Beauty products company Coty (NYSE: COTY) announced better-than-expected revenue in Q4 CY2025, but sales were flat year on year at $1.68 billion. Its non-GAAP profit of $0.14 per share was 24.2% below analysts’ consensus estimates.

Is now the time to buy Coty? Find out by accessing our full research report, it’s free.

Coty (COTY) Q4 CY2025 Highlights:

- Revenue: $1.68 billion vs analyst estimates of $1.66 billion (flat year on year, 1.1% beat)

- Adjusted EPS: $0.14 vs analyst expectations of $0.18 (24.2% miss)

- Adjusted EBITDA: $330.2 million vs analyst estimates of $338.1 million (19.7% margin, 2.3% miss)

- Operating Margin: 8.8%, down from 16.1% in the same quarter last year

- Free Cash Flow Margin: 30.6%, up from 25.1% in the same quarter last year

- Organic Revenue fell 3% year on year (beat)

- Market Capitalization: $3 billion

Company Overview

With a portfolio boasting many household brands, Coty (NYSE: COTY) is a beauty products powerhouse spanning cosmetics, fragrances, and skincare.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $5.81 billion in revenue over the past 12 months, Coty carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

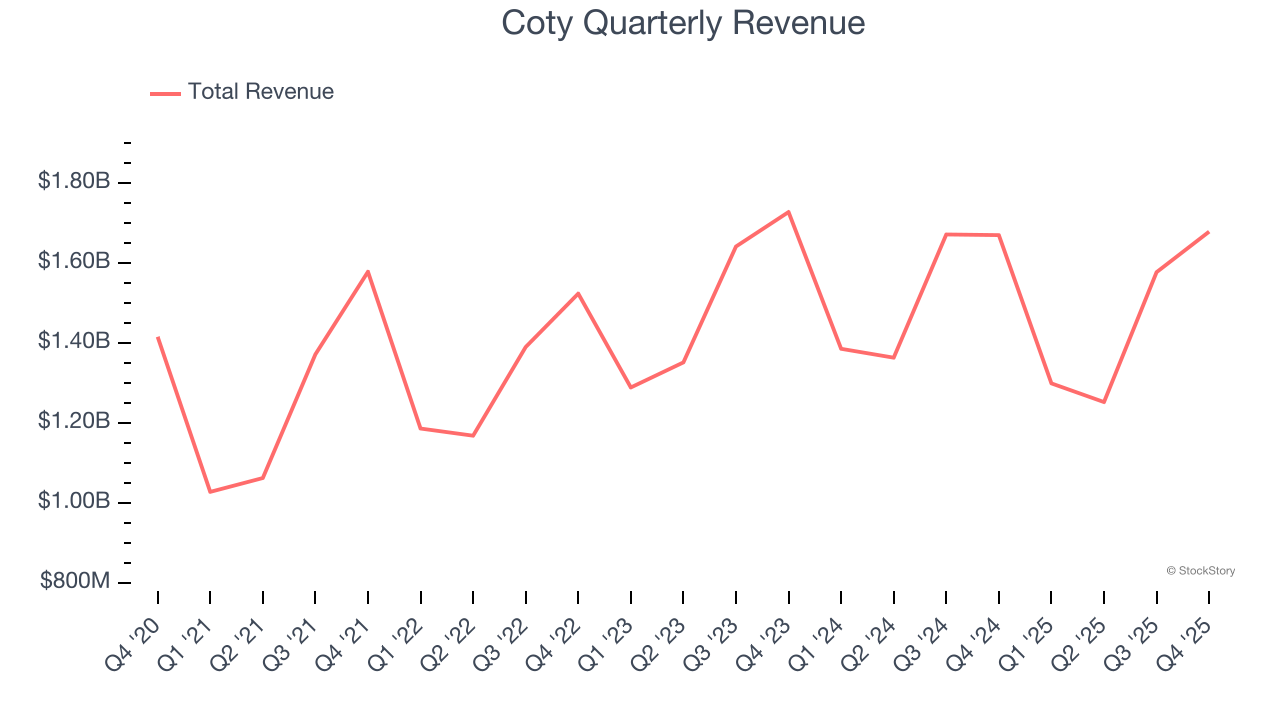

As you can see below, Coty’s sales grew at a sluggish 3.3% compounded annual growth rate over the last three years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, Coty’s $1.68 billion of revenue was flat year on year but beat Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months, similar to its three-year rate. This projection doesn't excite us and implies its newer products will not accelerate its top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Organic Revenue Growth

