Financial automation platform BILL (NYSE: BILL) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 14.4% year on year to $414.7 million. Guidance for next quarter’s revenue was better than expected at $402.5 million at the midpoint, 1.8% above analysts’ estimates. Its non-GAAP profit of $0.64 per share was 14.2% above analysts’ consensus estimates.

Is now the time to buy BILL? Find out by accessing our full research report, it’s free.

BILL (BILL) Q4 CY2025 Highlights:

- Revenue: $414.7 million vs analyst estimates of $400.1 million (14.4% year-on-year growth, 3.7% beat)

- Adjusted EPS: $0.64 vs analyst estimates of $0.56 (14.2% beat)

- Adjusted Operating Income: $74.09 million vs analyst estimates of $66.46 million (17.9% margin, 11.5% beat)

- The company lifted its revenue guidance for the full year to $1.64 billion at the midpoint from $1.61 billion, a 1.8% increase

- Management raised its full-year Adjusted EPS guidance to $2.37 at the midpoint, a 8.7% increase

- Operating Margin: -4.4%, up from -6% in the same quarter last year

- Free Cash Flow Margin: 22%, up from 20.8% in the previous quarter

- Market Capitalization: $3.73 billion

Company Overview

Transforming the messy back-office financial operations that plague small business owners, BILL (NYSE: BILL) provides a cloud-based platform that automates accounts payable, accounts receivable, and expense management for small and midsize businesses.

