Buffalo Wild Wings, Inc. (NASDAQ:BWLD) today mailed a letter to its shareholders in connection with the company’s upcoming 2017 Annual Meeting of Shareholders (“Annual Meeting”) to be held on June 2, 2017. The Buffalo Wild Wings Board of Directors unanimously recommends that shareholders vote the YELLOW proxy card “FOR” the election of all nine of the Board’s experienced and highly qualified director nominees: Cynthia L. Davis, Andre J. Fernandez, Janice L. Fields, Harry A. Lawton, J. Oliver Maggard, Jerry R. Rose, Sam B. Rovit, Harmit J. Singh and Sally J. Smith.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170522005840/en/

(Graphic: Business Wire)

All materials regarding the Board’s recommendation can be found at http://www.buffalowildwings.com/en/2017-annual-meeting/.

The full text of the letter follows:

VOTE “FOR” ALL OF BUFFALO WILD WINGS’ HIGHLY QUALIFIED DIRECTOR NOMINEES USING THE YELLOW PROXY CARD

May 22, 2017

Dear Fellow Shareholder:

The Buffalo Wild Wings 2017 Annual Meeting of Shareholders is fast approaching. At the meeting, shareholders will have a choice of directors. We encourage you to consider that choice carefully and to vote for the Board’s slate of nominees using the YELLOW proxy card.

One of our investors, Marcato Capital, L.P. (“Marcato”), wants you to do something different. They want you to remove every director who has served on the Board for more than one year. In fact, if you and your fellow shareholders were to vote for Marcato’s nominees, the average tenure among the independent directors will be just four months.

And yet, Buffalo Wild Wings has been among the best performing casual dining companies over the last one, three, five and ten years (and since its 2003 IPO). Why would you want to radically change the Board of such a successful company?

BUFFALO WILD WINGS HAS BEEN REFRESHING ITS BOARD AND STRENGTHENING ITS MANAGEMENT TEAM

The Board and company have not been standing still. Despite our outperformance and success, the Board has added three new independent directors and nominated two additional new independent nominees to its slate, together representing more than 50% of the total Board. These candidates bring fresh and valuable perspective to the company. The company's nominees have a mix of tenures and experience, ensuring that the institutional knowledge and history of the company are used to avoid pitfalls going forward.

The Board has also been changing and strengthening the management team as part of its ongoing evaluation of the needs of the business. In the last year, we have appointed a new Chief Financial Officer and, recognizing a changing customer demographic and the importance of our technology strategy in furthering our innovation and differentiation, we also created the role of Chief Information Officer. We have also restructured our North American management team, removing two layers of management and improving our responsiveness to market developments.

As a Board, we remain committed to the ongoing evaluation of management and will continue to make changes as appropriate. One thing we know for certain is that in order to deliver returns for our shareholders over the next 14 years that come close to the 24% annual returns we have generated since our IPO, we will need to continue to innovate, manage our business effectively and tackle entirely new challenges.

MARCATO’S NOMINEES, OTHER THAN SAM ROVIT, HAVE VERY SERIOUS WEAKNESSES AND COULD DO LASTING HARM TO BUFFALO WILD WINGS

As you would expect, the Board has been disciplined in its evaluation of strategy, management, Board composition and capital structure. When changes are needed, we have carefully evaluated opportunities for improvement and, based on rigorous analysis, sought the path that maximizes value without undue risk.

We have applied this culture of discipline to our review of Marcato’s candidates for the Board. We concluded that one of Marcato’s nominees, Sam Rovit, would be a valuable addition to the Board. In our discussions with Sam, it was clear that he prioritizes the interests of all shareholders, has a distinguished record of achievement and brings unique insights and skills in the food service and consumer sectors. We therefore welcomed him onto our slate and encourage shareholders to vote for him to join our Board.

That said, we have serious concerns about Marcato’s other three nominees.

