Microsoft trades at $383.71 per share and has stayed right on track with the overall market, losing 7.7% over the last six months while the S&P 500 is down 7.7%. This may have investors wondering how to approach the situation.

Following the drawdown, is now a good time to buy MSFT? Find out in our full research report, it’s free.

Why Are We Positive On MSFT?

Short for microcomputer software, Microsoft (NASDAQ: MSFT) is the largest software vendor in the world with its Windows operating system, Office suite, and cloud computing services.

1. Skyrocketing Revenue Shows Strong Momentum

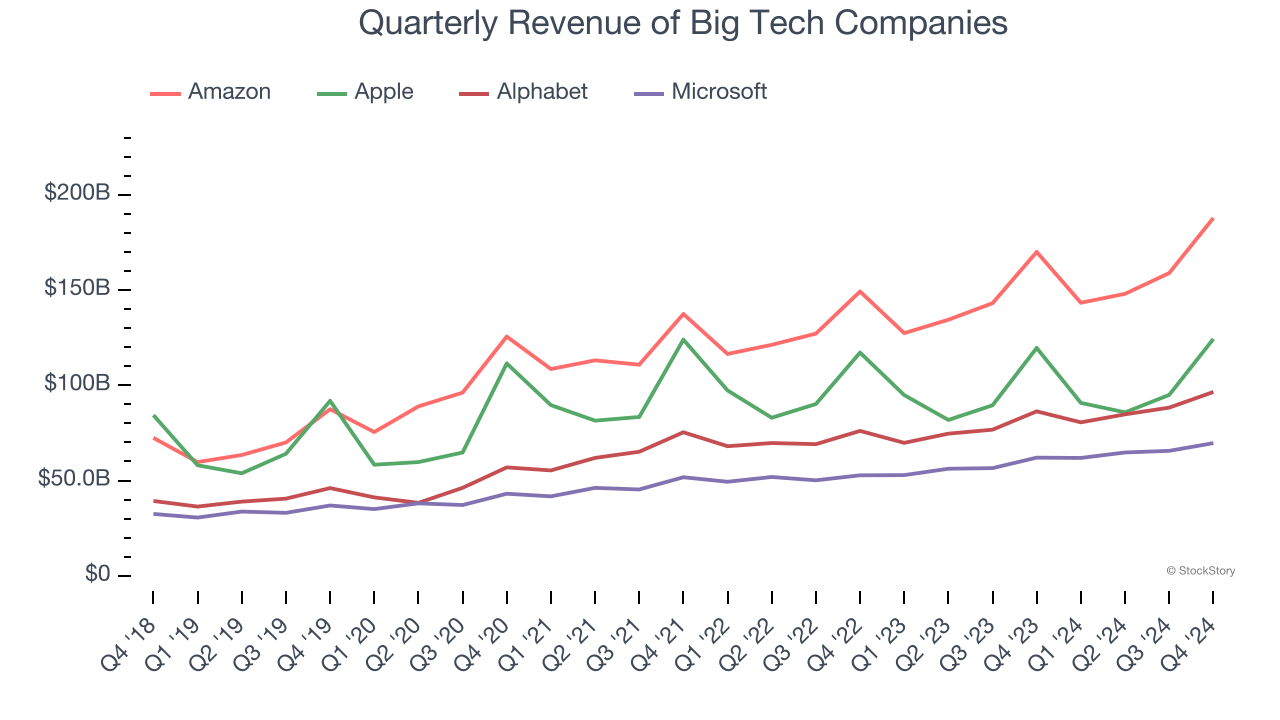

Microsoft shows that fast growth and massive scale can coexist despite the conventional wisdom about the law of large numbers. The company’s revenue base of $134.2 billion five years ago has nearly doubled to $261.8 billion in the last year, translating into an exceptional 14.3% annualized growth rate.

Over the same period, Microsoft’s big tech peers Amazon, Alphabet, and Apple put up annualized growth rates of 17.9%, 16.7%, and 8.1%, respectively.

2. Operating Margin Reveals a Well-Run Organization

Microsoft is a special business because its focus on software, bundling, and upselling leads to robust unit economics and vendor lock-in. The company’s elite business model and pricing power can be seen in its high gross margin, which averaged 69% over the last five years.

