Over the past six months, TransDigm’s shares (currently trading at $1,433) have posted a disappointing 8.8% loss, well below the S&P 500’s 7.7% gain. This might have investors contemplating their next move.

Following the pullback, is now the time to buy TDG? Find out in our full research report, it’s free.

Why Are We Positive On TransDigm?

Supplying parts for nearly all aircraft currently in service, TransDigm (NYSE: TDG) develops and manufactures components and systems for military and commercial aviation.

1. Core Business Firing on All Cylinders

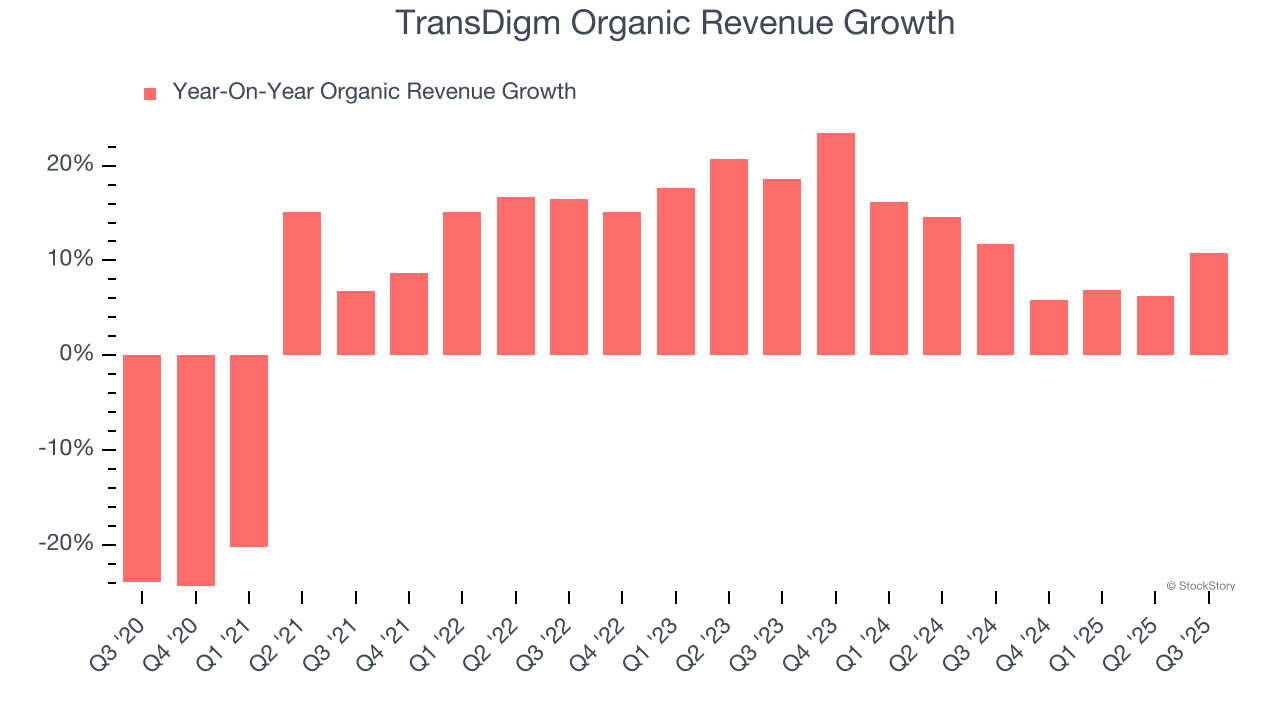

Investors interested in Aerospace companies should track organic revenue in addition to reported revenue. This metric gives visibility into TransDigm’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, TransDigm’s organic revenue averaged 12% year-on-year growth. This performance was impressive and shows it can expand quickly without relying on expensive (and risky) acquisitions.

