| |||||||||

|  |  |  |  | |||||

Vancouver, BC – TheNewswire - December 5, 2025 – Global Stocks News - Sponsored content disseminated on behalf of Dolly Varden Silver. On December 4, 2025 Dolly Varden Silver (TSX-V: DV) (NYSE MKT: DVS) (FSE: DVQ) reported drill results that expand the high-grade gold mineralized plunge within the Homestake Silver deposit.

“The expansion of the wide, high-grade gold and silver mineralization in the Homestake Silver Deposit continues to demonstrate the continuity and robustness of the potentially bulk underground minable zone,” stated Shawn Khunkhun, President and CEO of Dolly Varden.

Bulk mining generally has lower mining costs, allowing for a lower cut-off grade, increasing the tonnage per day and the number of ounces mined.

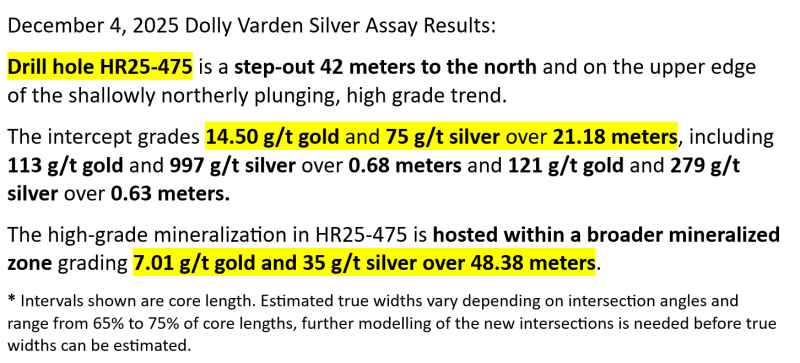

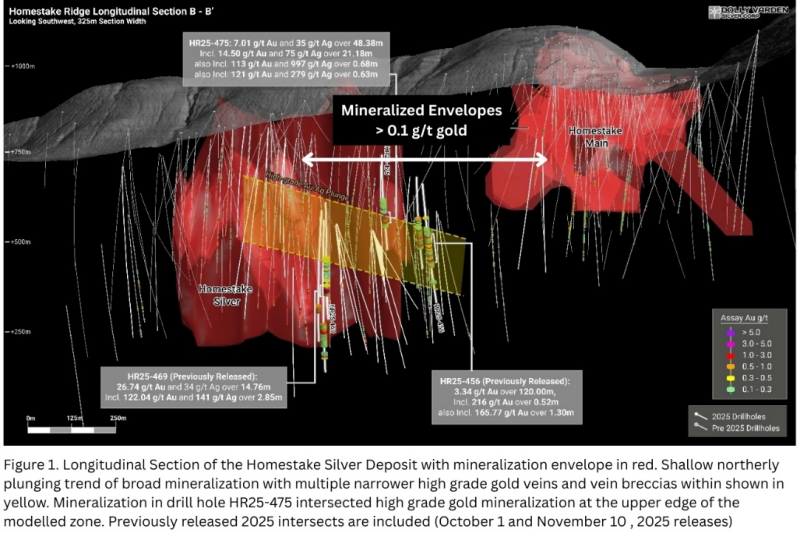

Drill hole HR25-475 is a 42-meter step-out to the north of hole HR24-448 (February 3, 2025 release) along the plunge of the main gold and silver zone at the Homestake Silver deposit.

The high-grade core of the Homestake Silver Deposit has been traced for over 300 meters vertically and extends for over 1,000 meters along plunge. The intercept occurs at the upper edge of the high-grade trend.

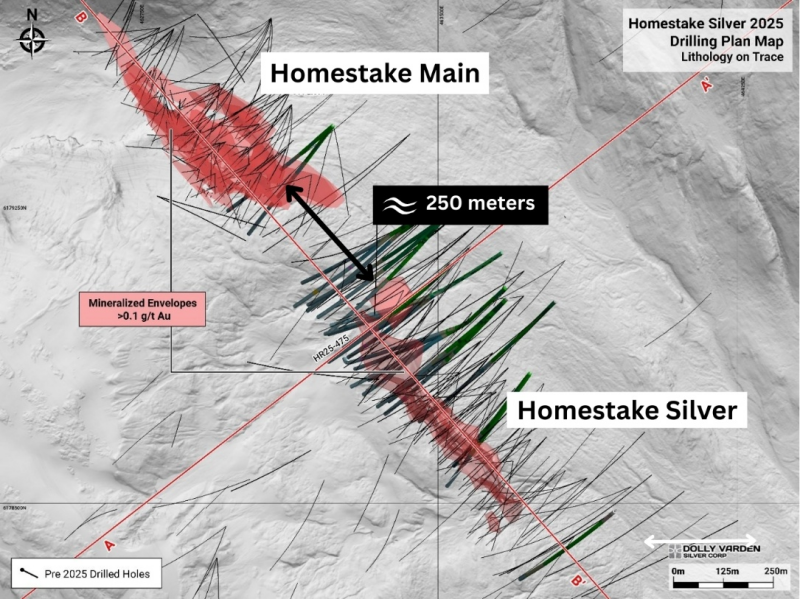

A total of 56,131 meters were drilled in 86 drill holes during the 2025 season by Dolly Varden, with approximately 40% of the meters drilled at Homestake Ridge focused on step-outs and local infill along the wider, high-grade gold plunge at Homestake Silver.

