Online money transfer platform Remitly (NASDAQ: RELY) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 34.4% year on year to $361.6 million. On the other hand, next quarter’s revenue guidance of $384 million was less impressive, coming in 0.9% below analysts’ estimates. Its GAAP profit of $0.05 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Remitly? Find out by accessing our full research report, it’s free.

Remitly (RELY) Q1 CY2025 Highlights:

- Revenue: $361.6 million vs analyst estimates of $347.5 million (34.4% year-on-year growth, 4.1% beat)

- EPS (GAAP): $0.05 vs analyst estimates of -$0.02 (significant beat)

- Adjusted EBITDA: $58.43 million vs analyst estimates of $39.15 million (16.2% margin, 49.2% beat)

- The company slightly lifted its revenue guidance for the full year to $1.58 billion at the midpoint from $1.57 billion

- EBITDA guidance for the full year is $202.5 million at the midpoint, above analyst estimates of $196.9 million

- Operating Margin: 3.4%, up from -7.4% in the same quarter last year

- Free Cash Flow Margin: 32.1%, up from 15% in the previous quarter

- Active Customers: 8 million, up 1.79 million year on year

- Market Capitalization: $4.32 billion

“We delivered an outstanding start to the year, significantly exceeding our expectations for the first quarter,” said Matt Oppenheimer, co-founder and Chief Executive Officer, Remitly.

Company Overview

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ: RELY) is an online platform that enables consumers to safely and quickly send money globally.

