Healthcare royalties company Royalty Pharma (NASDAQ: RPRX) met Wall Street’s revenue expectations in Q1 CY2025, but sales were flat year on year at $568 million. Its GAAP profit of $0.75 per share increased from $0.01 in the same quarter last year.

Is now the time to buy Royalty Pharma? Find out by accessing our full research report, it’s free.

Royalty Pharma (RPRX) Q1 CY2025 Highlights:

- Revenue: $568 million vs analyst estimates of $570 million (flat year on year, in line)

- Adjusted EBITDA: $738 million vs analyst estimates of $703.4 million (130% margin, 4.9% beat)

- Operating Margin: 94%, up from -13% in the same quarter last year

- Free Cash Flow Margin: 105%, up from 102% in the same quarter last year

- Market Capitalization: $14.19 billion

“Our business momentum continued in the first quarter of 2025 as we delivered double-digit growth in Portfolio Receipts and raised our financial guidance,” said Pablo Legorreta, Royalty Pharma’s founder and Chief Executive Officer.

Company Overview

Pioneering a unique business model in the pharmaceutical industry since 1996, Royalty Pharma (NASDAQ: RPRX) acquires rights to receive portions of sales from successful biopharmaceutical products, providing funding to drug developers without conducting research itself.

Sales Growth

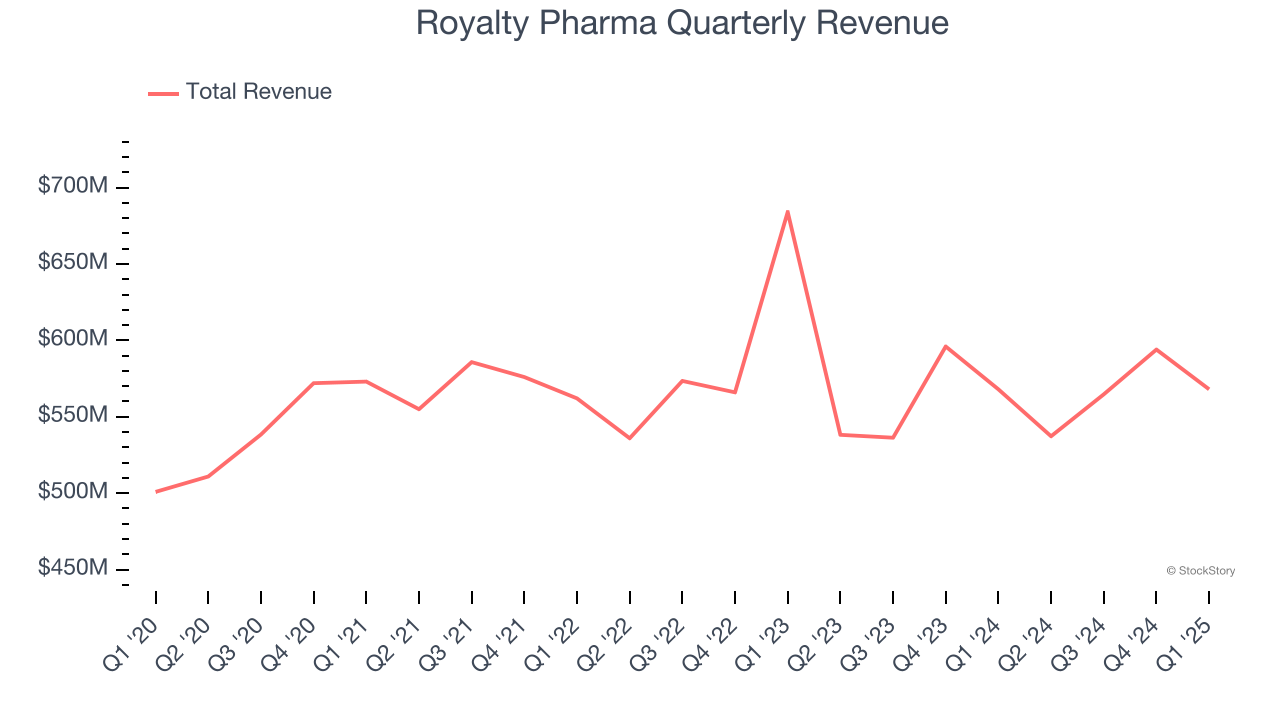

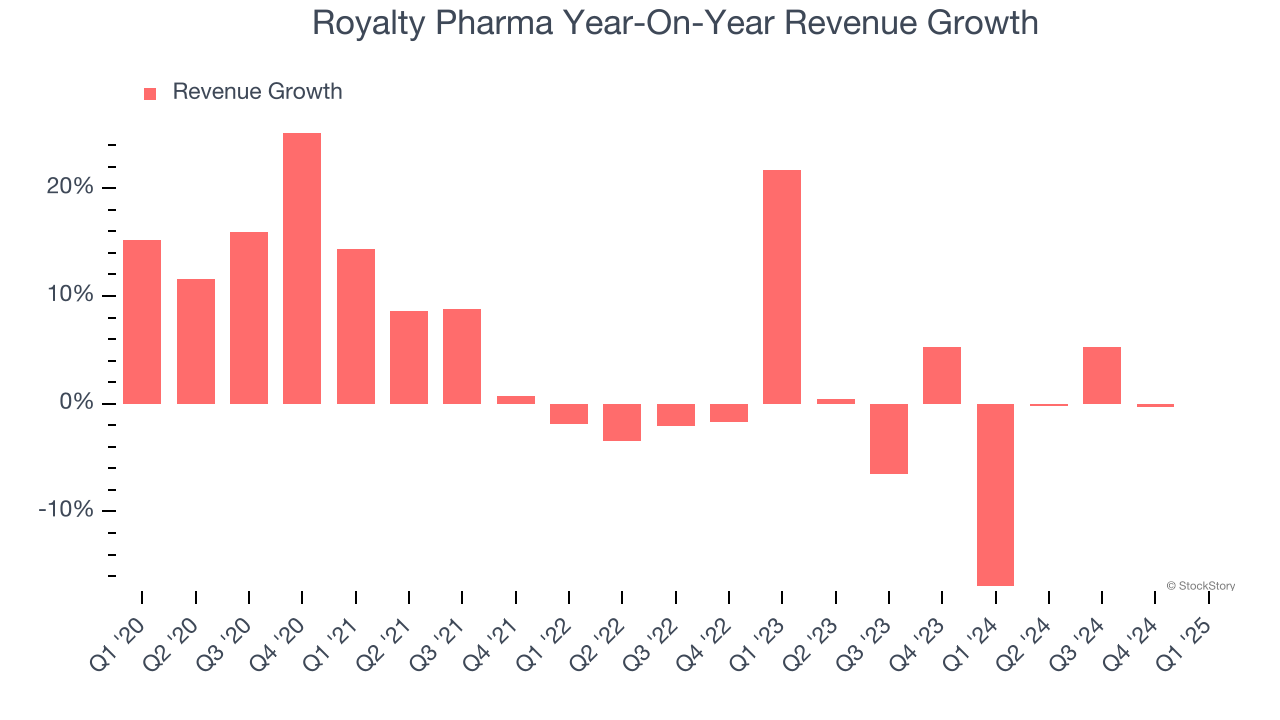

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Royalty Pharma’s sales grew at a tepid 3.8% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Royalty Pharma’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2% annually.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Portfolio Receipts. Over the last two years, Royalty Pharma’s Portfolio Receipts revenue averaged 11.2% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Royalty Pharma’s $568 million of revenue was flat year on year and in line with Wall Street’s estimates.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

