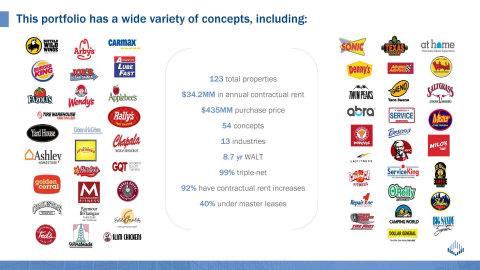

Spirit Realty Capital, Inc. (NYSE: SRC) (“Spirit” or “the Company”) announced today that it acquired 123 single-tenant properties for approximately $435 million in cash.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20191125005796/en/

Spirit Realty Capital, Inc. Announces Acquisition of 123 Properties for $435 Million (Photo: Business Wire)

The transaction was executed at an approximate 7.86% initial capitalization rate with rents of $34.2 million, a weighted average remaining lease term of 8.7 years and approximately 2 million leasable square feet.

“We are excited to announce this transaction, which added many high-quality tenants and concepts to our portfolio, particularly in the restaurant, auto-related and home furnishings industries,” stated Jackson Hsieh, President and Chief Executive Officer. “This transaction provided a unique opportunity to acquire high-quality real estate, in solid trade areas with tenants we know well at an attractive risk-adjusted return.”

Updated 2019 Acquisition Guidance

Range | ||||

Prior | Revised | |||

Acquisitions ($ in billions) | $1.10 – 1.30 | $1.25 – 1.35 | ||

Portfolio

This portfolio of 123 high-quality single-tenant retail assets has many attractive characteristics, including:

- 92% of rents escalate

- 99% of rents are triple-net

- 40% of rents are under master lease structures

- 78 restaurant properties

- 71% of rents are from service retail tenants, 29% from traditional retail tenants

- Strong demographics include portfolio weighted average $65,000 5-mile household income and 160,000 5-mile population

- Diversified across 26 states, with no state over 13.8% of rents

- $3.5 million average investment per property

The industries in this portfolio include:

Number of Properties | % of Total Portfolio Rent | |||

Restaurants - Casual Dining | 23 | 16.8 % | ||

Home Furnishings | 11 | 16.0 % | ||

Movie Theatres | 4 | 15.8 % | ||

Restaurants - Quick Service | 55 | 15.0 % | ||

Education | 5 | 10.5 % | ||

Automotive Dealers | 3 | 10.3 % | ||

Automotive Service | 12 | 7.2 % | ||

Health and Fitness | 3 | 4.8 % | ||

Specialty Retail | 1 | 1.4 % | ||

Car Washes | 1 | 0.7 % | ||

Automotive Parts | 3 | 0.6 % | ||

Apparel | 1 | 0.6 % | ||

Dollar Stores | 1 | 0.3 % | ||

Grand Total | 123 | 100.0 % |

ABOUT SPIRIT REALTY

Spirit Realty Capital, Inc. (NYSE: SRC) is a net-lease REIT that primarily invests in single-tenant, operationally essential real estate assets, subject to long-term net leases.

As of September 30, 2019, our diversified portfolio was comprised of 1,623 owned properties and 43 properties securing mortgage loans. Our owned properties, with an aggregate gross leasable area of approximately 30.3 million square feet, are leased to 260 tenants across 48 states and 31 industries.

View source version on businesswire.com: https://www.businesswire.com/news/home/20191125005796/en/

Contacts:

(972) 476-1403

InvestorRelations@spiritrealty.com