Regional bank OceanFirst Financial (NASDAQ: OCFC) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 9.5% year on year to $104.7 million. Its non-GAAP profit of $0.58 per share was 58.9% above analysts’ consensus estimates.

Is now the time to buy OceanFirst Financial? Find out by accessing our full research report, it’s free.

OceanFirst Financial (OCFC) Q4 CY2025 Highlights:

- Net Interest Income: $95.28 million vs analyst estimates of $94.34 million (14.3% year-on-year growth, 1% beat)

- Net Interest Margin: 2.9% vs analyst estimates of 2.9% (in line)

- Revenue: $104.7 million vs analyst estimates of $102.7 million (9.5% year-on-year growth, 1.9% beat)

- Efficiency Ratio: 80.4% vs analyst estimates of 68.9% (1,145.3 basis point miss)

- Adjusted EPS: $0.58 vs analyst estimates of $0.37 (58.9% beat)

- Tangible Book Value per Share: $19.79 vs analyst estimates of $19.62 (flat year on year, 0.9% beat)

- Market Capitalization: $1.09 billion

Chairman and Chief Executive Officer, Christopher D. Maher, commented on the Company’s results, “We are pleased to present our current quarter results, which reflect strong capital and robust net loan growth, while maintaining a strong commercial loan pipeline. We recently announced entry into a merger agreement with Flushing Financial Corporation and an investment from Warburg Pincus, to further improve financial performance and operating scale.”

Company Overview

Tracing its roots back to 1902 when it began serving coastal New Jersey communities, OceanFirst Financial (NASDAQ: OCFC) operates as a regional bank holding company that provides commercial and consumer banking services primarily in New Jersey and surrounding metropolitan areas.

