Honeywell International Inc. (HON) in Morris Township, N.J. is a diversified technology and manufacturing company that operates globally. The company operates through the broad segments of Aerospace; Honeywell Building Technologies; Performance Materials and Technologies; and Safety and Productivity Solutions.

HON’s CEO Darius Adamczyk stated that the company took a $183 million, or about 27 cents per share, hit after substantially suspending its Russian operations, following the breakout of war in Ukraine. However, HON has raised its guidance for the full year, with adjusted earnings expected to come in between $8.50-$8.80 per share, indicating an increase from its previous adjusted earnings guidance of between $8.40-$8.70 per share.

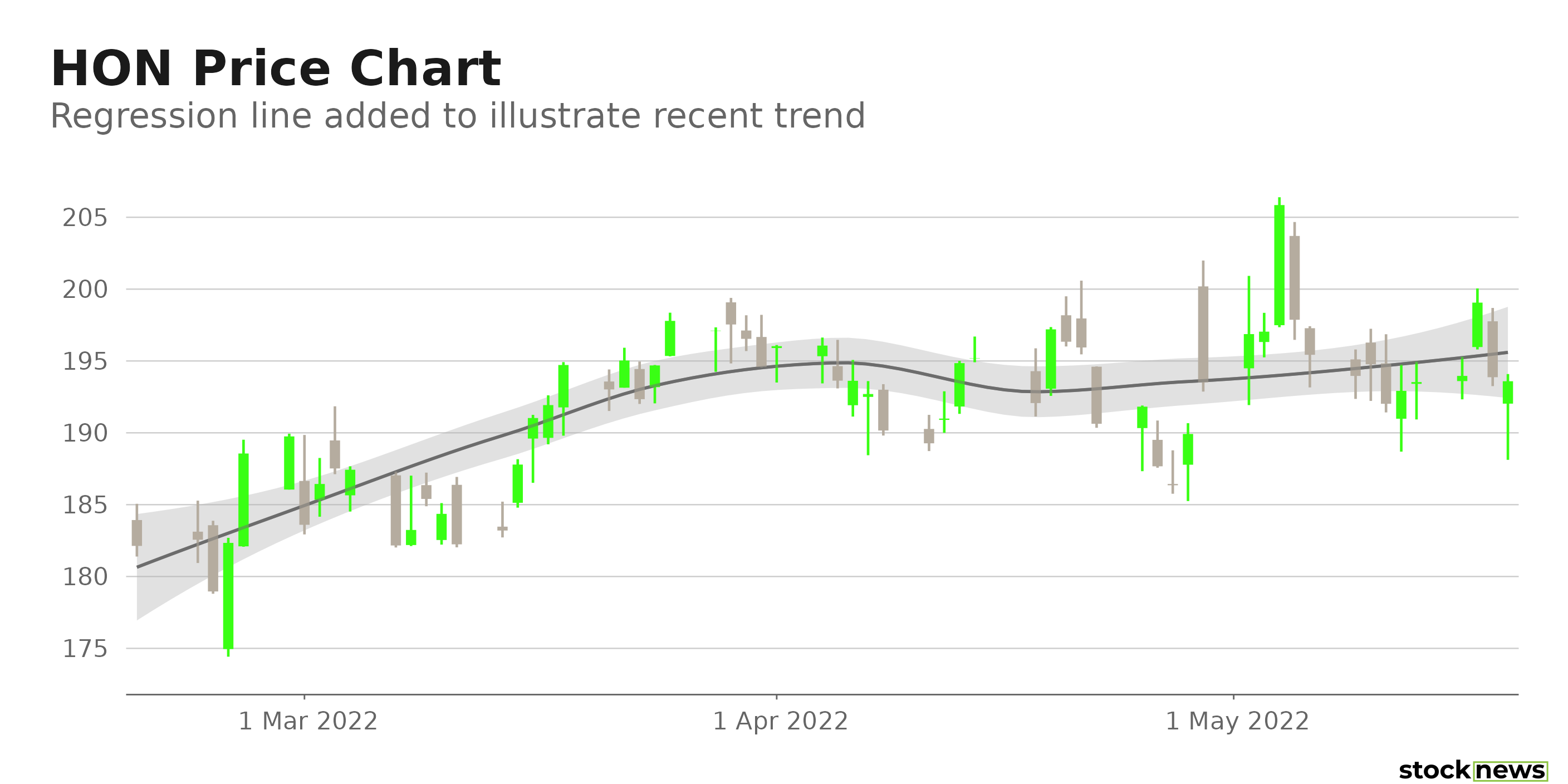

On April 25, HON declared a $0.98 per share regular quarterly dividend payment on its outstanding common stock, which is payable to shareholders on June 3. Its annual dividend rate of $3.92 yields 2.02% on its prevailing share price. The company’s dividend payouts have increased at a 6% CAGR over the past three years and a 7% CAGR over the past five years. It has 18 years of consecutive dividend growth. Over the past year, HON’s stock has declined 12.8% in price and 7% year-to-date to close yesterday’s trading session at $193.87. However, the stock has gained 6.4% over the past three months and 0.9% over the past month.

Bleak Bottom-line Growth

For the fiscal first quarter ended March 31, HON’s net sales decreased 0.9% year-over-year to $8.38 billion. Its net income attributable to HON declined 20.5% from the prior-year period to $1.13 billion. And the adjusted EPS of its common stock came in at $1.91, down 0.5% from the same period last year.

Favorable Analyst Expectations

The $2.30 consensus EPS estimate for the quarter ending Sept.30, 2022, indicates a 13.9% year-over-year increase. Likewise, the $9.16 billion consensus revenue estimate for the same quarter reflects a 5.9% improvement from the prior-year quarter. Furthermore, the Street’s $8.71 EPS estimate for fiscal 2022 indicates an 8.1% increase from the prior year, while the Street’s $35.98 billion revenue estimate for the same year reflects a 4.6% year-over-year rise.

Stretched Valuations

