Since January 2021, the S&P 500 has delivered a total return of 77%. But one standout stock has more than doubled the market - over the past five years, Woodward has surged 176% to $337.34 per share. Its momentum hasn’t stopped as it’s also gained 34.2% in the last six months thanks to its solid quarterly results, beating the S&P by 26.5%.

Following the strength, is WWD a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does WWD Stock Spark Debate?

Initially designing controls for water wheels in the early 1900s, Woodward (NASDAQ: WWD) designs, services, and manufactures energy control products and optimization solutions.

Two Positive Attributes:

1. Core Business Firing on All Cylinders

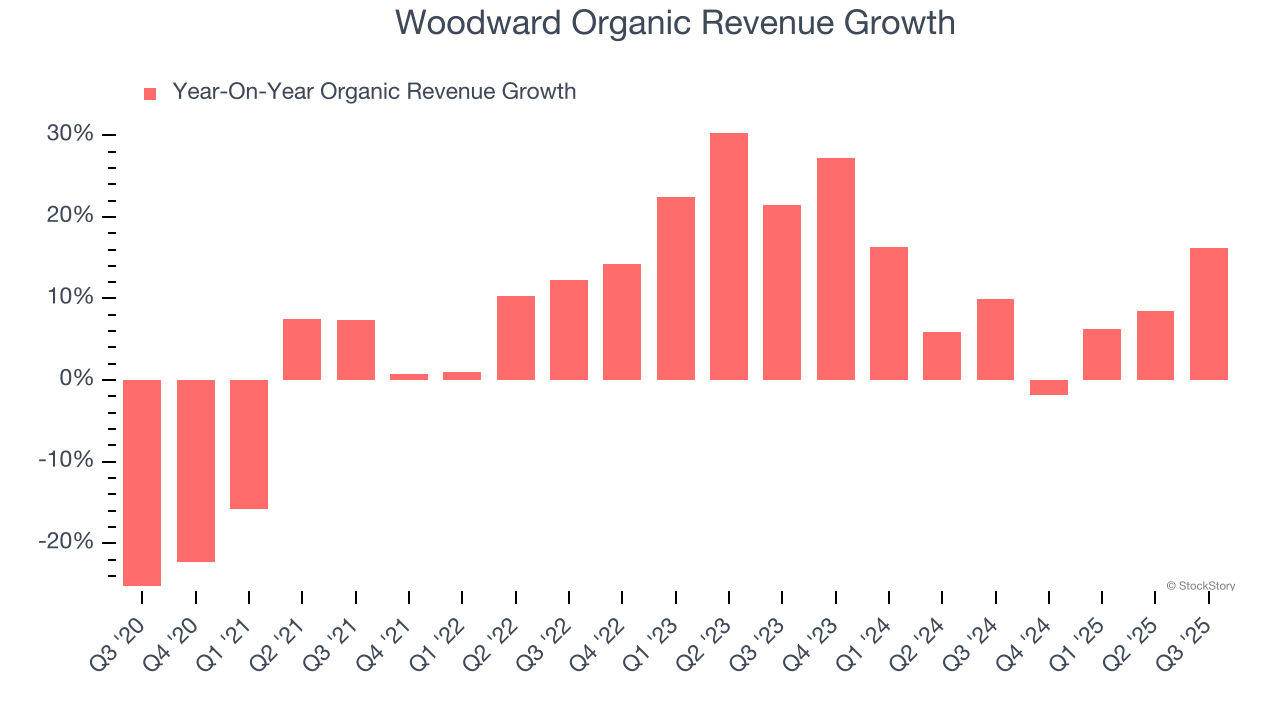

We can better understand Aerospace companies by analyzing their organic revenue. This metric gives visibility into Woodward’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Woodward’s organic revenue averaged 11.1% year-on-year growth. This performance was impressive and shows it can expand quickly without relying on expensive (and risky) acquisitions.

