Data collaboration platform LiveRamp (NYSE: RAMP) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 8.6% year on year to $212.2 million. On the other hand, next quarter’s revenue guidance of $205 million was less impressive, coming in 0.9% below analysts’ estimates. Its non-GAAP profit of $0.76 per share was 12.8% above analysts’ consensus estimates.

Is now the time to buy LiveRamp? Find out by accessing our full research report, it’s free.

LiveRamp (RAMP) Q4 CY2025 Highlights:

- Revenue: $212.2 million vs analyst estimates of $212 million (8.6% year-on-year growth, in line)

- Adjusted EPS: $0.76 vs analyst estimates of $0.67 (12.8% beat)

- Adjusted Operating Income: $62 million vs analyst estimates of $55.9 million (29.2% margin, 10.9% beat)

- Revenue Guidance for Q1 CY2026 is $205 million at the midpoint, below analyst estimates of $206.9 million

- Operating Margin: 18.6%, up from 7.5% in the same quarter last year

- Free Cash Flow Margin: 31.6%, up from 28.5% in the previous quarter

- Customers: 140 customers paying more than $1 million annually

- Net Revenue Retention Rate: 103%, down from 105% in the previous quarter

- Annual Recurring Revenue: $527 million vs analyst estimates of $529.9 million (7.3% year-on-year growth, miss)

- Market Capitalization: $1.45 billion

Company Overview

Serving as the digital middleman in an increasingly privacy-conscious world, LiveRamp (NYSE: RAMP) provides technology that helps companies securely share and connect their customer data with trusted partners while maintaining privacy compliance.

