United States Gasoline Fund LP (NY:UGA)

All News about United States Gasoline Fund LP

The Commodities Feed - Fed Comments Weigh On The Complex ↗

December 19, 2024

Via Talk Markets

Via Talk Markets

Topics

Commodities

Crude Oil Missing Catalyst To Lift Prices; What’s Next For The Market? ↗

December 21, 2024

Via Talk Markets

WTI Moves Below 69.00, Further Downside Seems Possible Due To Stronger US Dollar ↗

December 20, 2024

Via Talk Markets

Topics

Commodities

Speculator Extremes: Lean Hogs & Nasdaq Lead Weekly Bullish Positions ↗

December 16, 2024

Via Talk Markets

The Energy Report: Assad Falls - Monday, December 9 ↗

December 09, 2024

Via Talk Markets

Topics

Commodities

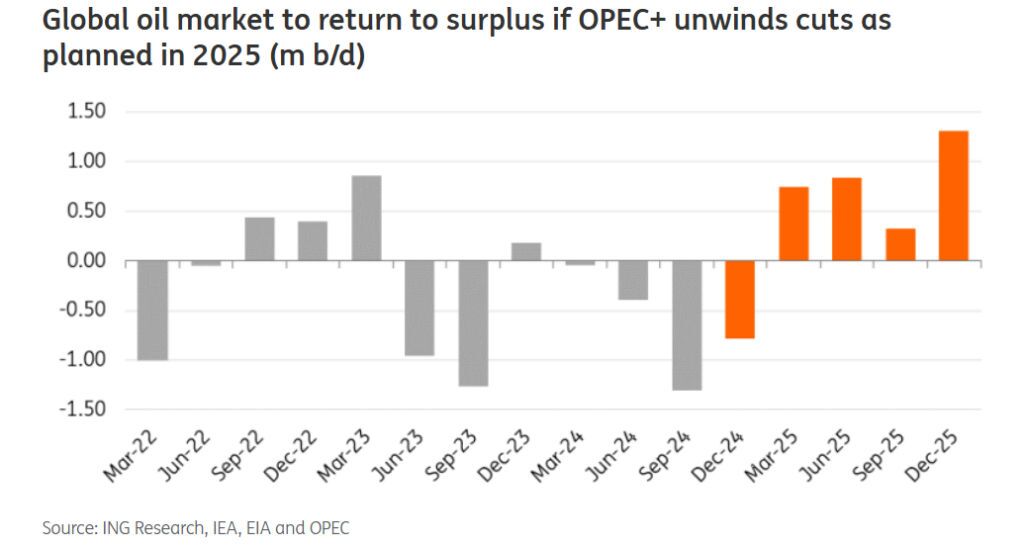

Crude Oil Ticks Up Rumors Picking Up On OPEC+ Discussions ↗

November 27, 2024

Via Talk Markets

Topics

Commodities

World Central Banks Continue To Cut Interest Rates. Us Stock Indices Break Records Again ↗

November 08, 2024

Via Talk Markets

Topics

Stocks

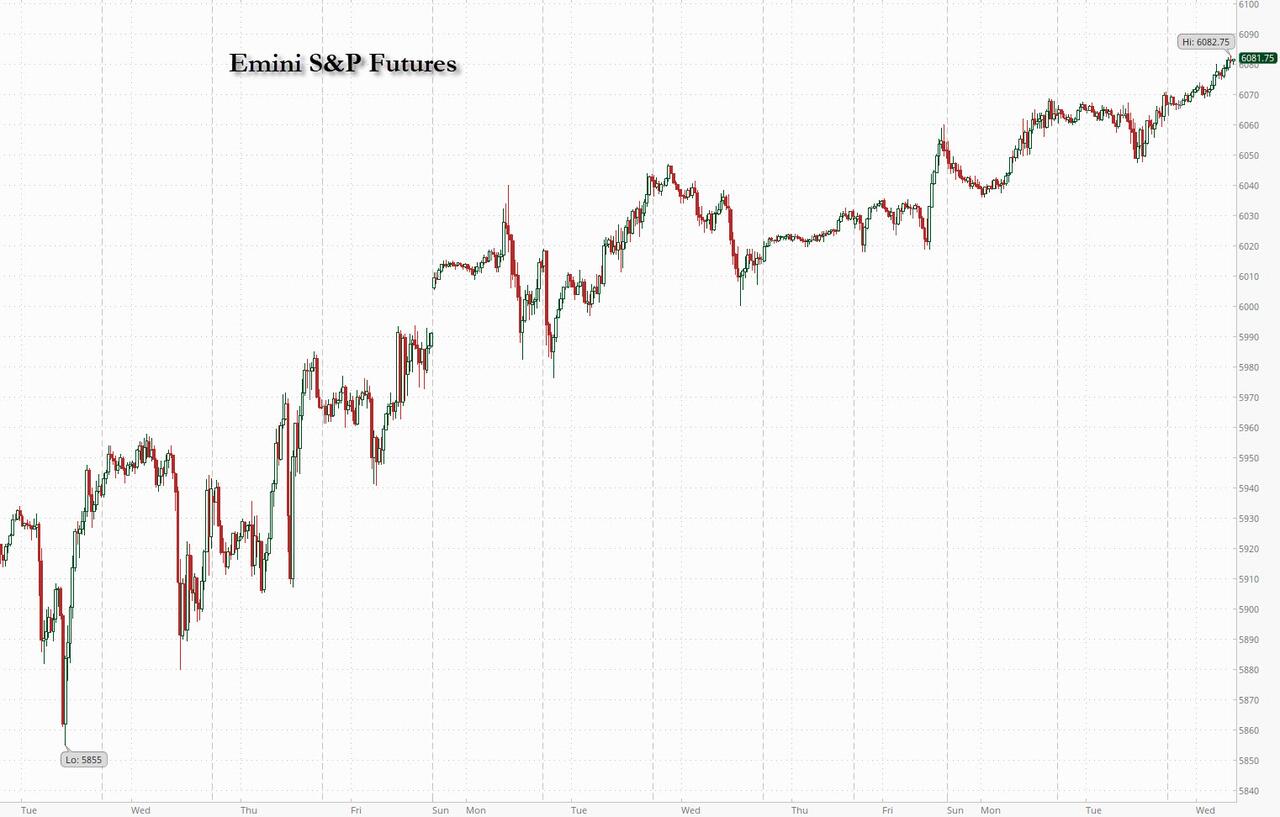

S&P Futures Extend Gains As Trump Trades Cool ↗

November 07, 2024

Via Talk Markets

Futures Jump After Blowout TSMC Earnings And Ahead Of ECB Rate Cut ↗

October 17, 2024

Via Talk Markets

Topics

Artificial Intelligence

WTI Rallies After API Reports Across-The-Board Inventory Draws ↗

October 16, 2024

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.