Martin Marietta Materials trades at $641.30 per share and has stayed right on track with the overall market, gaining 12.3% over the last six months. At the same time, the S&P 500 has returned 7.7%.

Is there a buying opportunity in Martin Marietta Materials, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Martin Marietta Materials Not Exciting?

We're sitting this one out for now. Here are three reasons there are better opportunities than MLM and a stock we'd rather own.

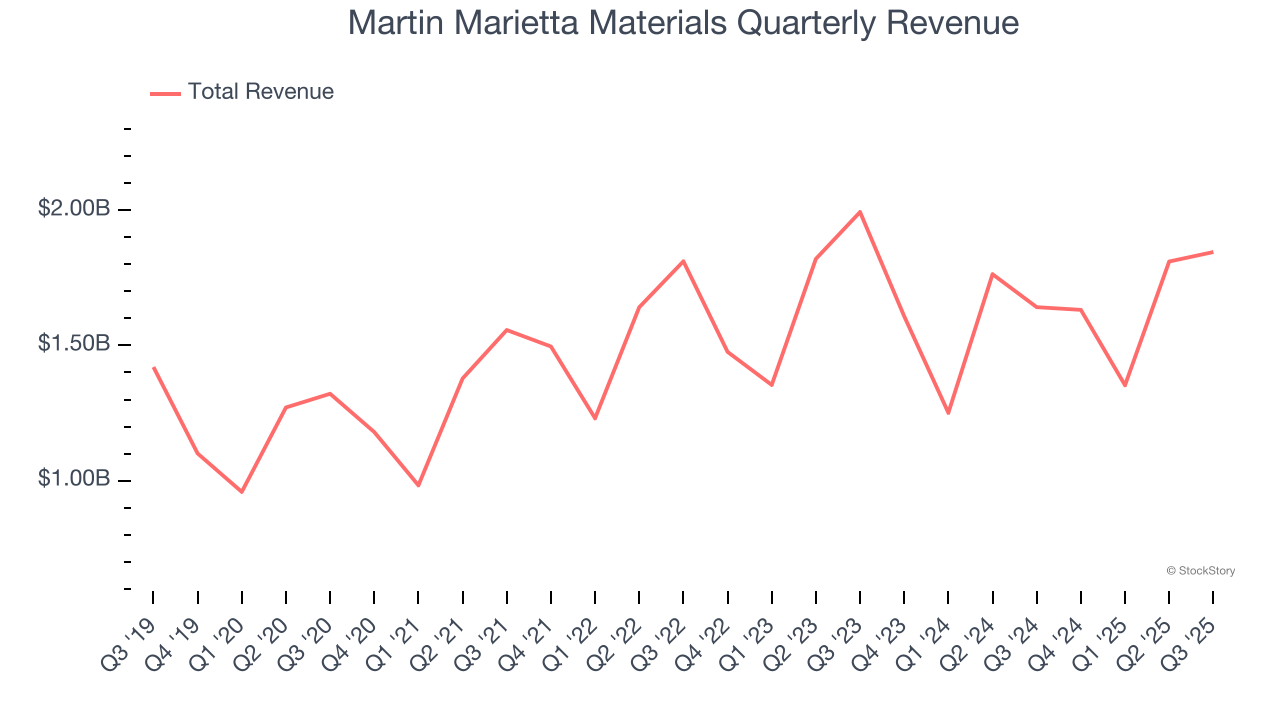

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Martin Marietta Materials grew its sales at a mediocre 7.4% compounded annual growth rate. This was below our standard for the industrials sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Martin Marietta Materials’s revenue to rise by 5.5%. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

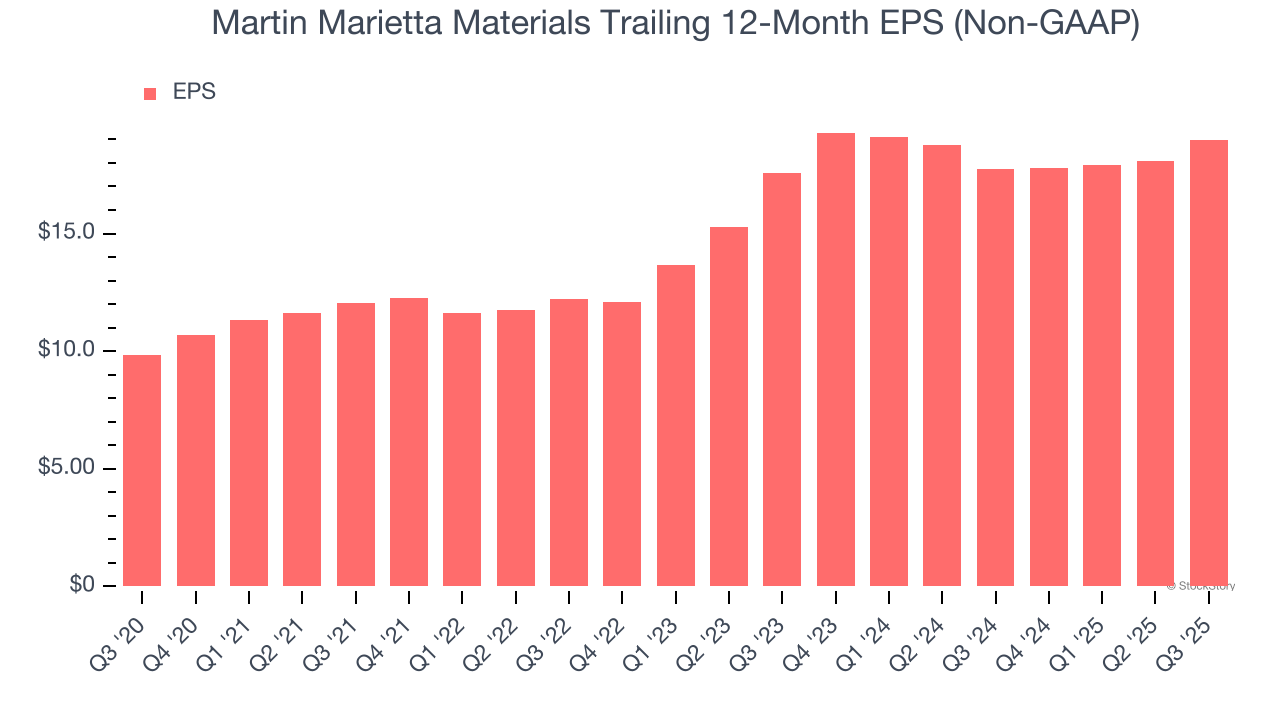

3. Recent EPS Growth Below Our Standards

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Martin Marietta Materials’s EPS grew at a weak 3.9% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

Final Judgment

Martin Marietta Materials isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 29.4× forward P/E (or $641.30 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than Martin Marietta Materials

Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.