EMIL LEE SANDERS VASTLY EXAGGERATES HIS LIMITED ACHIEVEMENTS AND HAS A MAJOR CONFLICT OF INTEREST

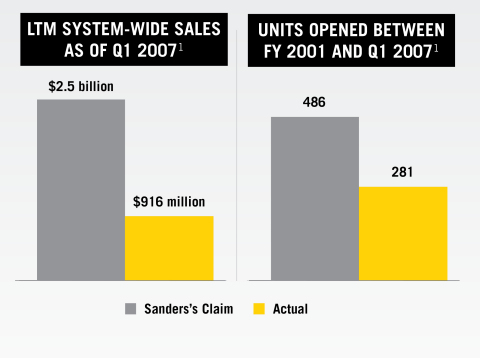

We are well acquainted with Mr. Sanders because he used to work for Buffalo Wild Wings. Marcato’s definitive proxy statement misrepresents Mr. Sanders accomplishments while at the company. It falsely states that he was responsible for opening 486 units in seven years, while driving annual sales of $2.5 billion.

This is simply not true. During the period Mr. Sanders was employed by the company, Buffalo Wild Wings only opened 281 units. And, in the year before Mr. Sanders left by mutual arrangement, the company reported sales of less than $1 billion.

As importantly, Mr. Sanders has a significant conflict of interest. He has expressed a strong desire to buy Buffalo Wild Wings units and become a franchisee. He has been soliciting our franchisees and attempting to scare them into selling their restaurants by suggesting that Marcato’s plans for the company will soon make the restaurant units less valuable: “[T]he timing for you and your investors [to sell to me] could not be better,” Mr. Sanders wrote to [several of] our franchisees because “the Marcato Hedge Fund efforts [mean] too much available product in the market will cause a commensurate decline in value.”2

To be clear: Mr. Sanders wants to buy our restaurant units. He has every interest in driving the value of those units lower so he can buy at a bargain price. And, he has said that Marcato’s plan will do precisely that.

But none of that is good for shareholders. If you vote for Mr. Sanders, you are voting to put the proverbial ‘fox in the hen house.’

Mr. Sanders’s claimed “achievements” are false and his conflict of interest irrefutable. Shareholders have no reason to have confidence in his ability to serve their interests.

MICK MCGUIRE’S PRIOR BOARD SERVICE HAS FAILED TO CREATE VALUE FOR SHAREHOLDERS

Mr. McGuire has no operating or execution experience at a public company, and he has no track record of success in the boardroom:

-

A few months after joining the Board of Borders Group, Inc., the

company put itself up for sale, and then failed to find a buyer.

- Subsequently, Mr. McGuire became Chairman.

- Mr. McGuire resigned from that post shortly before Borders filed for bankruptcy.

-

During Mr. McGuire’s brief one-year stint on the Board of NCR

Corporation – infamously referred to as “the lost year” by NCR

insiders – the company’s share price dropped 8%.

- Since resigning and selling his stake at the end of 2015, NCR’s share price has risen 69%.

Shareholders should be wary of electing a short-term activist investor with a poor track record of value creation.

SCOTT BERGREN HAD A POOR PERFORMANCE RECORD AS THE CEO OF PIZZA HUT AND HIS SKILL SET IS ALREADY WELL REPRESENTED ON THE BOARD

Scott Bergren’s experience at Yum! Brands is already well represented on the Board by independent director Harmit Singh, who served for 14 years at Yum! Brands and held various global leadership roles, including Chief Financial Officer. In addition, our nominee, Janice Fields, former President of McDonald’s USA, LLC, strengthens the Board’s restaurant and franchise experience.

Mr. Bergren’s record at Pizza Hut between 2011 and 2014 is not distinguished. During that period, Pizza Hut experienced material same-store sales weakness compared to Domino’s and Papa John’s, its two principal competitors. The stock price of Pizza Hut’s parent company, Yum! Brands, also performed very poorly compared to Domino’s and Papa John’s during Mr. Bergren’s tenure.

Mr. Bergren's history as a brand CEO is not distinguished and his experience is duplicative with current members of the Board and its nominees.

PROTECT THE VALUE OF YOUR INVESTMENT –

VOTE THE YELLOW

PROXY CARD TODAY

We do not believe it would be prudent to radically shift the Board’s composition or the strategy of Buffalo Wild Wings. Marcato wants you to empty the Board of all institutional knowledge so that there is room for Mick McGuire (who has no operational experience and has not added value for shareholders when he has served on public company Boards), Lee Sanders (who has been less than accurate about his past and has significant conflicts of interest) and Scott Bergren (who has no demonstrated record of achievement). That would be a mistake.

Instead, we encourage you to protect the value of your investment in Buffalo Wild Wings by using the YELLOW proxy card to vote by telephone or Internet. No matter how few shares you own, it is important that all shareholders have their voices heard in this critically important decision regarding your investment. We further encourage you to discard any proxy materials sent to you by Marcato.

