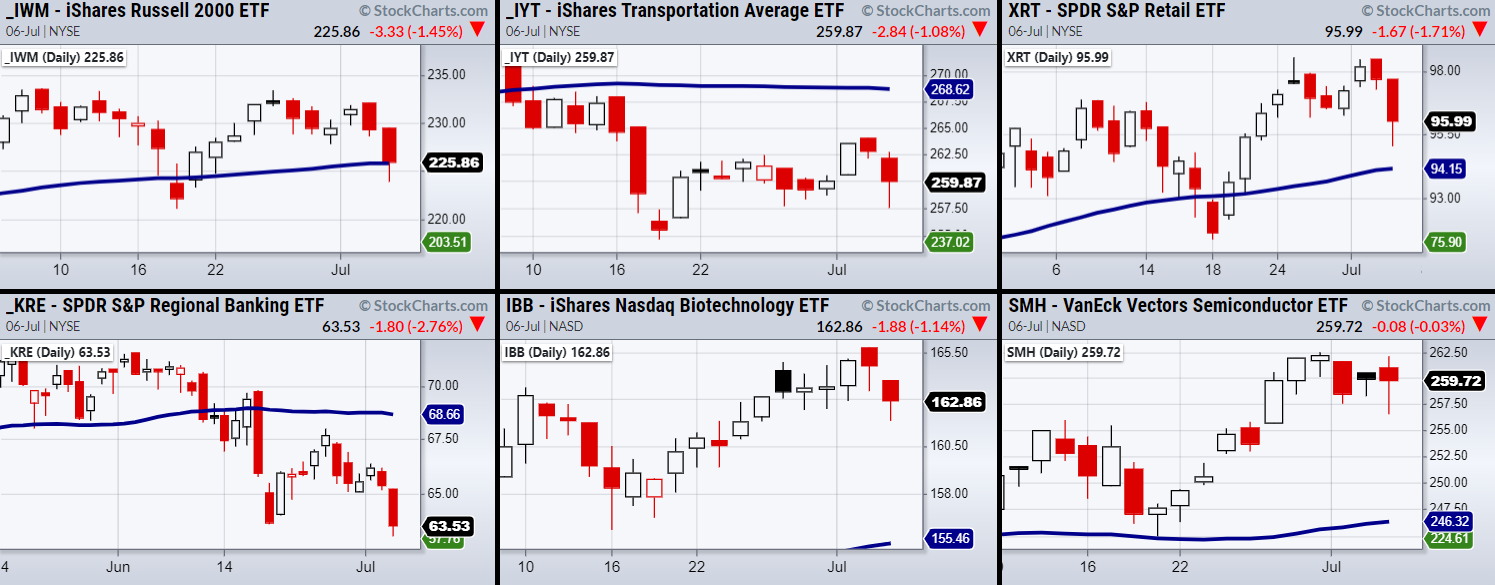

Headline News about S&P Regional Banking ETF SPDR

Practical Ways To Live Through Inflationary Times

July 08, 2021

Via Talk Markets

Topics

Economy

Exposures

Economy

Will Oil Prices Continue to Climb?

June 23, 2021

Via Talk Markets

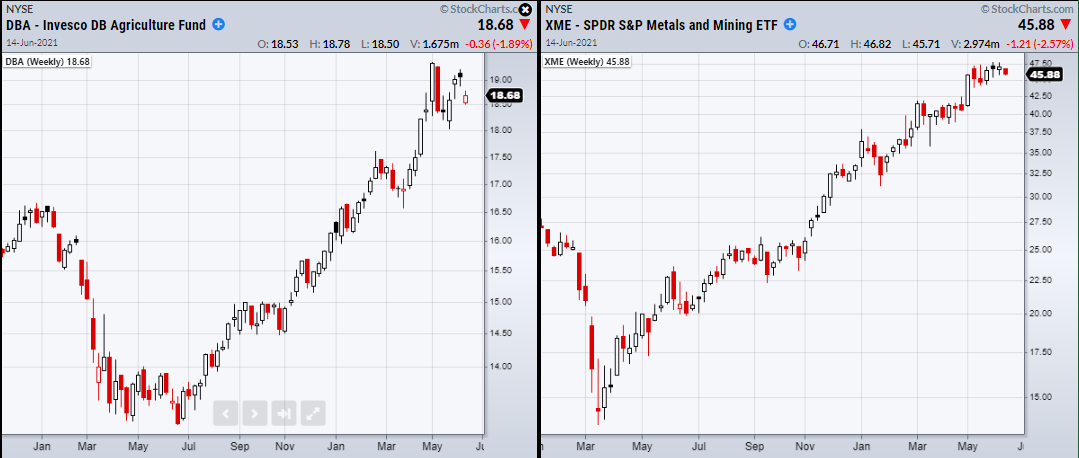

The Hidden Opportunity in Soft Commodities

June 15, 2021

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.