Packaged foods company Post (NYSE: POST) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 10.1% year on year to $2.17 billion. Its non-GAAP profit of $2.13 per share was 27.7% above analysts’ consensus estimates.

Is now the time to buy Post? Find out by accessing our full research report, it’s free.

Post (POST) Q4 CY2025 Highlights:

- Revenue: $2.17 billion vs analyst estimates of $2.18 billion (10.1% year-on-year growth, in line)

- Adjusted EPS: $2.13 vs analyst estimates of $1.67 (27.7% beat)

- Adjusted EBITDA: $418.2 million vs analyst estimates of $386.1 million (19.2% margin, 8.3% beat)

- EBITDA guidance for the full year is $1.57 billion at the midpoint, above analyst estimates of $1.54 billion

- Operating Margin: 11%, in line with the same quarter last year

- Free Cash Flow Margin: 5.5%, down from 8.7% in the same quarter last year

- Market Capitalization: $5.39 billion

Company Overview

Founded in 1895, Post (NYSE: POST) is a packaged food company known for its namesake breakfast cereal and healthier-for-you snacks.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $8.36 billion in revenue over the past 12 months, Post is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions.

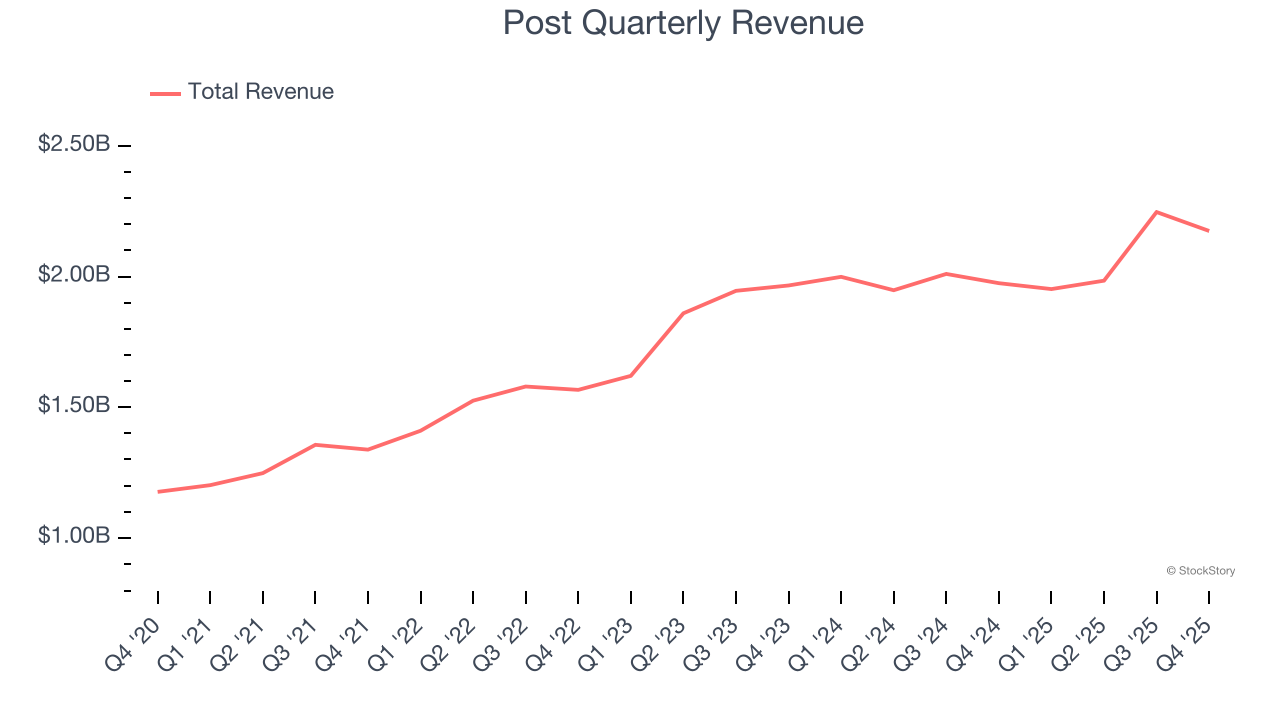

As you can see below, Post’s sales grew at a decent 11.2% compounded annual growth rate over the last three years despite consumers buying less of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, Post’s year-on-year revenue growth was 10.1%, and its $2.17 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products will face some demand challenges.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