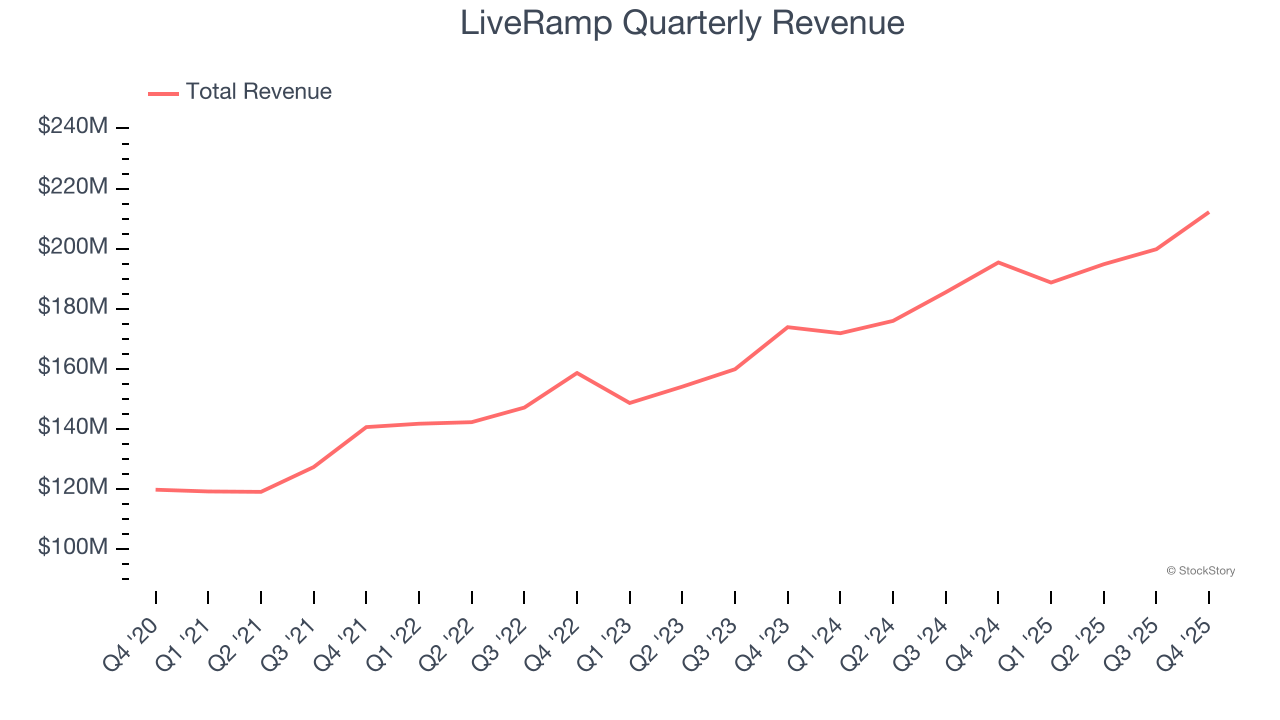

Revenue Growth

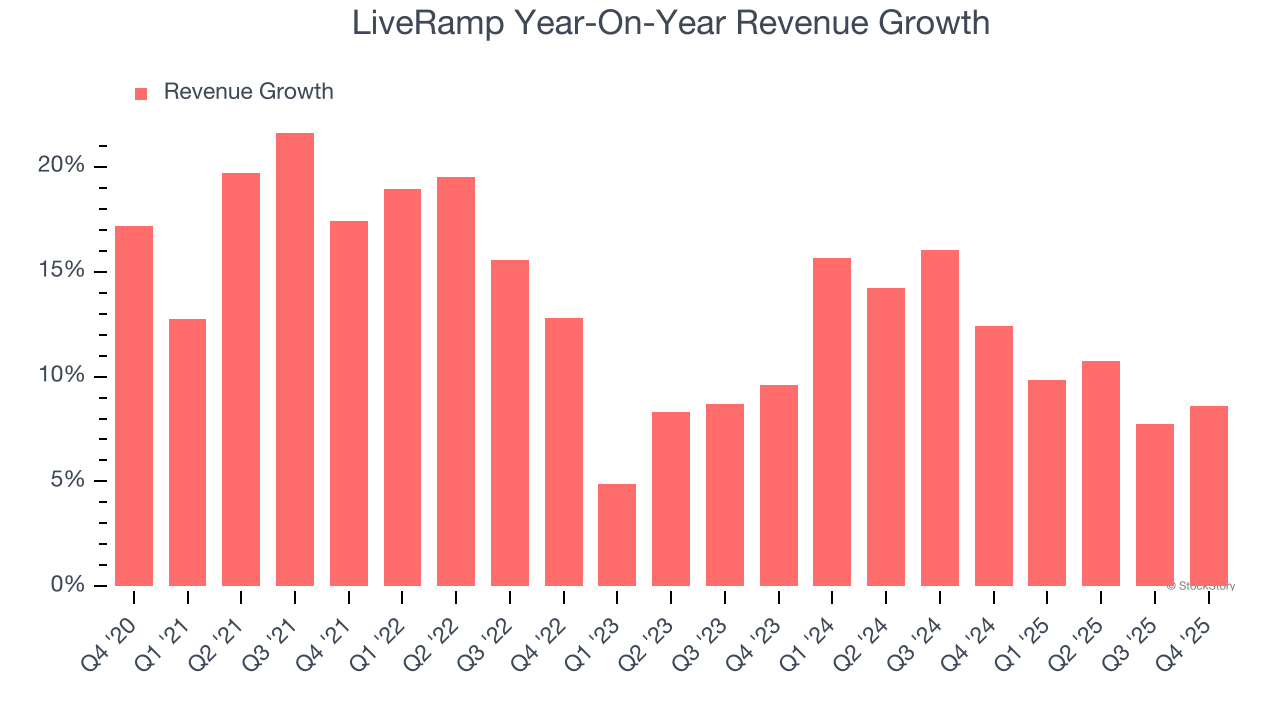

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, LiveRamp grew its sales at a 13.1% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. LiveRamp’s recent performance shows its demand has slowed as its annualized revenue growth of 11.8% over the last two years was below its five-year trend.

This quarter, LiveRamp grew its revenue by 8.6% year on year, and its $212.2 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 8.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.7% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

