Materials and photonics company Coherent (NYSE: COHR) announced better-than-expected revenue in Q1 CY2025, with sales up 23.9% year on year to $1.5 billion. Guidance for next quarter’s revenue was better than expected at $1.5 billion at the midpoint, 2% above analysts’ estimates. Its non-GAAP profit of $0.91 per share was 6.2% above analysts’ consensus estimates.

Is now the time to buy Coherent? Find out by accessing our full research report, it’s free.

Coherent (COHR) Q1 CY2025 Highlights:

- Revenue: $1.5 billion vs analyst estimates of $1.44 billion (23.9% year-on-year growth, 3.9% beat)

- Adjusted EPS: $0.91 vs analyst estimates of $0.86 (6.2% beat)

- Adjusted Operating Income: $279 million vs analyst estimates of $253.9 million (18.6% margin, 9.9% beat)

- Revenue Guidance for Q2 CY2025 is $1.5 billion at the midpoint, above analyst estimates of $1.47 billion

- Adjusted EPS guidance for Q2 CY2025 is $0.91 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 4.8%, up from 1.8% in the same quarter last year

- Market Capitalization: $10.82 billion

Jim Anderson, CEO, said, “We delivered strong growth and profitability in the March quarter with record revenue driven by another quarter of strong AI-related datacenter demand. We also introduced many new industry-leading optical networking products and technologies during the past quarter which position us well for long-term growth.”

Company Overview

Created through the 2022 rebranding of II-VI Incorporated, a company with roots dating back to 1971, Coherent (NYSE: COHR) develops and manufactures advanced materials, lasers, and optical components for applications ranging from telecommunications to industrial manufacturing.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $5.6 billion in revenue over the past 12 months, Coherent is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

