Luxury cruise operator Viking (NYSE: VIK) met Wall Streets revenue expectations in Q3 CY2025, with sales up 19.1% year on year to $2 billion. Its GAAP profit of $1.15 per share was 3.7% below analysts’ consensus estimates.

Is now the time to buy Viking? Find out by accessing our full research report, it’s free for active Edge members.

Viking (VIK) Q3 CY2025 Highlights:

- Revenue: $2 billion vs analyst estimates of $1.99 billion (19.1% year-on-year growth, in line)

- EPS (GAAP): $1.15 vs analyst expectations of $1.19 (3.7% miss)

- Adjusted EBITDA: $703.5 million vs analyst estimates of $682.2 million (35.2% margin, 3.1% beat)

- Operating Margin: 30.2%, up from 29.1% in the same quarter last year

- Free Cash Flow Margin: 30.5%, down from 42.5% in the same quarter last year

- : 96,000 at quarter end

- Market Capitalization: $32.06 billion

“We delivered another remarkable quarter, highlighted by a significant milestone – surpassing 100 ships,” said Torstein Hagen, Chairman and CEO of Viking.

Company Overview

From a single river cruise offering to a fleet of 96 vessels across multiple continents, Viking (NYSE: VIK) operates a fleet of small luxury cruise ships offering river, ocean, and expedition voyages focused on cultural enrichment and destination immersion.

Revenue Growth

Reviewing a company’s top-line performance can reveal insights into its business quality. Growth can signal it’s capitalizing on a new product or emerging industry trend. Viking’s annualized revenue growth rate of 17.1% over the last two years was weak for a consumer discretionary business.

This quarter, Viking’s year-on-year revenue growth was 19.1%, and its $2 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 15.9% over the next 12 months, similar to its two-year rate. Despite the slowdown, this projection is healthy and indicates the market sees success for its products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

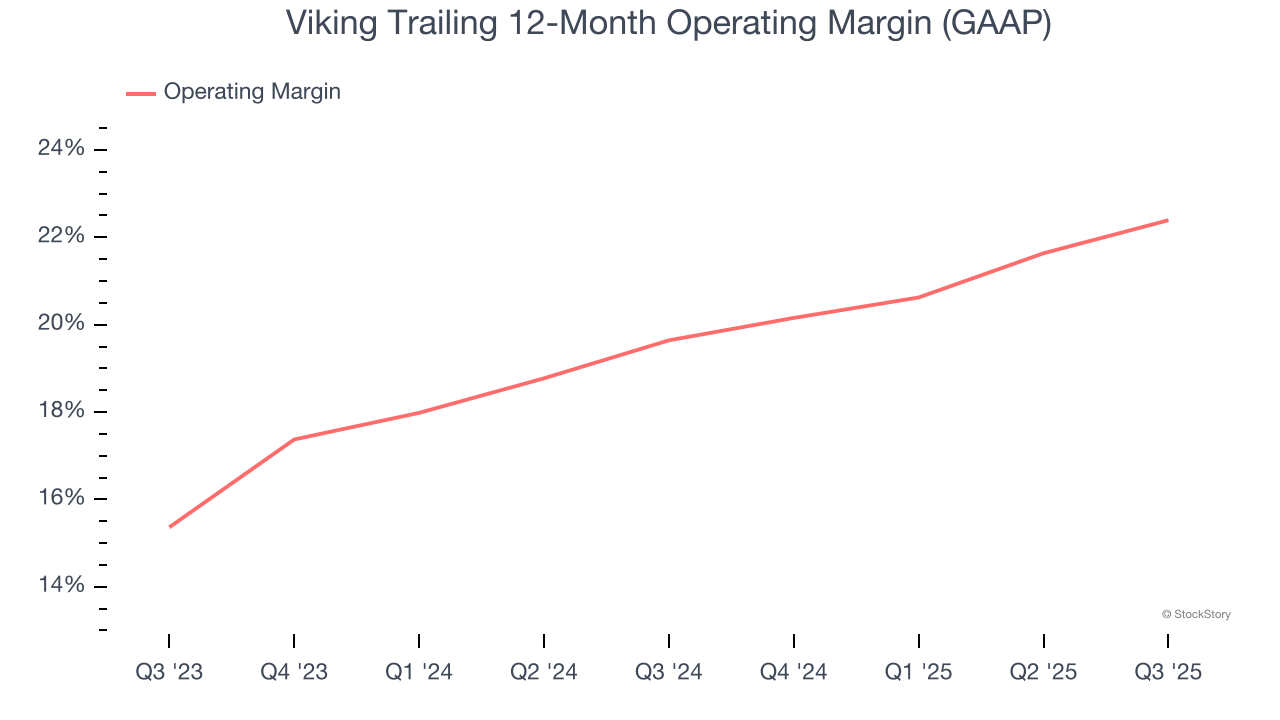

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Viking’s operating margin has risen over the last 12 months and averaged 21.1% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