DV is using directional drilling technology to precisely target areas for step-out and infill holes at Homestake Silver. Drill hole HR25-475 was drilled as a single hole utilizing directional drilling to precisely intercept the target within the mineralized zone.

Although historically considered a silver-rich gold deposit, recent drilling at Homestake Silver has defined a shallow north-plunging dilation zone that reveals a wide mineralized interval with increased frequency of high-grade gold veins and vein breccias. These breccias show a shift towards a gold-rich system towards the north. The deposit remains open along plunge and at depth.

Figure 4. Plan of Homestake Ridge >0.1g/t Au mineralized zones (in red), highlighting all 2025 drilling completed with lithology on drill trace. The focus of the 2025 drilling was at Homestake Silver.

"This identification of wide, high-grade gold mineralization represents a significant metallogenic breakthrough at Homestake Ridge; this style of mineralization is identical to the idled, Premier Gold Mine [owned by Ascot Resources] located 45km to the northwest,” stated Khunkhun.

The Premier Gold Mine has been on care and maintenance since June 25, 2025. The mill has been refurbished and commissioned at a rate of 2,500 tonnes per day. A new water treatment plant has been built and operating since February 2024, and there is a 128-bed camp.

On October 23, 2025 Ascot Resources announced that it had entered into an advisory services agreement with Fiore Management and Advisory Corporation to assist Ascot with restructuring, refinancing and enhancing the leadership team.

Dolly Varden operates within the Fiore Group offices which includes a team of engineers, geologists and financial experts lead by Frank Giustra.

“Gold is becoming increasingly important to the economics of a potential future Dolly Varden mine in the Kitsault Valley,” Rob van Egmond, VP of Exploration, told Global Stocks News (GSN).

“We’ve developed a number of high-grade underground systems in the Kitsault Valley that would benefit from a 'hub and spoke' production scenario, where multiple deposits feed into one mill,” continued van Egmond. “The Premier Mill is already built, and it's idle, so that is something we are keeping an eye on.”

Above: View of the idled Premier Mill, 45km to the northwest of Homestake Silver.

“With gold selling for CDN $5,870/ounce and silver at CDN $80/ounce,” van Egmond told GSN, “our team is encouraged to intersect 14.50 g/t gold and 75 g/t silver over 21.18 meters in the latest assays.”

The price of gold has risen 60% in the last 12 months, while silver has performed even better, with an 82% price appreciation.

“A major factor behind silver’s rally this year has been significant supply-chain issues,” reported Kitco News on December 2, 2025. “The year began with massive amounts of silver flowing into America as bullion banks and market participants built a substantial stockpile to avoid potential tariffs from President Donald Trump.”

“The current rally is no longer dominated by retail enthusiasm, with institutional buyers — particularly macro funds and family offices seeking to hedge against slow-moving but entrenched inflationary pressures, and the risk of a debt spiral,” wrote Ole Hansen, head of Commodity Strategy at Saxo Bank.

“According to Treasury data, in the nine weeks since the beginning of the fiscal year, the US government has spent $104 billion in interest on its $38 trillion borrowing burden,” reports Fortune Magazine on December 4, 2025. “That’s more than $11 billion a week and already represents 15% of federal spending in the current fiscal year”.

With 154 million Americans paying income tax, each US taxpayer will be on the hook for $3,800 this fiscal year - not to pay teachers’ salaries or build warships - just to service the national debt.

The Congressional Budget Office projects a $1.7 trillion deficit for 2026, an increase over 2025.

Ten years ago, Dolly Varden was a “silver pure play”. In the last few years, while expanding its silver inventory, the company has hit significant gold intercepts. DV’s metal value is now approximately a 50/50 split between silver and gold.

“Persistent fiscal deficits, a softening labour market and renewed discussions about long-term debt sustainability have strengthened investor appetite for hard assets,” confirmed Hansen.

“We will continue to release results from the 2025 drill program as they are received,” stated Khunkhun in the December 4, 2025 press release.

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101, has reviewed, validated and approved the scientific and technical information contained in this GSN release.

Disclaimer: Dolly Varden Silver paid GSN $1,750 for the research, creation and dissemination of this content.

Contact: guy.bennett@globalstocksnews.com

Full Disclaimer: Global Stocks News (GSN) researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN makes no recommendation to purchase any individual stock. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Copyright (c) 2025 TheNewswire - All rights reserved.