Automotive technology company Visteon (NYSE: VC) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 6.4% year on year to $917 million. The company’s full-year revenue guidance of $3.78 billion at the midpoint came in 0.8% below analysts’ estimates. Its non-GAAP profit of $2.15 per share was 1.2% above analysts’ consensus estimates.

Is now the time to buy Visteon? Find out by accessing our full research report, it’s free for active Edge members.

Visteon (VC) Q3 CY2025 Highlights:

- Revenue: $917 million vs analyst estimates of $957.8 million (6.4% year-on-year decline, 4.3% miss)

- Adjusted EPS: $2.15 vs analyst estimates of $2.12 (1.2% beat)

- Adjusted EBITDA: $119 million vs analyst estimates of $118.5 million (13% margin, in line)

- EBITDA guidance for the full year is $490 million at the midpoint, below analyst estimates of $496.2 million

- Operating Margin: 8.2%, up from 5.3% in the same quarter last year

- Free Cash Flow Margin: 12%, up from 7.4% in the same quarter last year

- Market Capitalization: $2.64 billion

Company Overview

Originally spun off from Ford Motor Company in 2000, Visteon (NYSE: VC) designs and manufactures cockpit electronics for vehicles, including digital instrument clusters, displays, infotainment systems, and battery management systems.

Revenue Growth

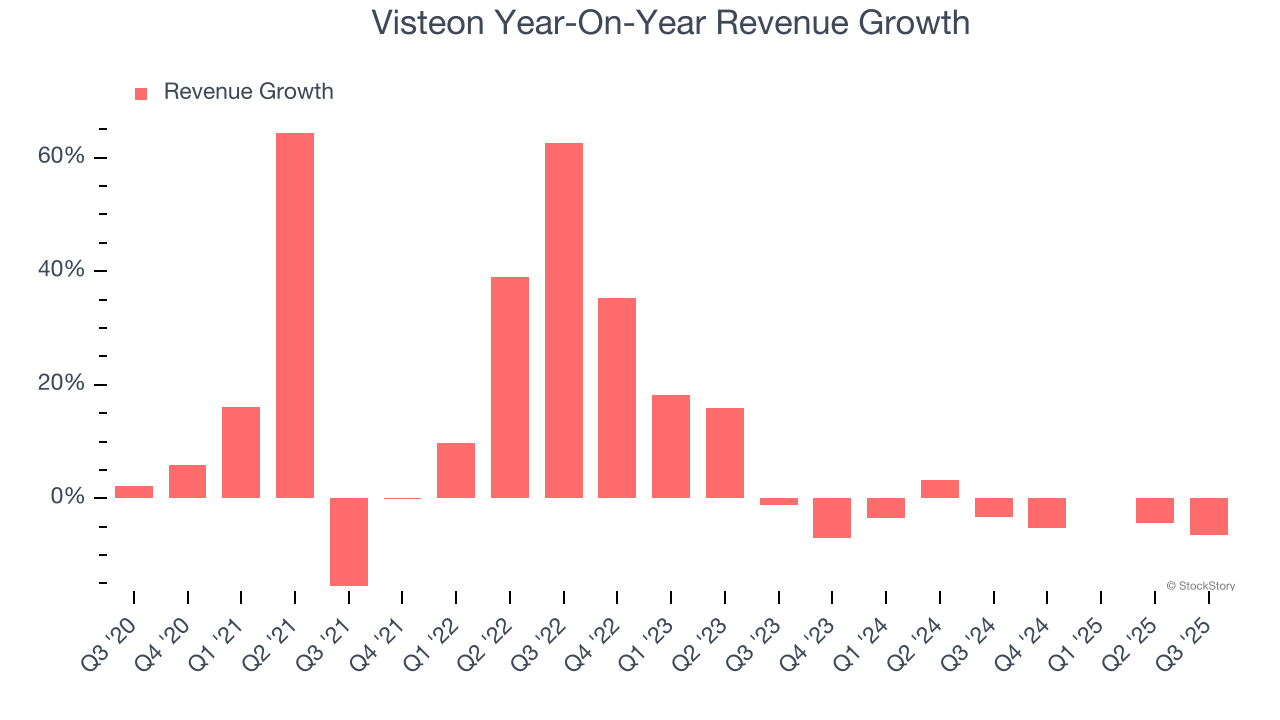

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Visteon’s 8.5% annualized revenue growth over the last five years was decent. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Visteon’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.4% over the last two years. Visteon isn’t alone in its struggles as the Automobile Manufacturing industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Visteon missed Wall Street’s estimates and reported a rather uninspiring 6.4% year-on-year revenue decline, generating $917 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector. At least the company is tracking well in other measures of financial health.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Visteon was profitable over the last five years but held back by its large cost base. Its average operating margin of 6% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Visteon’s operating margin rose by 7 percentage points over the last five years, as its sales growth gave it immense operating leverage. We’ll take Visteon’s improvement as many Automobile Manufacturing companies saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction.