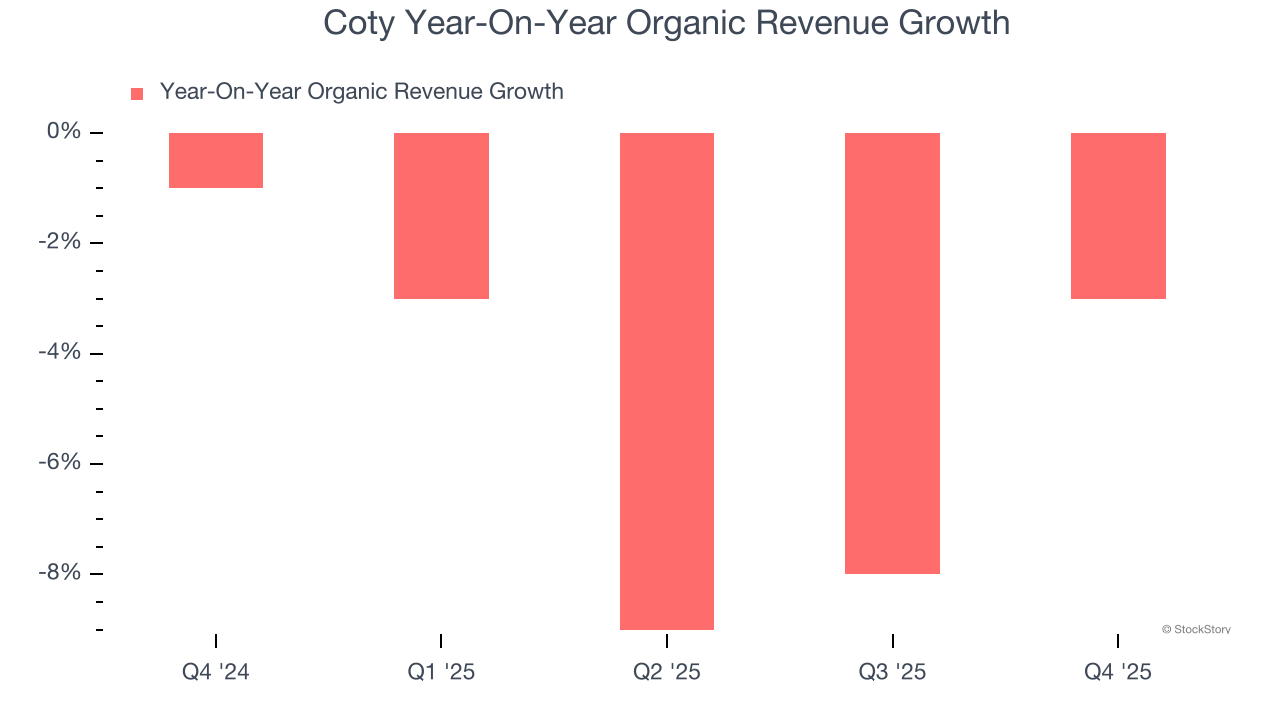

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

Coty’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 4.8% year on year.

In the latest quarter, Coty’s organic sales fell by 3% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Coty’s Q4 Results

It was good to see Coty narrowly top analysts’ revenue expectations this quarter. We were also happy its organic revenue was in line with Wall Street’s estimates. On the other hand, its EPS missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 14% to $2.71 immediately after reporting.

Coty’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).