Parcel delivery company UPS (NYSE: UPS) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales fell by 3.2% year on year to $24.5 billion. The company’s full-year revenue guidance of $89.7 billion at the midpoint came in 2% above analysts’ estimates. Its non-GAAP profit of $2.38 per share was 8.1% above analysts’ consensus estimates.

Is now the time to buy United Parcel Service? Find out by accessing our full research report, it’s free.

United Parcel Service (UPS) Q4 CY2025 Highlights:

- Revenue: $24.5 billion vs analyst estimates of $24.05 billion (3.2% year-on-year decline, 1.9% beat)

- Adjusted EPS: $2.38 vs analyst estimates of $2.20 (8.1% beat)

- Operating Margin: 10.5%, down from 11.6% in the same quarter last year

- Free Cash Flow Margin: 10.6%, up from 8.8% in the same quarter last year

- Market Capitalization: $90.75 billion

“I want to thank UPSers across the globe for their tireless commitment to serving our customers as we delivered best-in-class service during peak for the eighth year in a row and outperformed our financial expectations in the fourth quarter,” said Carol Tomé, UPS chief executive officer.

Company Overview

Trademarking its recognizable UPS Brown color, UPS (NYSE: UPS) offers package delivery, supply chain management, and freight forwarding services.

Revenue Growth

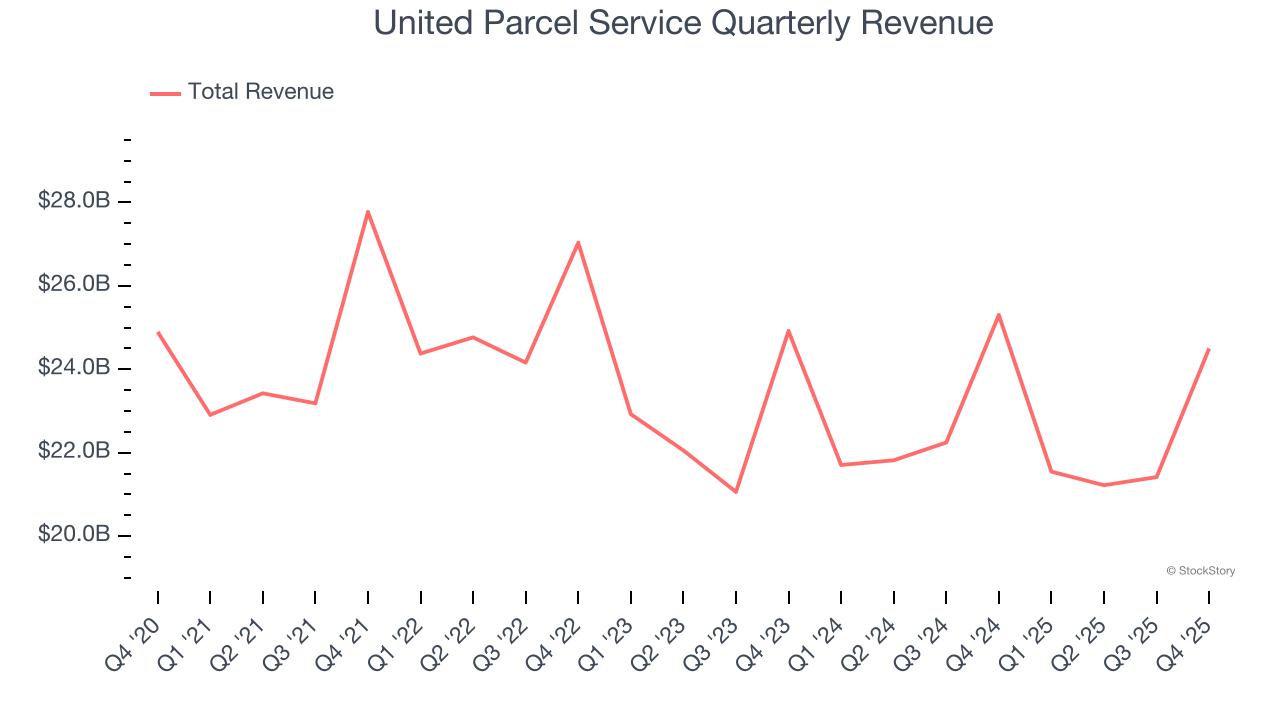

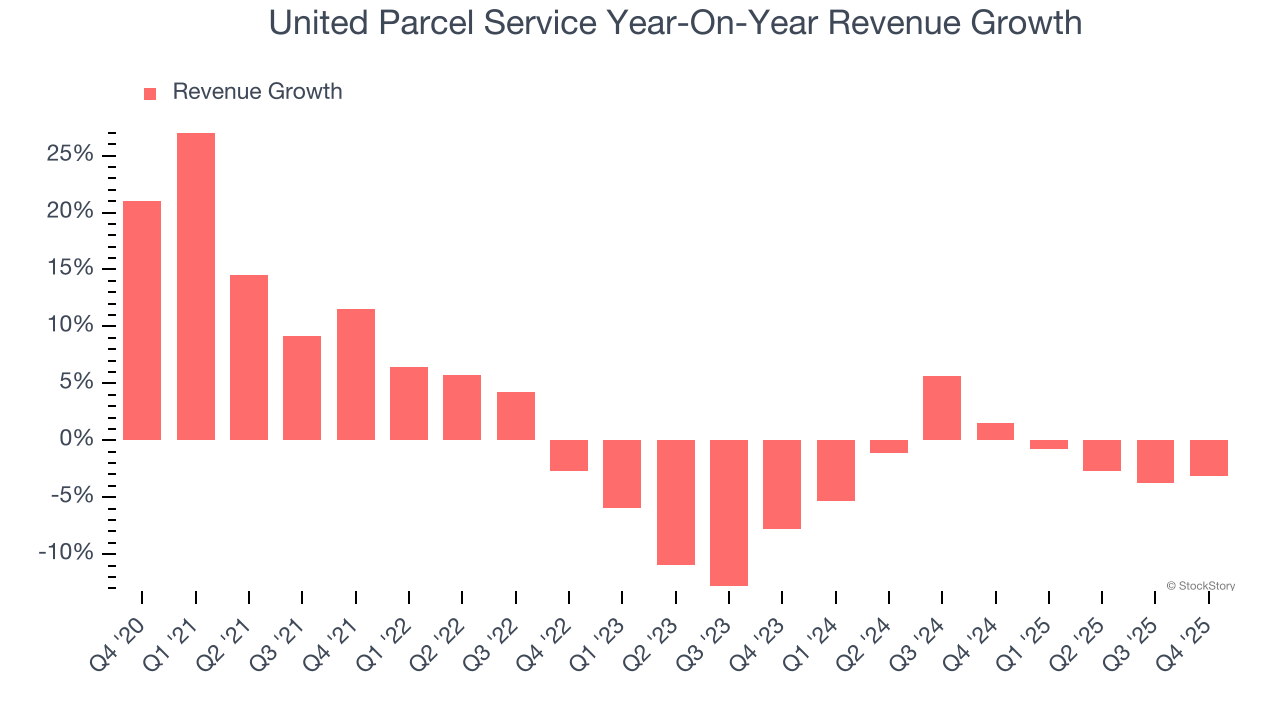

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, United Parcel Service struggled to consistently increase demand as its $88.68 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. United Parcel Service’s recent performance shows its demand remained suppressed as its revenue has declined by 1.3% annually over the last two years. United Parcel Service isn’t alone in its struggles as the Air Freight and Logistics industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, United Parcel Service’s revenue fell by 3.2% year on year to $24.5 billion but beat Wall Street’s estimates by 1.9%.

Looking ahead, sell-side analysts expect revenue to decline by 1% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not catalyze better top-line performance yet.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