Revenue Growth

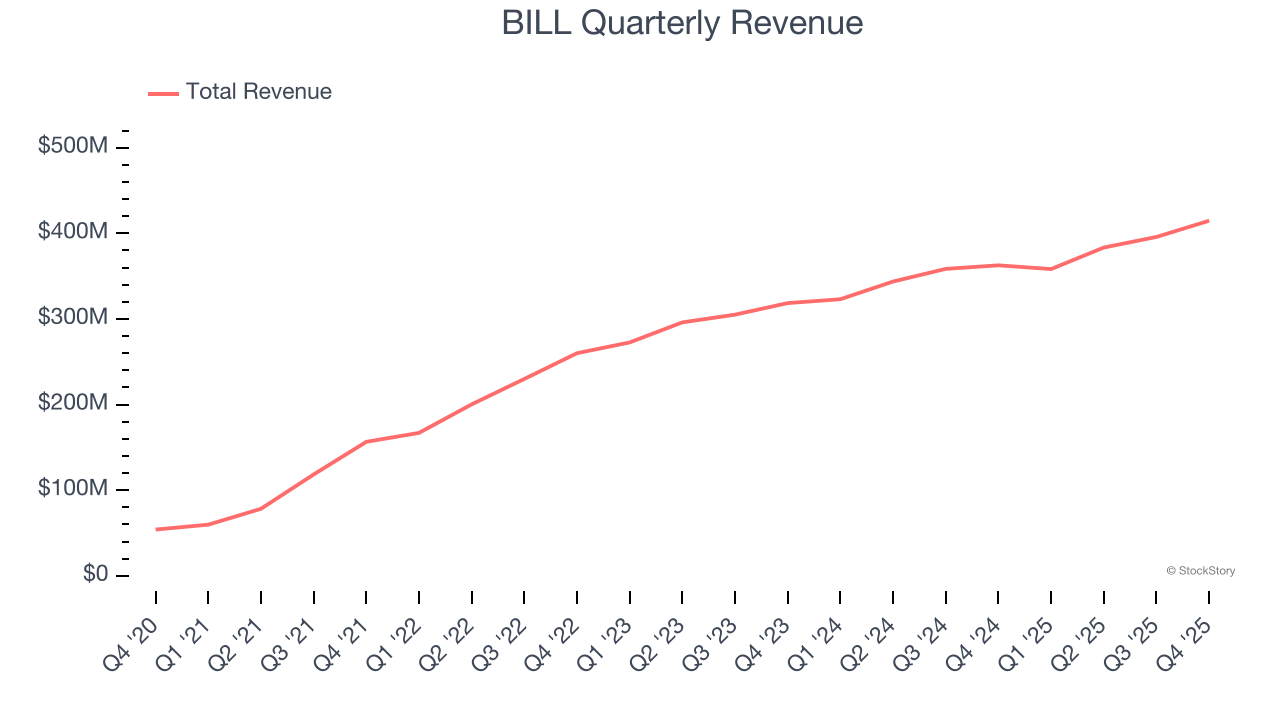

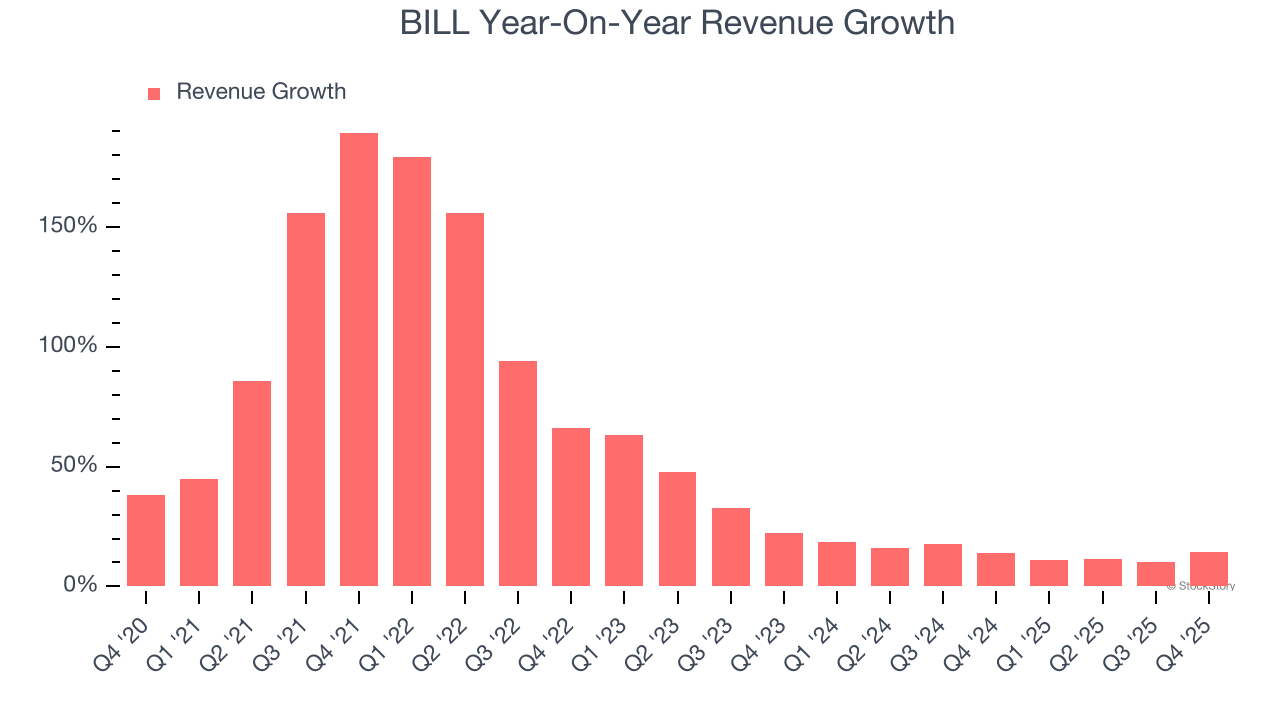

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, BILL grew its sales at an incredible 53.3% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. BILL’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 14.1% over the last two years was well below its five-year trend.

This quarter, BILL reported year-on-year revenue growth of 14.4%, and its $414.7 million of revenue exceeded Wall Street’s estimates by 3.7%. Company management is currently guiding for a 12.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

BILL’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between BILL’s products and its peers.

Key Takeaways from BILL’s Q4 Results

We were impressed by BILL’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 12.2% to $40.05 immediately after reporting.

Indeed, BILL had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).