iShares 3-7 Year Treasury Bond ETF (NQ:IEI)

Headline News about iShares 3-7 Year Treasury Bond ETF

Via The Motley Fool

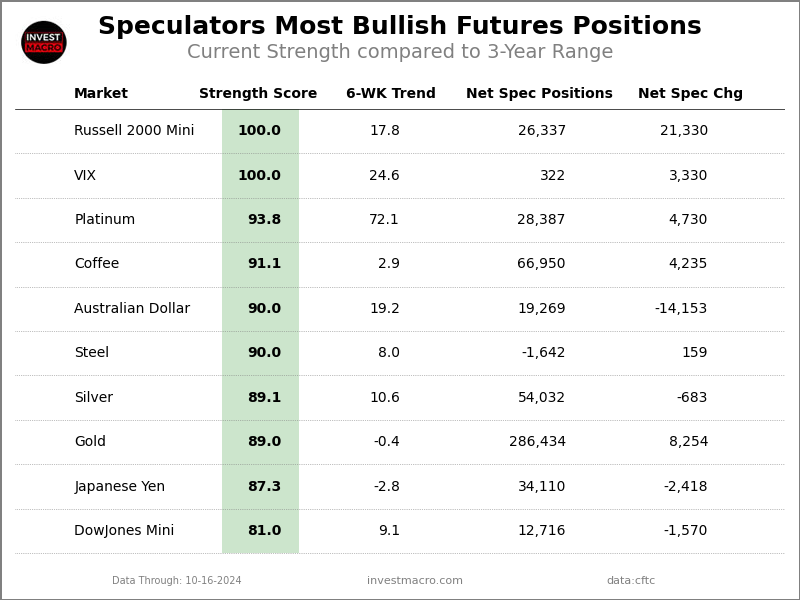

Speculator Extremes: Russell 2000, VIX, USD Index & 5-Year Bonds Lead Bullish & Bearish Positions ↗

October 20, 2024

Via Talk Markets

Topics

Stocks

Yield Curve Shifts Offer Signals For Stockholders ↗

August 28, 2024

Via Talk Markets

Topics

Economy

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.