Exxon Mobil (NY:XOM)

Headline News about Exxon Mobil

Via MarketMinute

Via MarketMinute

WTI Crude Oil Hits Six-Month High Amid US-Iran Tensions

Today 9:46 EST

Via MarketMinute

Occidental Petroleum Surges 9.4% as Q4 Earnings Crush Estimates Amid Rising Crude Prices

February 19, 2026

Via MarketMinute

Topics

Earnings

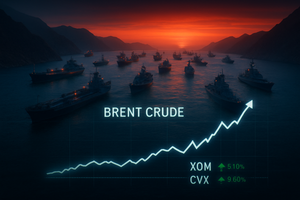

Chokepoint Crisis: Crude Surges as Persian Gulf Tensions Threaten Global Energy Arteries

February 19, 2026

Via MarketMinute

Topics

Economy

US Energy Stocks Surge as Geopolitical Tensions Ignite Oil Rally

February 19, 2026

Via MarketMinute

Via MarketMinute

January CPI Report: Inflation Cools to 2.4% as Energy Prices Slump

February 18, 2026

Via MarketMinute

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.