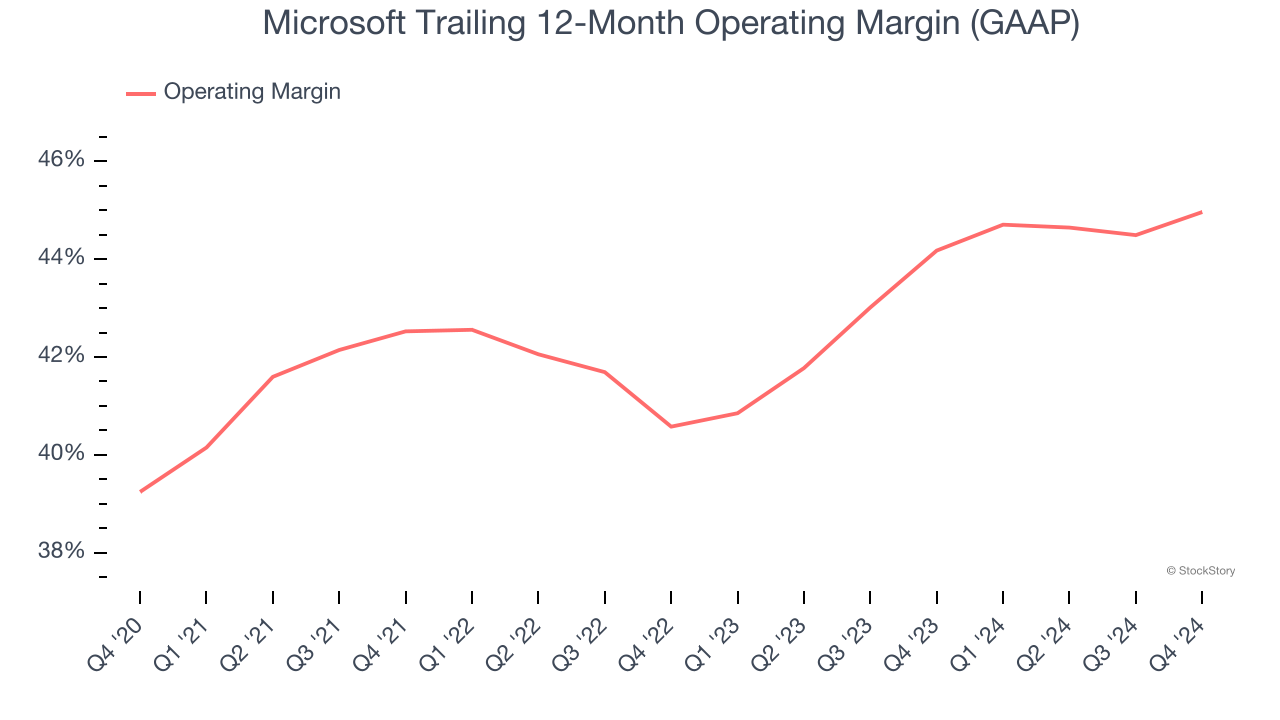

However, this dynamic is not new. A good way to have a more differentiated view on Microsoft’s profitability is through its operating margin, a metric that represents how much revenue is left after accounting for all operating expenses – everything from hiring engineers and IT infrastructure to selling, product development, and administrative overhead.

Microsoft has been a well-oiled machine over the last five years. It demonstrated elite profitability for a software business, boasting an average operating margin of 42.6%. This was one of the best results across all public companies because every one of its segments sells high-margin software (unlike its big tech peers Amazon and Apple, which partly depend on sales of lower-margin physical products).

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

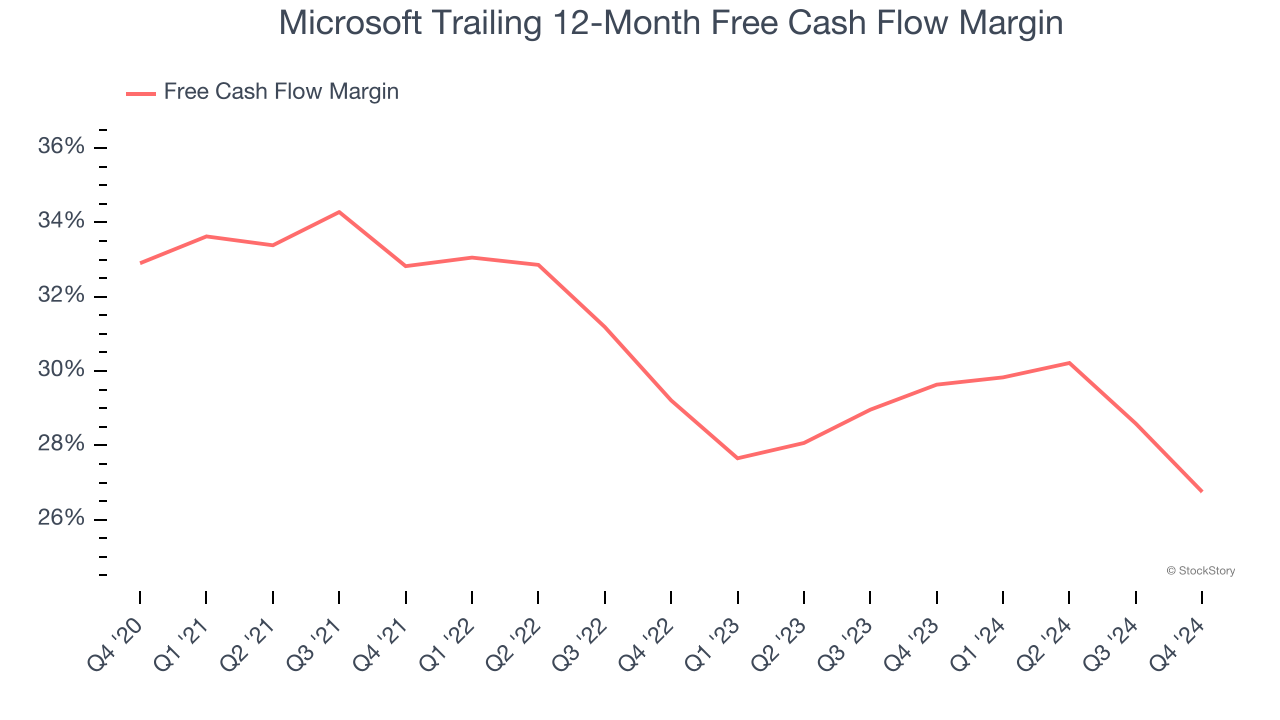

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills or invest for the future.

Microsoft has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging 29.9% over the last five years.

Final Judgment

These are just a few reasons Microsoft is a high-quality business worth owning. After the recent drawdown, the stock trades at 28.6× forward price-to-earnings (or $383.71 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Microsoft

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.