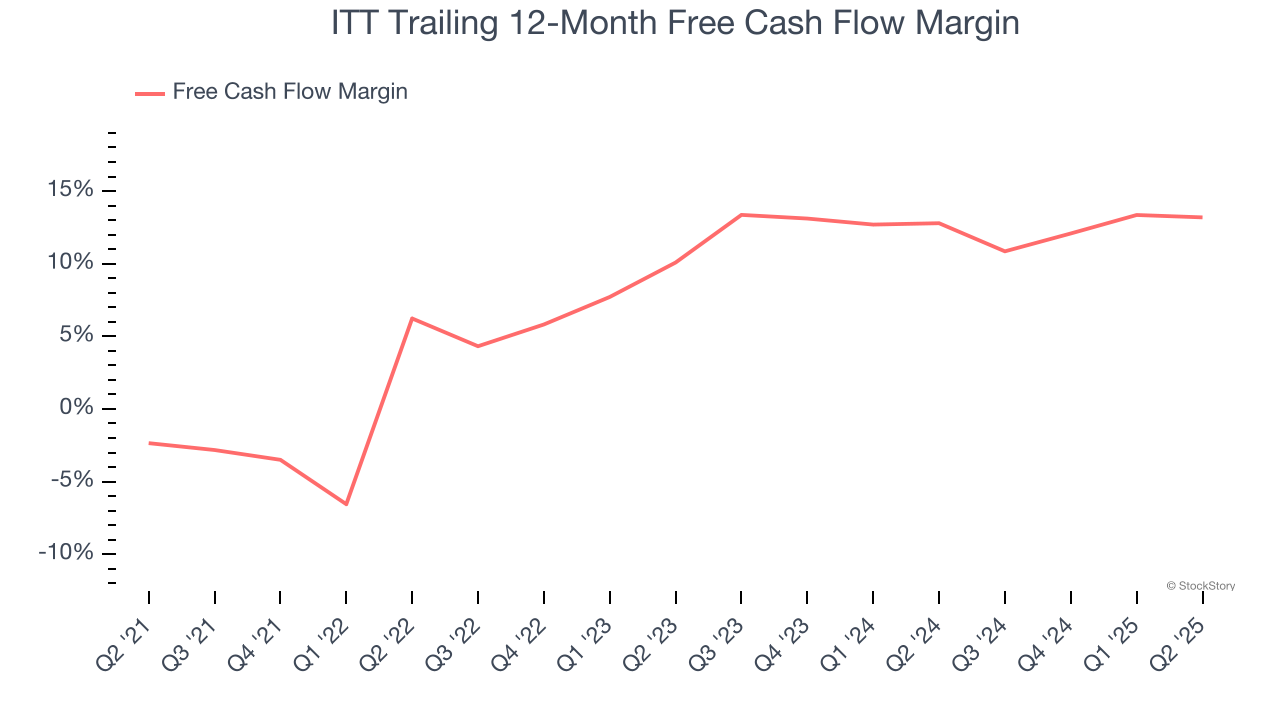

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, ITT’s margin expanded by 15.5 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. ITT’s free cash flow margin for the trailing 12 months was 13.2%.

One Reason to be Careful:

Slow Organic Growth Suggests Waning Demand In Core Business

We can better understand Gas and Liquid Handling companies by analyzing their organic revenue. This metric gives visibility into ITT’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, ITT’s organic revenue averaged 5.1% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

ITT has huge potential even though it has some open questions, and with its shares beating the market recently, the stock trades at 25× forward P/E (or $169.15 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than ITT

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.