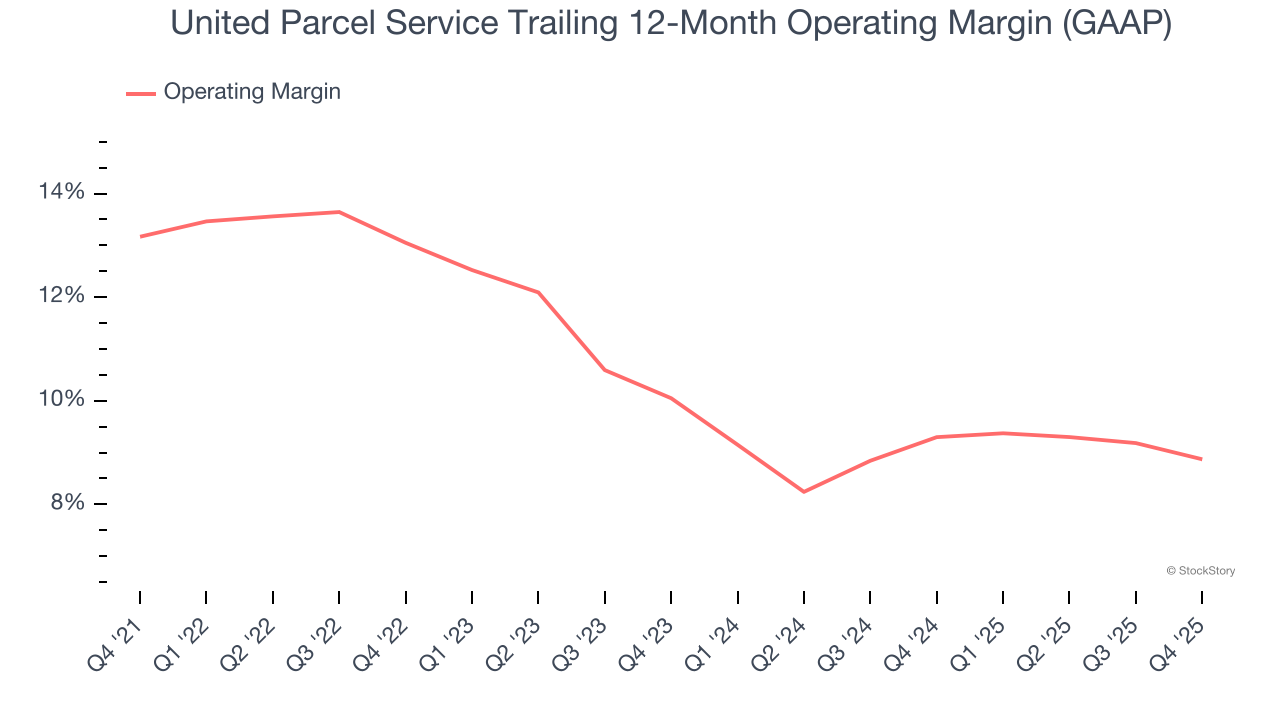

United Parcel Service has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, United Parcel Service’s operating margin decreased by 4.3 percentage points over the last five years. Many Air Freight and Logistics companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction. We hope United Parcel Service can emerge from this a stronger company, as the silver lining of a downturn is that market share can be won and efficiencies found.

This quarter, United Parcel Service generated an operating margin profit margin of 10.5%, down 1.1 percentage points year on year. The reduction is quite minuscule and shareholders shouldn’t weigh the results too heavily.

Earnings Per Share

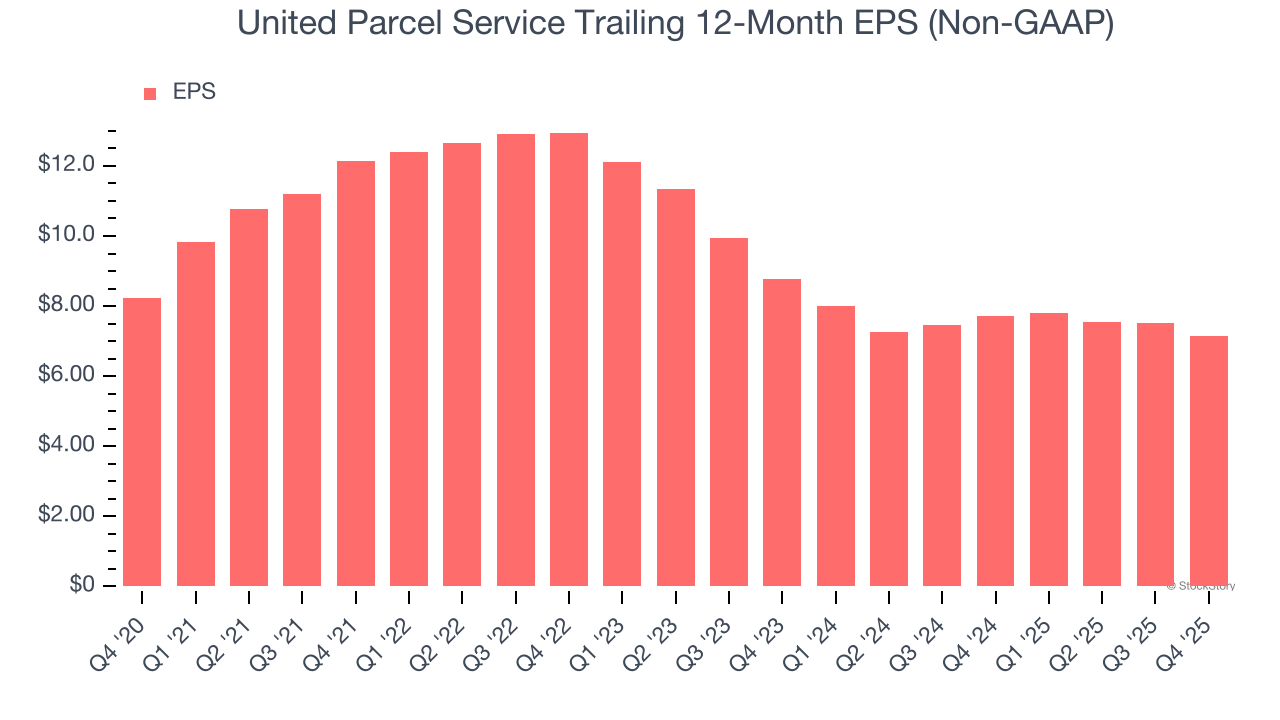

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for United Parcel Service, its EPS declined by 2.7% annually over the last five years while its revenue was flat. We can see the difference stemmed from higher taxes as the company actually improved its operating margin and repurchased its shares during this time.

Diving into the nuances of United Parcel Service’s earnings can give us a better understanding of its performance. As we mentioned earlier, United Parcel Service’s operating margin declined by 4.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For United Parcel Service, its two-year annual EPS declines of 9.7% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, United Parcel Service reported adjusted EPS of $2.38, down from $2.75 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 8.1%. Over the next 12 months, Wall Street expects United Parcel Service’s full-year EPS of $7.16 to shrink by 1.7%.

Key Takeaways from United Parcel Service’s Q4 Results

It was great to see United Parcel Service’s full-year revenue guidance top analysts’ expectations. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 3.8% to $111.08 immediately following the results.

Sure, United Parcel Service had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).