Global financial services firm Morgan Stanley (NYSE: MS) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 10.3% year on year to $17.89 billion. Its GAAP profit of $2.68 per share was 9.4% above analysts’ consensus estimates.

Is now the time to buy Morgan Stanley? Find out by accessing our full research report, it’s free.

Morgan Stanley (MS) Q4 CY2025 Highlights:

- Revenue: $17.89 billion vs analyst estimates of $17.66 billion (10.3% year-on-year growth, 1.3% beat)

- Efficiency Ratio: 68% vs analyst estimates of 69.8% (176 basis point beat)

- EPS (GAAP): $2.68 vs analyst estimates of $2.45 (9.4% beat)

- Tangible Book Value per Share: $50 vs analyst estimates of $49.54 (12.2% year-on-year growth, 0.9% beat)

- Market Capitalization: $287.3 billion

Company Overview

Founded in 1924 during the post-WWI economic boom by former JP Morgan partners, Morgan Stanley (NYSE: MS) is a global financial services firm that provides investment banking, wealth management, and investment management services to corporations, governments, institutions, and individuals.

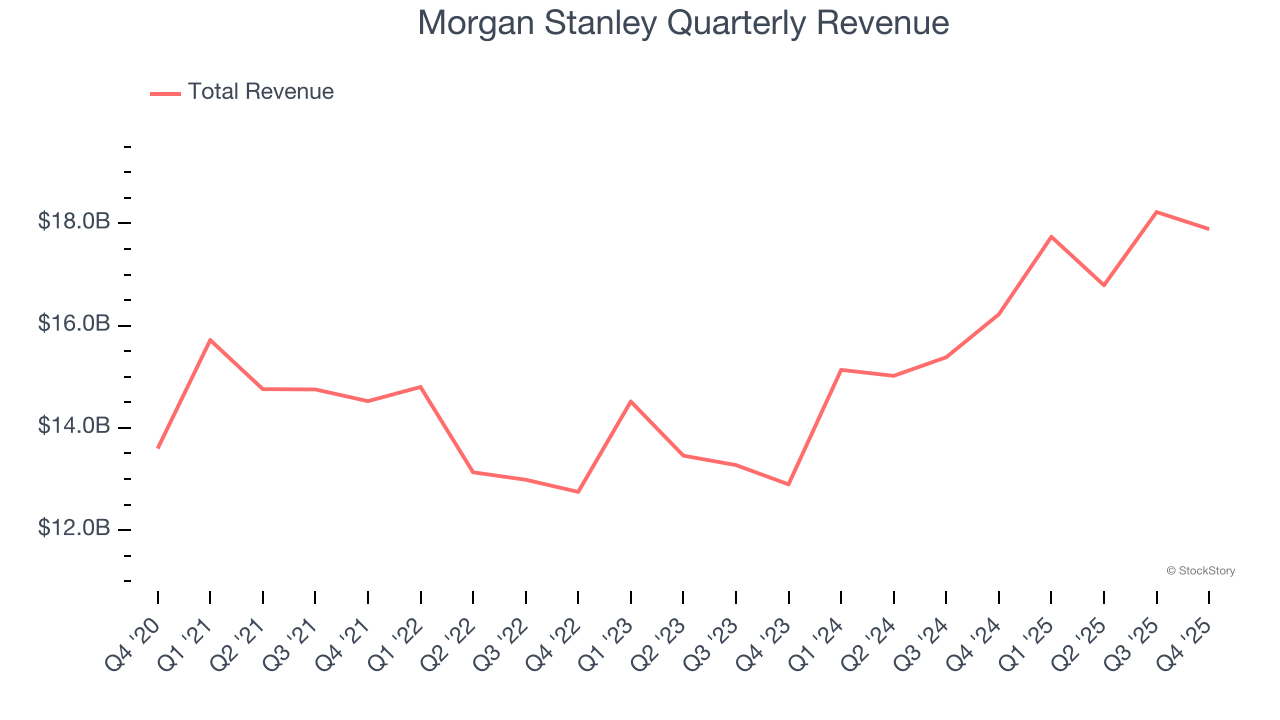

Revenue Growth

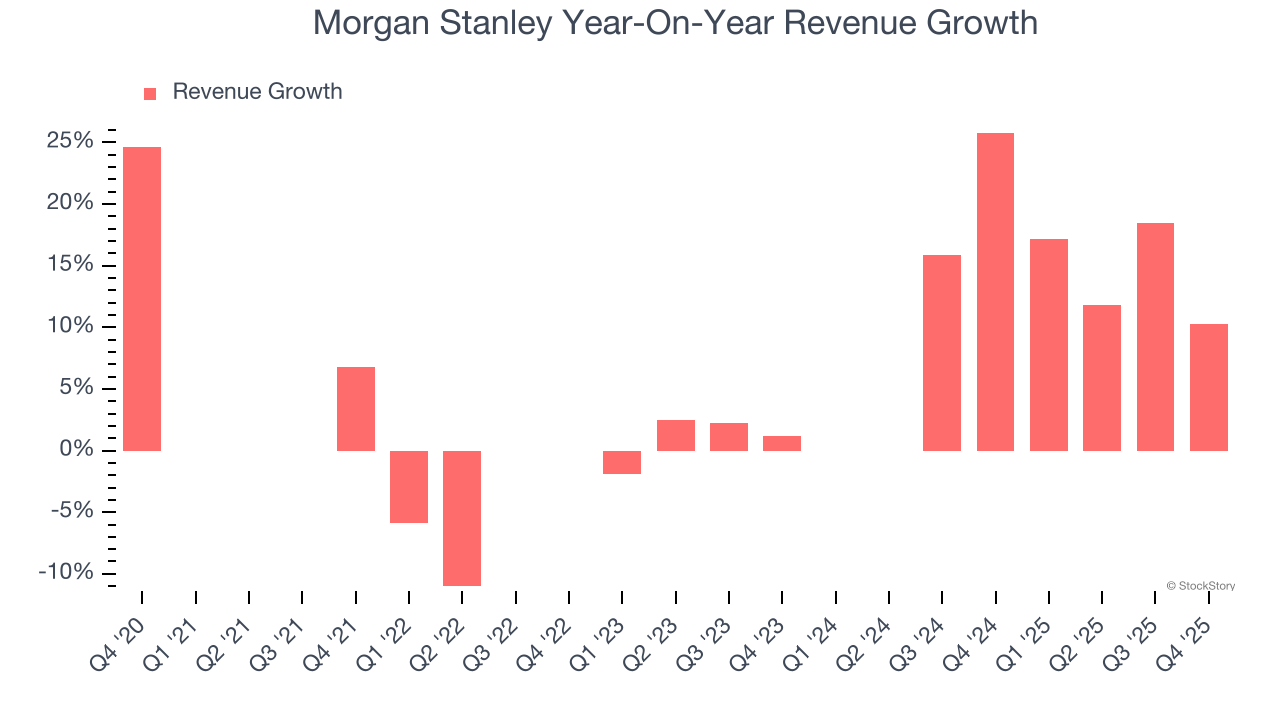

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Morgan Stanley’s revenue grew at a decent 7.7% compounded annual growth rate over the last five years. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Morgan Stanley’s annualized revenue growth of 14.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

