iShares 20+ Year Treasury Bond ETF (NQ:TLT)

All News about iShares 20+ Year Treasury Bond ETF

Inflation Expectations Are Becoming Unanchored ↗

February 23, 2025

Via Talk Markets

CoT: Peek Into The Future Thru Futures - How Hedge Funds Are Positioned, Feb. 23 ↗

February 23, 2025

Via Talk Markets

Topics

Stocks / Equities

The Fiscal Freeze Is Coming ↗

February 14, 2025

Via Talk Markets

Topics

Bonds

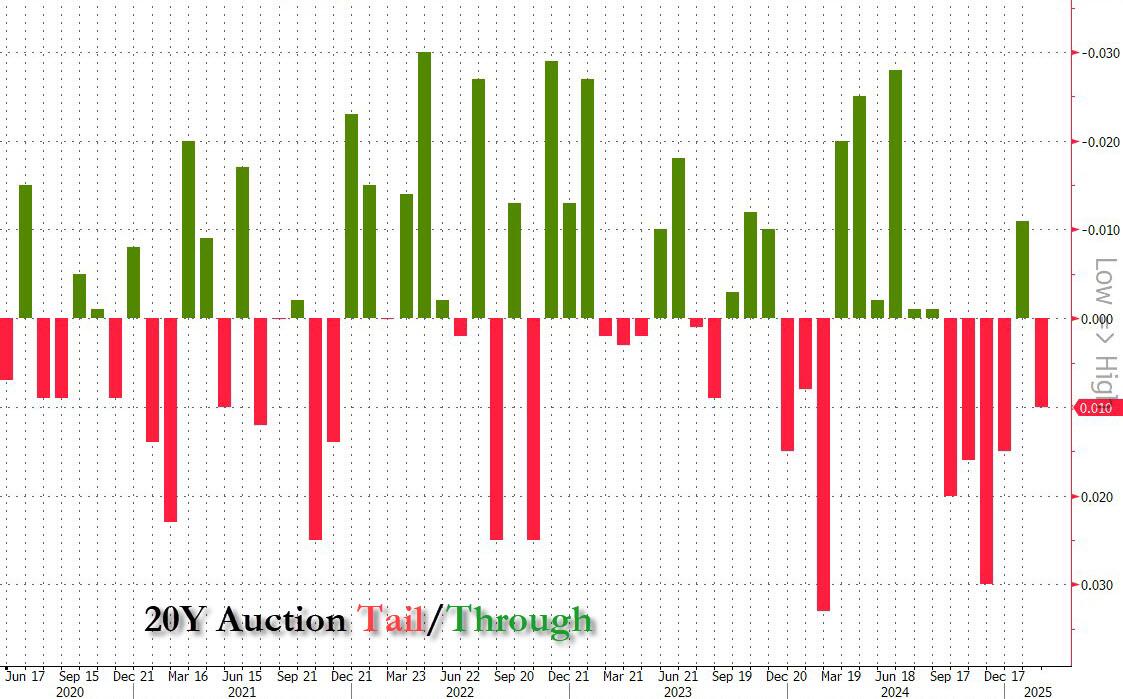

Long-Term Treasuries Devastation ↗

February 07, 2025

Via Talk Markets

Topics

Bonds

Via Talk Markets

Via Talk Markets

S&P 500 Earnings Breakdown: Valuation Remains Unfavorable ↗

February 08, 2025

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.