2. Outstanding Long-Term EPS Growth

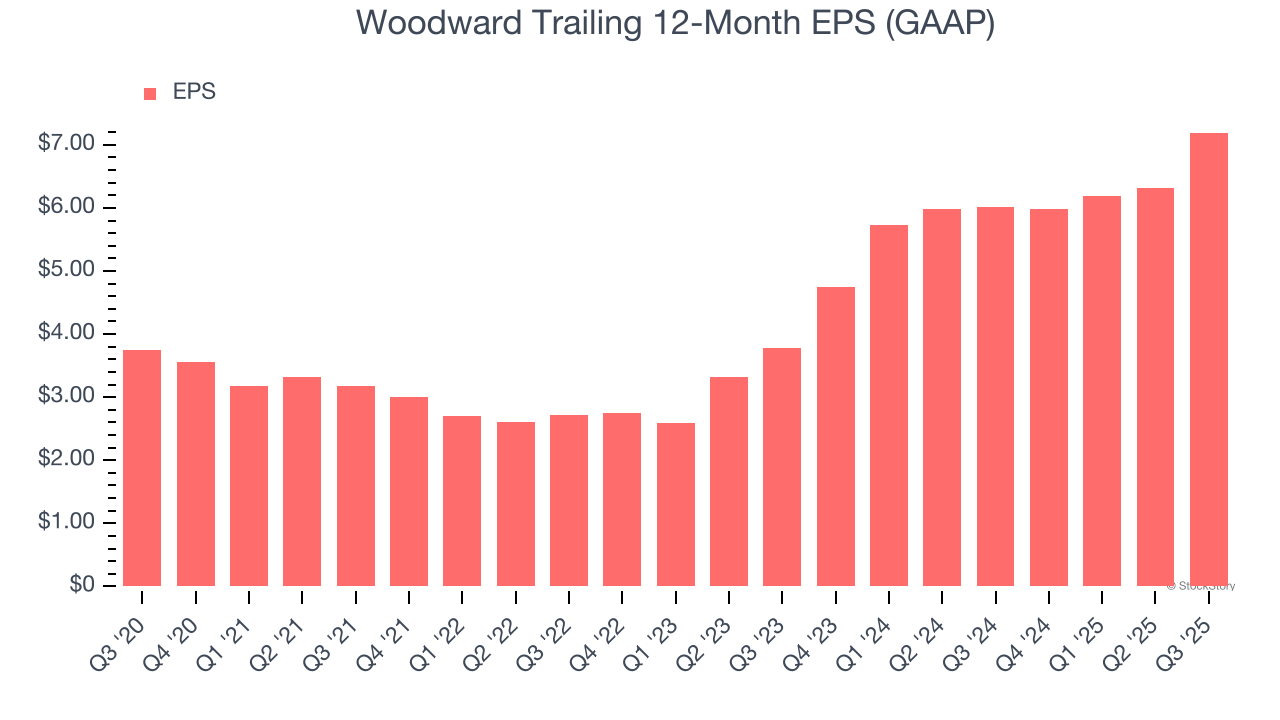

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Woodward’s EPS grew at a remarkable 14% compounded annual growth rate over the last five years, higher than its 7.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

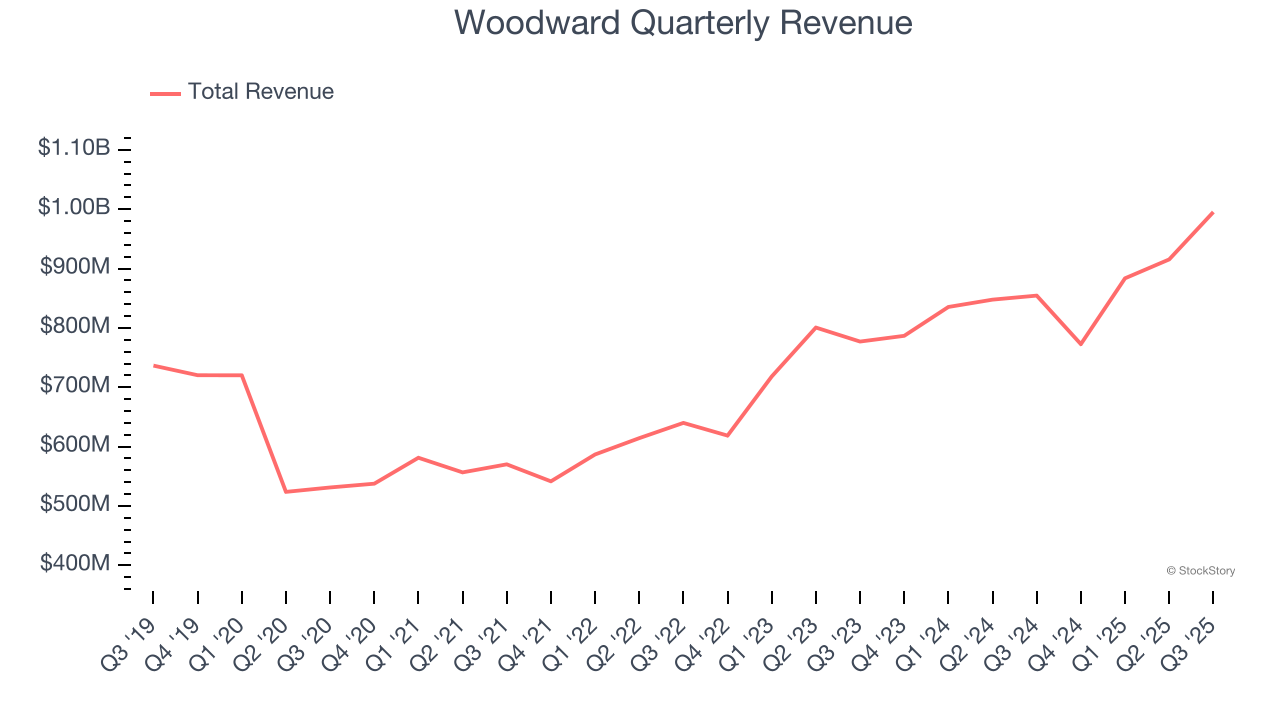

Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Woodward grew its sales at a mediocre 7.4% compounded annual growth rate. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Woodward.

Final Judgment

Woodward’s merits more than compensate for its flaws, and with its shares topping the market in recent months, the stock trades at 40.7× forward P/E (or $337.34 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.