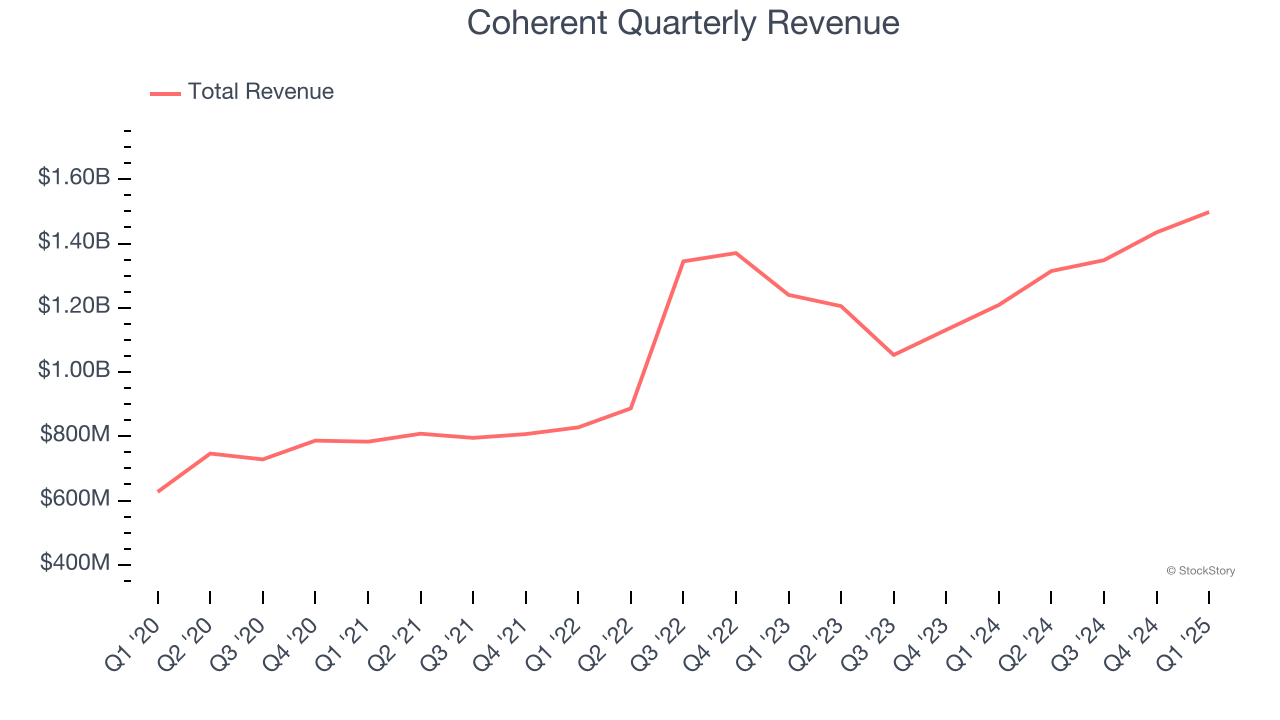

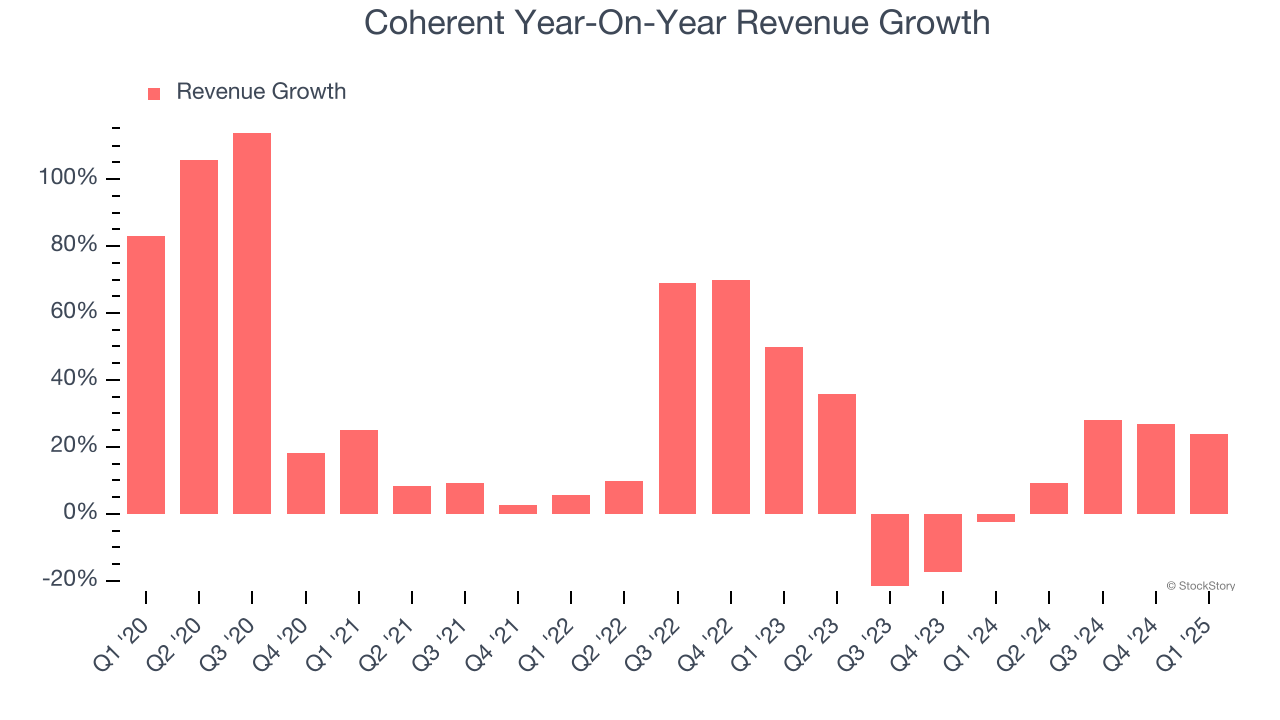

As you can see below, Coherent’s 22.9% annualized revenue growth over the last five years was incredible. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Coherent’s annualized revenue growth of 7.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Coherent reported robust year-on-year revenue growth of 23.9%, and its $1.5 billion of revenue topped Wall Street estimates by 3.9%. Company management is currently guiding for a 14.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.9% over the next 12 months, similar to its two-year rate. This projection is admirable and indicates its newer products and services will spur better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

