Online learning platform Udemy (NASDAQ: UDMY) met Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 3% year on year to $194 million. Its non-GAAP profit of $0.12 per share was 19% above analysts’ consensus estimates.

Is now the time to buy Udemy? Find out by accessing our full research report, it’s free.

Udemy (UDMY) Q4 CY2025 Highlights:

- On December 17, 2025, Udemy and Coursera entered into a definitive merger agreement under which Coursera will combine with Udemy in an all-stock transaction. Under the terms of the definitive agreement, Udemy stockholders will receive 0.800 shares of Coursera common stock for each share of Udemy common stock. Upon the closing of the transaction, existing Coursera stockholders are expected to own approximately 59% and existing Udemy stockholders are expected to own approximately 41% of the combined company, on a fully diluted basis.

- Revenue: $194 million vs analyst estimates of $193.2 million (3% year-on-year decline, in line)

- Adjusted EPS: $0.12 vs analyst estimates of $0.10 (19% beat)

- Adjusted EBITDA: $21.45 million vs analyst estimates of $19.67 million (11.1% margin, 9% beat)

- Free Cash Flow Margin: 6.1%, similar to the previous quarter

- Market Capitalization: $696.2 million

“Udemy demonstrated strong execution in Q4 and throughout 2025, creating tangible momentum toward becoming the system of record for helping companies upskill their workforce in an increasingly AI-driven world,” said Udemy President & CEO Hugo Sarrazin.

Company Overview

With courses ranging from investing to cooking to computer programming, Udemy (NASDAQ: UDMY) is an online learning platform that connects learners with expert instructors who specialize in a wide range of topics.

Revenue Growth

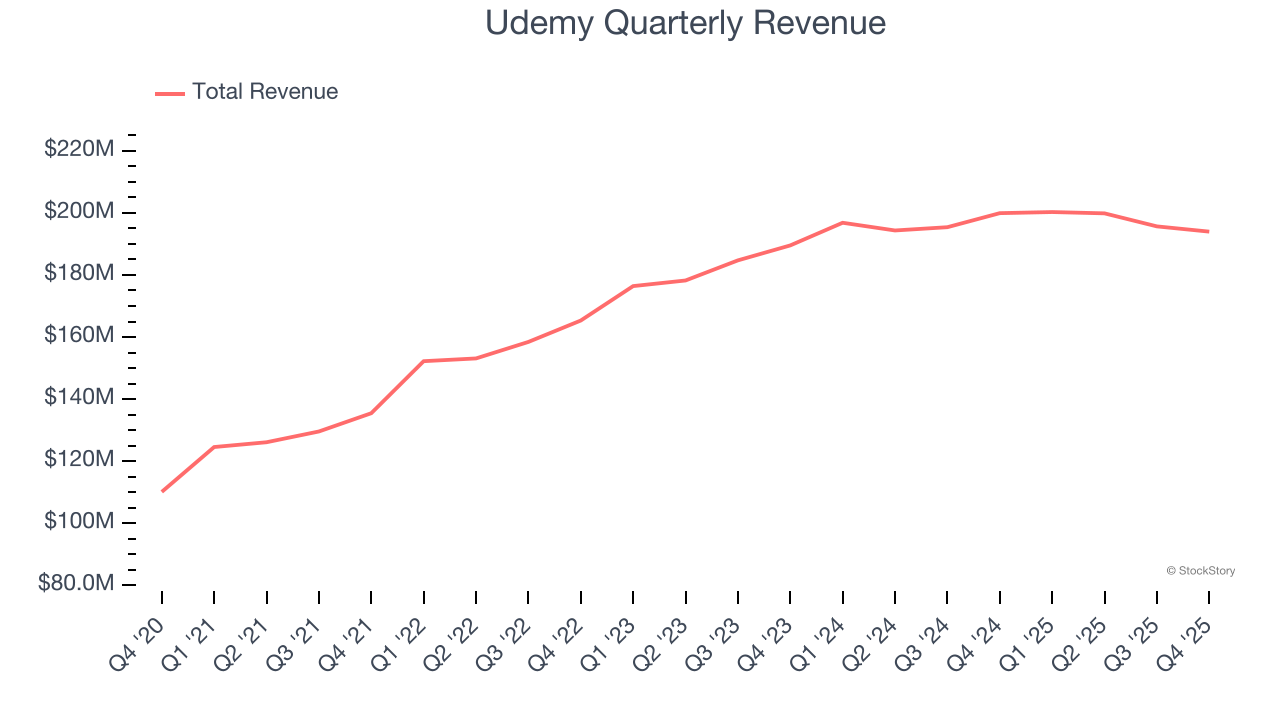

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Udemy’s 7.9% annualized revenue growth over the last three years was tepid. This fell short of our benchmark for the consumer internet sector and is a poor baseline for our analysis.

