Pet company Central Garden & Pet (NASDAQ: CENT) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 7.4% year on year to $833.5 million. Its non-GAAP profit of $1.04 per share was 11.6% above analysts’ consensus estimates.

Is now the time to buy Central Garden & Pet? Find out by accessing our full research report, it’s free.

Central Garden & Pet (CENT) Q1 CY2025 Highlights:

- Revenue: $833.5 million vs analyst estimates of $878.8 million (7.4% year-on-year decline, 5.1% miss)

- Adjusted EPS: $1.04 vs analyst estimates of $0.93 (11.6% beat)

- Adjusted EBITDA: $120.8 million vs analyst estimates of $114.5 million (14.5% margin, 5.5% beat)

- Management reiterated its full-year Adjusted EPS guidance of $2.20 at the midpoint

- Operating Margin: 11.2%, in line with the same quarter last year

- Free Cash Flow was -$57.52 million compared to -$33.87 million in the same quarter last year

- Market Capitalization: $2.04 billion

Company Overview

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQ: CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $3.16 billion in revenue over the past 12 months, Central Garden & Pet carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

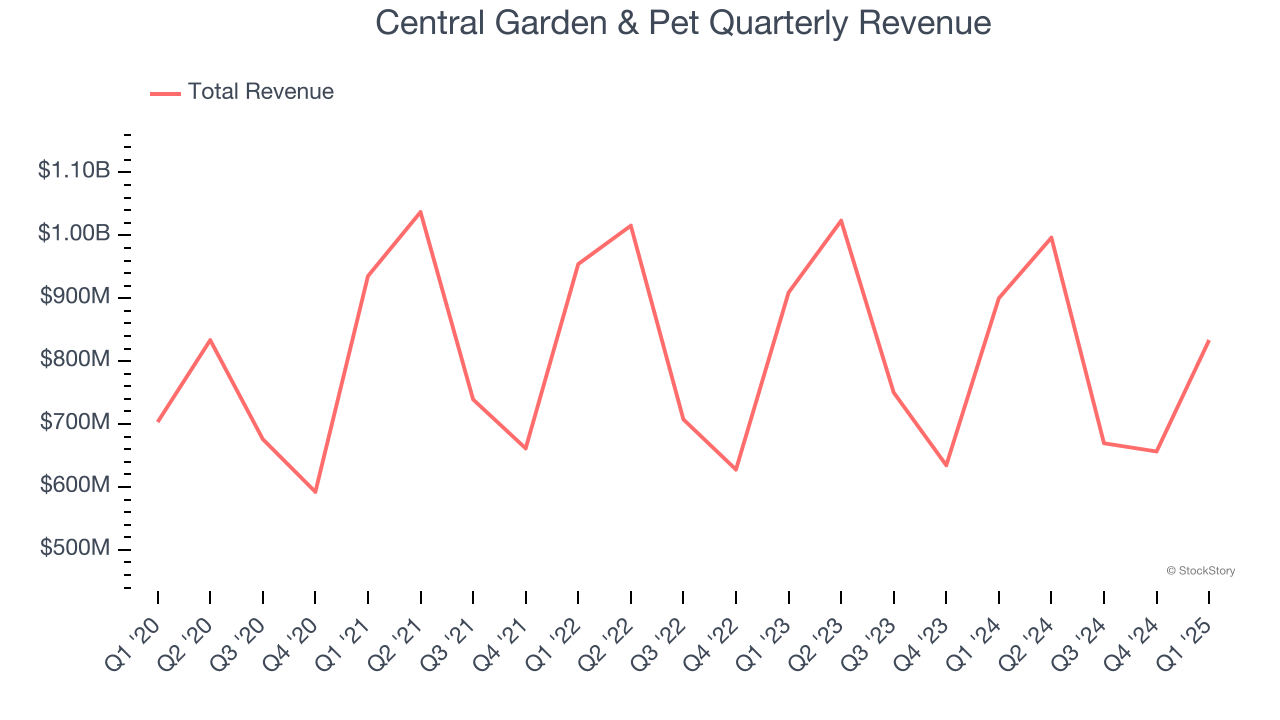

As you can see below, Central Garden & Pet’s demand was weak over the last three years. Its sales fell by 2.4% annually, a poor baseline for our analysis.