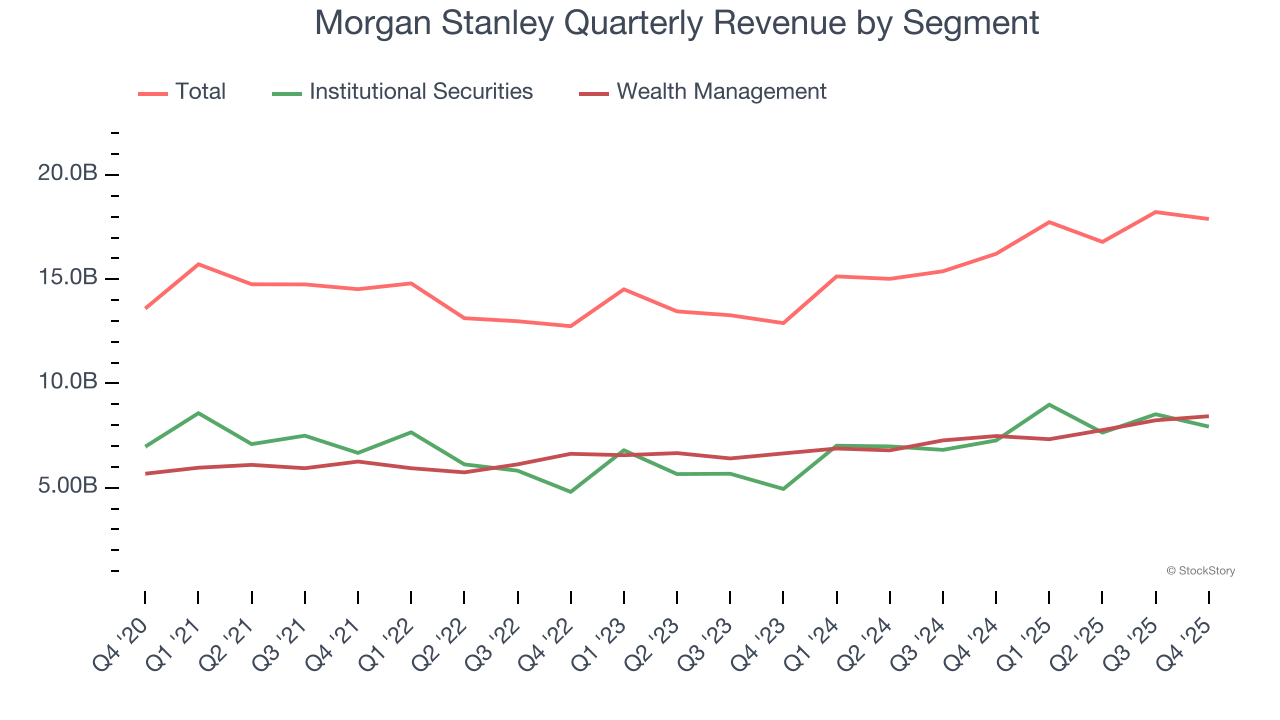

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Institutional Securities and Wealth Management, which are 44.3% and 47.1% of total revenue. Institutional Securities revenue grew by 4.6% and 19.8% annually over the past five and two years, respectively. At the same time, Wealth Management revenue increased by 10.7% and 9.9% per year over the past five and two years, respectively.

This quarter, Morgan Stanley reported year-on-year revenue growth of 10.3%, and its $17.89 billion of revenue exceeded Wall Street’s estimates by 1.3%.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

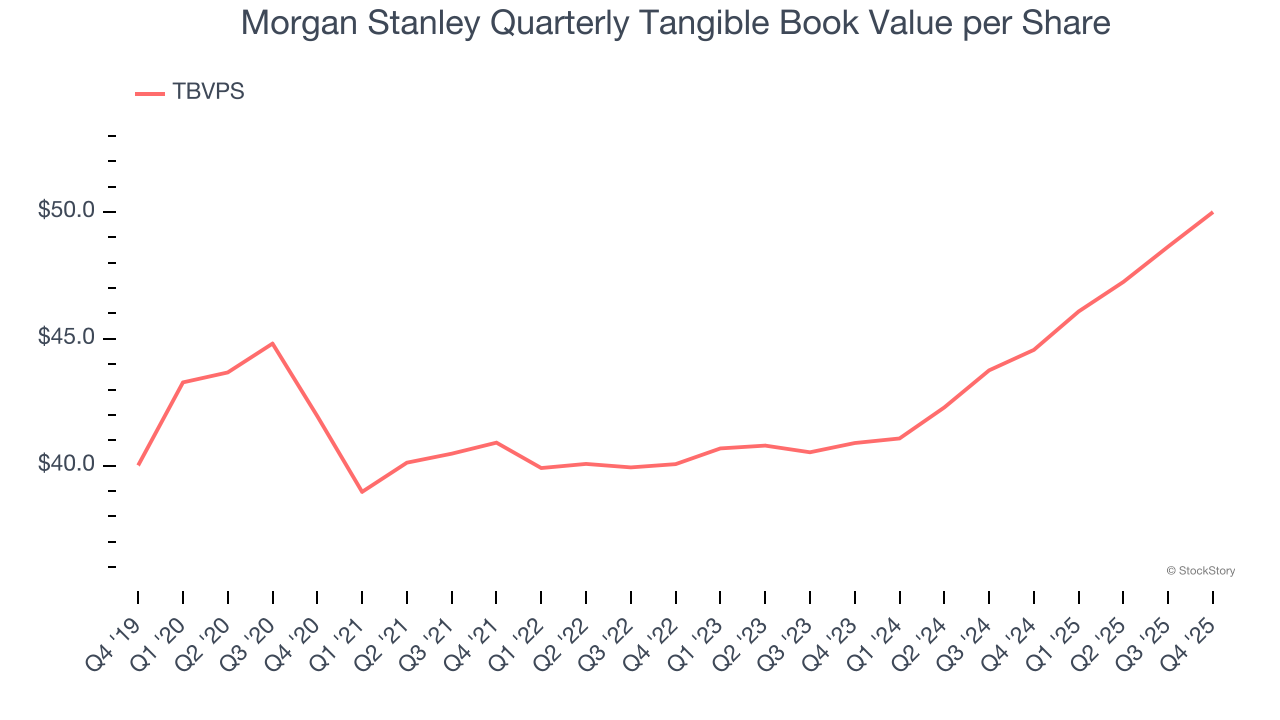

Tangible Book Value Per Share (TBVPS)

Financial institutions manage complex balance sheets spanning various financial activities. Valuations reflect this complexity, emphasizing balance sheet quality and long-term book value compounding across multiple revenue streams.

