Devon Energy Corporation (DVN), an independent oil and gas company, has seen a significant decline in its share value over recent months despite a favorable business environment for exploration and production activities in the broader energy sector.

Scheduled for release after the closing bell on November 7, DVN’s third-quarter 2023 results are eagerly awaited by investors. According to Wall Street analysts, DVN’s revenue for the quarter ended September 2023 will decrease 33.3% year-over-year to $3.63 billion. Meanwhile, its Earnings Per Share (EPS) is forecasted to come in at $1.55, marking a 28.7% decline from the same quarter in the previous year.

Further compounded by its troublesome earnings surprise history, DVN has not managed to meet analysts’ expectations in three of the trailing four quarters, causing a dampening in investor sentiment. Concerns are rising that the stock may face additional sell-off pressure if the upcoming earnings report does not appease investor expectations.

While DVN is preparing to announce its third-quarter results, caution may be advised for those considering this as an opportune point to invest in the stock. To assess the potential of this stock accurately, a close examination of some of its critical financial metrics is recommended.

Devon Energy Corporation’s Financial Performance: A Deep Dive into Income, Revenue, and Other Key Metrics from December 2020 to June 2023

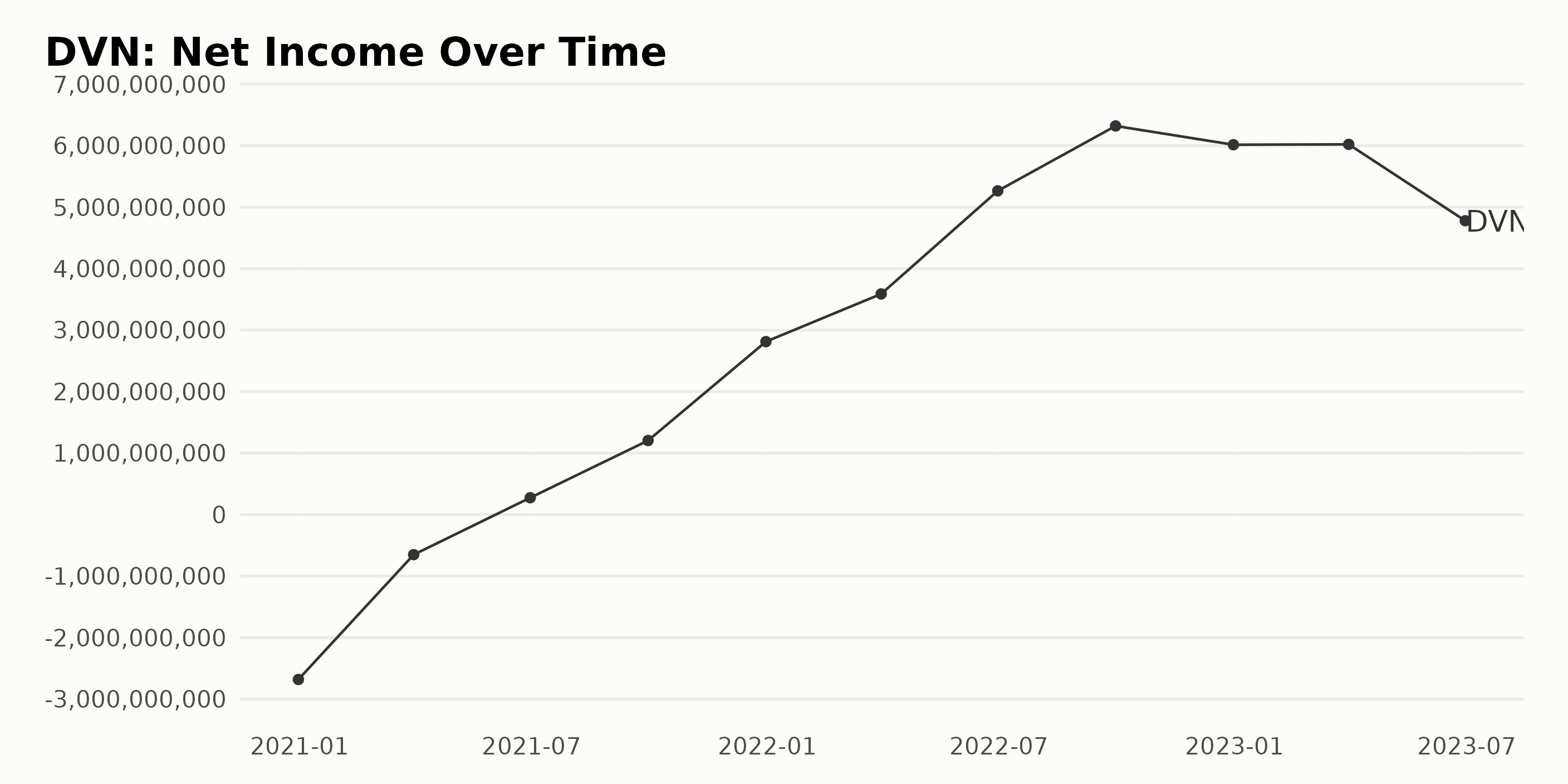

The trailing-12-month Net Income of Devon Energy Corporation (DVN) exhibited a general upward trend over the observed time period. However, there were a few fluctuations along the way.

- In December 2020, the Net Income was at a low, reported as a loss of -$2.68 billion.

- By March 2021, there was some improvement, with DVN’s net income decreasing their losses to -$651 million.

- A significant turning point was seen in June 2021, when the company made a profit of $275 million, marking an end to the consecutive periods of losses.

- This upward trend continued to September 2021 with the Net Income increasing to $1.205 billion.

- Over the next year and a half, DVN showed considerable growth with regular increases, peaking at $6.32 billion in September 2022. This was followed by a slight drop to $6.015 billion in December 2022.

- In the first half of 2023, DVN’s net income remained relatively steady in the first quarter ($6.021 billion), however, there was a notable decline to $4.779 billion by June 2023.

The deviation seen from time to time is indicative of the fluctuating nature of income in energy sectors based on factors such as commodity prices, production rates, and operational costs.

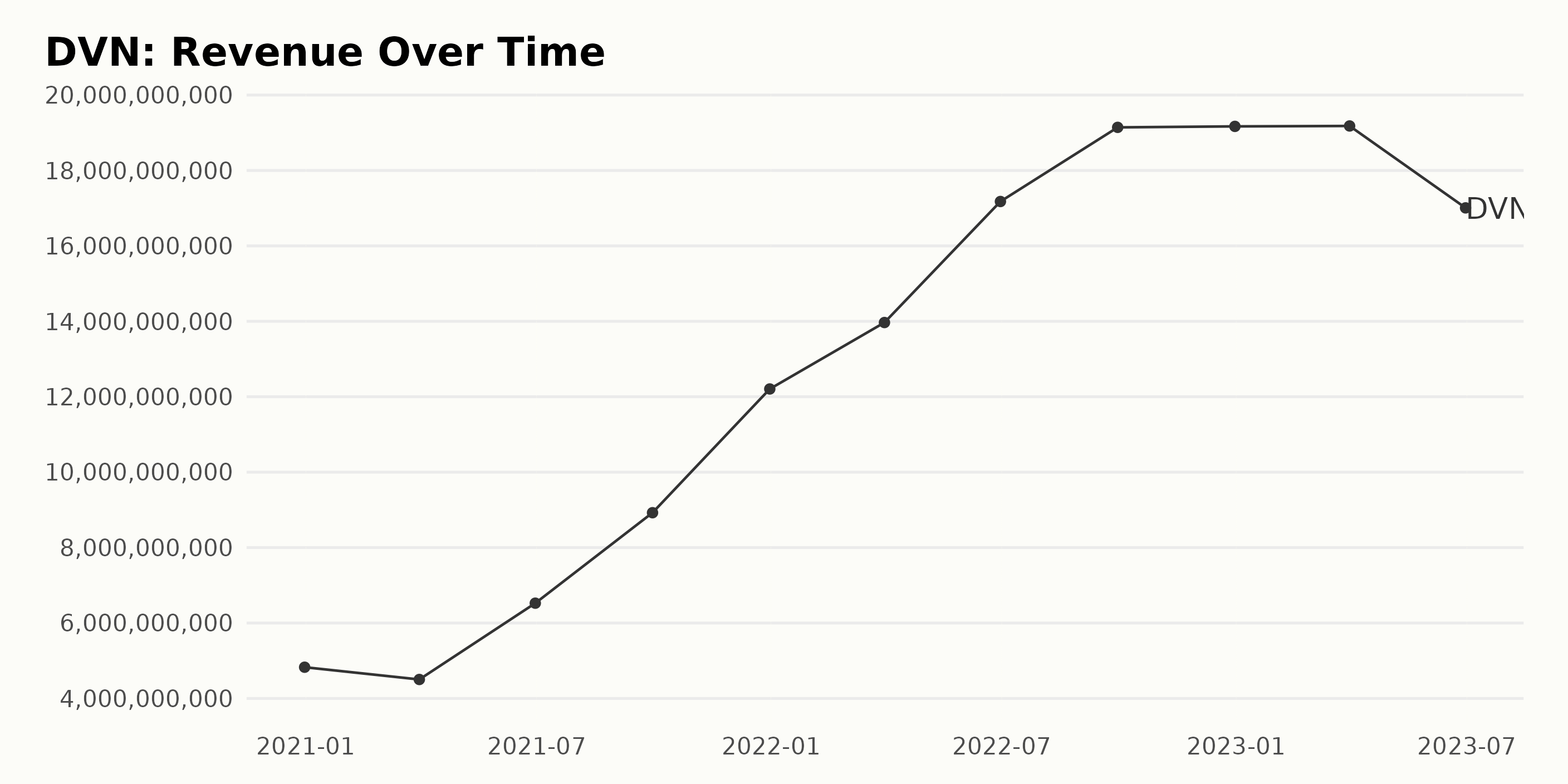

The trailing-12-month revenue trend of DVN has experienced an overall growth with several fluctuations, based on the reported data series from December 2020 to June 2023.

- December 2020: The revenue stood at approximately $4.83 billion.

- March 2021: A minor decline was observed with the revenue falling to about $4.50 billion.

- June 2021: An upward swing was noted as the revenue increased significantly to $6.53 billion.

- September 2021: The growth trend continued and the revenue surged to around $8.93 billion.

- December 2021: The end of the year marked a substantial increase in the revenue, touching a figure of approximately $12.21 billion.

- March 2022: The first quarter of 2022 witnessed an upward trend with the revenue peaking to about $13.97 billion.

- June 2022: An escalation was further observed as the revenue increased dramatically to $17.18 billion.

- September 2022: Continuing the growth trajectory, the revenue rose to nearly $19.14 billion.

- December 2022: A noteworthy revenue consistency was witnessed as DVN brought in nearly $19.17 billion, depicting a slight increase over the last quarter.

- March 2023: A marginal growth was observed with the revenue rounding up to about $19.18 billion.

- June 2023: As of the most recent data, June 2023 denotes a downward shift with DVN’s revenue standing at approximately $17.01 billion.

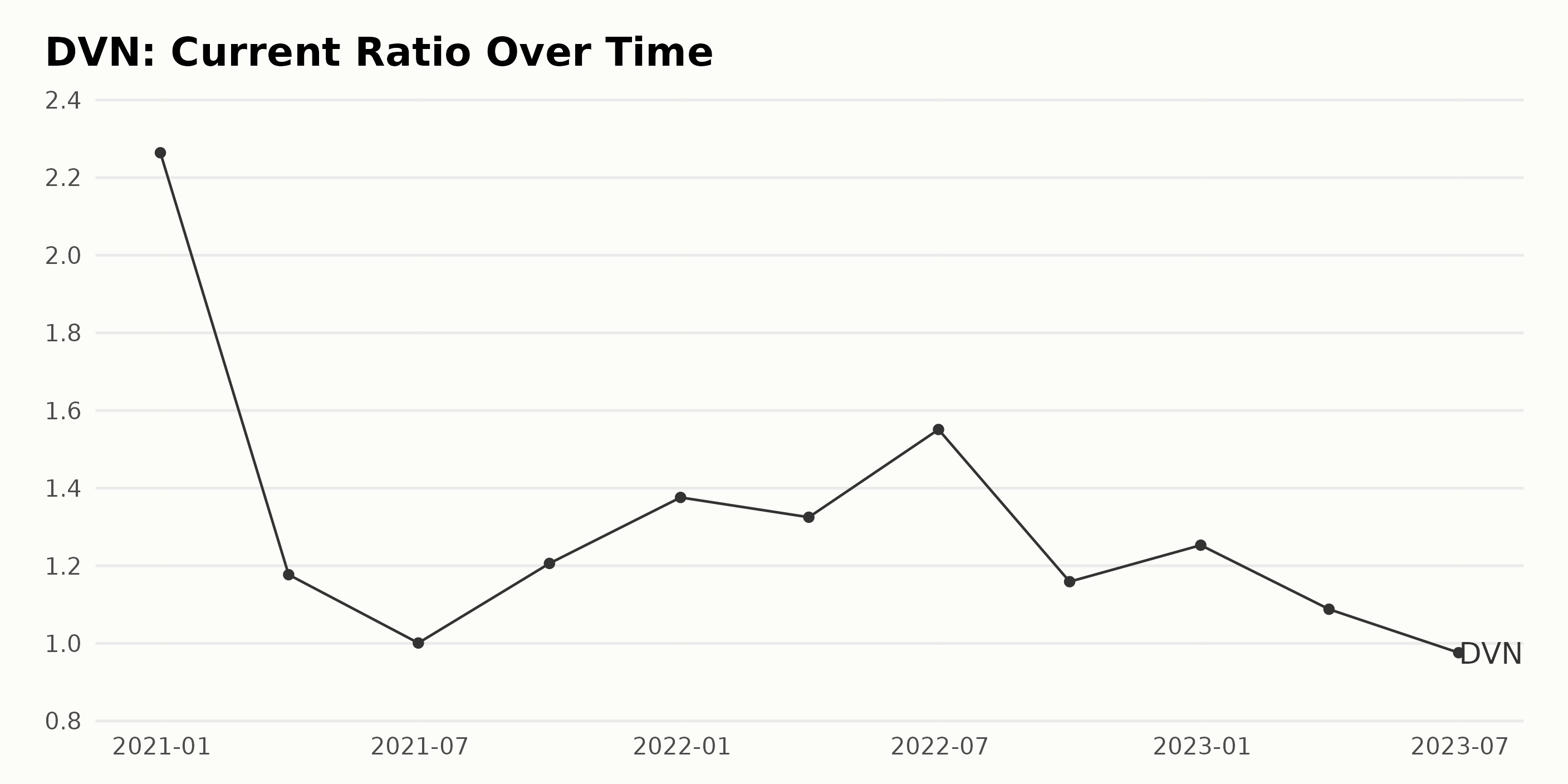

The Current Ratio of Devon Energy Corporation (DVN) fluctuated across the period from December 2020 to June 2023. This data reveals the following trends:

- On December 31, 2020, DVN reported a Current Ratio of 2.26. This was the highest point in the series.

- In the subsequent quarters of 2021, we observed significant decreases. By March 31, 2021, the Current Ratio had dropped to 1.18, a 48% decrease from the end of 2020. The ratio kept declining until it reached 1.001 by June 30, 2021.

- However, in the remaining part of 2021, the ratio witnessed a rebound, surging from 1.001 on June 30, 2021, to 1.38 on December 31, 2021.

- From March 31, 2022, to June 30, 2022, the ratio made a noticeable gain, increasing from 1.33 to 1.55. Thereafter, there was a downturn that continued until March 31, 2023, where it diminished to a low of 1.088.

- By June 30, 2023, the Current Ratio had diminished further to 0.976, which represents a 57% decrease from the peak ratio of 2.26 observed on December 31, 2020.

In overview, as of June 30, 2023, the Current Ratio had experienced a general decrease from its peak on December 31, 2020. It portrayed an overall downward trend over the noted time frame, with periods of temporary rebounds and declines. The emphasis is on the most recent data showing that DVN’s Current Ratio continued to lower in the first half of 2023.

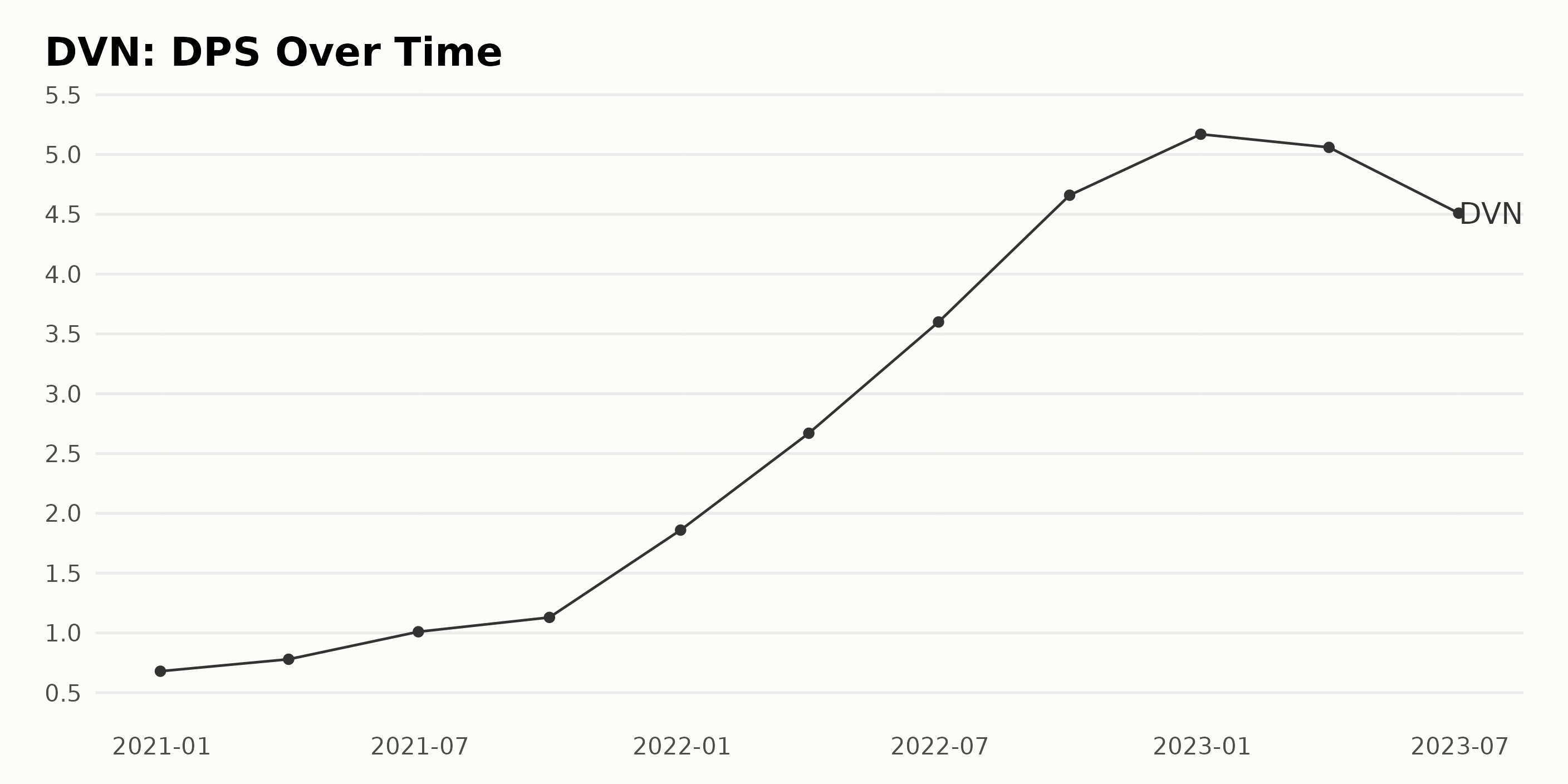

Over the course of the specified timeframe, there has been a significant uptrend in the DPS (dividend per share) value of Devon Energy Corporation (DVN).

- On December 31, 2020; the DPS stood at $0.68.

- The DPS value then rose to $0.78 on March 31, 2021 marking an increase from the initial value.

- Going forward, DVN reported a DPS of $1.01 on June 30, 2021, thereby continuing the upwards trend.

- By September 30, 2021, the company registered a sizeable stride in the values with a DPS of $1.13.

- DVN closed the year 2021 with a DPS of $1.86 on December 31.

- The rise continued into 2022 with a sharp increase of DPS to $2.67 by March 31, and further escalated to $3.6 by mid-year on June 30.

- The upward trajectory soared significantly with DVN reporting a DPS of $4.66 by end of the third quarter, September 30, 2022.

- The DPS peaked at $5.17 on December 31, 2022 marking the highest recorded value for this series.

- A note of shift appeared in the trend for the year 2023 where the DPS value took a slight dip to $5.06 on March 31.

- As of the most recent data point, the DPS stood at $4.51 on June 30, 2023 denoting a downtrend compared to the previous quarters.

Looking at these data points, there is clear evidence of substantial growth in DVN’s DPS over this period. The rise in DPS from $0.68 on December 31, 2020, to $4.51 on June 30, 2023, indicates a growth rate of approximately 563%. This analysis, however, warrants attention to the recent downtrend starting from the first quarter of 2023.

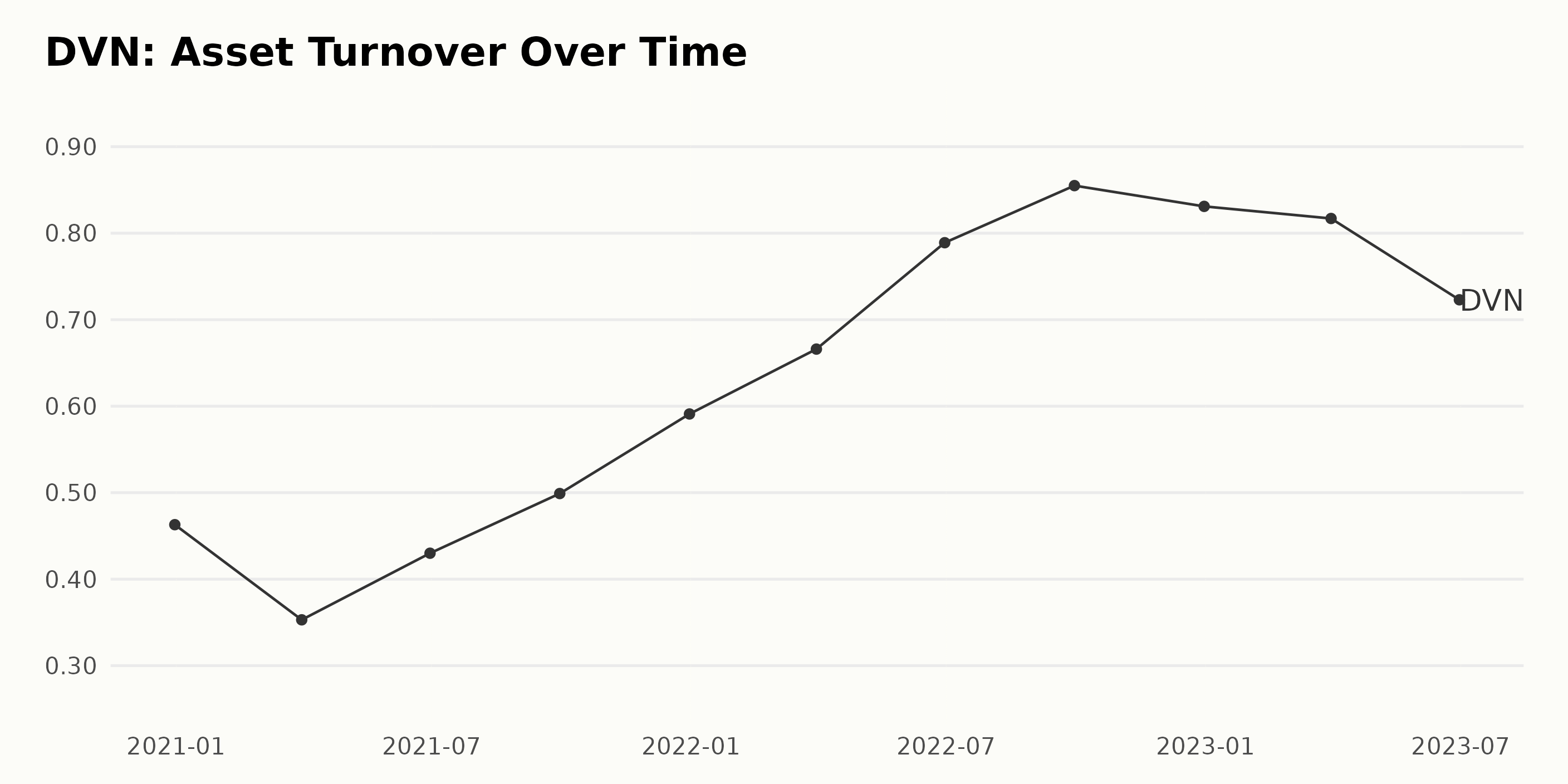

This data represents the Asset Turnover of DVN spanning over a period from December 2020 to June 2023. The Asset Turnover reflects how efficiently a company uses its assets to generate sales.

- The Asset Turnover value on December 31, 2020, was 0.46.

- There was a decline in this figure to 0.35 by the end of the first quarter of 2021 (March 31, 2021).

- Afterward, DVN showed steady increases in Asset Turnover, peaking at 0.86 by the third quarter of 2022 (September 30, 2022).

- Notably, there was a slight dip at the end of 2022 to 0.83. After that, the first quarter of 2023 experienced a slight decrease to 0.82 (March 31, 2023) before witnessing a considerable decrease to 0.72 by the end of the second quarter of 2023 (June 30, 2023).

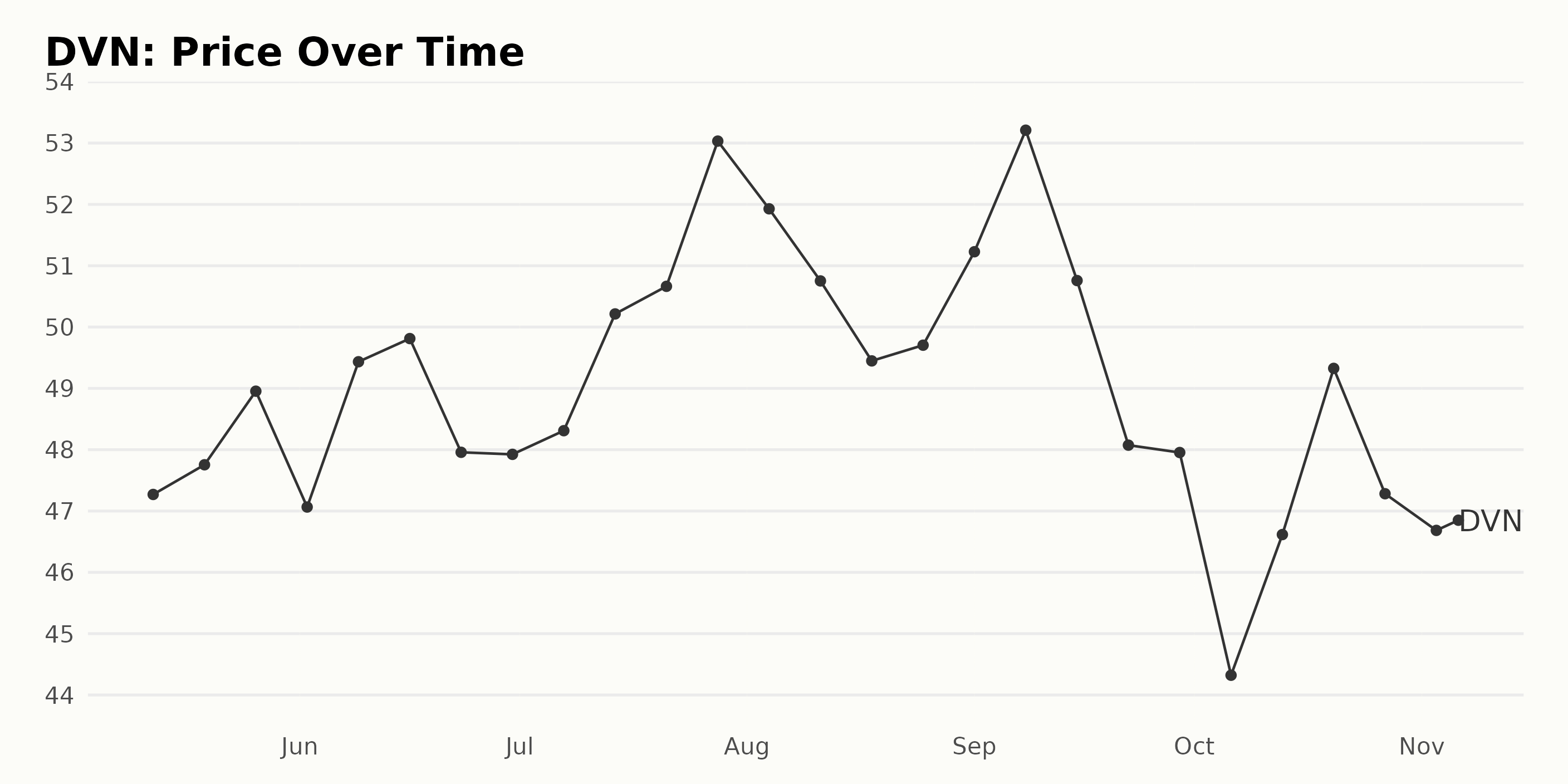

Analyzing the Fluctuating Trends of Devon Energy Corporation’s Share Price in 2023

The share price of Devon Energy Corporation (DVN) exhibits an overall fluctuating trend from May 2023 to November 2023. Here are key observations:

- Starting on May 12, 2023, with a share price of $47.27, the prices slightly increase over the course of two weeks reaching a peak value of $48.95 by May 26, 2023.

- In June 2023, the price pattern continued to fluctuate, tabulating the highest value for that month at $49.81 as of June 16, before a small decline to $47.92 by the end of the month.

- In July 2023, the trend was largely positive with the share price growing from $48.31 at the beginning of the month to a notable high of $53.03 by July 28, 2023.

- The downward trend started in August 2023, with the share price dropping from $51.93 at the start, to $49.70 by the end of the month.

- This decreasing trend persisted into September 2023, starting at $51.22 and plummeting to $47.95 by the end of the month.

- October 2023 began with the lowest point in the share price for the period, at $44.32 on October 6. However, the prices recovered in the following weeks to reach $49.32 by October 20, before finally declining again.

- By November 3, 2023, the share price slightly decreased further to $46.68, then marginally increased to $46.85 by November 6, 2023, ending the data set on a stable note.

In terms of a growth rate perspective, the fluctuations make it complex to establish a clear, continuous growth or decline rate over this period. It’s important to consider these variations and the context in which they occurred when evaluating the company’s financial performance. Here is a chart of DVN’s price over the past 180 days.

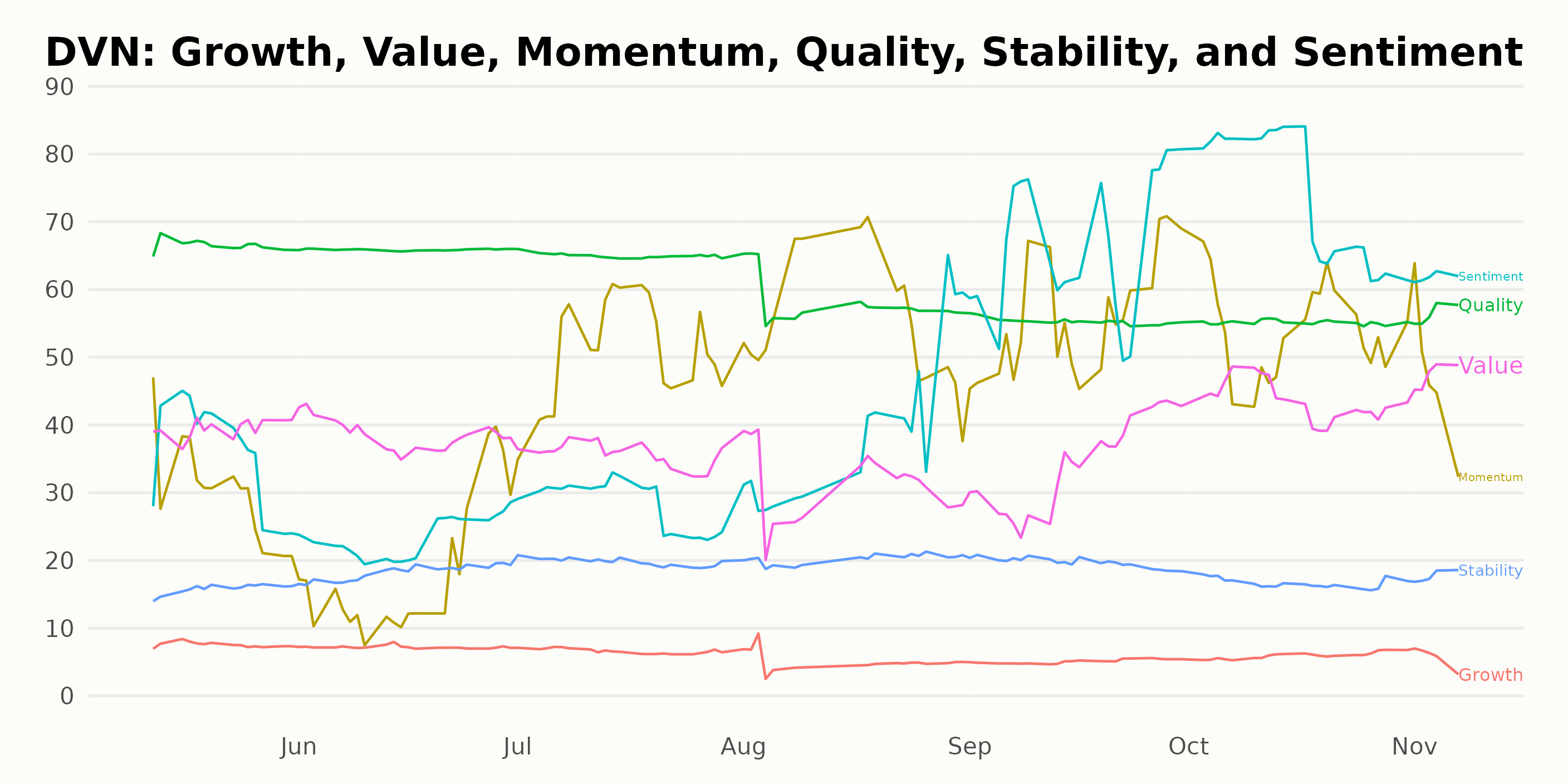

Analyzing Quality, Momentum, and Sentiment Trends for Devon Energy Corporation

DVN has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #71 out of the 85 stocks in the Energy - Oil & Gas category.

The POWR Ratings for the Devon Energy Corporation (DVN) across six dimensions reveal trending patterns in some areas. There are three dimensions that particularly standout based on their high ratings and clear trends. These are the Quality, Momentum, and Sentiment dimensions.

Quality - The Quality dimension consistently records the highest ratings over time, marking it as a leading strength for DVN. However, there is a downward trend observable. In May 2023, the rating sat at 67, but by November of the same year, the rating had dropped to 56.

Momentum - Momentum is a significant dimension for DVN, starting from a low of 30 in May 2023, and eventually reaching 56 by September 2023. Despite this increase, the rating experienced a slight dip to 48 by November 2023.

Sentiment - The Sentiment dimension shows a clear upward trend. It started at a relatively low 36 in May 2023, but experienced a significant increase to 74 by October 2023. However, there was a moderate drop to 62 in the following month.

These patterns provide close insights into Devon Energy Corporation’s position and performance across the Quality, Momentum, and Sentiment fronts. Attention to these indicators can offer valuable guidance in understanding DVN’s trajectory.

How does Devon Energy Corporation (DVN) Stack Up Against its Peers?

Other stocks in the Energy - Oil & Gas sector that may be worth considering are TotalEnergies SE (TTE), Cheniere Energy Inc. (LNG), and Weatherford International PLC (WFRD) -- they have better POWR Ratings.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

DVN shares were trading at $45.25 per share on Tuesday afternoon, down $1.47 (-3.15%). Year-to-date, DVN has declined -23.27%, versus a 15.56% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Devon Energy (DVN) Buy, Hold, or Sell Before Earnings Call? appeared first on StockNews.com