In Q3, Viking generated an operating margin profit margin of 30.2%, up 1.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

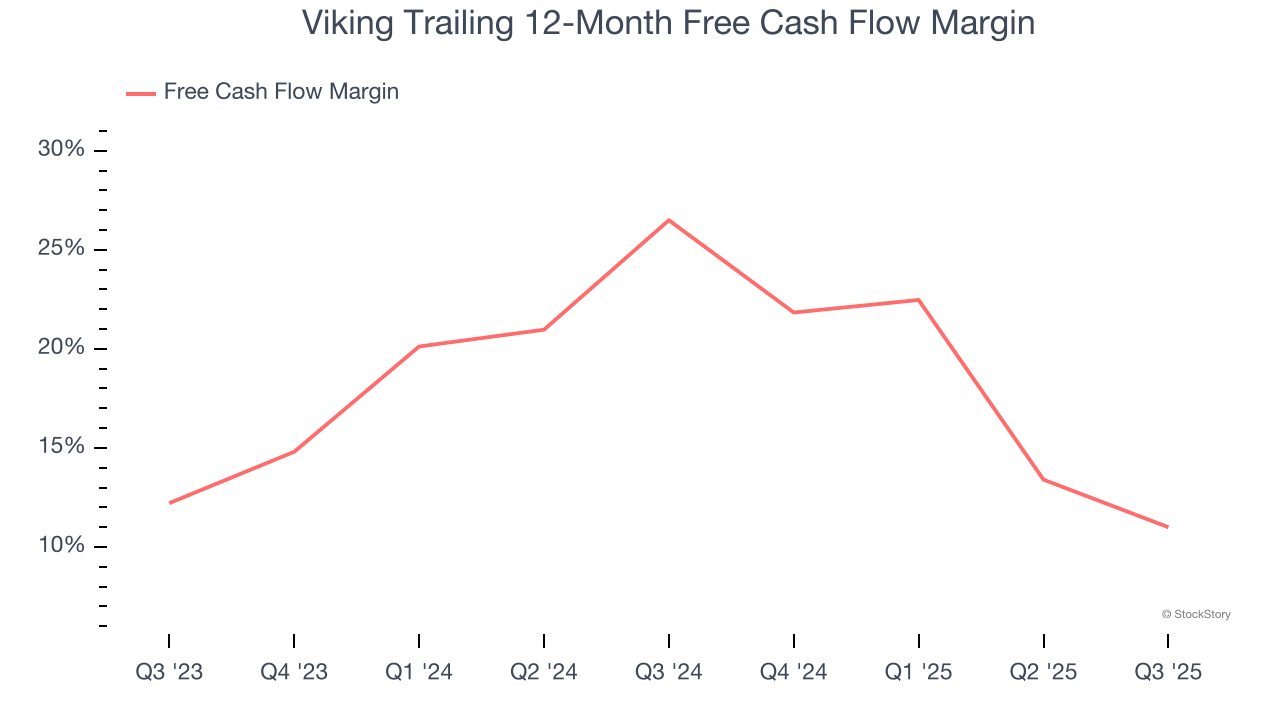

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Viking has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 18%, lousy for a consumer discretionary business.

Viking’s free cash flow clocked in at $609.4 million in Q3, equivalent to a 30.5% margin. The company’s cash profitability regressed as it was 12 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, causing short-term swings. Long-term trends trump temporary fluctuations.

Over the next year, analysts predict Viking’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 11% for the last 12 months will increase to 24.9%, giving it more flexibility for investments, share buybacks, and dividends.

Key Takeaways from Viking’s Q3 Results

It was encouraging to see Viking beat analysts’ EBITDA expectations this quarter. On the other hand, its EPS missed. Overall, this was a softer quarter. The stock traded up 1.3% to $73.18 immediately after reporting.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.