( click to enlarge )

( click to enlarge )Fitbit Inc (NYSE:FIT) An intraday close above horizontal resistance $16 would bring expectations of a spike higher towards $18 followed by $18.85 (April highs). From a technical standpoint, indicators are looking bullish. MACD crossed back above signal line and is moving up in positive territory. AD is also rising and RSI has moved above its 60% level. The stock is a short squeeze candidate, with a short float at 38% equivalent to 7 days of average volume.

( click to enlarge )

( click to enlarge )FORM Holdings Corp. (NASDAQ:FH) I alerted this one on Twitter/blog last week as a potential mover and the stock did what it was supposed to do, closing yesterday above the 200-day EMA for the first time in months. Price showed a lot of strength in afternoon trading, moving steadily higher toward the closing bell and should continue this upside move next week. The stock hit a high of $2.71, which is resistance for Monday’s move. I expect to see another strong upside move to $3 and better in the coming sessions.

( click to enlarge )

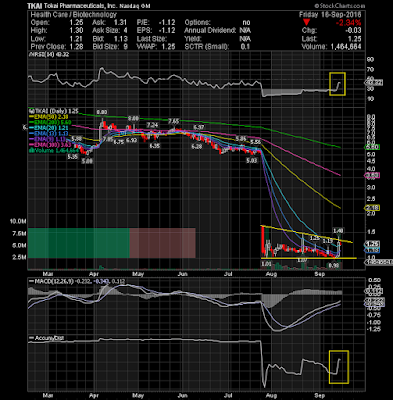

( click to enlarge )Tokai Pharmaceuticals Inc (NASDAQ:TKAI)This is one you should keep your eyes on for the next couple of days. My system detected unusual call buying in the Oct/Nov 5 and 7.5 calls respectively last Thursday. On September 8th, the company announced that its Board of Directors has initiated a review of strategic alternatives for the company focused on maximizing stockholder value. So, i believe that someone might already know something and is betting on a strong move higher. The stock is very close to resistance, above the resistance line is bullish. The Accumulation line also spiked with price action which could act as a near-term catalyst as well. For the reasons mentioned above, i started a position.

( click to enlarge )

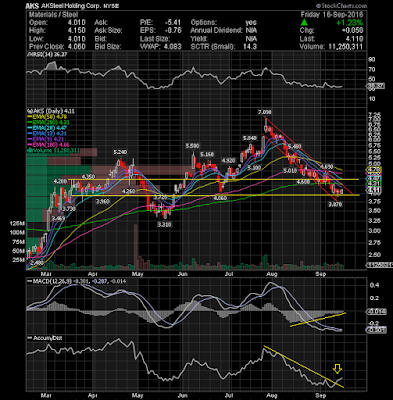

( click to enlarge )AK Steel Holding Corporation (NYSE:AKS) In the last week, I have been mentioning that support for stock should hold in the range of 3.9 to 4. Notably, the stock held up very well this area, relative to many of its peers. With the support holding well inside 3.90 ranges, my outlook stays exactly what it has been for past 4 days. Afterthe tumble the stock has taken since the July Highs, AKS is certainly starting to look cheap and a bounce could occur from here. On the upside the critical resistance is 4.35 and a break over that will support the above mentioned view. On the flipside any break below 4 should bring further consolidation. Watch the stock closely next week.

( click to enlarge )

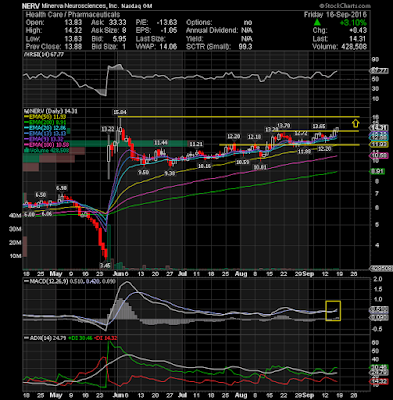

( click to enlarge )Minerva Neurosciences Inc (NASDAQ:NERV) closed at 14.31 on Friday, reconfirming the new uptrend after the recent break of the 13.75 resistance level. Because of this, I feel that this stock is ready to go towards its next target of $15.84 level (52-wk high). From the daily technical chart we can see that the stock is on a bull market as it is trading above all EMAs and MACD is above Zero line.

( click to enlarge )

( click to enlarge )Revance Therapeutics Inc (NASDAQ:RVNC) had a strong day on Friday and broke through its 50 and 100 EMAs. The volume confirmed the breakout as it was greater than average. The stock might fill the gap next week.

( click to enlarge )

( click to enlarge )SCYNEXIS Inc (NASDAQ:SCYX) good relative strength compared to the market on Friday. Key resistance is located at $3.35, a break above this level will confirm a new bullish trend and the following uptrend will take price up to $3.75 zone. The RSI is moving higher again, which is a sign of growing strength in the stock. I think its worth adding to your watchlist.

If you want to contact me for advertising opportunities on blog or twitter, then get in touch via email

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC