Invesco DB USD Index Bearish ETF (NY:UDN)

All News about Invesco DB USD Index Bearish ETF

FX Daily: US Prices And Activity In The Spotlight ↗

August 12, 2024

Via Talk Markets

Daily Market Outlook, Wednesday, September 4 ↗

September 04, 2024

Via Talk Markets

Via Talk Markets

Topics

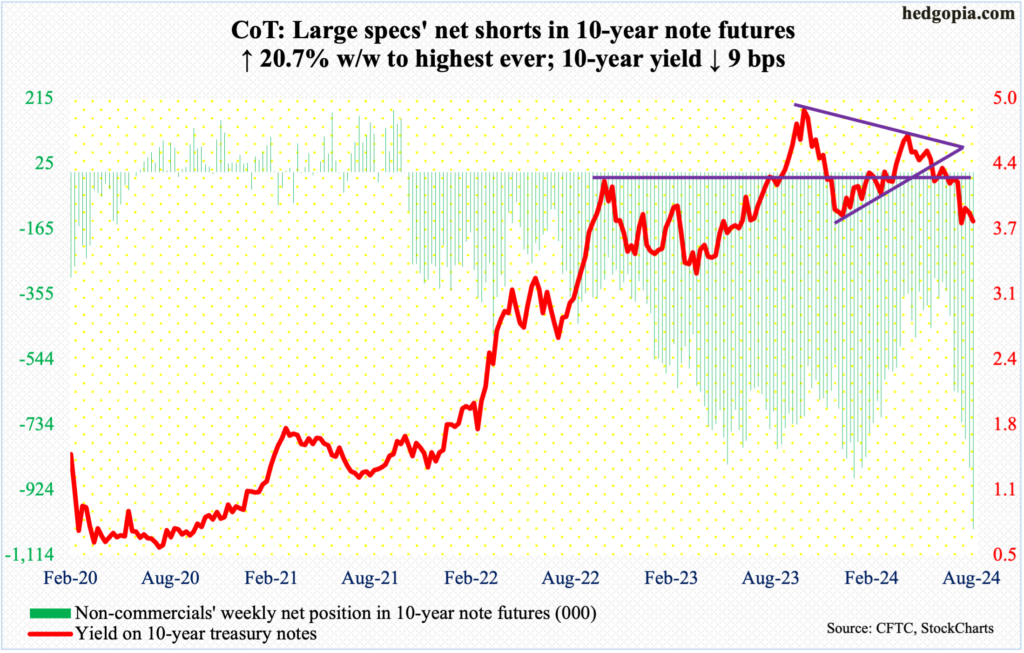

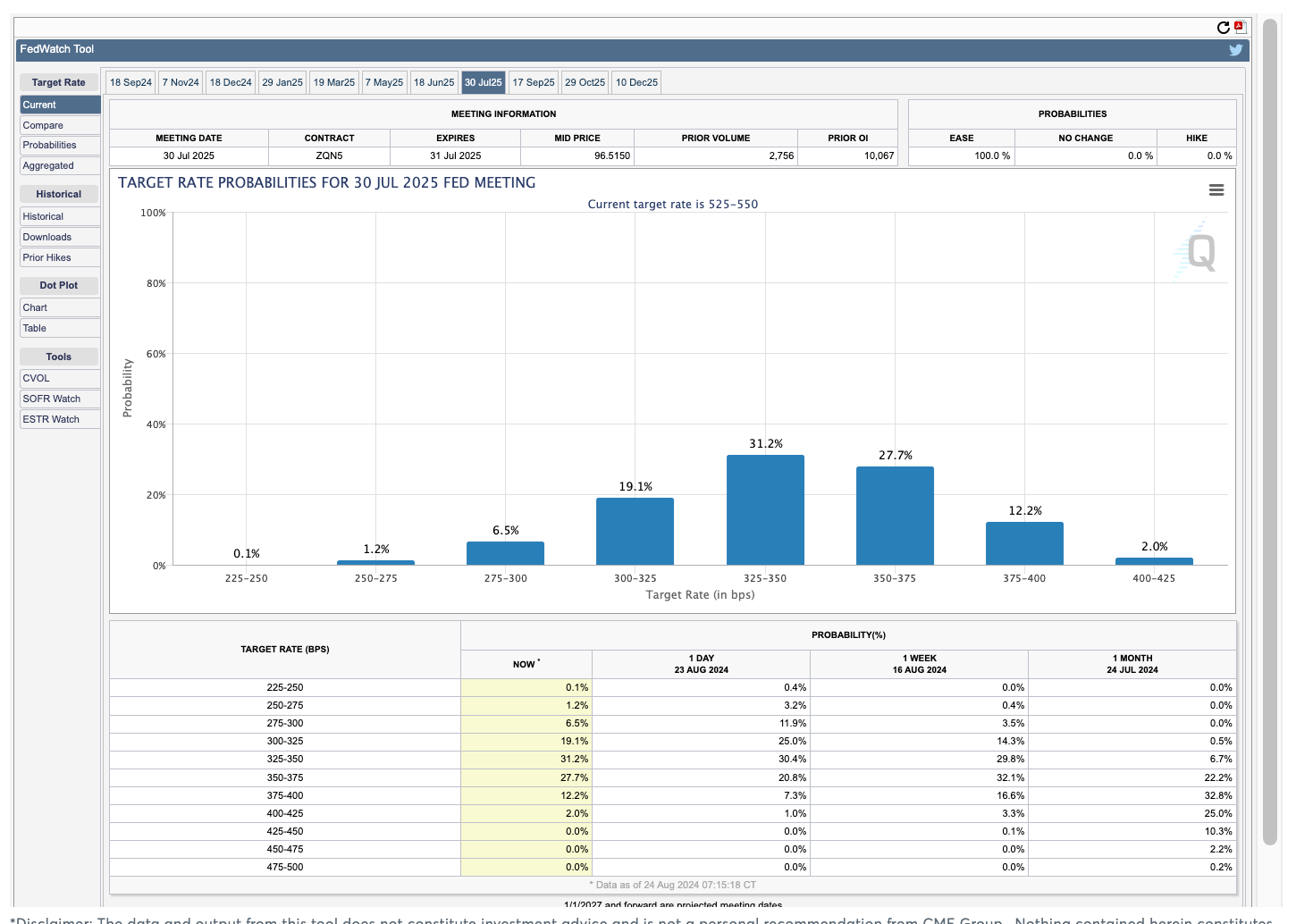

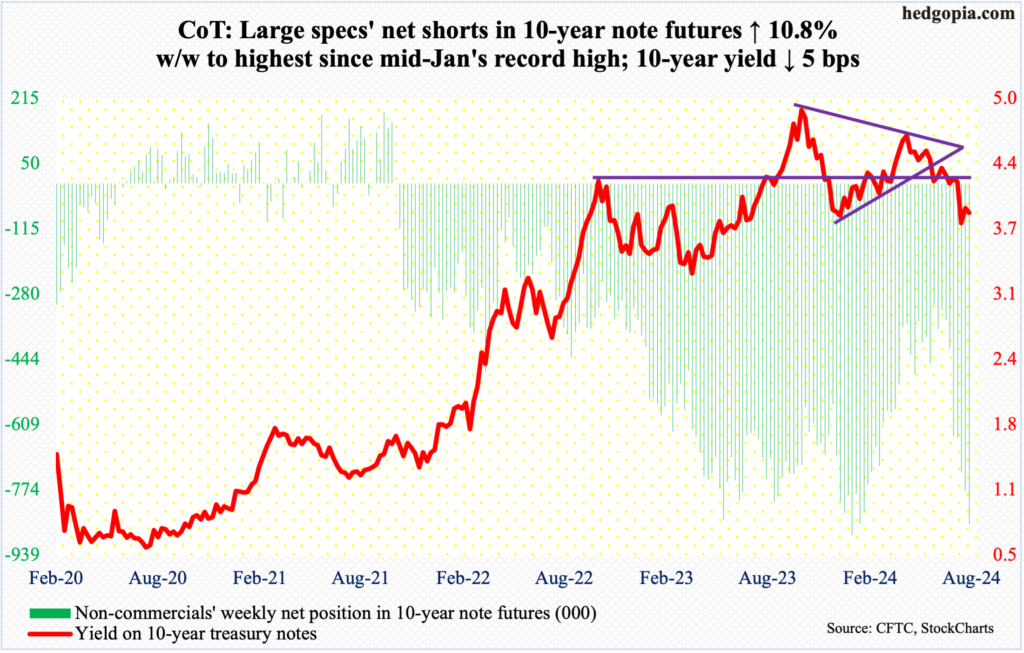

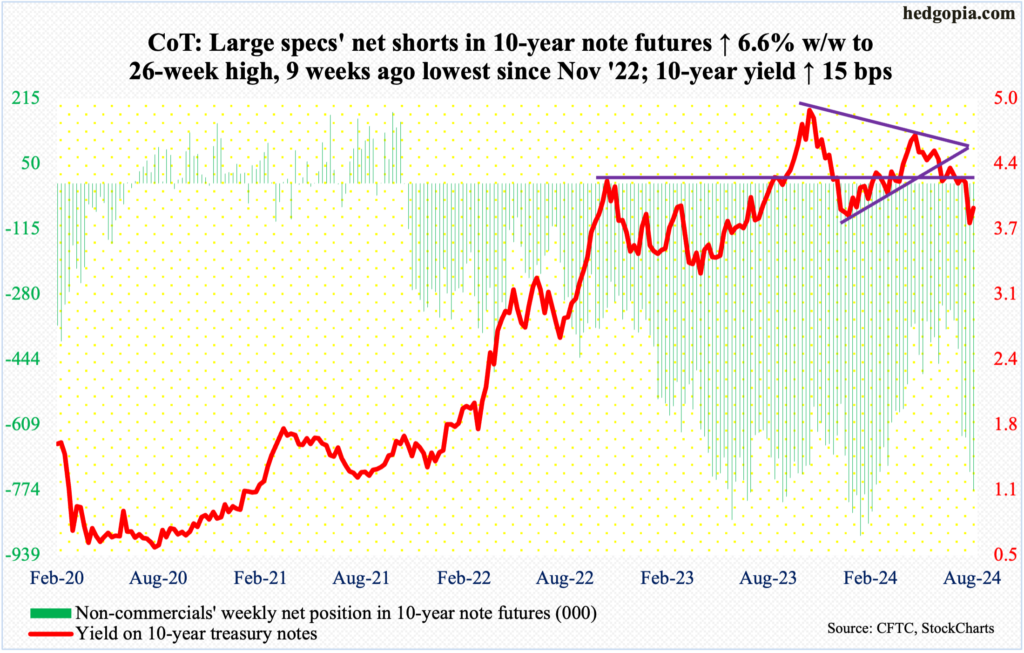

Bonds

Focus Returns To The Fed's Terminal Rate ↗

August 25, 2024

Via Talk Markets

Topics

Economy

.thumb.png.0b184e166c914405e402a1a18a298164.png)

Via Talk Markets

Topics

Stocks

ETFs To Boost Gains Amid Rising Rate Cut Expectations ↗

July 06, 2024

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.