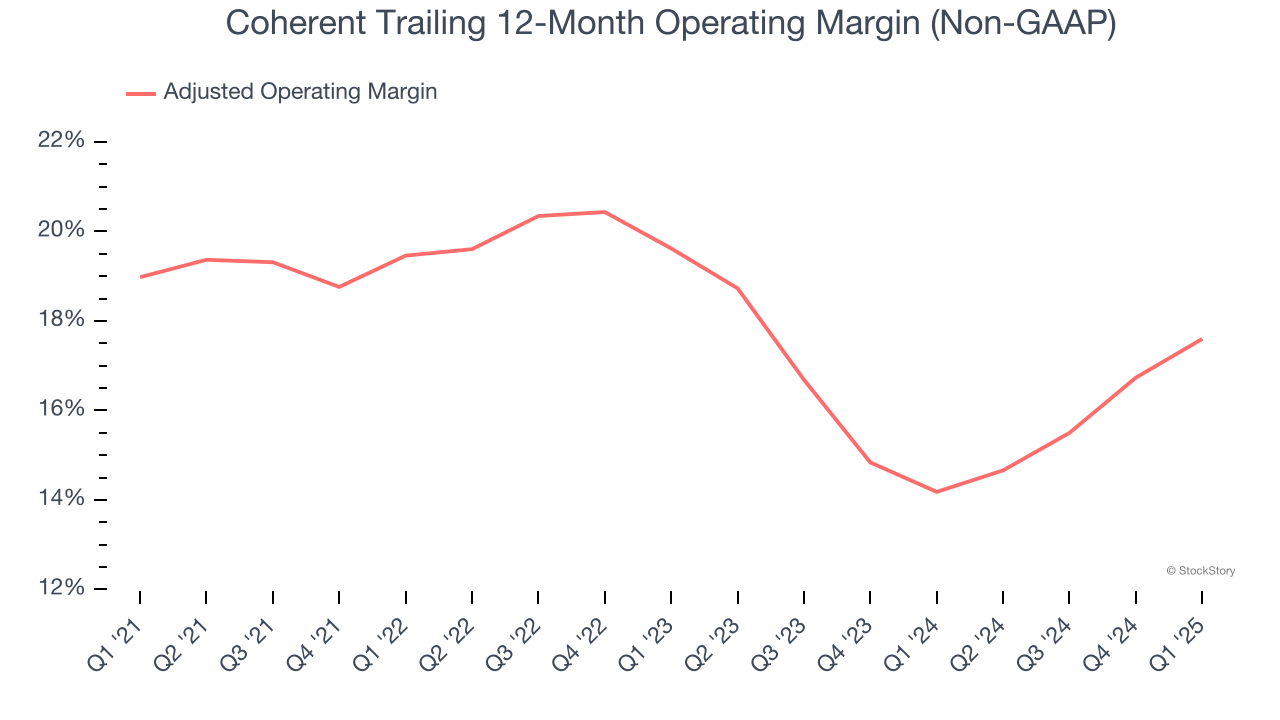

Coherent has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average adjusted operating margin of 17.8%.

Analyzing the trend in its profitability, Coherent’s adjusted operating margin decreased by 1.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q1, Coherent generated an adjusted operating profit margin of 18.6%, up 3.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

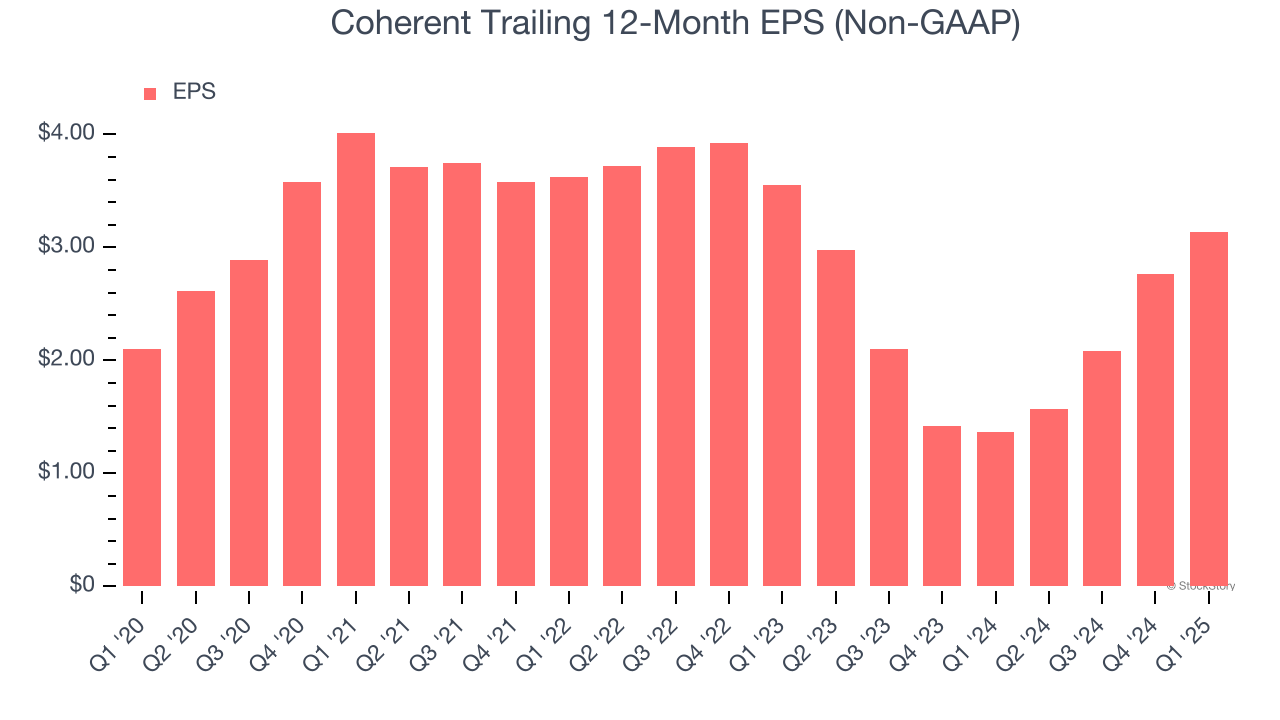

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Coherent’s EPS grew at a decent 8.4% compounded annual growth rate over the last five years. However, this performance was lower than its 22.9% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Coherent’s earnings can give us a better understanding of its performance. As we mentioned earlier, Coherent’s adjusted operating margin improved this quarter but declined by 1.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Coherent reported EPS at $0.91, up from $0.53 in the same quarter last year. This print beat analysts’ estimates by 6.2%. Over the next 12 months, Wall Street expects Coherent’s full-year EPS of $3.14 to grow 31.2%.

Key Takeaways from Coherent’s Q1 Results

We were glad Coherent’s revenue outperformed Wall Street’s estimates. It was great to see revenue guidance for next quarter top analysts’ expectations, although EPS guidance was just in line, potentially suggesting lower-than-expected margins next quarter. The market seemed to be hoping for more, and the stock traded down 3% to $67.50 immediately following the results.

So should you invest in Coherent right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.