All News about Ultra Bloomberg Crude Oil 2X ETF

OPEC+ Countries Continued To Reduce Oil Production. Indices Have Again Renewed Historical Highs

March 04, 2024

Via Talk Markets

Topics

Stocks

Exposures

US Equities

Stocks Fall On February 28 As Inflation Expectations Continue To Climb

February 28, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Via Talk Markets

Topics

Bonds

Via Talk Markets

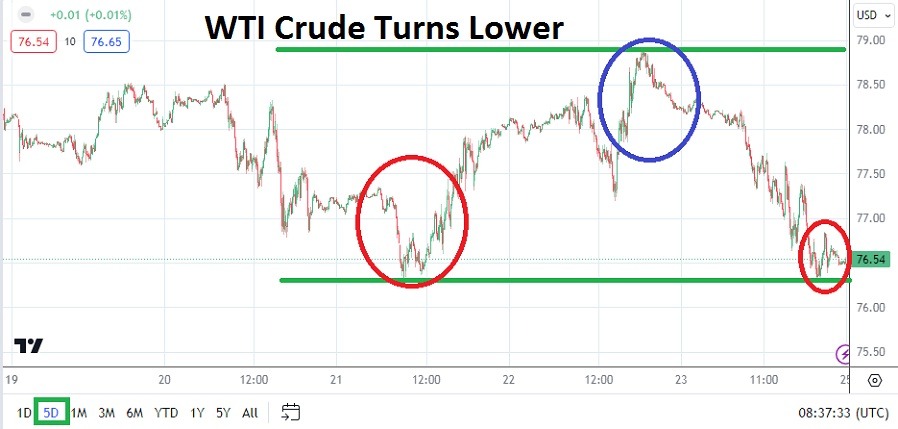

The Energy Report: Winter Warming Warnings

February 26, 2024

Via Talk Markets

Topics

Energy

Exposures

Fossil Fuels

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.