This quarter, Visteon generated an operating margin profit margin of 8.2%, up 2.9 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

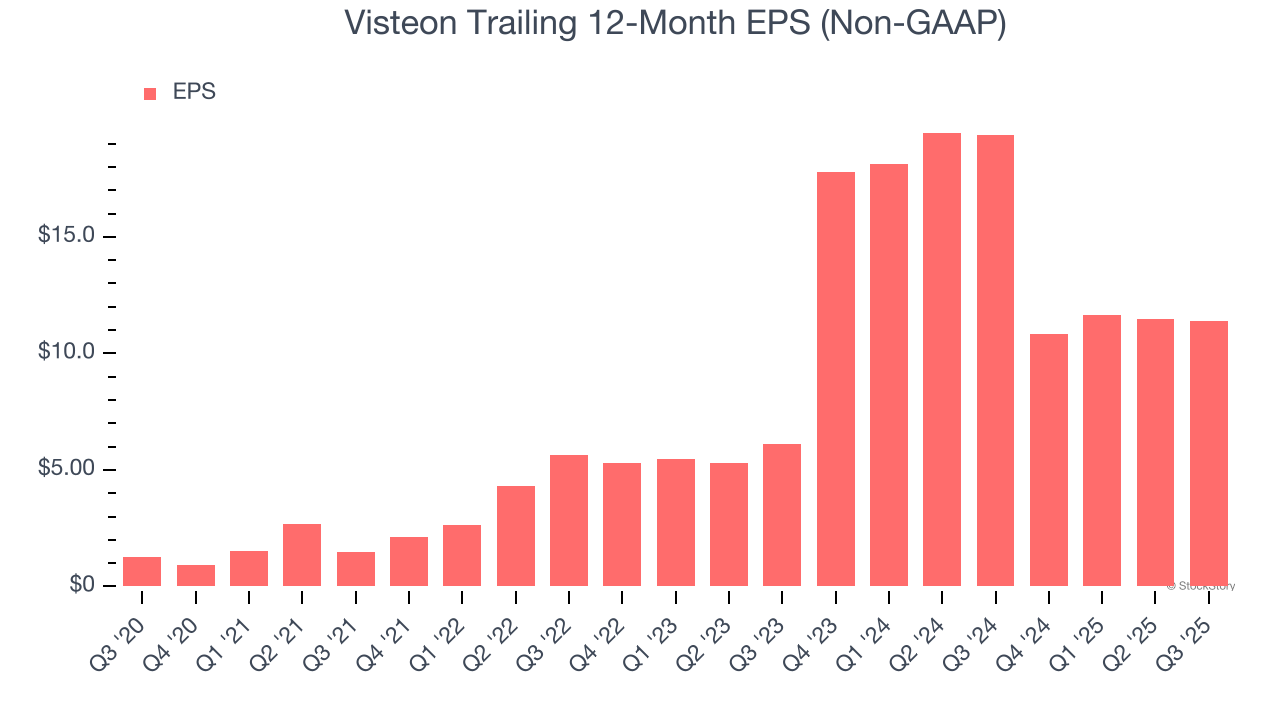

Visteon’s EPS grew at an astounding 55% compounded annual growth rate over the last five years, higher than its 8.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Visteon’s earnings can give us a better understanding of its performance. As we mentioned earlier, Visteon’s operating margin expanded by 7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Visteon, its two-year annual EPS growth of 36.6% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, Visteon reported adjusted EPS of $2.15, down from $2.26 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Visteon’s full-year EPS of $11.38 to shrink by 20%.

Key Takeaways from Visteon’s Q3 Results

We enjoyed seeing Visteon beat analysts’ adjusted operating income expectations this quarter. On the other hand, its revenue missed and its full-year EBITDA guidance fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $96.75 immediately following the results.

Is Visteon an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.