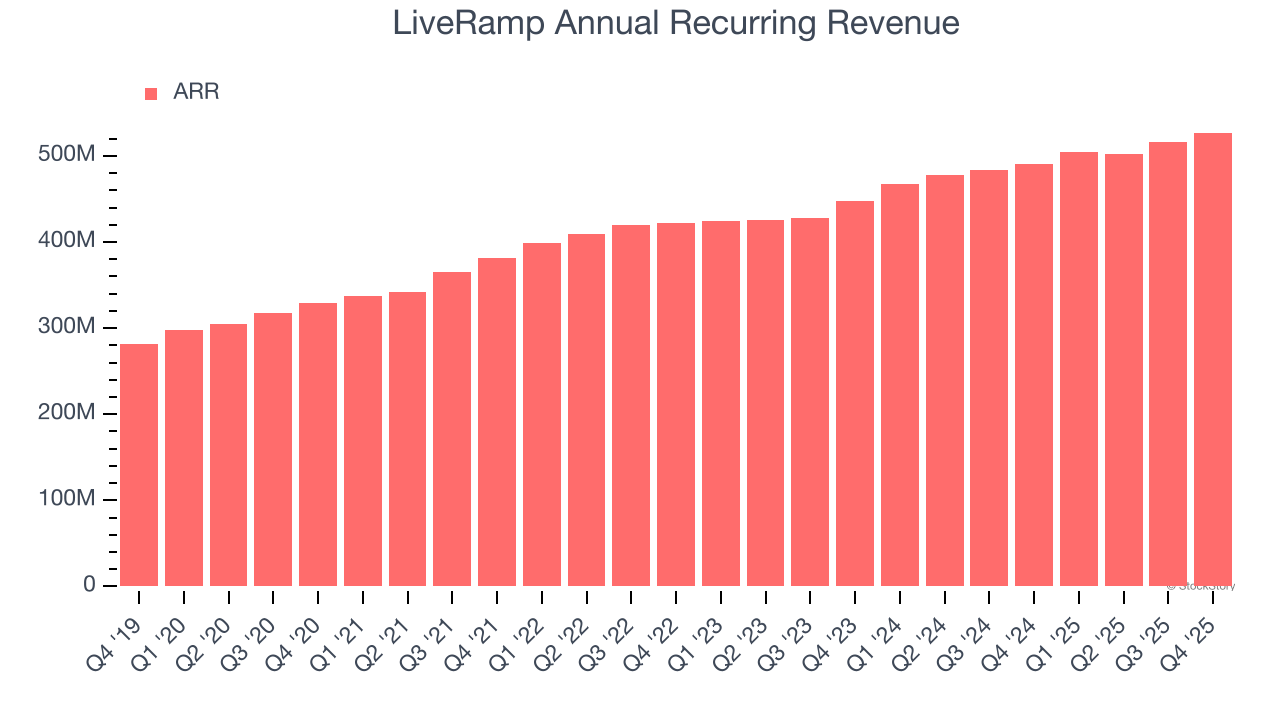

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

LiveRamp’s ARR came in at $527 million in Q4, and over the last four quarters, its growth was underwhelming as it averaged 6.8% year-on-year increases. This alternate topline metric grew slower than total sales, which likely means that the recurring portions of the business are growing slower than less predictable, choppier ones such as implementation fees. If this continues, the quality of its revenue base could decline.

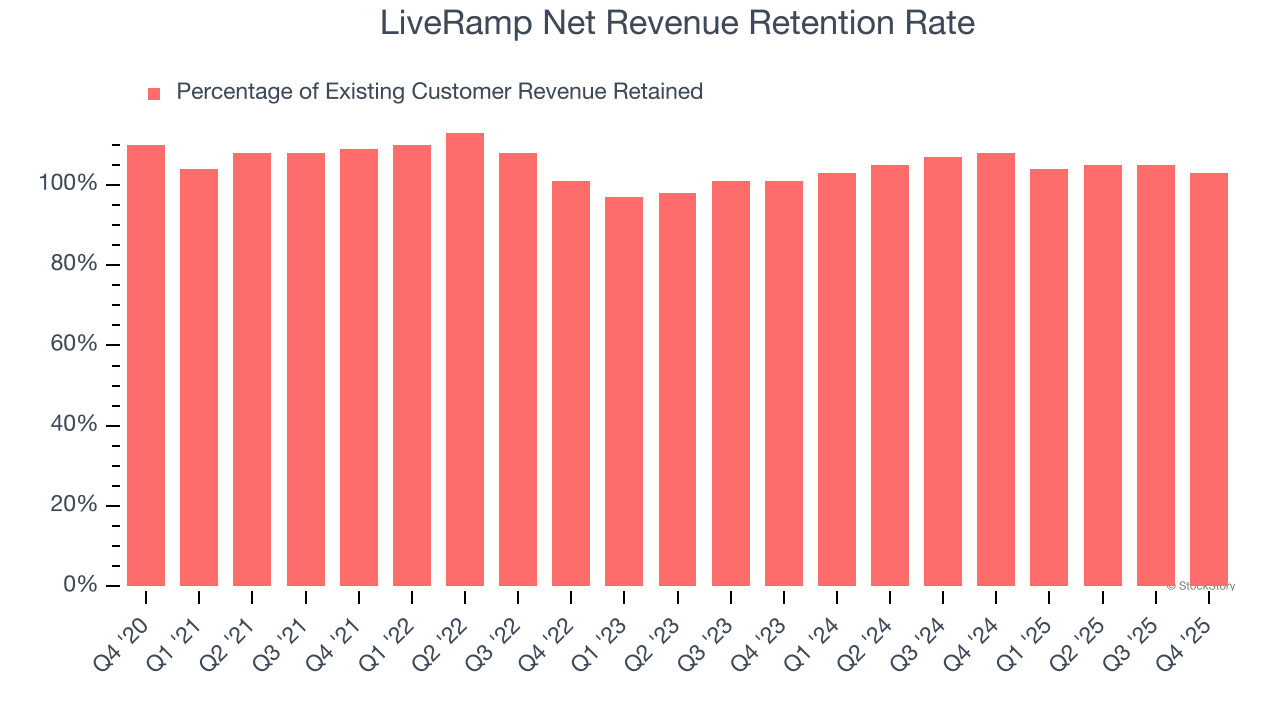

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

LiveRamp’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 104% in Q4. This means LiveRamp would’ve grown its revenue by 4.2% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, LiveRamp still has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

Key Takeaways from LiveRamp’s Q4 Results

We were impressed by how significantly LiveRamp blew past analysts’ EBITDA expectations this quarter. On the other hand, its revenue guidance for next quarter slightly missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 3.7% to $23.24 immediately after reporting.

So should you invest in LiveRamp right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).