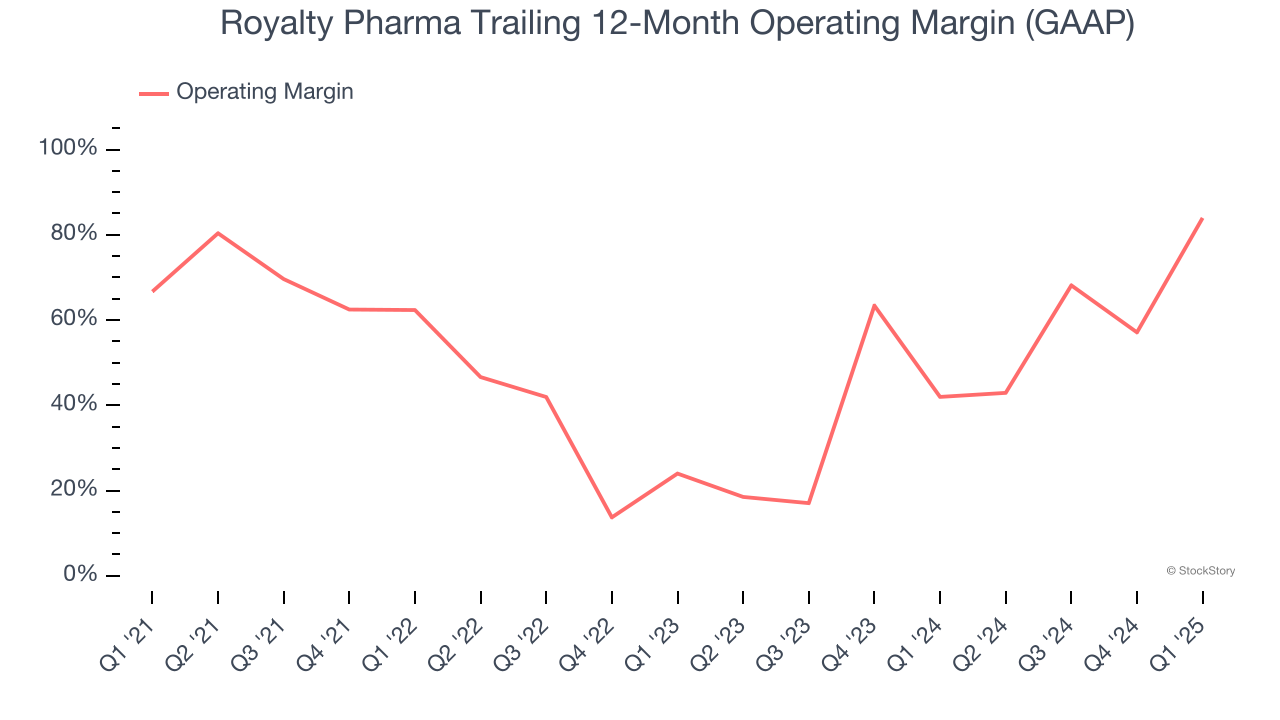

Royalty Pharma has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average operating margin of 55.5%.

Looking at the trend in its profitability, Royalty Pharma’s operating margin rose by 17.3 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 60 percentage points on a two-year basis.

This quarter, Royalty Pharma generated an operating profit margin of 94%, up 107 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

