iShares 0-1 Year Treasury Bond ETF (NQ:SHV)

Headline News about iShares 0-1 Year Treasury Bond ETF

Trust Co Goes Big on Bonds With $15 Million BND Buy ↗

October 12, 2025

Via The Motley Fool

Via Benzinga

Momentum And Large-Cap Growth Still Lead Equity Factor Returns ↗

August 28, 2024

Via Talk Markets

Topics

ETFs

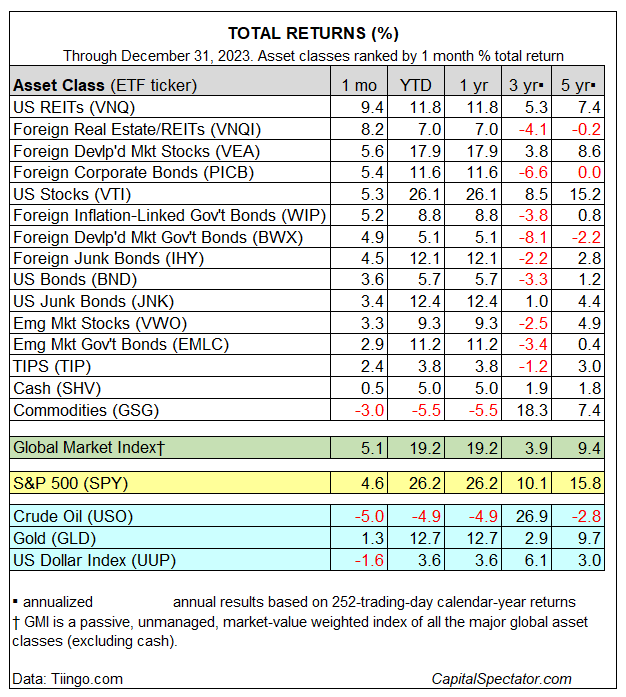

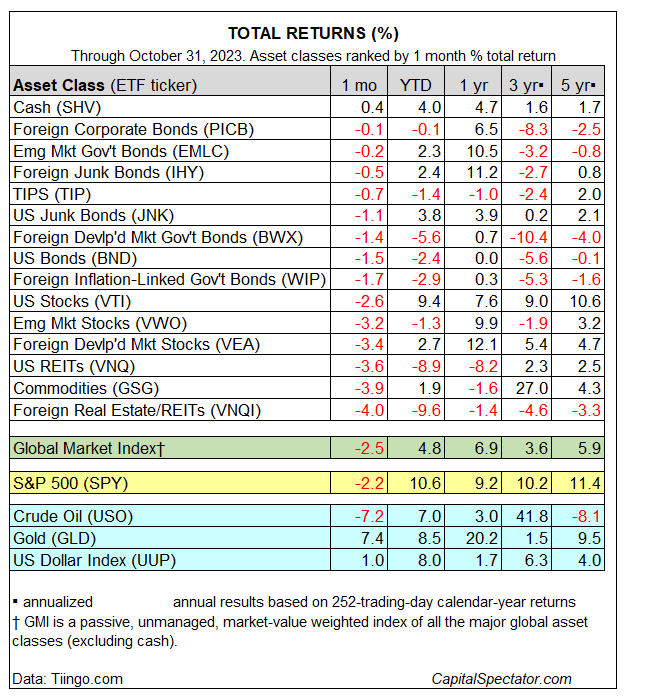

Major Asset Classes: September 2023 - Performance Review ↗

October 02, 2023

Via Talk Markets

Topics

ETFs

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.