We thank you for your continued support.

Sincerely,

|

Jerry R. Rose

/s/ Jerry R. Rose Chairman of the Board |

Cynthia L. Davis

/s/ Cynthia L. Davis Independent Director |

Andre J. Fernandez

/s/ Andre J. Fernandez Independent Director | ||||

|

Harry A. Lawton III

/s/ Harry A. Lawton III Independent Director |

J. Oliver Maggard

/s/ J. Oliver Maggard Independent Director |

Harmit J. Singh

/s/ Harmit J. Singh Independent Director | ||||

Sally J. Smith /s/ Sally J. Smith CEO & President and Director | James M. Damian /s/ James M. Damian Independent Director (retiring 2017) | Michael P. Johnson /s/ Michael P. Johnson Independent Director (retiring 2017) | ||||

| If you have any questions or require any assistance with voting your shares, |

| please contact the Company’s proxy solicitor listed below: |

MacKenzie Partners, Inc. |

105 Madison Avenue |

New York, New York 10016 |

Call Collect: (212) 929-5500 |

or |

Toll-Free (800) 322-2885 |

Lazard Ltd is serving as financial advisor and Faegre Baker Daniels is serving as legal advisor to the company.

About the Company

Buffalo Wild Wings, Inc., founded in 1982 and headquartered in Minneapolis, is a growing owner, operator and franchisor of Buffalo Wild Wings(R) restaurants featuring a variety of boldly-flavored, made-to-order menu items including its namesake Buffalo, New York-style chicken wings. The Buffalo Wild Wings menu specializes in 21 mouth-watering signature sauces and seasonings with flavor sensations ranging from Sweet BBQ(TM) to Blazin'(R). Guests enjoy a welcoming neighborhood atmosphere that includes an extensive multi-media system for watching their favorite sporting events. Buffalo Wild Wings is the recipient of hundreds of "Best Wings" and "Best Sports Bar" awards from across the country. There are currently more than 1,220 Buffalo Wild Wings locations around the world.

To stay up-to-date on all the latest events and offers for sports fans and wing lovers, like Buffalo Wild Wings on Facebook, follow @BWWings on Twitter and visit www.BuffaloWildWings.com.

Cautionary Statement Regarding Certain Information

This communication contains “forward-looking statements” within the meaning of the federal securities laws. Such statements include statements concerning anticipated future events and expectations that are not historical facts. All statements other than statements of historical fact are statement that could be deemed forward-looking statements. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, including the factors described under “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 25, 2016, as updated or supplemented by subsequent reports we file with the SEC. We do not assume any obligation to publicly update any forward-looking statement after they are made, whether as a result of new information, future events or otherwise.

Important Information

Buffalo Wild Wings, Inc., its directors and certain of its executive officers and employees are participants in the solicitation of proxies from Buffalo Wild Wings shareholders in connection with its 2017 annual meeting of shareholders to be held on June 2, 2017. Information concerning the identity and interests of these persons is available in the definitive proxy statement Buffalo Wild Wings filed with the SEC on April 21, 2017.

Buffalo Wild Wings has filed a definitive proxy statement in connection with its 2017 annual meeting. The definitive proxy statement, any amendments thereto and any other relevant documents, and other materials filed with the SEC concerning Buffalo Wild Wings are (or will be, when filed) available free of charge at http://www.sec.gov and http://ir.buffalowildwings.com. Shareholders should read carefully the definitive proxy statement and any other relevant documents that Buffalo Wild Wings files with the SEC when they become available before making any voting decision because they contain important information.

1 Source: Company filings.

2 Source: Lee Sanders, August 2016 email. Permission to use quotations neither sought nor obtained.

3 Source: Company filings and FactSet. Market data as of December 31, 2014.

4 Represents U.S. same-store sales for Pizza Hut and North American same-store sales for Papa John’s and Domino’s.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170522005840/en/

Contacts:

Buffalo Wild Wings, Inc.

Heather

Pribyl, 952-540-2095

or

Additional Investor Contact

MacKenzie

Partners, Inc.

Bob Marese/Paul Schulman

212-929-5500

or

Media:

Joele

Frank, Wilkinson Brimmer Katcher

Meaghan Repko / Nick Lamplough

212-355-4449