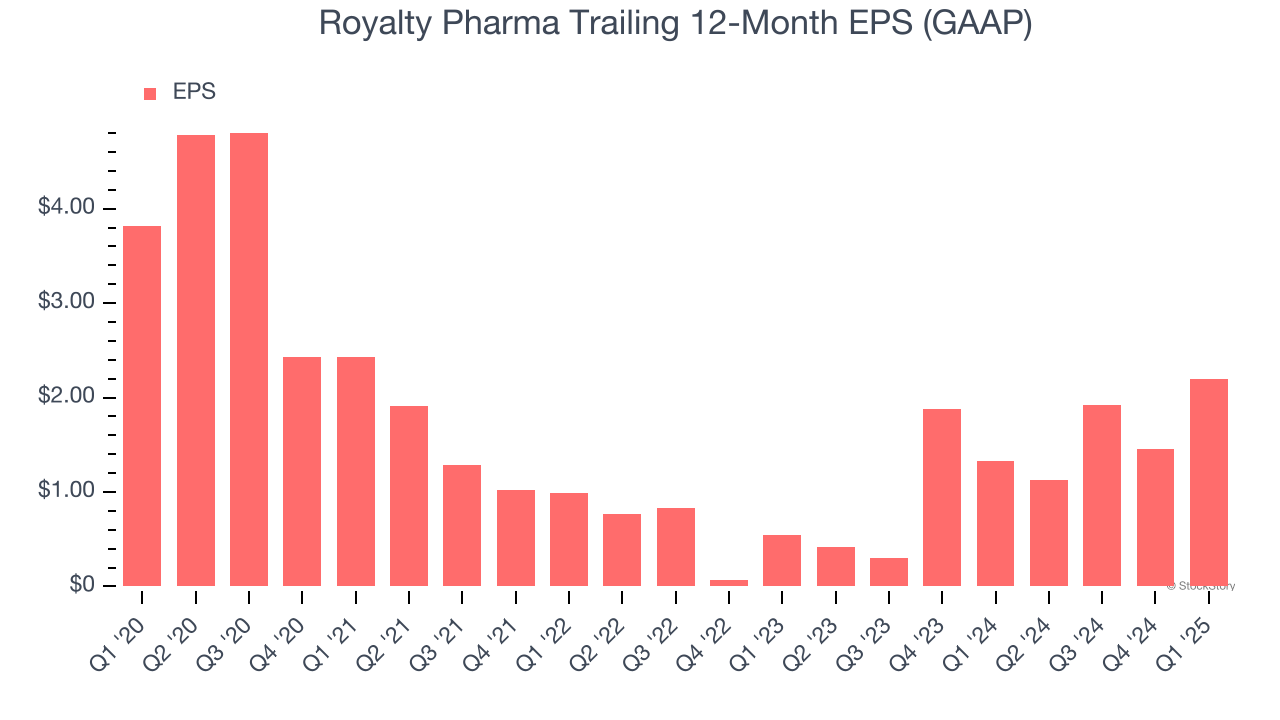

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Royalty Pharma, its EPS declined by 10.5% annually over the last five years while its revenue grew by 3.8%. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

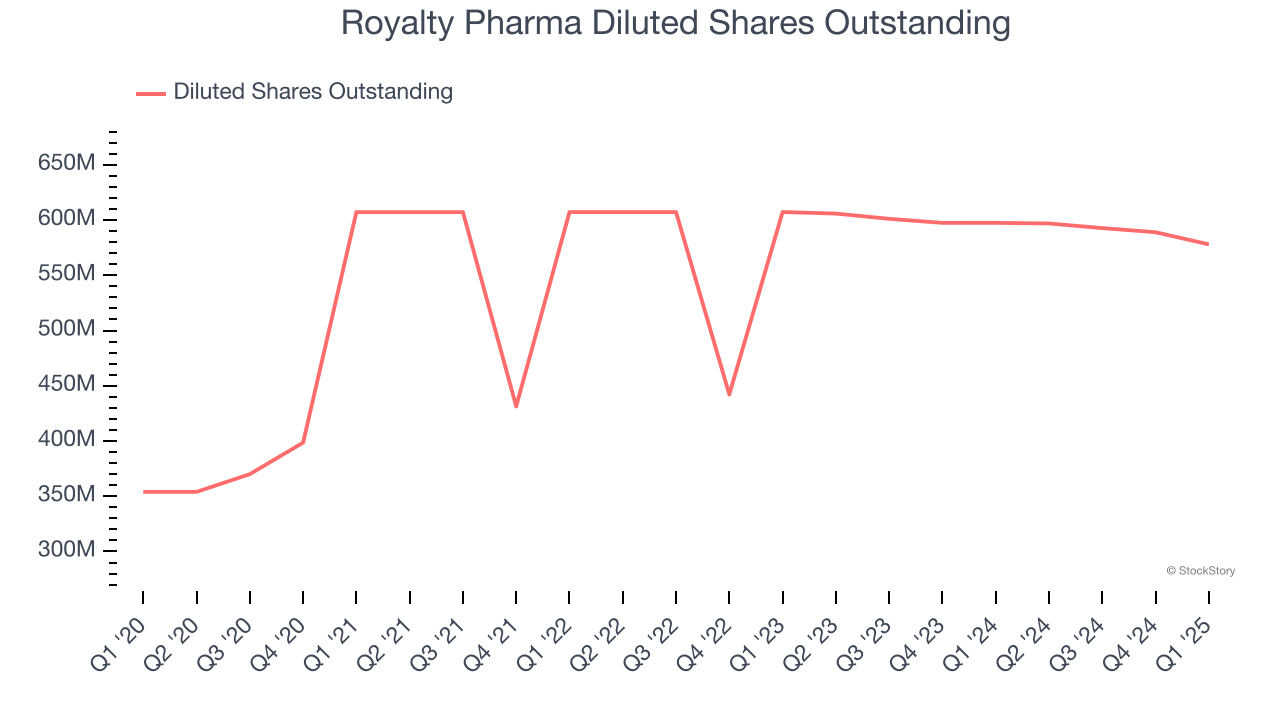

We can take a deeper look into Royalty Pharma’s earnings to better understand the drivers of its performance. Royalty Pharma recently raised equity capital, and in the process, grew its share count by 63.3% over the last five years. This has resulted in muted earnings per share growth but doesn’t tell us as much about its future. We prefer to look at operating and free cash flow margins in these situations.

In Q1, Royalty Pharma reported EPS at $0.75, up from $0.01 in the same quarter last year. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Royalty Pharma’s Q1 Results

Revenue was in line but EBITDA beat on better profitability. Overall, the quarter was solid. The stock traded up 1.4% to $33.25 immediately following the results.

So should you invest in Royalty Pharma right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.