When analyzing this sector, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value and provides insight into the institution’s capital position across diverse operations. EPS can become murky due to the complexity of multiple revenue streams, acquisition impacts, or accounting flexibility across different financial services, and book value resists financial engineering manipulation.

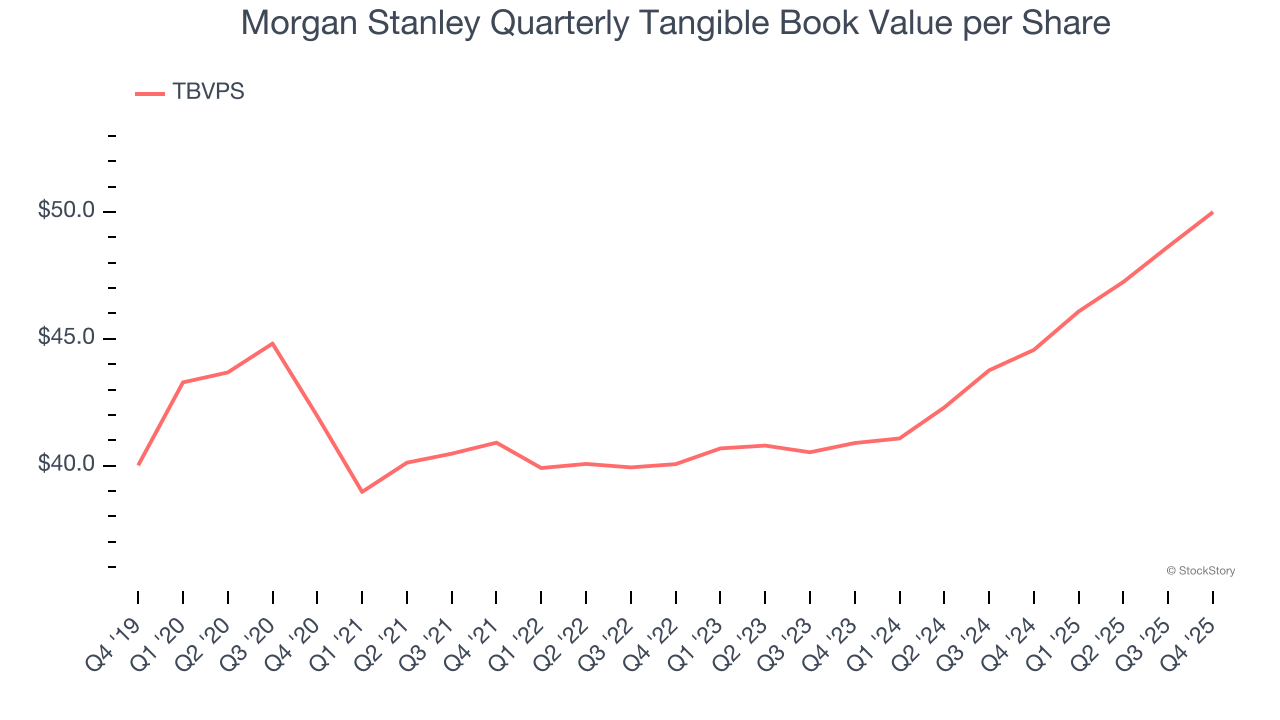

Morgan Stanley’s TBVPS grew at a sluggish 3.6% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 10.6% annually over the last two years from $40.89 to $50 per share.

Tangible Book Value Per Share (TBVPS)

Financial firms profit by providing a wide range of services, making them fundamentally balance sheet-driven enterprises with multiple intermediation roles. Market participants emphasize balance sheet quality and sustained book value growth when evaluating these multifaceted institutions.

This is why we consider tangible book value per share (TBVPS) an important metric for the sector. TBVPS represents the real net worth per share across all business segments, providing a clear measure of shareholder equity regardless of the complexity of operations. On the other hand, EPS is often distorted by the diverse nature of operations, mergers, and various accounting treatments across different business units. Book value provides clearer performance insights.

Morgan Stanley’s TBVPS grew at a sluggish 3.6% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 10.6% annually over the last two years from $40.89 to $50 per share.

Key Takeaways from Morgan Stanley’s Q4 Results

We enjoyed seeing Morgan Stanley beat analysts’ Institutional Securities segment expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its efficiency ratio missed. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $179.94 immediately after reporting.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).