This quarter, Udemy reported a rather uninspiring 3% year-on-year revenue decline to $194 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.9% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

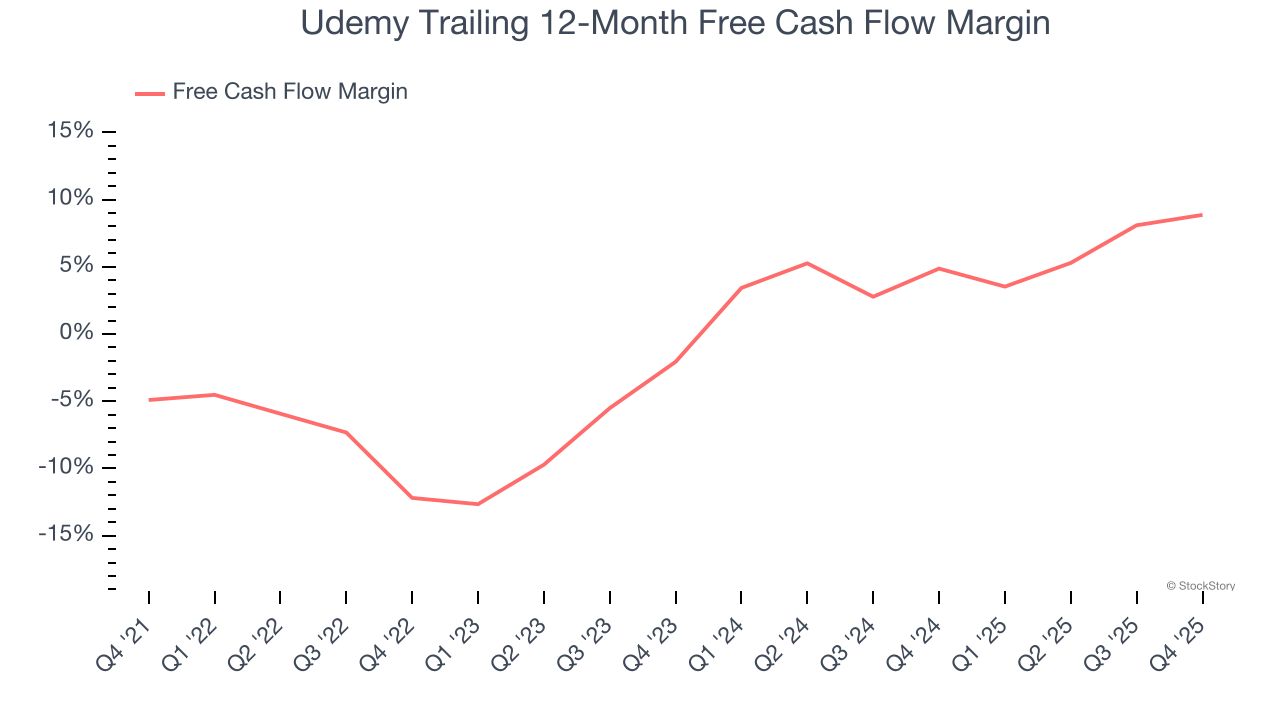

Udemy has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.9% over the last two years, slightly better than the broader consumer internet sector.

Taking a step back, we can see that Udemy’s margin expanded by 21 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Udemy’s free cash flow clocked in at $11.79 million in Q4, equivalent to a 6.1% margin. This result was good as its margin was 3 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Key Takeaways from Udemy’s Q4 Results

We were impressed by how significantly Udemy blew past analysts’ EBITDA expectations this quarter. Zooming out, we think this quarter featured some important positives. The stock traded up 2.5% to $4.83 immediately following the results.

On December 17, 2025, Udemy and Coursera entered into a definitive merger agreement under which Coursera will combine with Udemy in an all-stock transaction. Under the terms of the definitive agreement, Udemy stockholders will receive 0.800 shares of Coursera common stock for each share of Udemy common stock. Upon the closing of the transaction, existing Coursera stockholders are expected to own approximately 59% and existing Udemy stockholders are expected to own approximately 41% of the combined company, on a fully diluted basis.

Udemy may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).