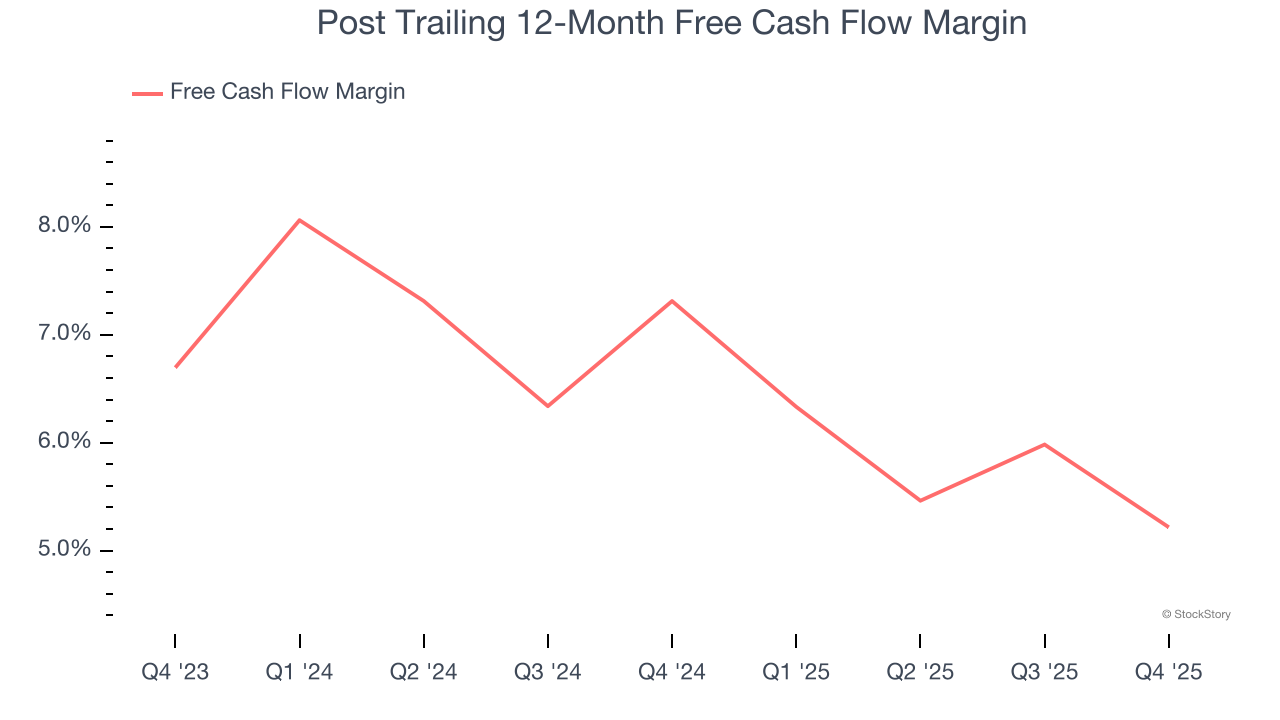

Post has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.2% over the last two years, slightly better than the broader consumer staples sector.

Taking a step back, we can see that Post’s margin dropped by 2.1 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity.

Post’s free cash flow clocked in at $119.3 million in Q4, equivalent to a 5.5% margin. The company’s cash profitability regressed as it was 3.2 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from Post’s Q4 Results

We were impressed by how significantly Post blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 1.5% to $106 immediately after reporting.

Post may have had a good quarter, but does that mean you should invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).