In terms of its forward EV/Sales, HON is currently trading at 3.97x, which is 152.1% higher than the 1.57x industry average. The stock’s 3.66 forward Price/Sales multiple is 200.1% higher than the 1.22 industry average. In terms of its forward Price/Book, it is trading at 7.21x, which is 187.2% higher than the 2.51x industry average.

Favorable Profit Margins

HON’s trailing 12-month EBITDA margin, net income margin, and levered FCF margin of 24.52%, 15.30%, and 11.03%, respectively, are 84.6%, 126.1%, and 211.8% higher than the 13.28%, 6.76%, and 3.54% industry averages.

Its trailing 12-month 28.88%, 11.27%, and 8.29% respective ROE, ROTC, and ROA of are 101.1%, 55.9%, and 53.1% higher than the 14.36%, 7.23%, and 5.41% industry averages.

POWR Ratings Indicate Uncertainty

HON has an overall C rating, which equates to Neutral in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

HON has a Momentum grade of C. This is justified because the stock is trading above its 50-day Moving Average of $193.21, but below its 200-day Moving Average of $207.64.

The stock has a D grade for Growth, which is in sync with its bleak bottom-line growth in its last reported quarter. It has a Quality grade of B, which is consistent with its favorable profit margins.

In the 78-stock Industrial – Machinery industry, HON is ranked #42. The industry is rated B.

Click here to see the additional POWR Ratings for HON (Value, Stability, and Sentiment).

View all the top stocks in the Industrial – Machinery industry here.

Click here to check out our Industrial Sector Report for 2022

Bottom Line

HON has a significant dividend growth history, triggering income investors' interest. However, the suspension of its Russian operations could hamper its near-term prospects. Moreover, its bleak bottom-line growth and lofty valuations are concerning. Hence, I think it might be wise to wait for a better entry point in the stock.

How Does Honeywell International Inc. (HON) Stack Up Against its Peers?

While HON has an overall POWR Rating of C, one might consider looking at its industry peers, Amada Co., Ltd. (AMDLY) and Donaldson Company, Inc. (DCI), which have an overall A (Strong Buy) rating, and Tennant Company (TNC) and IMI plc (IMIAY), which have an overall B (Buy) rating.

HON shares were trading at $193.62 per share on Thursday afternoon, down $0.25 (-0.13%). Year-to-date, HON has declined -6.15%, versus a -17.45% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Is Honeywell International a Good Dividend Stock to Buy Now? appeared first on StockNews.com