2. Outstanding Long-Term EPS Growth

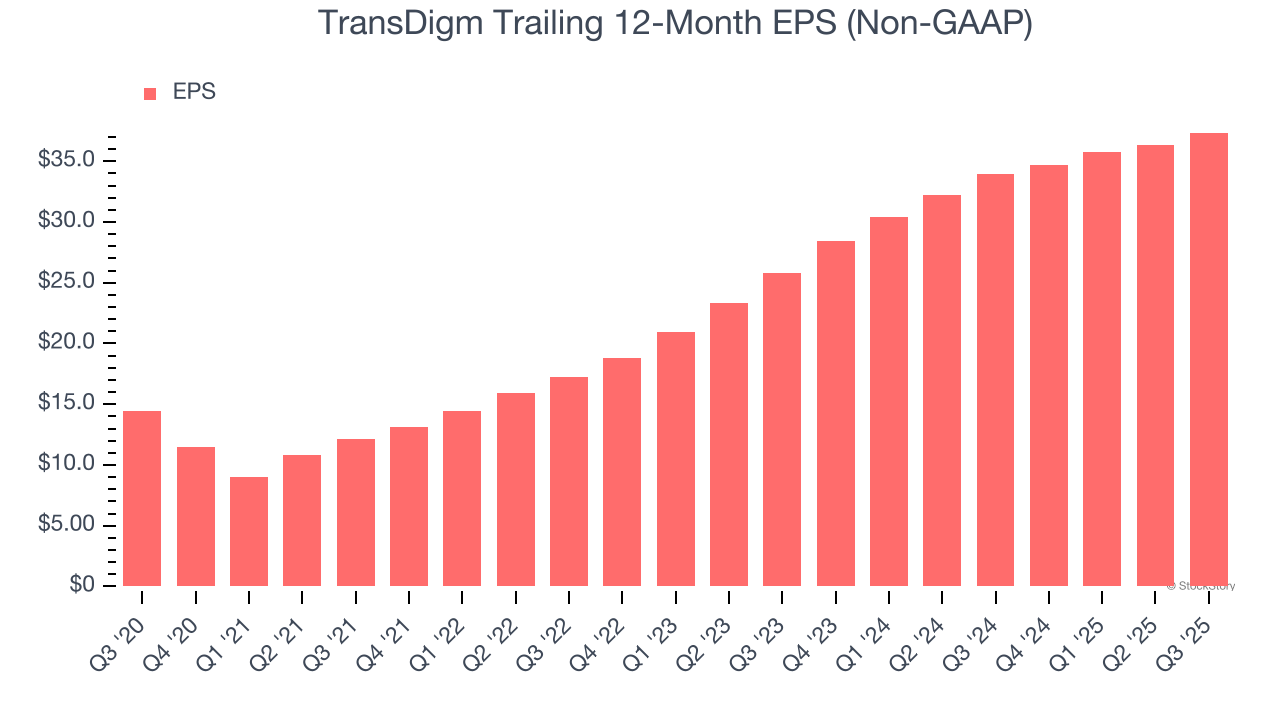

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

TransDigm’s EPS grew at an astounding 20.9% compounded annual growth rate over the last five years, higher than its 11.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

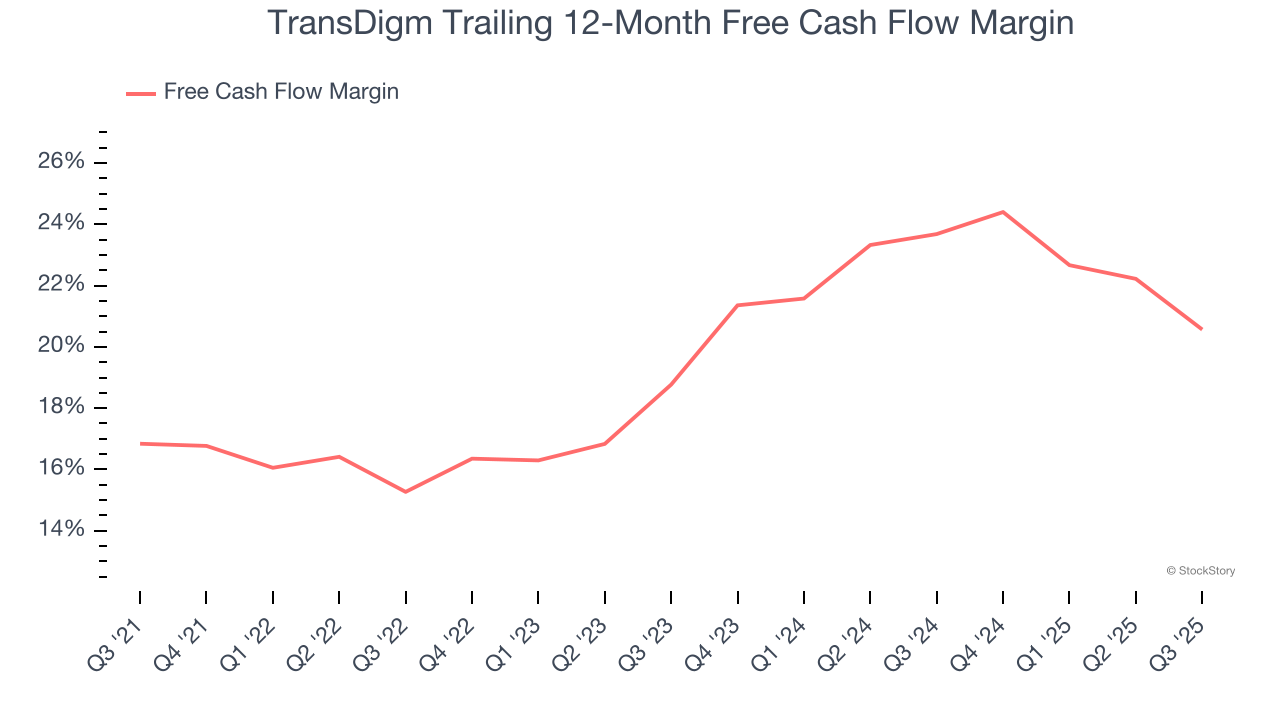

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

TransDigm has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 19.6% over the last five years.

Final Judgment

These are just a few reasons why TransDigm is a cream-of-the-crop industrials company. After the recent drawdown, the stock trades at 37.5× forward P/E (or $1,433 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.