The narrative is that as foreign oil producers see their incomes fall, directly or indirectly they will fewer US goods and services, aka, US exports.

Just read the highlighted part about exports:

Kansas City Fed Manufacturing Index![]()

Highlights

Tenth District manufacturing activity continued to expand at a moderate pace in December, and producers’ expectations for future activity remained at solid levels. Most price indexes grew at a slower pace, especially materials prices.

The month-over-month composite index was 8 in December, up slightly from 7 in November and 4 in October. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The slight increase in activity was mostly attributed to durable goods producers, particularly for electronics, aircraft, and machinery products, while nondurable goods production remained sluggish. Most other month-over-month indexes were also slightly higher than last month. The production and employment indexes were unchanged, but the shipments, new orders, and order backlog indexes increased markedly.

However, the new orders for exports index fell from 8 to 0. The finished goods inventory index rose for the second straight month, while the raw materials inventory index eased somewhat.

November 2014 Sea Container Counts Continue to Show Rapid Contraction of Exports

Written by Steven Hansen

Export container counts continue to weaken, which is a warning that the global economy is slowing. Export three month rolling averages continue to decelerate – being in negative territory year-over-year. This is a headwind for 4Q2014 GDP.Container counts are a good metric to gauge the economy.

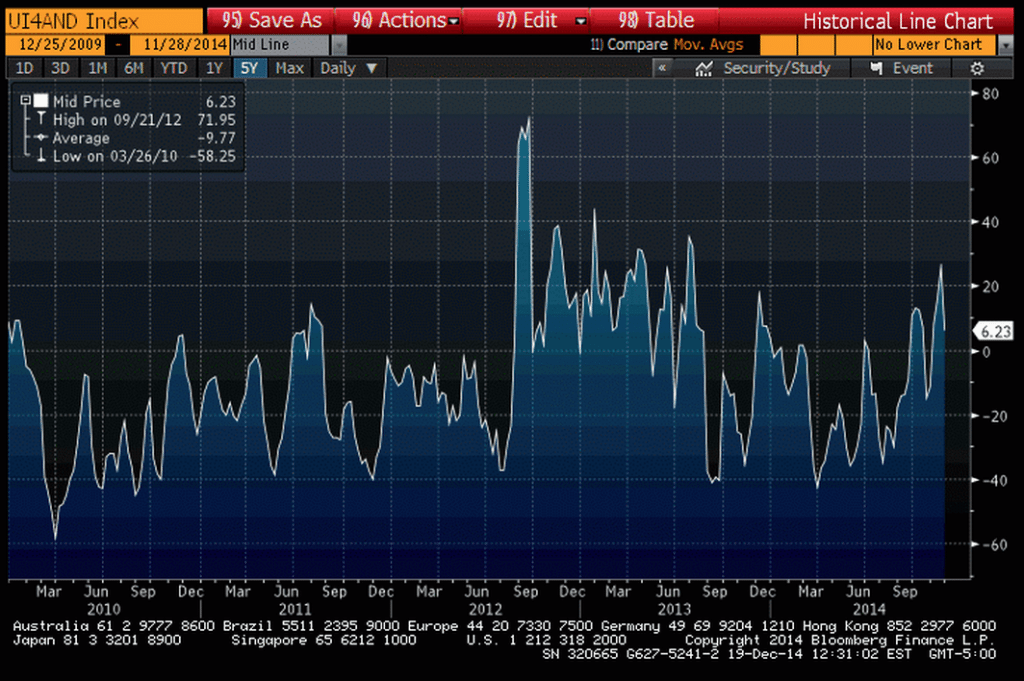

Keeping an eye on this as well- North Dakota and Texas unemployment claims.