This quarter, Central Garden & Pet missed Wall Street’s estimates and reported a rather uninspiring 7.4% year-on-year revenue decline, generating $833.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months. Although this projection indicates its newer products will fuel better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

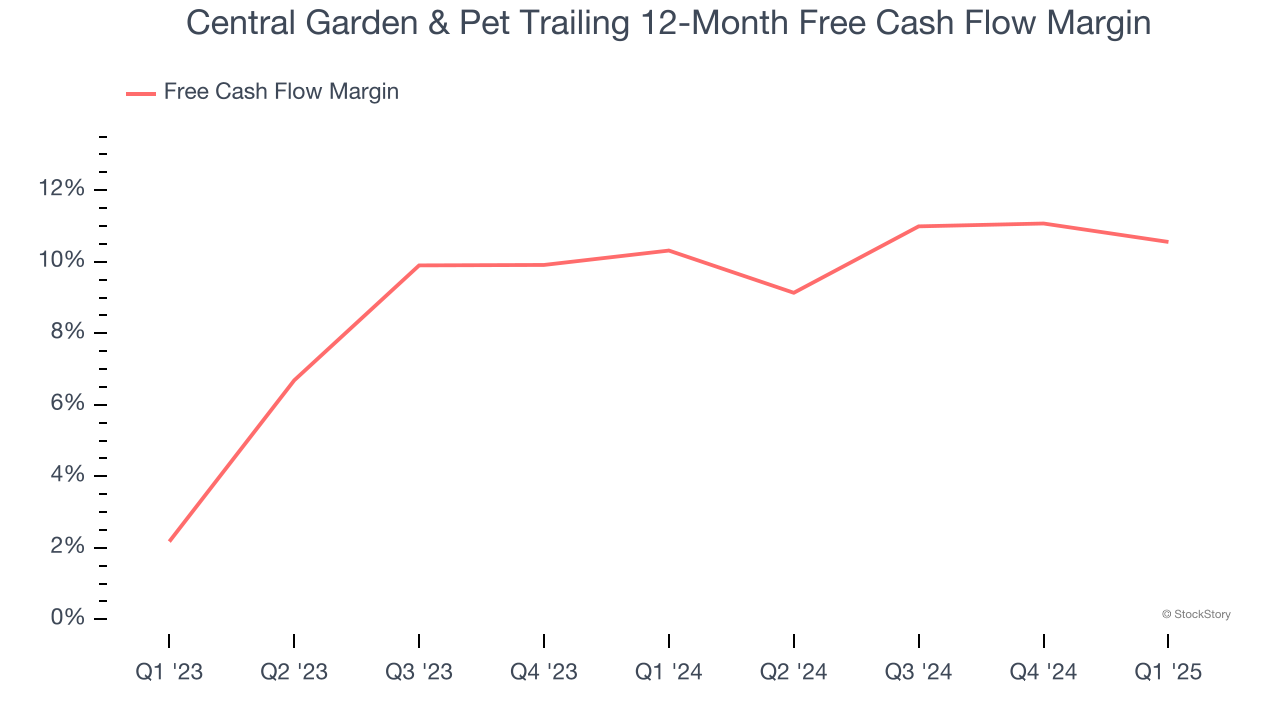

Central Garden & Pet has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.4% over the last two years, quite impressive for a consumer staples business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Central Garden & Pet’s margin was unchanged over the last year, showing it recently had a stable free cash flow profile.

Central Garden & Pet burned through $57.52 million of cash in Q1, equivalent to a negative 6.9% margin. The company’s cash burn increased from $33.87 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

Key Takeaways from Central Garden & Pet’s Q1 Results

We enjoyed seeing Central Garden & Pet beat analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue missed significantly and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $34.45 immediately after reporting.

Central Garden & Pet didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.