JNK (NY:JNK)

All News about JNK

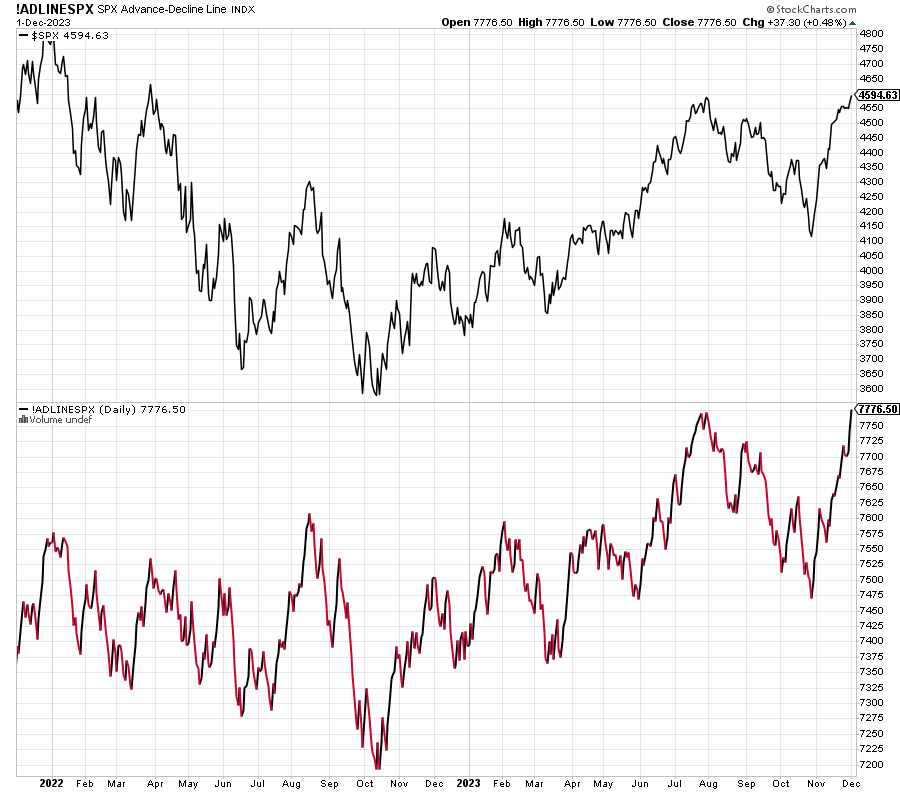

The Bull Market Has Broadened Out ↗

December 04, 2023

Via Talk Markets

Topics

Stocks

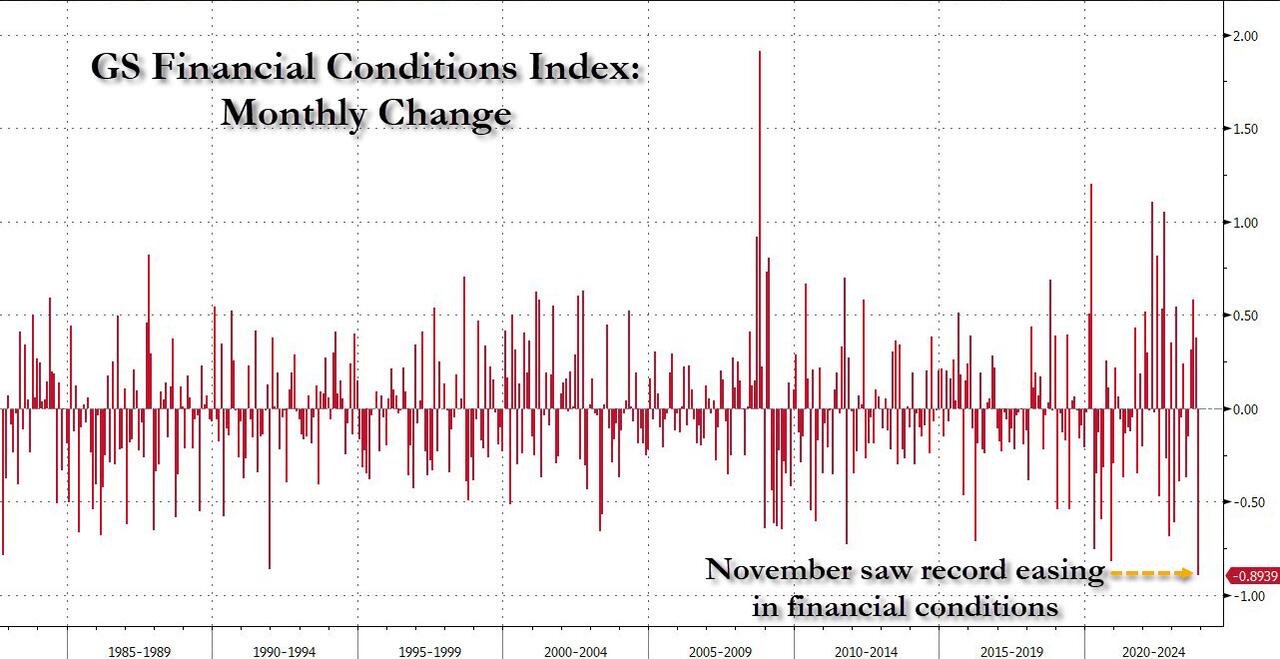

"A November To Remember": The Best And Worst Performing Assets In November And YTD ↗

December 01, 2023

Via Talk Markets

Topics

Stocks

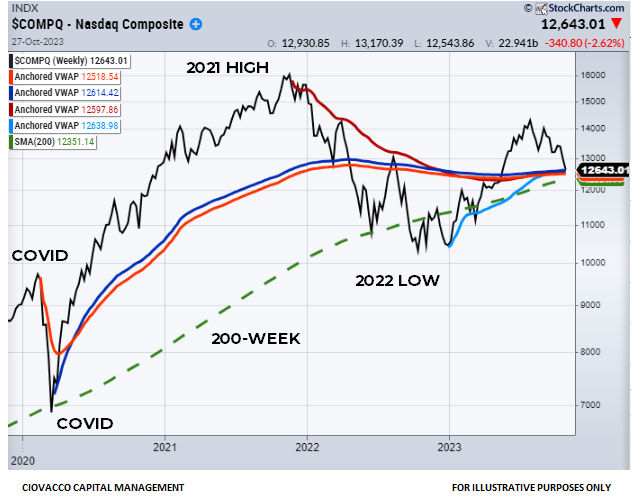

US Stocks’ Upside Outlier Performance In 2023 Looks Vulnerable ↗

October 23, 2023

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.