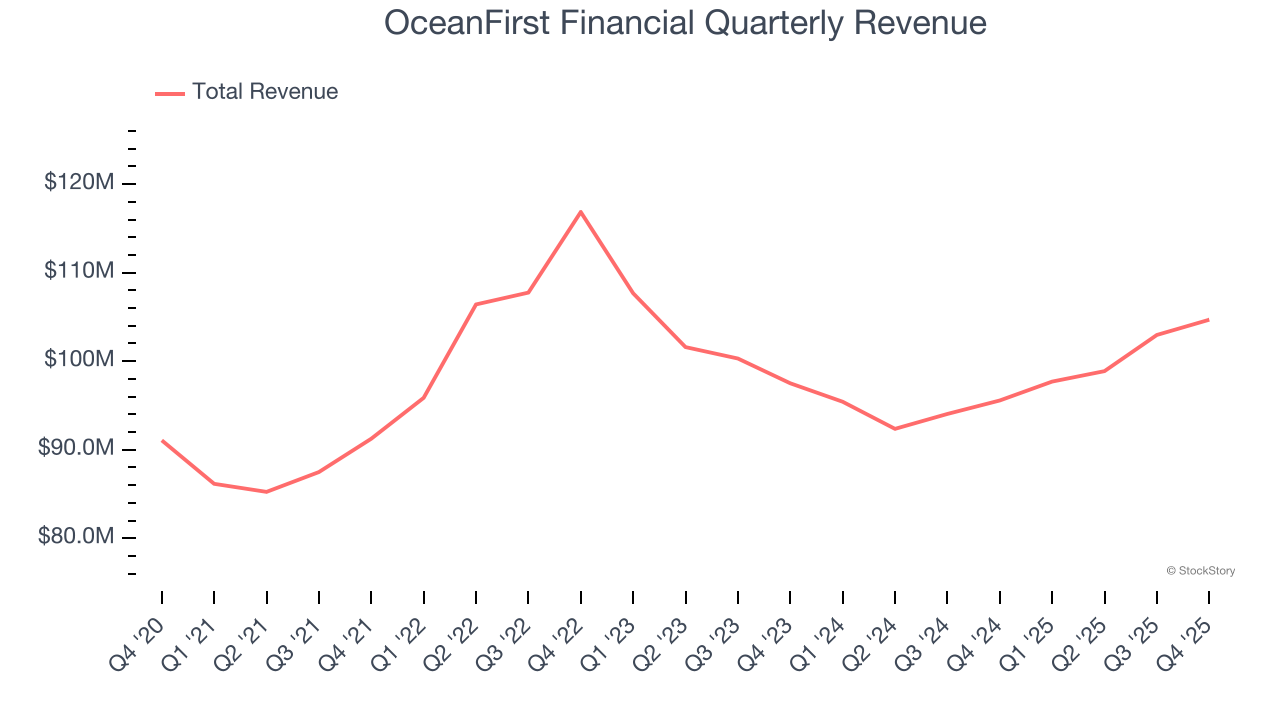

Sales Growth

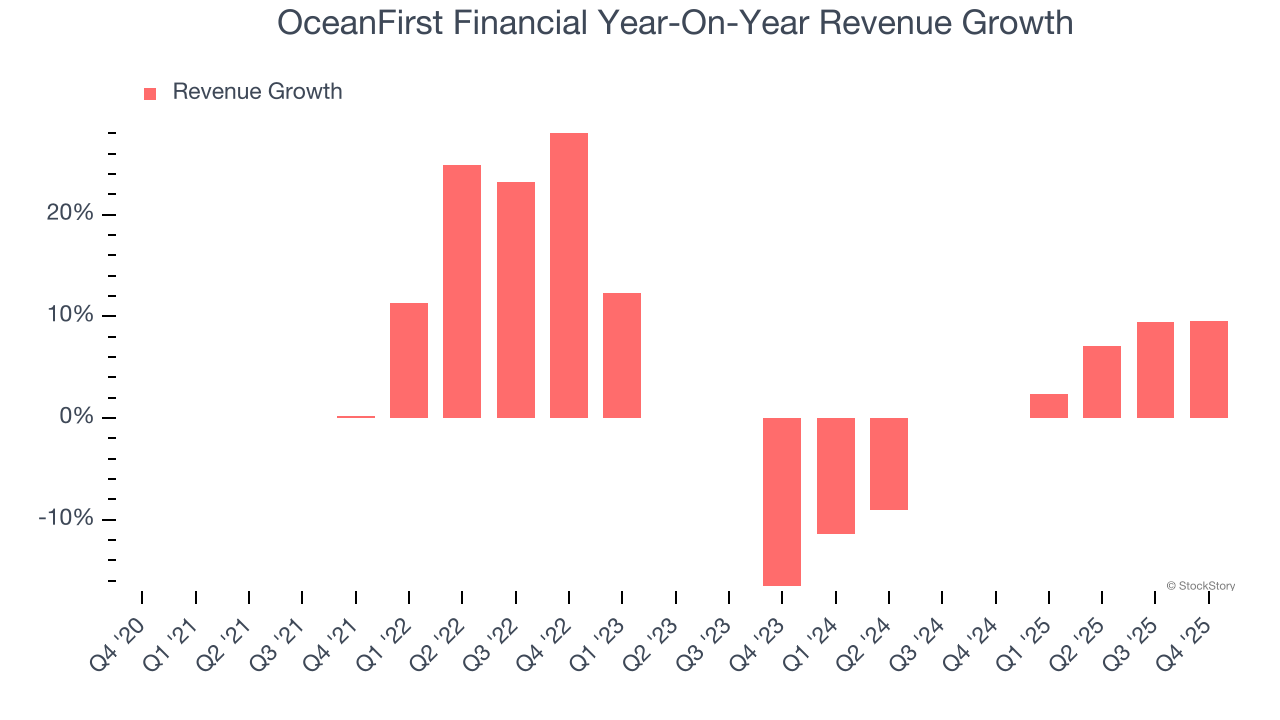

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees. Over the last five years, OceanFirst Financial grew its revenue at a sluggish 2.2% compounded annual growth rate. This was below our standards and is a rough starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. OceanFirst Financial’s recent performance shows its demand has slowed as its revenue was flat over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, OceanFirst Financial reported year-on-year revenue growth of 9.5%, and its $104.7 million of revenue exceeded Wall Street’s estimates by 1.9%.

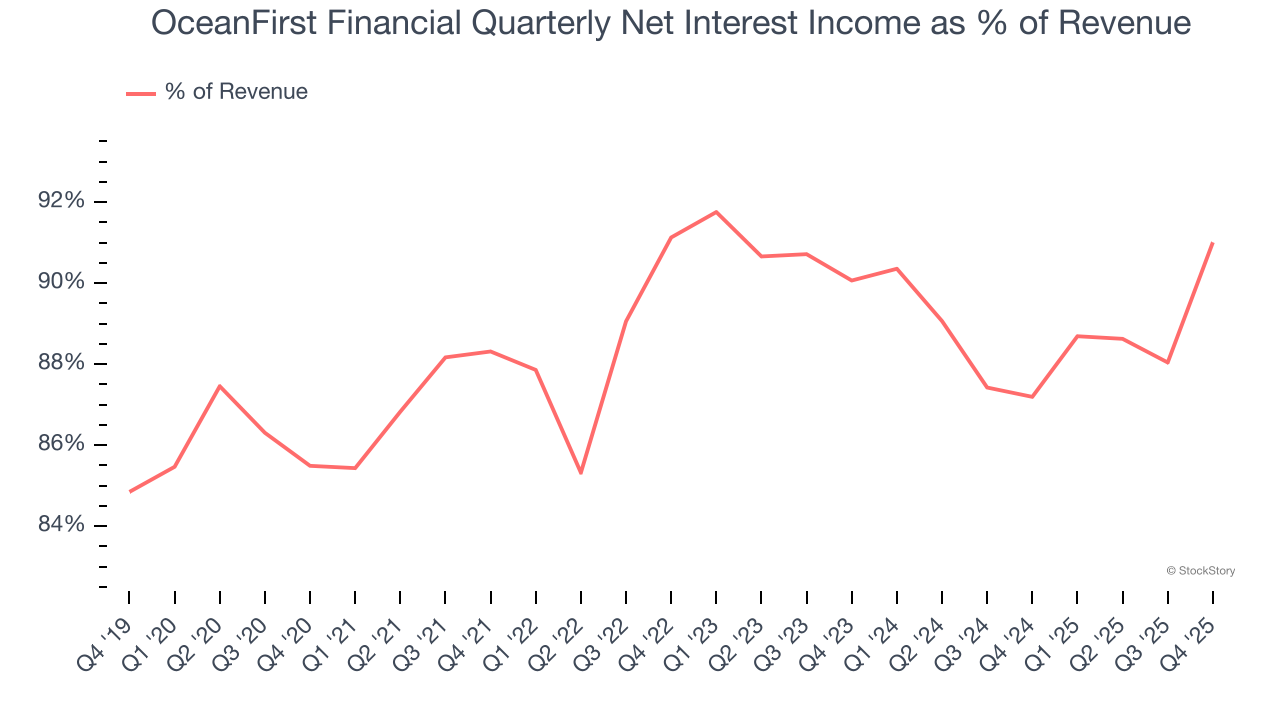

Net interest income made up 88.8% of the company’s total revenue during the last five years, meaning OceanFirst Financial barely relies on non-interest income to drive its overall growth.

While banks generate revenue from multiple sources, investors view net interest income as the cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of non-interest income.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

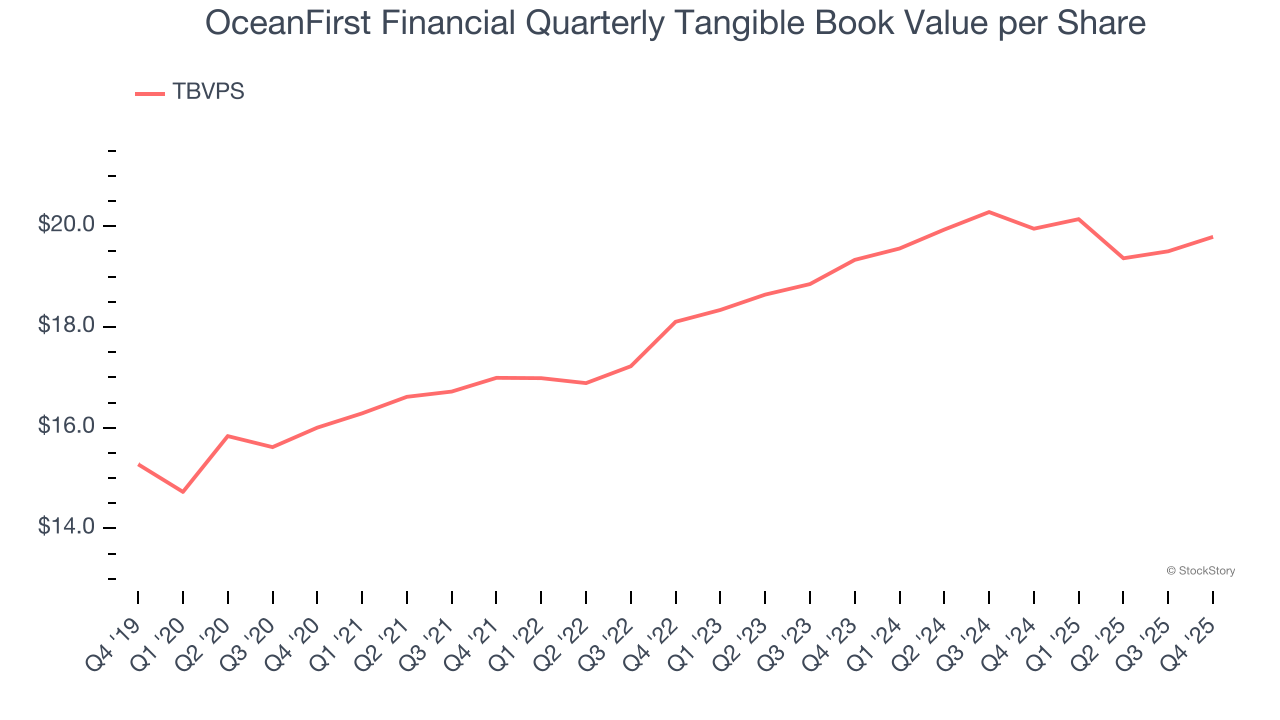

Tangible Book Value Per Share (TBVPS)

Banks operate as balance sheet businesses, with profits generated through borrowing and lending activities. Valuations reflect this reality, emphasizing balance sheet strength and long-term book value compounding ability.

This is why we consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation. On the other hand, EPS is often distorted by mergers and flexible loan loss accounting. TBVPS provides clearer performance insights.

OceanFirst Financial’s TBVPS grew at a mediocre 4.3% annual clip over the last five years. TBVPS growth has also recently decelerated to 1.2% annual growth over the last two years (from $19.33 to $19.79 per share).

Over the next 12 months, Consensus estimates call for OceanFirst Financial’s TBVPS to shrink by 1.2% to $19.56, a sour projection.

Key Takeaways from OceanFirst Financial’s Q4 Results

It was good to see OceanFirst Financial beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $19.19 immediately after reporting.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).