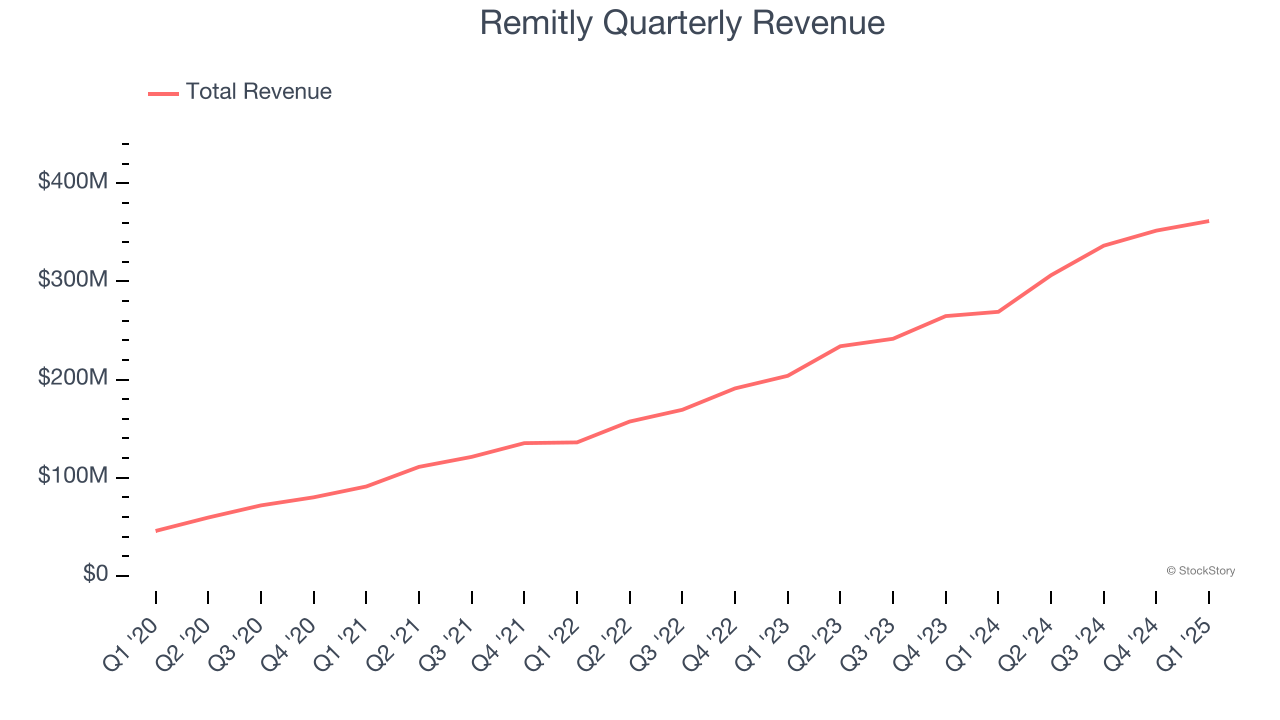

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Remitly’s 39.1% annualized revenue growth over the last three years was incredible. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Remitly reported wonderful year-on-year revenue growth of 34.4%, and its $361.6 million of revenue exceeded Wall Street’s estimates by 4.1%. Company management is currently guiding for a 25.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 22% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is noteworthy and implies the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

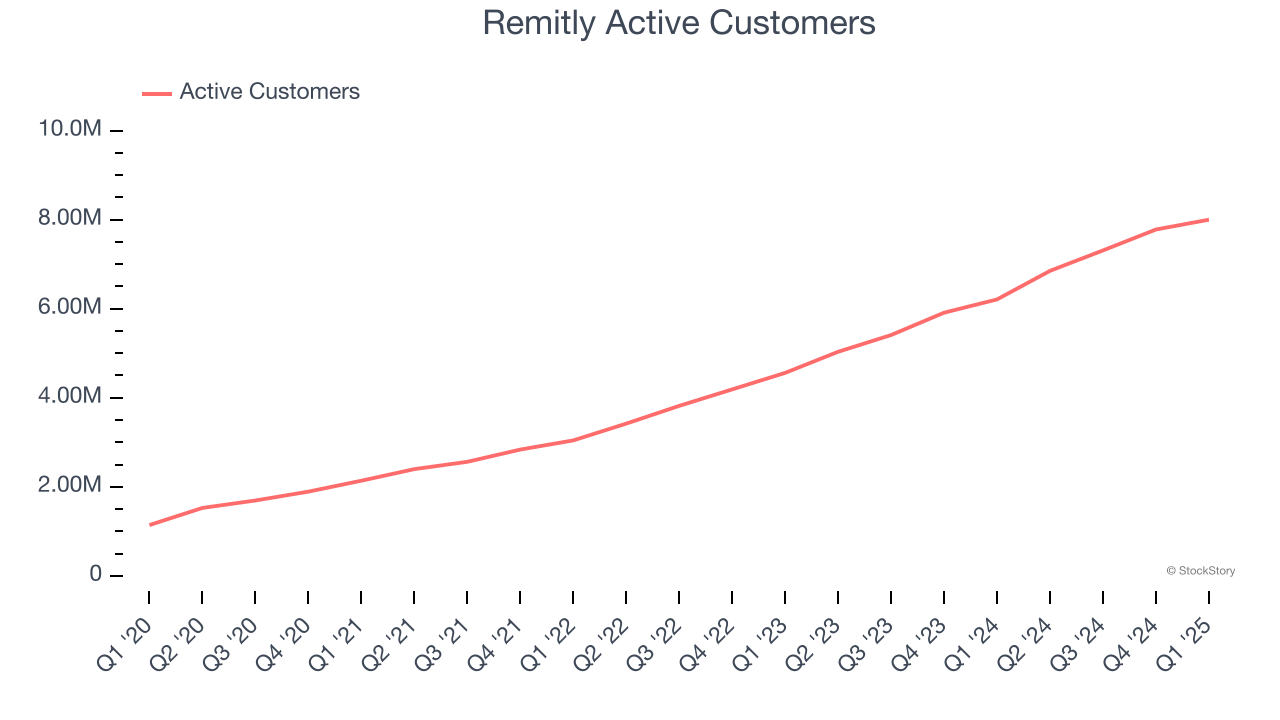

Active Customers

Customer Growth

As a fintech company, Remitly generates revenue growth by increasing both the number of users on its platform and the number of transactions they execute.

Over the last two years, Remitly’s active customers, a key performance metric for the company, increased by 37.2% annually to 8 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q1, Remitly added 1.79 million active customers, leading to 28.8% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating customer growth just yet.

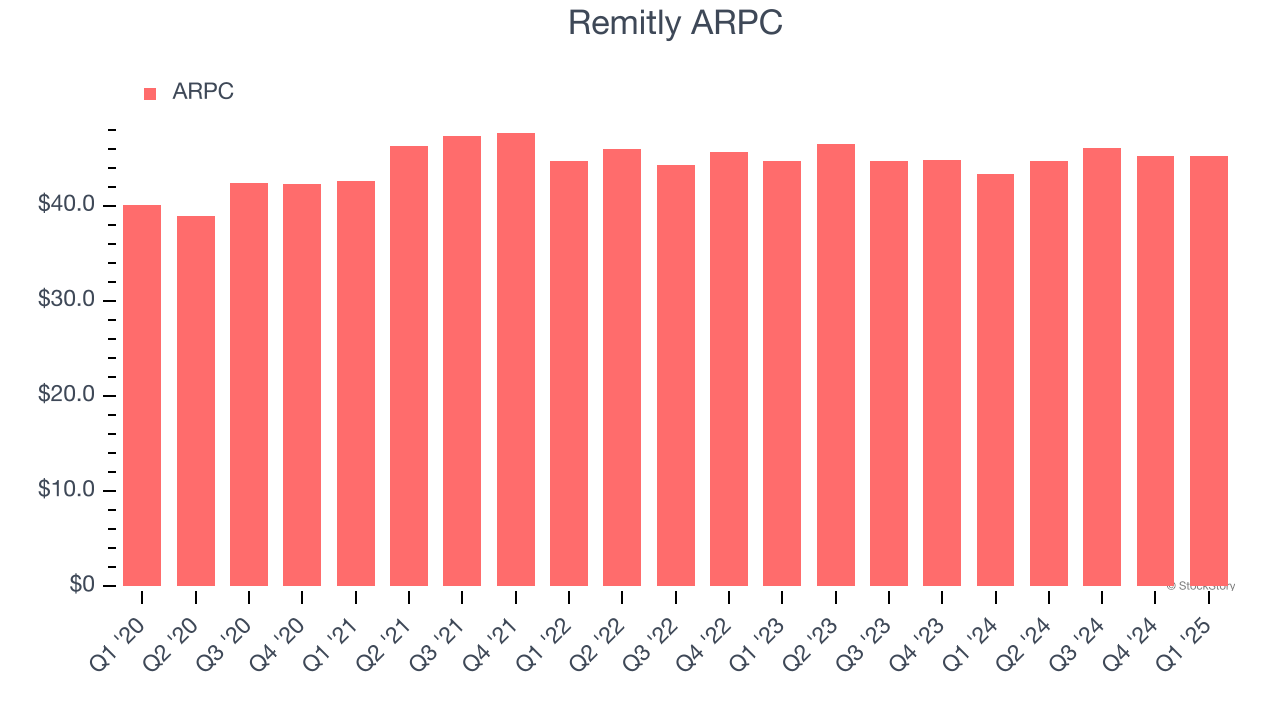

Revenue Per Customer

Average revenue per customer (ARPC) is a critical metric to track because it measures how much the company earns in fees from each user. ARPC also gives us unique insights into the average transaction size on Remitly’s platform and the company’s take rate, or "cut", on each transaction.

Remitly’s ARPC has been roughly flat over the last two years. This isn’t great, but the increase in active customers is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Remitly tries boosting ARPC by taking a more aggressive approach to monetization, it’s unclear whether customers can continue growing at the current pace.

This quarter, Remitly’s ARPC clocked in at $45.20. It grew by 4.3% year on year, slower than its customer growth.

Key Takeaways from Remitly’s Q1 Results

We were impressed by how significantly Remitly blew past analysts’ revenue and EBITDA expectations this quarter. We were also glad it raised its full-year revenue and EBITDA guidance. Overall, this "beat-and-raise" quarter had some key positives. The stock traded up 2.7% to $21.66 immediately following the results.

So do we think Remitly is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.