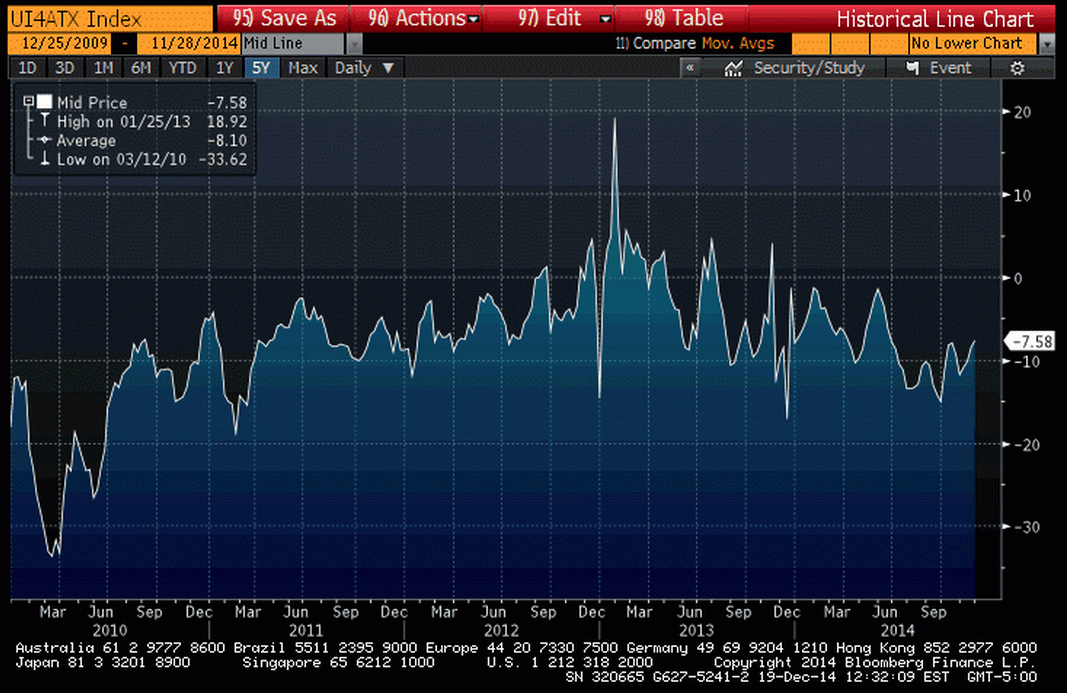

North Dakota 4 week moving average, year over year moving up some but nothing serious yet:

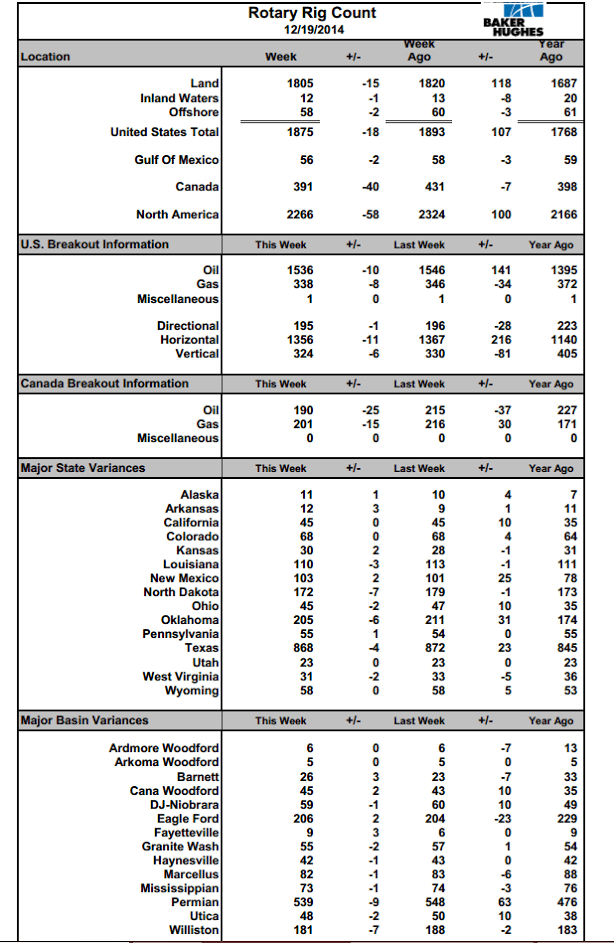

And oil rigs in service now heading south: