Since January 2021, the S&P 500 has delivered a total return of 77%. But one standout stock has nearly doubled the market - over the past five years, Morgan Stanley has surged 148% to $183.80 per share. Its momentum hasn’t stopped as it’s also gained 31.2% in the last six months thanks to its solid quarterly results, beating the S&P by 23.5%.

Is there a buying opportunity in Morgan Stanley, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Morgan Stanley Not Exciting?

We’re happy investors have made money, but we're cautious about Morgan Stanley. Here are two reasons we avoid MS and a stock we'd rather own.

1. EPS Barely Growing

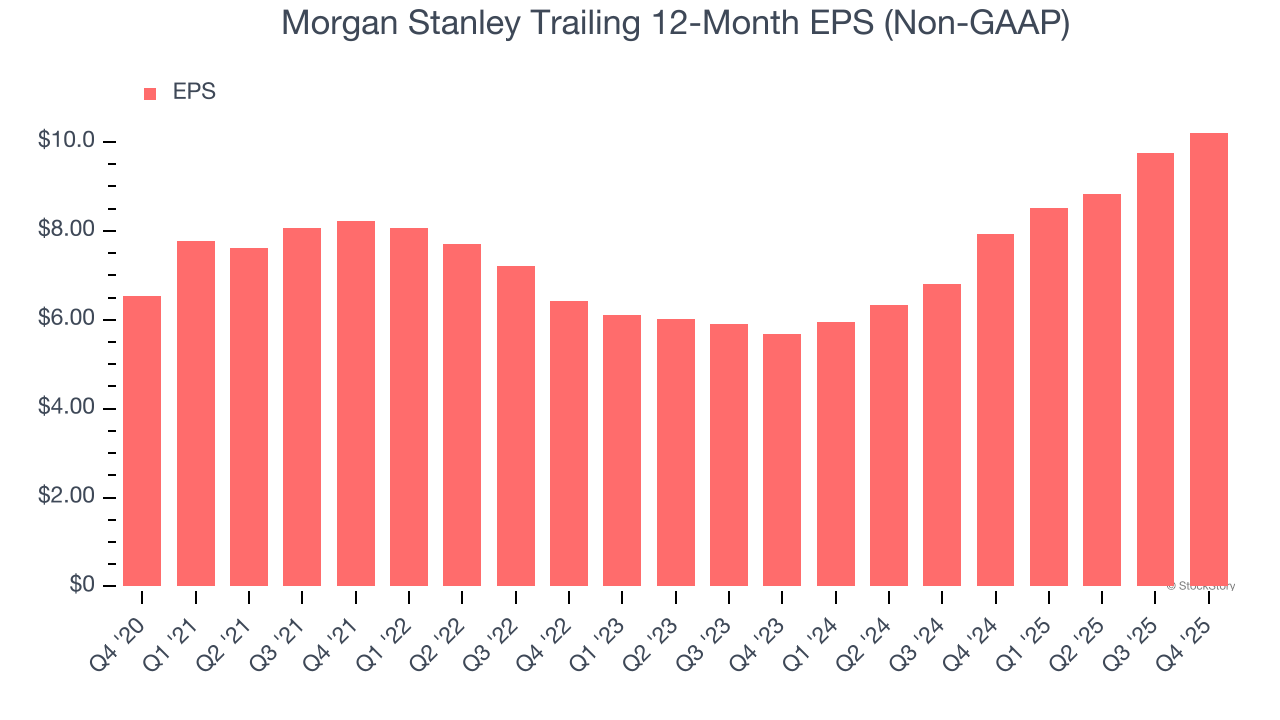

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Morgan Stanley’s unimpressive 9.3% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

2. TBVPS Growth Demonstrates Strong Asset Foundation

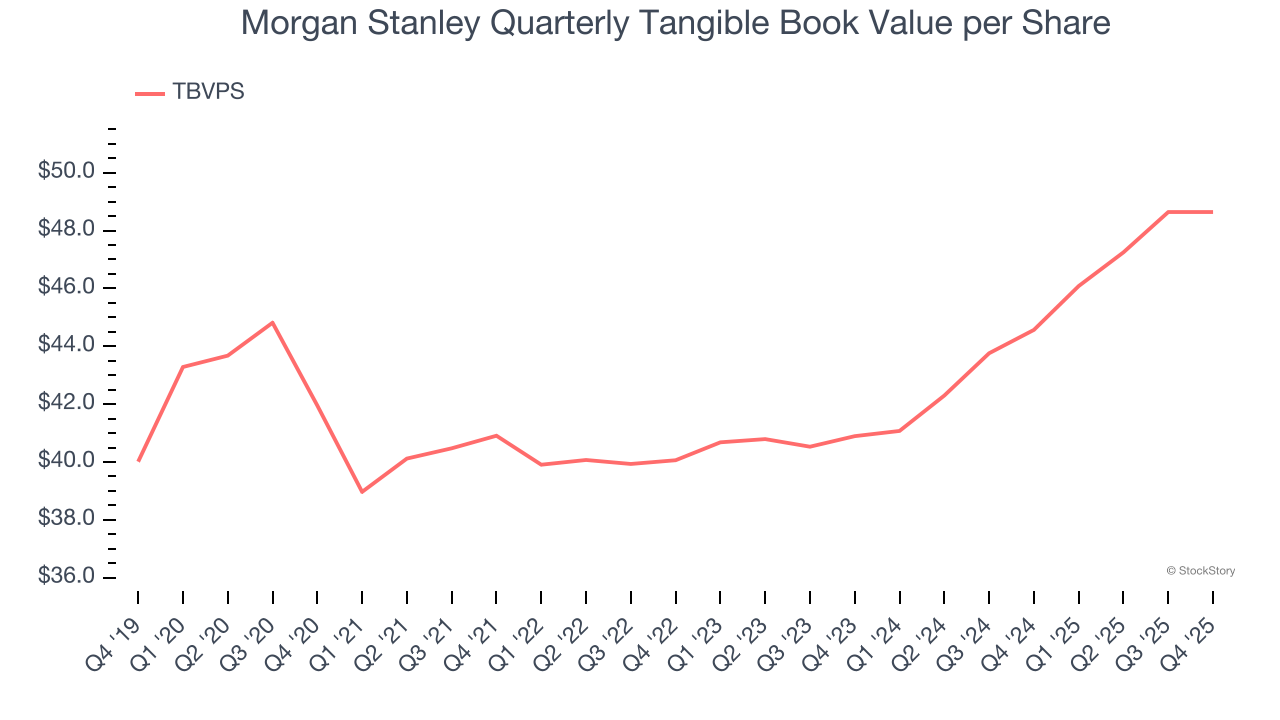

We consider tangible book value per share (TBVPS) an important metric for financial firms. TBVPS represents the real, liquid net worth per share of a company, excluding intangible assets that have debatable value upon liquidation.

Although Morgan Stanley’s TBVPS increased by a meager 3% annually over the last five years, the good news is that its growth has recently accelerated as TBVPS grew at a decent 9.1% annual clip over the past two years (from $40.89 to $48.64 per share).

Final Judgment

Morgan Stanley isn’t a terrible business, but it isn’t one of our picks. With its shares beating the market recently, the stock trades at 16× forward P/E (or $183.80 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d suggest looking at our favorite semiconductor picks and shovels play.

High-Quality Stocks for All Market Conditions

Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.